Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Exercising patience might be the most difficult part of investing. However, I find it much easier to patiently own some stocks more than others.

You might think that stocks with high dividend yields wouldn't be in that group. After all, such dividends can often be unsustainable. That isn't always the case, though. Here are five high-yield stocks I plan on holding for the next 10 years or longer.

AbbVie (NYSE: ABBV) has proved that it's able to easily navigate one of the biggest challenges for a drugmaker: a patent cliff. The company's autoimmune-disease drug Humira once generated more than 60% of its total sales and ranked as the world's best-selling drug. But AbbVie hasn't skipped a beat since Humira lost U.S. patent exclusivity in 2023.

The company invested in research and development. It made smart acquisitions. Today, it's growing despite plunging sales for Humira. Although the big pharma company will face more patent expirations for other drugs in the future, I'm confident it will be able to survive and thrive over the long run.

I also have a warm and fuzzy feeling about the sustainability of AbbVie's dividend. The company is a Dividend King, with 53 consecutive years of dividend increases. Its payout has soared 310% since AbbVie was spun off from Abbott Labs in 2013 and now yields a healthy 3.16%.

Enbridge (NYSE: ENB) highlighted its "low-risk, utility-like business profile" to investors in its second-quarter update. That's the kind of business I can be comfortable owning part of for the next 10 years or longer.

By the way, Enbridge's management wasn't exaggerating. The company's pipelines transport 30% of all crude oil produced in North America and 20% of all natural gas consumed in the U.S. Enbridge is the largest natural gas utility in North America based on volume. It's investing in renewable energy. And the company projects roughly $50 billion in growth opportunities through the end of this decade.

Enbridge offers a forward dividend yield of 5.71%. While the stock isn't a Dividend King like AbbVie, the company has an impressive 30 consecutive years of dividend increases.

Enterprise Products Partners (NYSE: EPD) has a lot in common with Enbridge. It's also a midstream energy leader, with over 50,000 miles of pipeline spanning the U.S. that transport natural gas, natural gas liquids (NGLs), crude oil, and other refined products.

Two key differences between Enterprise Products Partners and Enbridge stand out. First, it doesn't run a natural gas utility, as Enbridge does. Second, Enterprise is a limited partnership (LP) rather than a corporation. LPs come with some tax hassles, but I think the advantages of owning Enterprise are worth the extra work.

Notably, Enterprise Products Partners pays an especially juicy distribution that yields 6.82%. The LP has also increased its distribution for 27 consecutive years.

Realty Income (NYSE: O) listed its shares on the New York Stock Exchange in 1994. Since then, the company has delivered a positive operational return (defined as the sum of annual adjusted funds from operations per share growth and dividend yield) every year.

I like that this real estate investment trust (REIT) has a highly diversified property portfolio, with 1,630 clients representing 91 industries. I like its triple-net-lease business model, which shifts most costs to tenants. I also like its growth opportunities, especially in Europe, where it faces only one major rival in a total addressable market of around $8.5 trillion.

And I love Realty Income's monthly dividend, which currently yields 5.55%. I also love that the company has increased its payout for 30 consecutive years.

Verizon Communications (NYSE: VZ) ranks as one of the world's largest wireless providers. The high costs associated with building out wireless networks present a formidable entry barrier for new competitors. Verizon already more than holds its own with current rivals, generating industry-leading wireless service revenue in its latest quarter.

Sure, this telecom stock's performance hasn't been great over the last five and 10 years. However, Verizon's business is humming along now. The company could also have a tremendous opportunity with 6G networks expected to roll out by the end of the decade.

I expect the dividend program will increase the chances that the stock delivers strong total returns. The dividend currently yields a mouthwatering 6.17%. Verizon has increased its dividend for 18 consecutive years, a streak that I think will soon be extended.

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $651,599!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,639!*

Now, it’s worth noting Stock Advisor’s total average return is 1,049% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Keith Speights has positions in AbbVie, Enbridge, Enterprise Products Partners, Realty Income, and Verizon Communications. The Motley Fool has positions in and recommends AbbVie, Abbott Laboratories, Enbridge, and Realty Income. The Motley Fool recommends Enterprise Products Partners and Verizon Communications. The Motley Fool has a disclosure policy.

