Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)A:--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)A:--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)A:--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)A:--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)A:--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)A:--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)A:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime RateA:--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)A:--

F: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)A:--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)A:--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)A:--

F: --

P: --

U.K. Unemployment Rate (Dec)

U.K. Unemployment Rate (Dec)A:--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)A:--

F: --

P: --

U.K. 3-Month ILO Employment Change (Nov)

U.K. 3-Month ILO Employment Change (Nov)A:--

F: --

P: --

U.K. Unemployment Claimant Count (Dec)

U.K. Unemployment Claimant Count (Dec)A:--

F: --

Euro Zone Current Account (Not SA) (Nov)

Euro Zone Current Account (Not SA) (Nov)A:--

F: --

Euro Zone Current Account (SA) (Nov)

Euro Zone Current Account (SA) (Nov)A:--

F: --

South Africa Gold Production YoY (Nov)

South Africa Gold Production YoY (Nov)A:--

F: --

P: --

South Africa Mining Output YoY (Nov)

South Africa Mining Output YoY (Nov)A:--

F: --

P: --

Germany ZEW Current Conditions Index (Jan)

Germany ZEW Current Conditions Index (Jan)A:--

F: --

P: --

Germany ZEW Economic Sentiment Index (Jan)

Germany ZEW Economic Sentiment Index (Jan)A:--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Jan)

Euro Zone ZEW Current Conditions Index (Jan)A:--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Jan)

Euro Zone ZEW Economic Sentiment Index (Jan)A:--

F: --

P: --

Euro Zone Construction Output YoY (Nov)

Euro Zone Construction Output YoY (Nov)A:--

F: --

P: --

Euro Zone Construction Output MoM (SA) (Nov)

Euro Zone Construction Output MoM (SA) (Nov)A:--

F: --

Argentina Trade Balance (Dec)

Argentina Trade Balance (Dec)--

F: --

P: --

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)--

F: --

P: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Dec)

