Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After 4chan was hacked on April 14 and vast troves of user and moderator data were leaked online, the controversial website quickly went down, and many believed it would never recover. However, less than two weeks later, the imageboard was back online, defiant as ever.

“4chan is back,” an official blog post proclaimed. “No other website can replace it, or this community. No matter how hard it is, we are not giving up.”

The imageboard has left its mark on the world in many consequential ways, birthing countless memes and conspiracy theories, serving as a platform for political movements ranging from the alt-right to Anonymous, and acting as a dumping ground for leaks and hacks of all sorts.

Crypto is no exception, with 4chan also a historically influential gathering place to share altcoin alpha, coordinate campaigns to pump tokens, share price prophesies and more.

With the imageboard back from the dead, here are just a few of the ways it has influenced the crypto space during its storied history.

Finding alpha on 4chan’s /Biz/ imageboard

The primary hub of crypto activity on 4chan is its /Biz/, or “Business & Finance,” imageboard, where traders, gamblers, investors and commentators gather to share info, shill tokens, and discuss the state of the crypto industry at large.

The imageboard has gathered a reputation for being a place where intrepid investors can go to learn about moonshot tokens the broader community has yet to discover, though X and Telegram have since given 4chan a run for its money. It has also been ground zero for countless shilling campaigns that have helped pump prices for various tokens.

/Biz/ has also become known for the various prophecies, lore and legends that emerge from its anonymous users. People who claim to have inside knowledge on major market movements often leak alleged secret info on the imageboard or issue prophecies, and every once in a while, they actually turn out to be accurate.

In January 2019, a user correctly predicted that Bitcoin would hit $5,300 by April and $9,200 by July, sparking huge interest online. Unfortunately, their remaining price predictions quickly fell short of reality, including that Bitcoin would hit $87,000 by October 2020.

Another user claimed in May 2021 to work at a Chinese firm that collaborated closely with the government and said they had insider information that Bitcoin would sell off due to major news out of China. A few hours later, reports emerged that China would ban payment companies and financial institutions from offering services related to crypto transactions, and Bitcoin sold off.

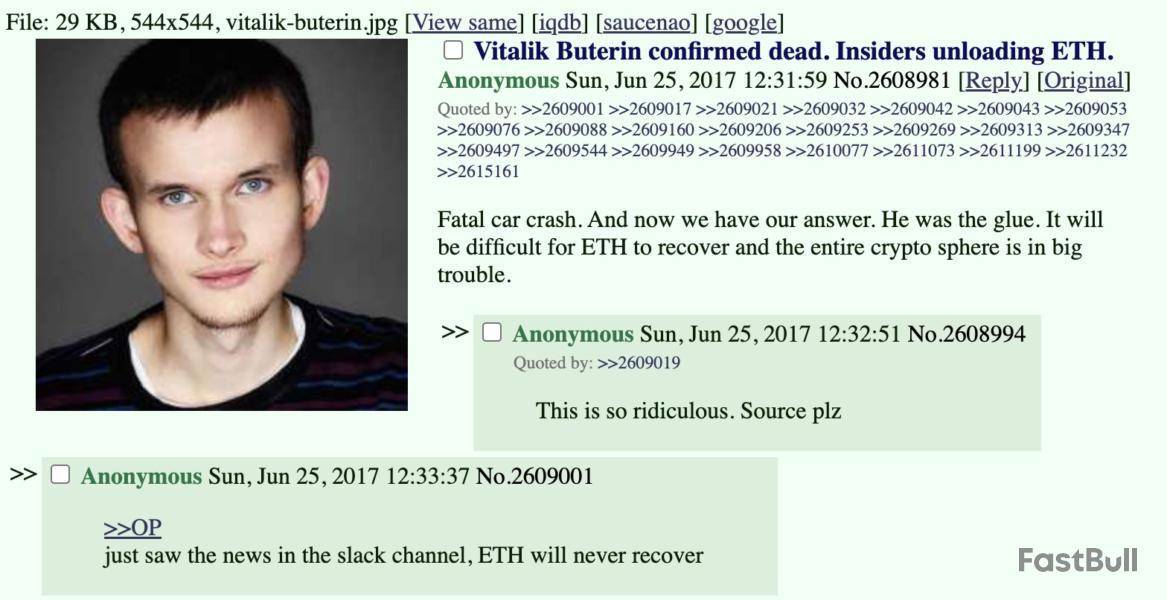

/Biz/ was also the source of a June 2017 rumor that Ethereum co-founder Vitalik Buterin had died in a car crash. The fake news led to Ether’s market cap crashing by $4 billion before Buterin stepped in to share that he had, in fact, not died.

