Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

All major U.S. stock indices improved more than 1.5% on Aug. 22, 2025, following Federal Reserve Chair Jerome Powell’s latest hint at a possible cut in the nation’s interest rate next month. Resultantly, traders across the board reacted to this optimistically and thus Wall Street observed a decent hike.

This might encourage stakeholders to invest more in the stock market right now in the anticipation that market will move up more each day as we progress towards the upcoming September Fed-meet. However, considering the fact that the share market has lately been on edge, we recommend choosing safe-bet stocks stocks like NatWest Group (NWG), Sterling Infrastructure (STRL), Luxfer Holdings (LXFR), Evercore (EVR) and Hillman Solutions Corp. (HLMN) that are less leveraged and thus likely to provide a protective cushion against a sudden economic crisis.

Now, before selecting low-leverage stocks, let’s explore what leverage is and how choosing a low-leverage stock helps investors.

In finance, leverage is a term used to denote the practice of borrowing capital by companies to run their operations smoothly and expand them. Such borrowings are done through debt financing. But there remains an option for equity finance. This is probably due to the cheap and easy availability of debt over equity financing.

However, debt financing has its share of drawbacks. Particularly, it is desirable only as long as it successfully generates a higher rate of return compared to the interest rate. So, to avoid considerable losses in your portfolio, one should always avoid companies that resort to excessive debt financing.

The crux of safe investment lies in choosing a company that is not burdened with debt, as a debt-free stock is almost impossible to find.

The equity market can be volatile at times, and, as an investor, if you don’t want to lose big time, we suggest you invest in stocks that bear low leverage and are, hence, less risky.

To identify such stocks, historically, several leverage ratios have been developed to measure the amount of debt a company bears. The debt-to-equity ratio is one of the most common ratios.

Debt-to-Equity Ratio = Total Liabilities/Shareholders’ Equity

This metric is a liquidity ratio that indicates the amount of financial risk a company bears. A lower debt-to-equity ratio reflects improved solvency for a company.

With the second-quarter 2025 earnings season almost in its last lap, investors must be eyeing stocks that have exhibited solid earnings growth in the recent past.

But if a stock bears a high debt-to-equity ratio in times of economic downturn, its so-called booming earnings picture might turn into a nightmare.

Considering the factors above, it is prudent to choose stocks with a low debt-to-equity ratio to ensure steady returns.

Yet, an investment strategy based solely on the debt-to-equity ratio might not fetch the desired outcome. To choose stocks that have the potential to give you steady returns, we have expanded our screening criteria to include some other factors.

Debt/Equity less than X-Industry Median: Stocks that are less leveraged than their industry peers.

Current Price greater than or equal to 10: The stocks must be trading at a minimum of $10 or above.

Average 20-day Volume greater than or equal to 50000: A substantial trading volume ensures that the stock is easily tradable.

Percentage Change in EPS F(0)/F(-1) greater than X-Industry Median: Earnings growth adds to optimism, leading to a stock’s price appreciation.

VGM Score of A or B: Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy), offer the best upside potential.

Estimated One-Year EPS Growth F(1)/F(0) greater than 5: This shows earnings growth expectation.

Zacks Rank #1 or 2: Irrespective of market conditions, stocks with a Zacks Rank #1 or 2 have a proven history of success.

Excluding stocks that have a negative or a zero debt-to-equity ratio, here we present our five picks out of the 14 stocks that made it through the screen.

NatWest Group: It operates as a banking and financial services company. On Aug. 22, 2025, NatWest announced that it has joined the debt financing syndicate to fund the essential upgrades and tunnel replacements, ensuring continued water supply for the UK’s largest potable water aqueduct — Haweswater Aqueduct. As a Mandated Lead Arranger, NWG will provide £140 million in lending. This project further reinforced NatWest’s position as the UK’s leading bank for infrastructure financing.

The Zacks Consensus Estimate for NWG’s 2025 sales suggests an improvement of 20.1% from the 2024 reported figure. The company boasts a long-term (three-to-five years) earnings growth rate of 10.9%. It currently has a Zacks Rank #2.

