Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After expanding by nearly $40B since Donald Trump’s victory in the US election, the stablecoin market has now soared past the $200B mark as far as market capitalization is concerned. One of the biggest reasons behind this terrific growth has been the increased use of bots, especially on Solana.

It’s worth noting that stablecoins are an integral part of the crypto economy, seeing as they simplify switching between different crypto assets. A growth in stablecoin’s liquidity means more and more people are being onboarded in the crypto industry, which is a hugely positive sign for the overall crypto market.

All in all, it’d be safe to say that we’re on the cusp of yet another crypto bull run, which could be bigger and more rewarding than any we’ve seen so far. This is, therefore, the best time to invest in these 5 high-potential altcoins that could explode alongside crypto’s growth.

1. Solaxy ($SOLX) – Overall Best Altcoin to Buy In 2025

As the first-ever Layer 2 solution on the Solana network, Solaxy ($SOLX) aims to boost Solana’s utility by getting rid of several critical issues it has begun facing because of its popularity. These include the concerning frequency at which transactions get declined on the network, which is a result of too much congestion and limited scalability.

Thanks to Solaxy’s multi-chain nature (it combines the best of Ethereum and Solana), it will be able to smoothen operations by bundling transactions through batch processing. This will not only result in higher throughputs but also reduce overall costs.

Another reason to be bullish on Solaxy is the attention its presale has received from both retailers and whales. With over $17M raised in its ongoing presale, $SOLX’s current price of $0.001622 is an attractive entry point for early adopters. If you’d like some help through the buying process, here’s a detailed guide on how to buy $SOLX.

2. Best Wallet Token ($BEST) – Native Token of the Best Crypto Wallet Available Right Now

Best Wallet Token ($BEST) is the native token of Best Wallet App, a well-rounded crypto wallet that exhibits serious potential of fulfilling its promise to control over 40% of the non-custodial crypto wallet industry by 2026.

Best Wallet supports more than 60 blockchains, allowing users to manage almost all their crypto assets from a single platform. Additionally, you get the ability to execute easy and quick cross-chain swaps, thanks to a built-in decentralized exchange called Best DCS.

$BEST token holders will receive an array of benefits within the Best Wallet ecosystem, including the right to vote on critical decisions regarding the project’s future. What’s more, you’ll also benefit from reduced transaction fees and early access to hyped and high-potential projects, as well as staking rewards of 197%.

The $BEST presale has performed exceedingly well, with over $8.8M in funding at the time of writing. 1 $BEST is currently available for just $0.023825, and you can buy $BEST by either visiting its official presale website or directly from the Best Wallet App on your Android or iOS device.

3. MIND of Pepe ($MIND) – Unlock Real-Time Investment Advice with Hive-Mind Analysis

MIND of Pepe ($MIND) is one of the hottest crypto presales of 2025, which is hardly a surprise seeing as it titillates not one but two high-potential segments: the AI space and finance bros. Plus, it carries the OG Pepe meme’s appeal, which is not to be taken lightly, either.

$MIND is an AI agent that interacts with crypto enthusiasts and communities on platforms like X. Next, and the most interesting bit, is that $MIND is self-evolving; it scans everything that’s being said in the market, forms its own opinions, drives trends and conversations according to its bias, and identifies early-stage investment opportunities for the token holders.

The MIND of Pepe presale is growing every minute, and it currently boasts over $4.7M in funding. The best AI agent coin is currently available for just $0.0032402, but interested investors should hurry up because prices increase in the next 40 hours.

4. Fartcoin ($FARTCOIN) – Solana Meme Coin Based on Fart Jokes

Fartcoin started out as a joke. After all, the whole idea that you can claim free tokens by submitting fart jokes is absurd, isn’t it? However, it doesn’t have to make sense to make you money – which should be the ethos of $FARTCOIN that now has a market capitalization of more than $850M.

Make the mistake of thinking that $FARTCOIN is all fun and games at your own peril – it’s a ‘serious’ meme coin that hit all-time highs of around $2.40 early this year, jumping 300% in just two weeks, resulting in massive gains for early investors.

Although Fartcoin is down quite a fair bit right now, the current price of $0.86 offers a discounted entry point for long-term investors.

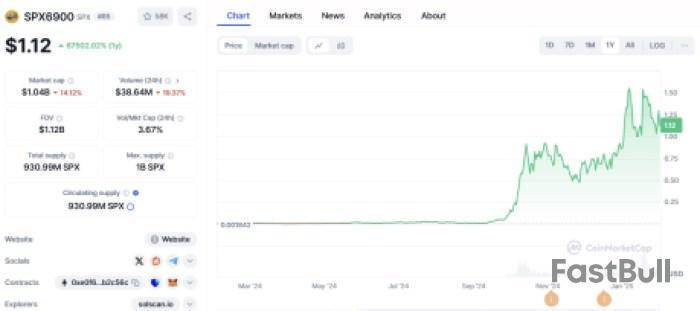

5. SPX6900 ($SPX) – Meme Coin Twist to the S&P 500 Index

If you thought Fartcoin had a weird theme, wait till you hear about SPX6900. With a market cap of over $1B, SPX6900 is an Ethereum-based altcoin that blends humor with finance, offering a meme coin twist to the S&P 500 index, which is one of the biggest and baddest stock market indexes in the world.