5 High-Yield Dividend Stocks I Plan on Holding for the Next 10 Years or Longer was originally published by The Motley Fool

You don't have to be rich to make money. Furthermore, you don't have to have a lot of money to begin making money almost immediately.

An easy way to get started is to invest in great dividend stocks. With a matter of months (or less), the dividends will begin flowing in.

Which dividend stocks are good picks? Here are three of the smartest dividend stocks to buy with $500, in my opinion.

Archer-Daniels-Midland (NYSE: ADM), usually referred to as ADM, ranks among the world's largest agribusiness companies. Founded in 1902, ADM supplies agricultural products and services to more than 180 countries.

The company's forward dividend yield stands at 3.26%. Even better, ADM is a Dividend King, with 53 consecutive years of dividend increases. It has also paid dividends for 375 consecutive quarters. That's 93 years of uninterrupted dividend payments.

Why buy ADM stock now? Despite a solid year-to-date gain, the agricultural leader's shares remain attractively valued. ADM's forward price-to-earnings (P/E) ratio is 15.9. That multiple is well below the consumer staples sector's average forward P/E of 22.2.

There's also considerable uncertainty in the stock market, with the full impact of tariffs yet to be felt and many stocks trading at historically high premiums. ADM's business should be relatively stable regardless of what happens, though, because people always need to eat.

ADM's share price is below $65 right now. At that price, you can afford to scoop up a couple of shares and still have plenty remaining to buy the other two stocks on the list.

AbbVie (NYSE: ABBV) is one of the world's biggest pharmaceutical companies. It markets around a dozen blockbuster drugs, with its top products including Botox, Rinvoq, and Skyrizi.

Like ADM, AbbVie is a Dividend King, with 53 years of consecutive dividend increases. The company has more than quadrupled its dividend payout since spinning off from Abbott Labs in 2013. Its forward dividend yield is currently 3.14%.

Investors have other reasons to like AbbVie in addition to its dividend. The drugmaker should have robust growth prospects in the coming years, thanks to strong growth from several products already on the market and a promising pipeline. This growth also makes AbbVie's valuation attractive: The stock's price-to-earnings-to-growth (PEG) ratio, which is based on analysts' five-year earnings growth projections, is a low 0.44, according to LSEG.

You'll need to shell out around $210 of your initial $500 to buy one share of AbbVie. But with this big pharma company's great dividend and growth opportunities, I think it will be money well spent.

Enbridge (NYSE: ENB) operates around 18,085 miles of crude pipeline that transports roughly 30% of crude oil produced in North America. It has 18,952 miles of natural gas and natural gas liquids (NGL) pipelines, plus another 53,600 miles of pipeline operated by DCP Midstream, a joint venture between the company and Phillips 66. Enbridge is also the largest natural gas utility in North America based on volume.

The company offers an especially juicy forward dividend yield of 5.74%. Enbridge is a Dividend Champion, with 30 consecutive years of dividend increases. It expects to continue growing the dividend by up to 5% each year going forward.

This energy stock is a good pick right now, in part due to its dividend, but also because of its stability and growth potential. Enbridge's cash flow is predictable and relatively low risk. The company believes it has around $50 billion of growth opportunities through 2030, with nearly half of them focused on gas transmission.

If you bought two shares of ADM and one share of AbbVie, you'd have at least $160 remaining from your initial $500. That's more than enough to buy three shares of Enbridge, which currently trades below $50 per share.

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $664,110!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,104,355!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Keith Speights has positions in AbbVie and Enbridge. The Motley Fool has positions in and recommends AbbVie, Abbott Laboratories, and Enbridge. The Motley Fool recommends Phillips 66. The Motley Fool has a disclosure policy.

The Smartest Dividend Stocks to Buy With $500 Right Now was originally published by The Motley Fool

Dividend Champions are long-term winners. These companies have grown their dividends for at least 25 straight years. They don't have to be members of the S&P 500 (SNPINDEX: ^GSPC), which broadens the universe of qualifying stocks.

Here are seven top Dividend Champions to buy now to steadily grow your dividend income.

Chevron (NYSE: CVX) is a leading integrated oil and gas producer. Its industry-leading upstream break-even level at around $30 a barrel means Chevron can remain profitable even if oil prices fall. It also boasts having a fortress-like balance sheet and one of the sector's lowest leverage ratios. These features put Chevron in a strong position to pay a sustainable and steadily growing dividend.