Chainlink and the LINK Marines

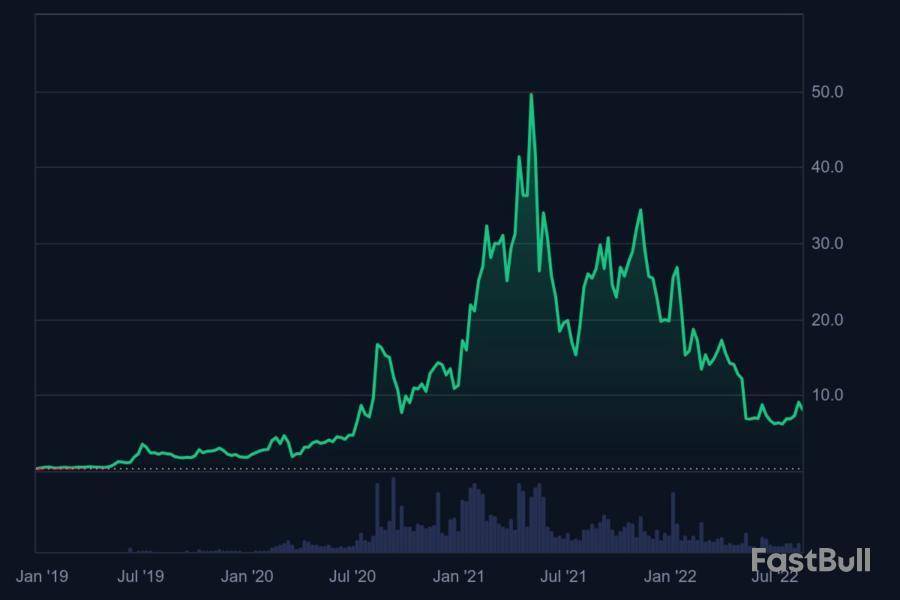

Perhaps the most successful shilling campaign to come out of 4chan is that of Chainlink , which saw a massive rally that started in 2020 and continued into 2021. Many of the oracle project’s most diehard community members, known as the LINK Marines, first discovered Chainlink on /Biz/.

Much of the excitement among the early Chainlink community was galvanized by a mysterious figure known as “AssBlaster,” who claimed to have insider knowledge about the project and would share alpha on /Biz/.

The LINK Marines relentlessly promoted Chainlink on 4chan and social media platforms, and by 2020, LINK had experienced its first major rally — from $1.80 at the start of the year to a high of $16.64 on Aug. 12.

Following the rally, Mechanism Capital co-founder Andrew Kang declared that “4chan has become the largest market driver” in crypto, “more powerful than even China or institutional crypto fund capital.”

LINK went on in 2021 to hit an all-time high of $49.54, becoming one of the year’s most talked-about crypto success stories.

LINK Marine Albert Nazarov told Cointelegraph Magazine in March 2021 that “4chan is basically a crucible of raw thoughts; the best and balanced make it to the top. It’s almost anything goes there, and it trains the brain to decipher good info from bad stuff.”

Chainlink remains the third most mentioned stock or cryptocurrency on /Biz/ over the last 24 hours as of the time of writing, behind only Bitcoin and Ether.

Pepe the Frog and memes galore

One of the most well-recognized memes associated with 4chan is Pepe the Frog, though its origins have nothing to do with the imageboard. Pepe was created by artist Matt Furie back in 2005 for a comic titled Boy’s Club.

Over the next several years, Pepe was popularized by 4chan and eventually became a mainstream meme. But in 2015, posters from 4chan’s /R9k/ board decided to “reclaim” Pepe and began a campaign to intentionally associate it with the far right. Nevertheless, the frog remains a popular meme on 4chan and in crypto circles.