Although you can argue that $SPX is all hype and no logic, there’s little to no room for debate about its potential. It’s up over 67,000% in the last year, and an active social media community (80K followers on X and over 19K subscribers on its Telegram) means that there could still be room for more growth.

Bottom Line

Having mentioned the 5 best altcoins that could explode in 2025, it’s important to mention that the crypto market isn’t all sunshine and rainbows, and it can have its fair share of ups and downs as well. This is why you must be careful about how much you put into the market.

Plus, you must do your own research (DYOR) before investing because that will give you the required confidence to stick with your bets. Lastly, none of the above is financial advice, and we merely hope to offer our best opinions and insights.

Swiss banking giant UBS has successfully tested its UBS Key4 Gold product on ZKSync, an Ethereum Layer-2 network.

This move highlights the increasing adoption of blockchain technology by traditional financial institutions seeking efficiency and security.

UBS Integrates ZKSync for Blockchain-Based Gold Trading

On January 31, ZKSync reported that UBS, which manages assets worth $5.7 trillion, is exploring how blockchain can streamline gold investments.

The test focuses on allowing the bank’s Swiss customers to purchase physical gold directly through a blockchain-based system while ensuring scalability, privacy, and interoperability.

UBS Key4 Gold enables retail investors to buy fractional gold shares, offering real-time pricing, deep liquidity, and secure storage. The product operates on the UBS Gold Network, a permissionless blockchain that connects vaults, liquidity providers, and distributors.

To optimize efficiency, UBS leveraged ZKSync’s Validium mode. It’s a zero-knowledge rollup solution that enhances scalability by storing data off-chain.

As part of the proof-of-concept, the bank deployed smart contracts on the Validium testnet to simulate the UBS Gold Network. These contracts facilitated gold token issuance and transaction processing.

“This PoC reflects UBS’ continued efforts to explore how blockchain can enhance its financial offerings and support its broader digital asset strategy. I firmly believe that the future of finance will take place onchain,” wrote Alex Gluchowski, inventor of ZKsync.

The testnet also enhanced privacy by restricting participants’ visibility to their transactions while maintaining verification mechanisms.

Additionally, it allowed stablecoin to merge with Ethereum, making gold token purchases more cost-effective and scalable.

Growing Institutional Interest in Blockchain Solutions

UBS’ test reflects a broader shift toward blockchain adoption in traditional finance (TradFi). The bank has previously explored tokenization by launching an Ethereum-based money market investment fund.

UBS’ Digital Assets Lead Christoph Puhr noted that tokenized securities hold great potential, but scalability, privacy, and interoperability remain hurdles. He highlighted that the ZKSync PoC showcased how Layer-2 networks and zero-knowledge technology can help address these challenges.

“This is another great example of how UBS collaborates with technology providers to stay at the forefront of innovation. Our PoC with ZKsync demonstrated that Layer 2 networks and ZK technology hold the potential to resolve these,” Puhr noted.

ZKSync co-inventor Alex Gluchowski echoed this sentiment while pointing out that these initiatives show that the future of finance is on-chain.

According to him, zero-knowledge technology would serve as a catalyst for innovation and provide a robust foundation for tokenized assets, which could accelerate Web3 adoption.

The weekend has started with sellers' pressure, according to CoinMarketCap.CoinMarketCap">

The rate of Bitcoin has declined by 2.25% over the last day.TradingView">

On the hourly chart, the price of BTC might have set a local support of $101,418. If the growth continues, one can expect a test of the resistance level of $102,744 by tomorrow.TradingView">

On the bigger time frame, neither bulls nor bears are dominating. However, if the sellers break the vital zone of $100,000, the accumulated energy might be enough for a more profound correction to the $98,000 range.

Such a scenario is relevant for the upcoming week.TradingView">

From the midterm point of view, sideways trading is the more likely scenario. The volume keeps falling, which means any sharp moves are unlikely to happen shortly.

Bitcoin is trading at $102,018 at press time.