The oil giant has increased its dividend for 38 straight years, which includes multiple downturns in the oil market. It has delivered peer-leading dividend growth over the past decade, a period when several peers had to reduce their payments due to oil price volatility.

Chevron expects to add an incremental $12.5 billion to its annual free cash flow starting next year. Meanwhile, its recently closed merger with Hess enhanced and extended its production and free cash flow growth outlook into the 2030s. As a result, it should have plenty of fuel to continue increasing its more than 4%-yielding dividend in the future.

Consolidated Edison (NYSE: ED) is an electric and gas utility focused on the New York City area. Because its utility operations generate steady cash flow from stable demand and government-regulated rates, the company can maintain and steadily grow its dividend. This reliability should appeal to investors aiming for consistent income.

The company delivered its 51st annual dividend increase earlier this year, the longest streak among utilities in the S&P 500. As a result, it's not just a Dividend Champion, but also a Dividend King, as a company with 50 or more years of dividend increases.

Consolidated Edison plans to invest $38 billion to maintain and grow its utility operations through the end of the decade. These investments should deliver reliable earnings growth, giving the utility plenty of power to continue increasing its nearly 3.5%-yielding dividend.

Enterprise Products Partners (NYSE: EPD) is a master limited partnership (MLP) that owns energy midstream assets, including pipelines, processing plants, and export terminals. The long-term contracts and regulated rate structures provide the MLP with highly predictable cash flow, supporting its attractive nearly 7% yield. Enterprise offers income-focused investors a robust payout, backed by a strong financial profile.

The MLP has increased its distribution for 27 straight years. That growth should continue. Enterprise currently has $6 billion of organic capital projects on track to enter commercial service by the end of this year, which should provide a big boost to its cash flow in 2026. The MLP expects to invest between $2.2 billion and $2.5 billion in growth capital projects next year to further enhance its cash flow.

With one of the best balance sheets in the energy midstream sector, Enterprise Products Partners has ample fuel to continue growing its business and high-yielding distribution.

Enbridge (NYSE: ENB) is a leading North American energy infrastructure company. With 98% of earnings from predictable revenue frameworks, Enbridge has extreme visibility into its earnings. The Canadian pipeline and utility company has achieved its annual financial guidance for 19 straight years, making it a compelling option for investors who highly value predictability.

The energy company has increased its dividend (which yields nearly 6%) for 30 straight years. It should have plenty of fuel to continue increasing its payout in the future. Enbridge currently has around 32 billion Canadian dollars ($23 billion) of capital projects in its backlog that should enter commercial service through 2029. This backs the company's outlook that it can grow its cash flow per share at a 3% annual rate through 2026 and by around 5% annually thereafter, which should support dividend growth within the same annual range.

Genuine Parts (NYSE: GPC) is a leading provider of automotive and industrial replacement parts. The company has been incredibly resilient over the decades, growing its sales in 91 of its 97 years, while increasing its earnings in 79 of those years. That has enabled the company to pay one of the world's most consistent dividends. This year marks the 69th straight year it has raised its payment.

The company has benefited from durable and growing demand for replacement parts. It also has a very disciplined record of making acquisitions that drive profitable growth. Genuine Parts seeks deals that will accelerate its sales growth and margin rates, while also boosting its earnings per share within the first year. The company's strong cash flows and balance sheet should enable it to steadily grow its business and 3%-yielding dividend.

NNN REIT (NYSE: NNN) is a real estate investment trust (REIT) focused on investing in single-tenant, net leased (NNN) retail properties. NNN leases generate very stable rental income because tenants cover all property operating costs such as routine maintenance, real estate taxes, and building insurance. The company invests in well-located properties in strong markets, making it easier to find a replacement tenant should the existing one run into financial difficulties.

The NNN REIT has increased its dividend for 36 straight years, the third-longest streak in the sector. Less than 80 publicly traded companies have reached this milestone.

The REIT remains in an excellent position to continue increasing its more than 5.5%-yielding dividend. It has a very conservative financial profile, giving it the flexibility to continue investing in new income-generating retail properties.

PepsiCo (NASDAQ: PEP) is a global beverage and snacking giant. Its iconic brands generate steady and growing cash flow to support its nearly 4% dividend yield. The company has raised its dividend payment for 53 years in a row, joining Consolidated Edison as a Dividend King.