In the cryptosphere, Pepe became closely associated with Chainlink. Sanctum CEO Tyler Ward, who sparked a Pepe non-fungible token (NFT) craze in 2021, told Magazine, “When Chainlink started doing well, it just became this cultish prophecy of 4chan, and 4chan really likes Pepe the frog, so it was kind of this merger.”

Crypto’s obsession with Pepe the Frog has since grown significantly beyond its early association with Chainlink. In 2023, the memecoin Pepe (PEPE), named after the frog, was launched and quickly became popular among traders. The token truly took off in 2024 amid the memecoin mania, going from a $591-million market cap at the start of the year to $11 billion by December, flipping Uniswap’s UNI (UNI) token.

But Pepe is not the only 4chan meme to be tokenized and explode in price. Mog Coin (MOG), a memecoin based on the phrase “mogging” — dominating, outclassing or outshining others — gained 1,800% in early 2024. According to CoinGecko, 4chan-themed memecoins command a $37-billion market cap as of May 8.

The popular phrase “we’re all gonna make it,” or WAGMI, was also popularized on 4chan. It was borrowed from Australian bodybuilder Aziz “Zyzz” Shavershian, who would frequently post on the Bodybuilding.com forum as well as 4chan’s fitness board and who passed away in 2011. It later made its way into crypto around 2017, seemingly as users who had been active in online fitness communities got into digital assets.

Despite the growing attention platforms like Telegram and X command among the crypto community, 4chan remains a cultural powerhouse, and these are just a handful of the ways it has influenced crypto culture and markets.

And with 4chan back online and seemingly fully committed to continuing its operations, they won’t be its final influences — at least as long as 4chan can avoid being taken down for good.

Magazine: ChatGPT a ‘schizophrenia-seeking missile,’ AI scientists prep for 50% deaths: AI Eye

Following its recent rebound, dog-themed Shiba Inu has made massive progress in the broader crypto ecosystem. Amid the general bullish wave in the crypto market, SHIB has recorded significant gains, climbing from a low of $0.00001476 to over $0.000015.

Shiba Inu registers momentum as volume and market cap soar

As per CoinMarketCap data, SHIB has risen to $0.00001594, marking a 3.13% increase in the last 24 hours. The meme coin rose to $0.00001607 as transaction volume soared before witnessing corrections.

Investors remain active, pushing trading volume up 3.71% to $595.15 million. This suggests renewed interest from SHIB holders in the market.

The increased activity supported a spike in SHIB’s total market capitalization. SHIB now has a market cap of $9.3 billion, a development that helped it flip Hedera from the 15th position to 16th. Hedera’s market cap stands at $8.79 billion.

If SHIB sustains its bullish momentum, it could take on Stellar (XLM), XRP’s key rival. Notably, XLM currently has a market cap of $9.404 billion. SHIB is just about $100 million away from catching up with XLM.

However, this relies on the assumption that SHIB and XLM will continue on their current growth trajectories. As of press time, XLM maintained price growth of 0.25% against SHIB’s 3.13%.

May's historical performance supports SHIB to flip XLM

If history repeats itself, SHIB appears equal to flipping XLM. Several factors suggest this is possible, including the current uptick in trading volume, bullish rally and historical data.

The meme coin has average growth of 61% in May and could lose another zero from its price. If SHIB achieves that, it could become the 14th-ranked asset by market capitalization or even better.

This would require ecosystem support, particularly from loyal long-term holders who comprise 78% of the community.

XRP, the fourth-largest cryptocurrency by market capitalization, is heading toward a crucial moment that could shape its price trajectory: the emergence of its first major chart cross of 2025. The daily 50-day and 200-day Simple Moving Averages (SMA) are converging on the chart, raising the possibility of a golden cross or a death cross in the coming days.

Currently, the gap between the 50-day SMA and the 200-day SMA is narrowing, which often precedes a crossover. A golden cross occurs if the 50-day SMA crosses above the 200-day SMA, a bullish signal. If the 50-day SMA falls below the 200-day SMA, it will confirm a death cross, a bearish indicator that foreshadows downward momentum. Daily Chart, Courtesy: TradingView">

Chart crosses, especially golden and death crosses on the daily and weekly charts, often carry more weight and are watched closely by analysts and traders. While they do not guarantee a directional move, they are used to validate prevailing trends or hint at potential reversals.