U.S. New Housing Starts Annualized MoM (SA) (Dec)--

F: --

P: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)--

F: --

P: --

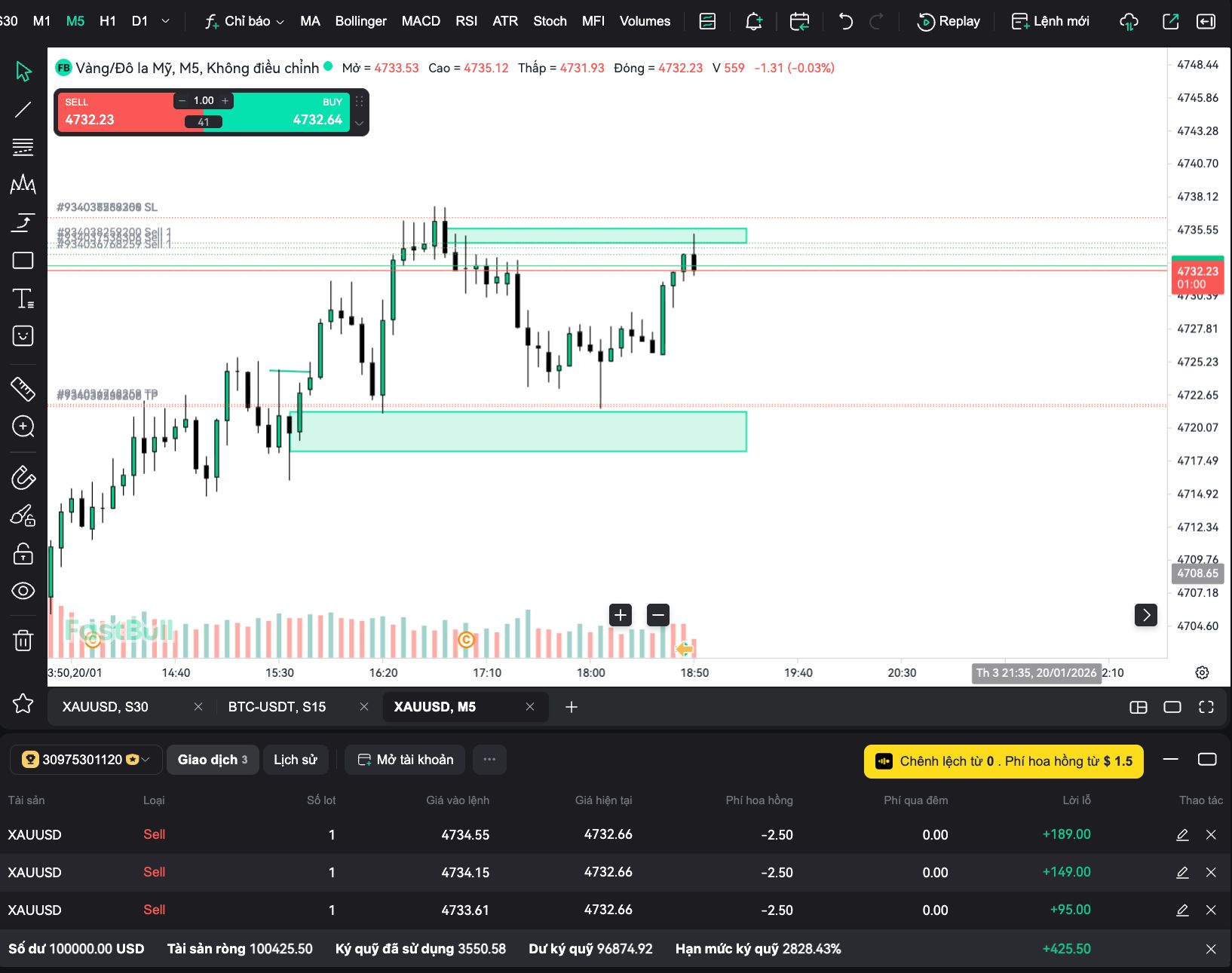

80/20 win/loss. Whoever sells will win, whoever buys will lose according to the ratio 20/80.

80/20 win/loss. Whoever sells will win, whoever buys will lose according to the ratio 20/80.

I sell

I sell [ ...

[ ...

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. consumer prices jump 6.2% in October, the biggest inflation surge in 31 years, while gold rarely surged with dollar rarely synchronously surged with the US dollar, boiling down to a sharp rise in inflation expectations and a further decline in U.S. real interest rates.

The data released from Labor Department showed that CPI rose for the 17th month in October, increased 6.2% on a year-over-year basis, the highest level in 31 years. Core inflation, stripping out food and energy, increased 4.6%, beating expectations of 4.3% and continuing to set a new record since the outbreak of Covid-19.

In the face surprising inflation data, the financial market also reacted strongly, the VIX jumped close to 20, the three major US stock indexes that kept hitting new highs fell sharply, the dollar index soared to nearly 100 bps overnight, the US treasury yields soared, and the 5-Year Breakeven Inflation Rate hit 3.1%, the highest since 2002. Crypto currency intraday hit an all-time high again, and gold jumped more than $40......All kinds of rare records burst out.

Dollar surged with gold

It is fair to say that the high inflation data has not only renewed doubts about the credibility of the theory that inflation to be transitory, but also sparked speculation that the Fed may raise interest rates sooner than expected. So what we have seen is an unusual phenomenon: gold rose almost in tandem with the dollar index, breaking the negative relationship between the two.

Dollar surged, if only on the basis of rate hike anticipation builds, but gold rally is counterintuitive. Gold has almost fallen lopsided and moved almost in the opposite direction of the dollar after the release of stronger than expected CPI data this year, as high inflation could lead to tighter monetary policy. But this time gold bears seem to have no resistance, there is no too much entanglement in disk surface, gold even rose above 1860. It is clear that high inflation has sparked fears and riots, and that gold is playing a key role in hedging against inflation.

In fact, since the Fed announced to start tapering its bound purchases in November, which should be a signal of tighter policy, but gold has not been affected by the announcement and has staged an unusually strong rally. Shows that the market has fully digested the tapering in the early days and is now completely indifferent to it. As for the continuity of inflation, the Fed can be described as obsessively confident. The Fed has repeatedly made it clear that it is still premature to start talking about rate increases, at least until June next year, so the expected impact of rate hikes on gold at least at this stage is also minimal.

How does inflation affect gold?

Gold surged this time which also easily broke through a key resistance at 1832 and occurred as the dollar was moving higher, has also led several investment institutions to raise their expectations for the future movement of gold.

Citi lifted its zero- to three-month gold price target by 11% to $1,900 an ounce. David Meger, director of metals trading at High Ridge Futures. He said, gold being the quintessential hedge against inflation, they believe inflation is the underlying positive environment that will foster the gold market rally in the weeks and months ahead. So what is the possible movement next for gold?

Gold itself has two main characteristics, it is both a typical hedge against inflation and very sensitive to interest rates, but when interest rate hike expectations rise and inflation spikes at the same time, many investors become confused.

Over the long term, the price of gold actually depends on the U.S. real interest rate, which is the yield of Treasury Inflation-Protected Security (TIPS), the difference between the treasury yields and the expected inflation rate for the same maturity. When the U.S. real interest rate rises, the price of gold falls; when the U.S. real interest rate falls, the price of gold rises.