PepsiCo's reign among the dividend elite should continue. It invests heavily to grow its business through new product innovations, capacity expansions, and productivity enhancements. The company anticipates these investments will drive mid-single-digit annual revenue growth and high-single-digit earnings-per-share growth over the long term. PepsiCo also has a strong balance sheet, which it's currently using to make acquisitions that accelerate the transformation of its portfolio to healthier food and drink options.

These companies have all increased their dividends annually for at least a quarter-century. Their resilient business models and financial strength put them in excellent positions to continue growing their payouts. It makes them ideal choices for investors seeking durable and steadily rising passive dividend income.

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $664,110!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,104,355!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Matt DiLallo has positions in Chevron, Enbridge, Enterprise Products Partners, Genuine Parts, and PepsiCo. The Motley Fool has positions in and recommends Chevron and Enbridge. The Motley Fool recommends Enterprise Products Partners and Genuine Parts. The Motley Fool has a disclosure policy.

7 Best Dividend Champions to Buy Now was originally published by The Motley Fool

AbbVie currently trades at $207.60 per share and has shown little upside over the past six months, posting a small loss of 0.7%. The stock also fell short of the S&P 500’s 9.2% gain during that period.

Is now the time to buy ABBV? Find out in our full research report, it’s free.

Why Does AbbVie Spark Debate?

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

Two Things to Like:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $58.33 billion in revenue over the past 12 months, AbbVie is one of the most scaled enterprises in healthcare. This is particularly important because therapeutics companies are volume-driven businesses due to their low margins.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AbbVie has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 36.6% over the last five years.

One Reason to be Careful:

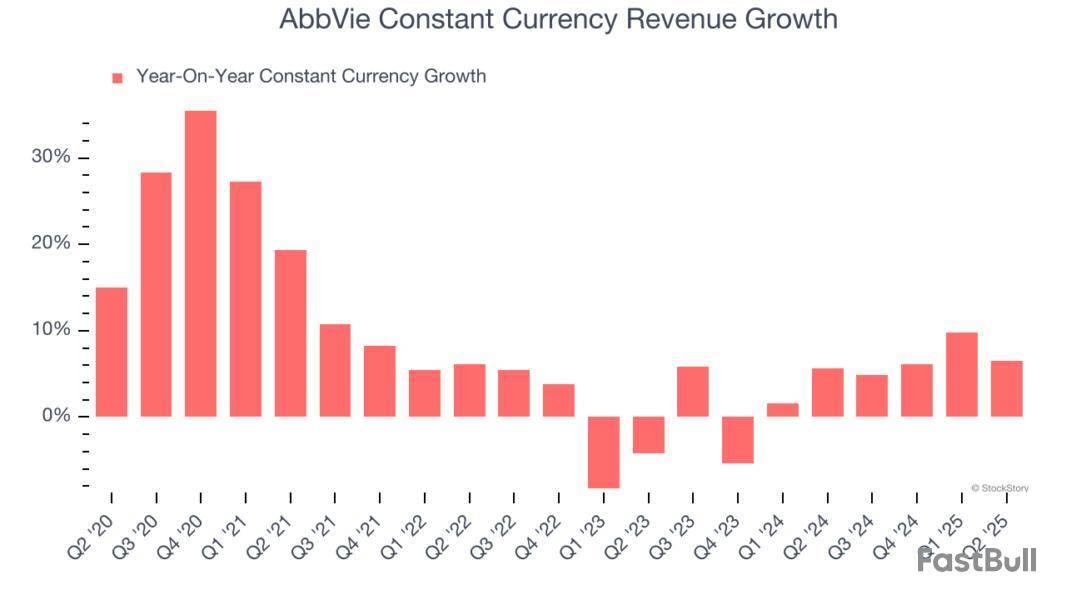

Weak Constant Currency Growth Points to Soft Demand

We can better understand Therapeutics companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of AbbVie’s control and are not indicative of underlying demand.

Over the last two years, AbbVie’s constant currency revenue averaged 4.4% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

AbbVie has huge potential even though it has some open questions. With its shares lagging the market recently, the stock trades at 15.8× forward P/E (or $207.60 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than AbbVie

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

By Ian Salisbury

Healthcare stocks are struggling. But they may be worth a second look. By at least one key measure, they're trading at cheaper prices than they have in more than 20 years.