Sterling Infrastructure: It operates through subsidiaries within segments specializing in E-Infrastructure, Building and Transportation Solutions, principally in the United States. On Aug. 4, 2025, STRL announced its second-quarter 2025 results. Its revenues improved 21% year over year, while its earnings per share surged a solid 40.8%.

The Zacks Consensus Estimate for STRL’s 2025 earnings suggests a year-over-year improvement of 45.9%. The stock boasts a four-quarter average earnings surprise of 12.1%. It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Luxfer Holdings: It is a materials technology company specializing in the design, manufacture and supply of high-performance materials, components and gas cylinders. On July 29, 2025, LXFR released its second-quarter 2025 results. Its adjusted net sales improved 5.8% year over year, while its adjusted earnings per share surged a solid 25%.

LXFR boasts a solid long-term earnings growth rate of 8%. The Zacks Consensus Estimate for Luxfer’s 2025 sales suggests a year-over-year improvement of 1.1%. It currently carries a Zacks Rank #2.

Evercore: It is a premier global independent investment banking advisory firm. On July 30, 2025, Evercore announced its second-quarter 2025 results. Its adjusted revenues improved 20.7% year over year, while its earnings surged 30.4%.

The Zacks Consensus Estimate for EVR’s 2025 sales indicates an improvement of 15.9% from the 2024 reported actuals. The Zacks Consensus Estimate for 2025 earnings also indicates an improvement of 31.7% from the 2024 reported figure. It currently carries a Zacks Rank #2.

Hillman Solutions: It is a leading provider of hardware-related products and solutions to retail markets in North America. On Aug. 5, 2025, Hillman Solutions announced its second-quarter 2025 results. Its sales improved a solid 6.2% year over year, while adjusted earnings per share grew 6.3%.

The Zacks Consensus Estimate for HLMN’s 2025 sales indicates an improvement of 6.6% from the 2024 reported actuals. The Zacks Consensus Estimate for 2025 earnings also indicates an improvement of 12.2% from the 2024 reported figure. It currently carries a Zacks Rank #2.

You can get the remaining nine stocks on this list by signing up now for your 2-week free trial to the Research Wizard and start using this screen in your trading.

Further, you can also create your strategies and backtest them first before taking the investment plunge.

The Research Wizard is a great place to begin. It's easy to use. Everything is in plain language. And it's very intuitive. Start your Research Wizard trial today.

And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come out.

Click here to sign up for a free trial to the Research Wizard today.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Evercore Inc (EVR) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Luxfer Holdings PLC (LXFR) : Free Stock Analysis Report

NatWest Group plc (NWG) : Free Stock Analysis Report

Hillman Solutions Corp. (HLMN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

What Happened?

A number of stocks fell in the morning session after investors took some profits off the table as markets awaited signals on future monetary policy from the Federal Reserve's Jackson Hole symposium later in the week.

The downturn in the market was largely attributed to a significant sell-off in megacap tech and chipmaker shares. Nvidia, Advanced Micro Devices (AMD), and Broadcom all saw notable drops, dragging down the VanEck Semiconductor ETF. Other major tech-related companies like Tesla, Meta Platforms, and Netflix were also under pressure.

A key reason for this trend is that much of the recent market gains have been concentrated in the "AI trade," which includes these large technology and semiconductor companies. So this could also mean that some investors are locking in some gains ahead of more definitive feedback from the Fed.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On DXP (DXPE)

DXP’s shares are very volatile and have had 23 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The biggest move we wrote about over the last year was 10 months ago when the stock gained 21.5% on the news that the company reported strong third-quarter earnings. DXP blew past analysts' sales, EPS, and EBITDA estimates as its acquisition-driven strategy continued to pay off. Notably, the company closed five acquisitions through the third quarter and already added two more for the next quarter. Zooming out, we think this was a good quarter with some key areas of upside.