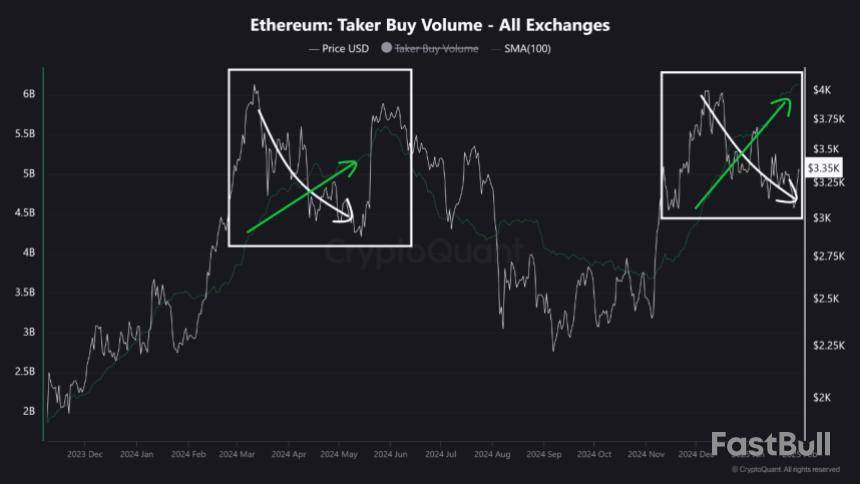

The price of Ethereum (ETH) has shown some significant change in the past day rising by 1.86%. However, according to trading data from CoinMarketCap, the popular altcoin has recorded negative growth since December 2024 despite some significant gains in the past month. Interestingly, underlying market activity points to a potential price breakout.

Ethereum Sees Strong Accumulation Activity Amid Price Dip

Ever since touching the $4,000 price mark, Ethereum has slipped into a downtrend falling as low as $3,000. Amidst notable gains by Bitcoin in January, Ethereum continues to struggle hitting consistent lower lows during this period.

However, a CryptoQuant market expert with the username Crypto Sunmoon has noted an increase in market buying volume amidst the current price dip indicating a bullish divergence in the ETH market. For context, a bullish divergence occurs when an asset’s price is making lower lows while a momentum indicator is making higher lows, thereby hinting at a potential reversal or upward movement.

As for Ethereum, the increase in buying volume amid falling prices indicates a strong demand from buyers especially at the current price levels. This development further suggests a strong confidence in the asset’s profitability as investors expect buying pressure to surpass selling activity in the coming days.

Based on historical data, Crypto Sunmoon predicts Ethereum may experience a price surge such as the one in May 2024 when a similar bullish divergence last occurred. During that month, ETH rose by over 21% suggesting the altcoin will likely return to $4,000 if the projected price breakout occurs, according to current market prices.

ETH Long-Term Holders Signal Strong Market Confidence

In other news, IntoTheBlock reports that long-term holders of Ethereum currently boast an average holding time of 2.4 years showing massive confidence in Ethereum’s future value potential.

However, Ethereum faces other issues including an absence of short-term participants which prevents ETH from experiencing significant levels of speculative trading that can drive up price appreciation. Furthermore, the rapid growth of layer 2 solutions such as Optimism, and layer 1 blockchains such as Solana are also tampering with the potential market demand and attention for Ethereum.

At press time, ETH trades at $3,306 after a gain of 1.86% over the past day as earlier stated. Meanwhile, the asset’s daily trading volume has increased by 55.69% resulting in a value of $30.3 billion. On larger time frames, Ethereum is also up by 0.22% on its weekly chart but down by 2.27% on its monthly chart leaving much to desire for many short-term investors.

Dogecoin , the biggest meme coin by market capitalization, faces a key resistance on the daily chart. This outlook comes amid a spike in the daily trading volume, demonstrating heightened investor interest.

Dogecoin key resistance

According to CoinMarketCap data, DOGE was trading at $0.323, down 1.24% in the past 24 hours. Within this time frame, DOGE touched a high price of $0.35 before dropping to its current level. Now, it is looking at retesting its key resistance level at the $0.3 level.DOGE 1D Price Chart. Source: CoinMarketCap">

The daily chart shows bears have continued to push DOGE down, as indicated by the declining price. As a result, DOGE has yet to enter a consolidation channel that will later become a foundation for recovery. If bulls recover, the effort to flip the $0.33 level could be successful in the short term.

However, traders have increased support for the meme coin, as the volume profile indicates. Within the last 24 hours, 5,459,592,843 DOGE has been shuffled on-chain, amounting to a trading volume increase of over 45% to $1.8 billion, showing increased investor interest.

Over the past few weeks, intense trading volume and accompanying DOGE accumulation have been a precursor to price rebounds.

Surging DOGE institutional interest

Meanwhile, expectations about a DOGE exchange-traded fund (ETF) approval continue to rise in the crypto market. This has sparked rising institutional interest for the leading meme coin.

As reported by U.Today, Polymarket has forecast a 56% chance to launch a DOGE ETF in 2025. Several asset managers, including Bitwise and REX Shares, recently submitted applications for a DOGE ETF.