This bull market hasn't been kind to the sector. The Health Care Select Sector SPDR, an ETF, is down 12% in the past year, while the S&P 500 has surged 15%.

In midday trading Thursday, the ETF was off 0.6%. So too was Eli Lilly, the fund's largest holding. Johnson & Johnson and AbbVie were down as well — 0.7% and 0.6%, respectively.

The past year's dismal performance has cut into healthcare's average forward price-to-earnings ratio. Today, it stands at 16.6, down from 19.7 a year ago. The rest of the market has only gotten richer.

But price-to-earnings ratios aren't the only way to value healthcare stocks. By another important measure, the sector looks cheaper than at any time since 2000, according to a note Thursday by independent market researcher Jim Paulsen.

Besides traditional valuation metrics, Paulsen argues, investors should look at healthcare stock prices relative to real, or inflation-adjusted, drug prices. The two have largely moved in sync, according to data going back to 1990.

The cost of drugs "is a central price that defines these stocks' existence," Paulsen told Barron's. "It doesn't fit all of the healthcare industry — but it gives you a sense of where they are going."

Inflation-adjusted drug prices have been under pressure for several years — a startling reversal after decades of prices marching upward year after year almost as a matter of course.

Last year, net prices for brand-name drugs rose 0.1% in nominal terms and fell by 3% after adjusting for inflation, according to the Drug Channels Institute, a group that tracks the industry.

The dip represented the seventh year of decline in real prices. One factor was competition — the growth of biosimilars and companies rushing to expand GLP-1 weight-loss drugs. Shanges to Medicare and Medicaid drug payments have also played a role, the group said.

But if inflation-adjusted drug prices have been falling, prices of healthcare stocks have fallen much faster, according to Paulsen's note.

Paulsen's P-D, or (stock) price-to-drug (price) ratio, peaked in 2022 at about 0.17, and has since tumbled to about 0.1. That represents the lowest level since 2000, according to his calculations, and one of the lowest levels since 1990.

Paulsen declined to venture a guess on when exactly prices for drugs or healthcare stocks will recover. But he said the steep decline in his P-D ratio, with stock prices falling much more steeply than drug prices, almost certainly reflects an overreaction by spooked investors.

Healthcare stocks are "priced at panic levels," he said. "It's gone way beyond the fundamentals."

Write to Ian Salisbury at ian.salisbury@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at therapeutics stocks, starting with Moderna .

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 9 therapeutics stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 5.1%.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

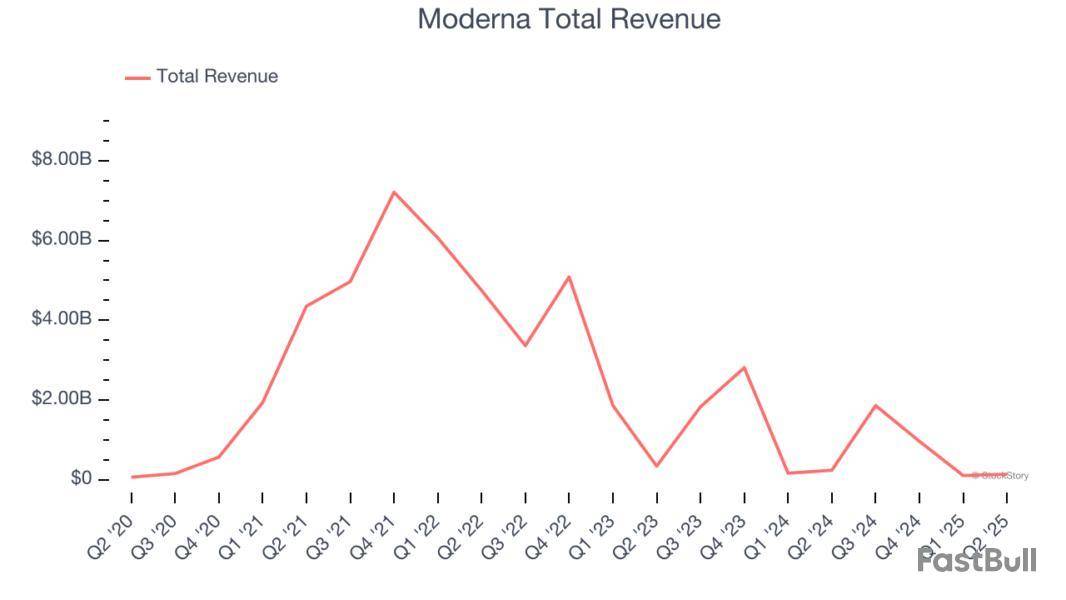

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Moderna reported revenues of $142 million, down 41.1% year on year. This print exceeded analysts’ expectations by 10.7%. Overall, it was a satisfactory quarter for the company with a beat of analysts’ EPS estimates.