DXP is up 37.5% since the beginning of the year, and at $116.06 per share, it is trading close to its 52-week high of $122.29 from August 2025. Investors who bought $1,000 worth of DXP’s shares 5 years ago would now be looking at an investment worth $6,070.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Sterling Infrastructure, Inc. STRL reported second-quarter 2025 results on Aug. 4, with both earnings and revenues exceeding the Zacks Consensus Estimate by 19% and 10.7%, respectively. The company also delivered strong year-over-year growth across key metrics. Adjusted diluted earnings per share came in at $2.69, up 41% year over year, while revenues increased 21% (excluding the impacts of RHB deconsolidation).

The company’s performance benefited from a strong increase in E-Infrastructure Solutions and Transportation Solutions, which offset weakness in the Building Solutions segment. The gross margin expanded 400 basis points to 23%, marking a new high as the business continued to shift toward higher-margin service offerings. Supported by revenue growth and margin expansion, adjusted EBITDA advanced 35% from the prior-year quarter.

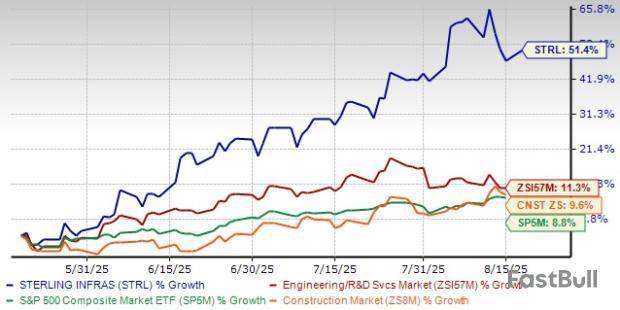

STRL Stock Outperforms Peers, Industry & Market

Shares of Sterling have gained 51.4% in the past three months compared with the Zacks Engineering - R and D Services industry’s and the S&P 500’s rallies of 11.3% and 8.8%, respectively. The STRL stock has also outperformed the broader Construction sector's 9.6% rise during the same period. Sterling stock has been on an upward trajectory since reporting its second-quarter 2025 results on Aug. 4, rising 6.6%.

The STRL stock has outperformed some other players, including AECOM ACM, Fluor Corporation FLR and KBR, Inc. KBR. In the past three months, AECOM and Flour have rallied 9.7% and 10.5%, respectively, while KBR has lost 10.5%.

Sterling’s second-quarter results underscored strong execution and momentum. The next step is to look at what may shape the company’s path forward — let us delve deeper.

E-Infrastructure Momentum Gains Strength

Sterling’s E-Infrastructure Solutions segment continued to lead growth in the second quarter, supported by rising demand for large-scale data centers and e-commerce distribution facilities. Revenues in the segment increased 29% year over year, while adjusted operating income grew 57%. Margins expanded by more than 500 basis points to 28%, reflecting improved project execution and a shift toward mission-critical work.

Data center revenues more than doubled in the quarter, and e-commerce backlog also showed meaningful growth. Bookings remained strong, with data centers now accounting for 62% of the segment’s total backlog, while e-commerce distribution backlog skyrocketed nearly 700% year over year.

Moving forward, the company expects E-Infrastructure revenues to rise 18-20% in 2025, with operating profit margins holding in the mid-to-high 20%.

Backlog Expansion Supports Visibility

The company exited the second quarter with a strong backlog position, providing clear visibility into future revenue streams. Total backlog reached $2 billion, up 24% from the prior year, while E-Infrastructure backlog grew 44% to $1.2 billion. In addition, Sterling maintained approximately $750 million in future-phase opportunities tied to existing projects, bringing combined visibility close to $2 billion for E-Infrastructure.

This expanded pipeline strengthens confidence in the company’s multi-year growth prospects, with management citing increasing customer demand and sustained capital investment plans.

Transportation Solutions Drives Profitability

Sterling’s Transportation Solutions segment is positioned for steady growth, supported by a healthy backlog and favorable market dynamics. Backlog for the segment stood at $715 million at the end of the quarter, up 5% year over year, though sequentially lower due to strong revenue burn and seasonal award timing. The company is approaching the final year of the current federal funding cycle, which runs through September 2026, providing more than two years of visibility and supporting strong bid activity in core Rocky Mountain and Arizona markets.