Furthermore, Grayscale Investments has launched its first Dogecoin Trust to broaden its digital asset offerings. The new product, available only to eligible investors, will offer investors a direct way to gain exposure to DOGE.

As DOGE continues to gain institutional interest, the price is expected to see a corresponding increase. Dogecoin also set a precedent for other ecosystem meme coins to launch their exchange-traded fund.

According to a recent tweet issued by Shibburn, the weekly burn rate of the second largest meme cryptocurrency Shiba Inu has displayed a large four-digit increase, surpassing 2,000%.

A single burn made by a SHIB team member earlier this week has pushed the weekly burn metric reading that high up.

SHIB burns soar 2,085%

The tweet published by the data source mentioned above revealed that over the past seven days, a mind-blowing amount of meme coins has been transferred into a virtual furnace and out of the circulating supply — 1,138,148,465 SHIB. The overall burn rate rise reached 2,085.71%.

Notably, the majority of this tremendous SHIB amount was burned in a single transfer as 1,000,148,675 SHIB coins were torched by the SHIB team — its major developer Kaal Dhairya made an announcement about that on his X account on Friday. This was also shared by the “Shibarium Updates” X account. At the time of the burn transaction, that amount of SHIB was worth roughly $18,800.

Shibburn@shibburnFeb 01, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001909 (1hr 0.01% ▲ | 24hr 1.52% ▲ )

Market Cap: $11,241,166,223 (1.49% ▲)

Total Supply: 589,255,699,526,690

TOKENS BURNT

Past 24Hrs: 3,273,853 (-99.7% ▼)

Past 7 Days: 1,138,148,465 (2085.71% ▲)

A tweet published by the latter revealed that this huge burn was aligned with the launch of ShibTorch V2 — an improved burn system developed to have “greater efficiency, accessibility, and community participation.”

A portion of transaction fees on Shibarium converted from BONE tokens to SHIB was eliminated in this burn. Now, thanks to the above-mentioned upgrade, the automated BONE-to-SHIB conversion will be faster with SHIB burns taking place further. Besides, other changes will be able to participate in burns from now on, apart from Shibarium.

SHIB price reacts unexpectedly

During the past 24 hours, the popular meme-inspired cryptocurrency SHIB has plunged, printing a loss of more than 4%. After reaching a local peak at roughly $0.00001968, it landed at the $0.00001858 price level. As of now, after a tiny rebound, it is changing hands at $0.00001866.

That plunge followed impressive 5.91% growth demonstrated on Friday, Jan. 31. On that day, SHIB nosedived mirroring the price trajectory of the crypto market leader Bitcoin. The world’s flagship cryptocurrency tanked following the stock market after U.S. president’s administration confirmed the implementation of higher trade tariffs for Canada, Mexico and China.

Bitcoin went down by 4.20% and lost the $106,000 mark, now trading at $101,700 per coin.

Dogecoin has experienced significant whale activity in recent days, with large holders accumulating 560 million DOGE in the past week.

According to crypto analyst Ali, whales have accumulated 560 million Dogecoin in the past week following an intense sell-off; Dogecoin’s price has steadily declined since Jan. 18 after reaching highs of $0.434.

The move, according to Ali, signals renewed interest from large holders. This might have been contributed to by the recent optimism stemming from Dogecoin ETF filings this week.

Ali@ali_chartsJan 31, 2025Whales have accumulated 560 million #Dogecoin $DOGE in the past week following an intense sell-off, signaling renewed interest from large holders! pic.twitter.com/ObAVfqC9xi

At the time of writing, Dogecoin was down 0.59% in the last 24 hours to $0.324, reflecting slight profit-taking in the markets amid recent inflation data release.

According to inflation data published on Friday, the personal consumption expenditures price index jumped 2.6% year on year in December, while core PCE rose 2.8%, both in line with estimates but significantly above the Fed's 2% objective.

The data comes two days after the Fed voted unanimously to keep its key interest rate at 4.25%-4.5%, taking a pause from three consecutive decreases totaling a full percentage point.

The cryptocurrency market had experienced a sell-off earlier this week as investors awaited the Fed's rate announcement. Dogecoin likewise took a hit, plunging three days at a stretch and reaching lows of $0.305 on Jan. 27.

Dogecoin marks big week with ETF filings

With a now somewhat crypto-friendly Securities and Exchange Commission, asset managers have launched a flurry of applications for spot ETFs covering major cryptocurrencies, including Dogecoin.

Eric Balchunas, senior ETF analyst for Bloomberg, reports up to four Doge ETF filings at present.

On Friday, asset manager Grayscale launched a new trust that provides exposure to Dogecoin and also filed a 19b-4 form to convert the Trust into a proper spot ETF.

On Tuesday, asset manager Bitwise threw its hat into the ring, filing for a Dogecoin ETF. Investment managers Rex Shares and Osprey Funds also filed paperwork for crypto ETFs, including Dogecoin.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up