Moderna delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 15.6% since reporting and currently trades at $24.94.

Is now the time to buy Moderna? Access our full analysis of the earnings results here, it’s free.

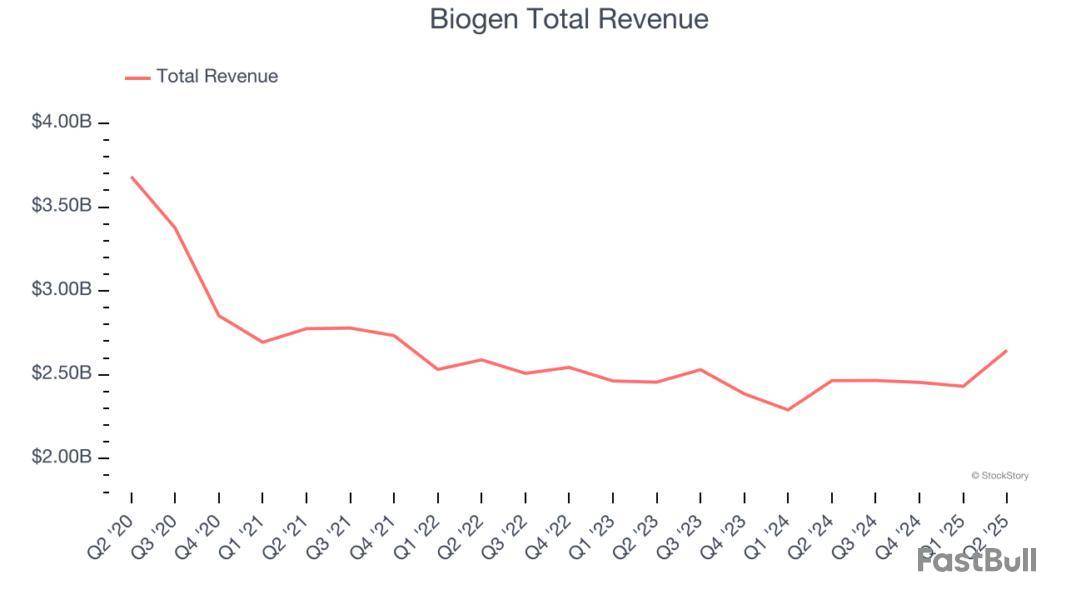

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

Biogen reported revenues of $2.65 billion, up 7.3% year on year, outperforming analysts’ expectations by 13.7%. The business had an incredible quarter with a beat of analysts’ EPS and full-year EPS guidance estimates.

Biogen delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7.4% since reporting. It currently trades at $136.35.

Is now the time to buy Biogen? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: United Therapeutics

Founded by a mother seeking treatment for her daughter's pulmonary arterial hypertension, United Therapeutics develops and commercializes medications for chronic lung diseases and other life-threatening conditions, with a focus on pulmonary hypertension treatments.

United Therapeutics reported revenues of $798.6 million, up 11.7% year on year, falling short of analysts’ expectations by 0.5%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

United Therapeutics delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 2.8% since the results and currently trades at $305.34.

Read our full analysis of United Therapeutics’s results here.

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

Myriad Genetics reported revenues of $213.1 million, flat year on year. This print beat analysts’ expectations by 5.5%. It was a stunning quarter as it also logged a beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Myriad Genetics delivered the highest full-year guidance raise among its peers. The stock is up 56.5% since reporting and currently trades at $6.04.

Read our full, actionable report on Myriad Genetics here, it’s free.

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

AbbVie reported revenues of $15.42 billion, up 6.6% year on year. This number surpassed analysts’ expectations by 2.6%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 10% since reporting and currently trades at $208.26.

Read our full, actionable report on AbbVie here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up