The planned downsizing of low-bid heavy highway operations in Texas is progressing as intended, resulting in some moderation of revenues and backlog but creating a more profitable mix. Looking ahead, Sterling expects Transportation Solutions revenue growth in the low-to-mid teens on an adjusted basis for 2025, with operating profit margins improving into the low teens from the 9.6% registered in 2024.

Expansion Through Acquisition

Sterling continues to advance its strategy of strengthening the E-Infrastructure platform through targeted acquisitions. The pending $505-million purchase of CEC Facilities Group will add mission-critical electrical and mechanical services to the portfolio, enhancing the company’s ability to deliver end-to-end solutions.

The company expects the integration to create cross-selling opportunities, accelerate project timelines and expand Sterling’s geographic footprint. Once closed, the acquisition is set to deepen customer relationships and support long-term growth across high-demand infrastructure markets.

Upward Estimate Revisions for Sterling

Wall Street analysts remain optimistic about STRL’s earnings potential. Over the past 30 days, earnings estimates for 2025 have been revised upward to $8.90 per share from $8.61. The estimate indicates growth of 45.9% from that reported a year ago.

Conversely, AECOM and KBR’s earnings in the current year are likely to witness year-over-year increases of 15.9% and 13.2%, respectively, while Fluor’s earnings are expected to decline 12.5%.

A Look at Sterling Stock’s Valuation

From a valuation standpoint, the company is currently trading at a premium relative to its industry and historical metrics, with its forward 12-month price-to-earnings (P/E) ratio sitting above its five-year average.

Moreover, STRL is priced higher than some of its industry peers, such as AECOM, Fluor and KBR, which trade at 21X, 18.95X and 12.25X, respectively.

Conclusion: Why is STRL Stock a Buy?

Sterling’s second-quarter results highlighted strong execution, margin gains and solid visibility, backed by a growing backlog. Demand in mission-critical data centers and transportation markets, along with the acquisition of CEC Facilities Group, reinforces the company’s positioning for long-term growth. Its disciplined approach to bidding and focus on higher-margin opportunities continue to strengthen profitability and build resilience across market cycles.

Upward earnings estimate revisions for 2025 reflect analyst confidence in Sterling’s outlook. Despite trading at a premium to peers, the stock’s consistent performance, expanding end-market exposure and favorable growth drivers justify this position.

Backed by these factors, Sterling currently has a Zacks Rank #2 (Buy), signaling that the stock remains attractively placed for investors heading into the next phase of 2025. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The Russell 2000 is home to many small-cap stocks, offering investors the chance to uncover hidden gems before the broader market catches on. However, these companies often come with higher volatility and risk, as their smaller size makes them more vulnerable to economic downturns.

Navigating this part of the market can be tricky, which is why we built StockStory to help you separate the winners from the laggards. That said, here are two Russell 2000 stocks that could be the next big thing and one that may struggle to keep up.

One Stock to Sell:

CoreCivic (CXW)

Market Cap: $2.23 billion

Originally founded in 1983 as the first private prison company in the United States, CoreCivic operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

Why Are We Wary of CXW?

At $21.15 per share, CoreCivic trades at 16.8x forward P/E. To fully understand why you should be careful with CXW, check out our full research report (it’s free).

Two Stocks to Watch:

Sterling (STRL)

Market Cap: $8.38 billion

Involved in the construction of a major highway, the Grand Parkway in Houston, TX, Sterling Infrastructure provides civil infrastructure construction.

Why Are We Backing STRL?

Sterling’s stock price of $276.16 implies a valuation ratio of 31.2x forward P/E. Is now the time to initiate a position? Find out in our full research report, it’s free.

Rumble (RUM)

Market Cap: $2.68 billion

Founded in 2013 as a champion for content creator rights and free expression, Rumble is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Why Does RUM Stand Out?

Rumble is trading at $7.94 per share, or 19.8x trailing 12-month price-to-sales. Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

What Happened?