The last time such happened was in November 2024, a golden cross that preceded XRP's bull run to highs of $3.4 in January.

XRP price action

At the time of writing, XRP was down 1.05% in the last 24 hours, reflecting slight profit-taking following an explosive rise in the week.

XRP surged in the Thursday session, rising from lows of $2.117 to $2.329 to gain momentum above the daily SMA 50 at $2.165. The increase continued, with XRP reaching a high of $2.43 early Saturday.

If the rise sustains, XRP may target $2.60 and $3 next. On the other hand, support is envisaged at the daily moving averages of 50 and 200 at $2.165 and $2.109, respectively, if profit taking occurs.

In positive news, healthcare infrastructure firm Wellgistics Health plans to build out an XRP treasury and XRP-enabled payment infrastructure.

The lengthy legal battle between the Securities and Exchange Commission and Ripple Labs has been officially settled. Under the settlement agreement filed with the court Thursday, $50 million will go to the SEC, with the remainder of the escrow funds (just over $75 million) going back to Ripple.

A Taiwanese politician urged the government Friday to include Bitcoin in its reserve composition. He made the appeal during the National Conference and amplified the message on X. His purpose is straightforward: incorporate Bitcoin along with gold and foreign currency to assist in protection against shock drops.

Push For Bitcoin In Reserves

In the opinion of Ju‑Chun, Bitcoin is capable of withstanding large fluctuations in the global economy. He informed the conference that introducing even a thin slice of Bitcoin to Taiwan’s asset stack might make the financial system more resilient.

He also appealed to crypto enthusiasts on X, referring them to his speech and asking for feedback. His tone was assertive and straightforward. He explained that this action would not be a substitute for current reserves, but possibly reinforce them.

Meeting With Bitcoin Advocate

According to reports, Ju‑Chun last week had a meeting with Samson Mow, who is the CEO of Jan3, a firm that specializes in extensive Bitcoin adoption. Jan3 released a statement on Thursday emphasizing the imperative for countries to prepare against currency fluctuations through the holding of Bitcoin.

Mow explained to Ju‑Chun that fiat currencies have turned more volatile. Their conversation addressed technical barriers, security requirements and how Taiwan could purchase and hold BTC without risks.

JAN3@JAN3comMay 08, 2025Taiwan is exploring a potential #Bitcoin reserve strategy amid currency volatility, following talks between @Excellion and Legislator Ko Ju-Chun (@dAAAb).

Read more via @BTCTimescom: https://t.co/HfUfDWJXWH

Current Reserve Holdings

Taiwan currently possesses 423 metric tons of gold and some $577 billion in foreign exchange assets. Ju-Chun noted that the New Taiwan Dollar has fluctuated wildly at times. He attributed higher global prices and regional tensions in East Asia as the cause.

He contended that for over 15 years, Bitcoin has demonstrated it can defy external pressure and remain accessible when other assets collapse. That, he added, is worth a place in the national locker.

科技立委葛如鈞 Ko Ju-Chun@dAAAbMay 07, 2025Taiwan could follow suit! We could allocate a maximum of 5% of our $USD 50 billion reserve to $BTC. https://t.co/HmOTkf9gqy

Proposal To Allocate 5%

Ju-Chun proposed that Taiwan invest up to 5% of a $50 billion reserve in Bitcoin. That is approximately $2.5 billion. He mentioned that New Hampshire recently approved the same action, and referenced US President Donald Trump’s directive to create a US Bitcoin reserve. He also mentioned that some large economies, such as the UK and Japan, are still waiting on the sidelines. He indicated that Taiwan can lead Asia if it acts now.

Some experts caution that Bitcoin can rise or fall 10 to 20 % in a week. Others are concerned about the legal steps required to hold a digital asset at the state level. Ju‑Chun said these issues can be contained. He called on lawmakers to examine how central banks could buy, hold and insure Bitcoin. He also requested clear rules to ensure any losses do not spill over into the broader economy.

Featured image from Gemini Imagen, chart from TradingView

Ethereum's price has lagged behind Bitcoin over the last two years. However, over the past two days, ETH has outperformed BTC and other major coins.