Looking at just the last decade, gold has maintained a near-perfect inverse relationship with the yield of 10-year TIPS, with few exceptions.

In October, when CPI exceeded 6%, the U.S. bond yields collectively soared, as did the breakeven inflation rate, which represents inflation expectations, while the U.S. real interest rate, which represents the yield of TIPS, fell further. The 10-year TIPS yield fell as low as -1.243%, while the 30-year yield fell to -0.608%, both record lows.

Aside from the Fed's 0-0.25% nominal interest rate, real interest rates fell into negative, indicating that treasury yields, anchor of the global asset pricing, have run down inflation expectations and inflation is becoming more and more serious. As long as the Fed continues "printing money" in short-term, the U.S. real interest rates are likely to remain negative, and gold still has room to rise.

In terms of technical charts, gold broke through the key pressure level of 1832 after the early flag consolidation, and the next primary target are expected near 1900.

Recently, the news about the change of leadership of Fed set off a hot discussion in the whole market. Powell’s term as chairman of the Fed is set to expire in February 2022, and whether he will be reappointed as chairman of the Fed for the next four years is the focus of the market. Especially in the wake of the Fed’s Taper announcement, the market considering betting on future selections and is anxious for some indication of the policy bias.

Competitors

Current market expectations for mainstream Fed chair candidate center on current Fed Chairman Powell and Fed Governor Brainard. Powell is widely expected to win a second term, but Brainard is gaining support.

Powell

As his predecessor Yellen said, Powell has certainly done a good job, particularly in managing the transition without major missteps during a time of great challenges such as the covid-19. Powell, a Republican and former deputy Treasury secretary, joined the Fed board of Governors in May 2012 and has been nominated as chairman of the Fed since Trump took office. Powell is a centrist in monetary policy stance and supports easing financial regulation. Judging from his previous speeches and policy stance, although he had a "hawkish" tendency in monetary policy in the past, he paid more attention to balance and further strengthened the "expectation management" means of the Federal Reserve.

The Fed's monetary policy stance is expected to be more balanced if Powell is reappointed, but that is one of the biggest obstacles to his reappointment. Throughout history, the previous U.S. governments prefer to use relatively loose policies to stimulate and guarantee the growth momentum of the economy and the prosperity of the financial market in order to achieve political achievements. Powell raised interest rates four times in 2018, causing the stock market to tumble, which make the ruling Democrats worried, because they don't want any more fallout in next year's midterm elections.

Brainard

Another candidate, Fed Governor Brainard, a Democrat, was nominated as a member of the Fed board by Obama in 2014. Brainard is also a former deputy Treasury secretary whose monetary policy stance is seen as more dovish than Powell's and more in line with Democratic Party’s needs in the midterm elections. After Brainard was summoned by the White House, there was even more obvious turmoil in the market, with both short and long term treasury yields falling. Markets are beginning to anticipate whether brainard, if nominated, will favor a slower Taper process and a later tapering point.

Moreover, for the Fed's two main policy goals, Brainard prioritized full employment over inflation and was more tolerant of higher inflation. In a Speech in September, She said full employment should be measured not by aggregate measures but by the welfare and job market status of "marginalized" groups like people of color. In terms of financial stability, Brainard supports the development of digital currency in the United States, but does not support those virtual currencies with high volatility, inadequate supervision and severe risks. She strongly advocates the rectification of financial regulation, including the recent stock market turmoil caused by members of the Federal Reserve. On climate change, Brainard believes that the Fed should establish a climate monitoring and analysis model, and timely assess and predict the risk impact of climate change.

Brainard's track record on jobs, financial stability is also consistent with the Democratic Party, which will be an advantage in her chances of getting the Fed nomination.

Easing will continue

According to the latest odds on Predictit, a U.S. political betting website, Powell's chances remain high, even as Brainard's support continues to rise.

However, considering the overall easing environment of the Fed, many industry analysts believe that whoever wins, the basic framework of monetary policy will not change sharply, next June or so will finish the purchase.

Michael Feroli, chief U.S. Economist at J.P. Morgan, said there are many institutional factors that influence the Fed's decisions and provide continuity, including the role of regional banks and the influence of the Fed's staff. With Brainard seen as more dovish, the market could expect inflation expectations to rise further, but the renewed recovery in treasury yields also reflects affirmation of the continuity of Fed policymaking.

In short, there's no need to read too much into a Fed reshuffle or expect a dramatic change in policy, as the Fed does not want to see financial market turmoil.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up