A number of stocks fell in the afternoon session after an unexpectedly sharp rise in wholesale inflation fueled concerns about rising costs and their impact on corporate profits. The primary catalyst was the July 2025 Producer Price Index (PPI), a measure of inflation at the wholesale level, which jumped 0.9% against forecasts of a 0.2% rise. This represents the most significant monthly increase in over three years, pointing to mounting cost pressures for manufacturers, with tariffs cited as a key factor. This data complicates the Federal Reserve's upcoming interest rate decisions, as persistent inflation may prevent rate cuts, creating a headwind for cyclical sectors like Industrials.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Mercury Systems (MRCY)

Mercury Systems’s shares are not very volatile and have only had 9 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The previous big move we wrote about was 2 days ago when the stock gained 24.9% on the news that the company reported second-quarter 2025 results that significantly beat Wall Street's expectations for both revenue and profitability. The aerospace and defense firm announced revenue of $273.1 million, a 9.9% year-on-year increase that surpassed analyst estimates of $244.2 million. The company's bottom line was even more impressive, with adjusted earnings per share of $0.47, more than double the consensus forecast of $0.22. This strong performance was also reflected in its operational efficiency, as its operating margin improved to 8.6% from a negative 3.2% in the same period last year. Additionally, Mercury Systems reported a healthy backlog of $1.4 billion, indicating a solid pipeline of future business.

Mercury Systems is up 60.3% since the beginning of the year, and at $67.83 per share, it is trading close to its 52-week high of $68.39 from August 2025. Investors who bought $1,000 worth of Mercury Systems’s shares 5 years ago would now be looking at an investment worth $849.04.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Civil infrastructure construction company Sterling Infrastructure reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 5.4% year on year to $614.5 million. The company expects the full year’s revenue to be around $2.13 billion, close to analysts’ estimates. Its non-GAAP profit of $2.51 per share was 11.4% above analysts’ consensus estimates.

Is now the time to buy STRL? Find out in our full research report (it’s free).

Sterling (STRL) Q2 CY2025 Highlights:

StockStory’s Take

Sterling delivered Q2 results that surpassed Wall Street’s revenue and non-GAAP profit expectations, driven by strong demand in its E-Infrastructure Solutions and Transportation segments. Management attributed the quarter’s performance to rapid growth in mission-critical data center projects, a favorable shift toward higher-margin services, and strong execution in project management. CEO Joseph Cutillo highlighted a 29% increase in E-Infrastructure revenue and noted, “Data centers are now 62% of our total backlog and E-Infrastructure.” The company’s ability to execute large, complex projects ahead of schedule was a recurring theme in management’s remarks.

Looking forward, Sterling’s guidance reflects confidence in continued demand for data centers, manufacturing facilities, and e-commerce distribution projects. Management is optimistic about margin expansion opportunities as project complexity grows and expects to leverage the pending CEC Facilities Group acquisition to deliver integrated, end-to-end solutions. Cutillo stated, “We are getting pulled into new geographies by our customers, including Texas, and believe that the pending CEC acquisition will only accelerate our footprint expansion.” The company’s outlook is also supported by a growing backlog and multiyear customer commitments.

Key Insights from Management’s Remarks

Management credited the quarter’s outperformance to strength in data center construction, productivity gains from large projects, and favorable service mix shifts.

Drivers of Future Performance

Sterling’s outlook is anchored by sustained data center demand, margin gains from complex project execution, and strategic expansion efforts.

Catalysts in Upcoming Quarters

In the upcoming quarters, our analysts will be watching (1) Sterling’s ability to secure and execute large data center and e-commerce projects in new markets such as Texas, (2) progress on closing and integrating the CEC Facilities Group acquisition, and (3) whether margin expansion in E-Infrastructure and Transportation can offset ongoing softness in Building Solutions. The evolution of the project pipeline and any further acquisition activity will also be important markers.

Sterling currently trades at $304.51, up from $272.50 just before the earnings. Is the company at an inflection point that warrants a buy or sell? Find out in our full research report (it’s free).

High Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up