Ethereum’s recent price action against Bitcoin supports this bullish narrative. According to recent chart data, rare golden crosses have appeared on the pair's one-hour and four-hour charts, with short-term momentum building in Ethereum’s favor.

A golden cross occurs when a shorter-term moving average, usually the 50-period, crosses above a longer-term moving average, like the 200-period. It is often regarded as a bullish signal that precedes sustained upward momentum. 4-Hour Chart, Courtesy: TradingView">

On the daily chart, ETH has broken above the 50-day SMA at 0.02 in a two-day climb, a key resistance level that had previously capped upside attempts. This breakout could signal the start of a trend reversal, especially if ETH can maintain strength above this level. If the rise continues, the next target could be the 200-day SMA, often seen as a gatekeeper for long-term trend changes.

ETH just had its best day since 2021

In a Friday tweet, Arkham wrote, "Ethereum just had its best day since 2021." Ethereum surged nearly 30% to a high of $2,489 on Friday, following the Pectra upgrade, which core developers described as the "most ambitious upgrade" the network has ever completed.

On Wednesday, Ethereum successfully implemented its Pectra upgrade. This was the network's third major upgrade since The Merge in 2022, when it switched from the proof-of-work consensus process to proof of stake.

On Thursday, the second-largest cryptocurrency by market capitalization burst through the $2,000 barrier in a significant surge, eventually topping $2,400 early Friday, reaching its highest level in almost three months. Between Thursday and Friday, ETH climbed by more than 37%, while Bitcoin rose only 7.7%.

The second-largest cryptocurrency is trading at $2,419, up 3.47% in the last 24 hours, beating Bitcoin's daily gains of 0.08%.

Charles Hoskinson, the founder of Cardano , has made a bold decision that signals he cannot wait to see the blockchain make rapid progress. In a recent update shared with community members, Hoskinson emphasized he would no longer tolerate delays to project developments within the ecosystem.

Charles Hoskinson moves to accelerate Cardano's technical road map

The Cardano founder’s clarification came after a community member asked the reason behind the termination of specific project contracts.

In his response, Charles Hoskinson maintained he was keen on getting the Leios upgrade live on the mainnet in 2026, not 2028.

"I value Pragma and different ideas and implementations. No more … delays. Cardano needs to get to the next level," he stated.

The decision suggests that the founder was possibly frustrated with Cardano’s slow development regarding the Leios upgrade. Notably, the Leios upgrade aims to scale the chain to handle transactions at a faster speed of up to 11,000 per second.

Charles Hoskinson@IOHK_CharlesMay 10, 2025Because I want Leios in 2026 not 2028 and I value Pragma and different ideas and implementations. No more fucking games or delays. Cardano needs to get to the next level.

As per the U.Today report, Leios' upgrade will advance the source efficiency of its node usages. Leios will leverage previously idle nodes to do computations and scale the chain. It will also boost defense against congestion and attacks.

Hoskinson’s support for Pragma also indicates that he appreciates different ideas and implementations that would help see the project through. He appears keen on achieving the new 2026 timeline and would not tolerate excuses.

Cardano's product milestones signal momentum

The update signals a need for Cardano to step up and compete with other chains in the crypto ecosystem.

Cardano recently made news after launching the Lace Wallet on the Mozilla Firefox browser, a milestone achievement for Web3. The Lace version 1.22.1 enables users to interact without having to switch browsers.

The development will support increasing Cardano’s visibility to many new users in the crypto space.

Dog-themed cryptocurrency Shiba Inu is nearing a critical price range that could determine its next major move. According to IntoTheBlock data provided by Sentora, nearly 516.12 trillion SHIB previously bought by 116,430 addresses are priced between $0.000016 and $0.000019. The SHIB price is inching closer to this range, and eyes are peeled for what comes next.

Shiba Inu was up 4.95% in the last 24 hours to $0.00001559 as of this writing and up 18% weekly. The cryptocurrency market is surging into the weekend, with many sectors seeing double-digit percentage market value increases. Meme coins have benefited the most from this upward trend.

Shiba Inu has benefited from this bullish momentum and is on track for its sixth straight day of gains since May 5. SHIB reached highs of $0.00001611 early Saturday, a level not seen since February.

As SHIB sustains technically above key levels, in particular the daily SMA 50 at $0.00001286, which capped its price action since December 2024, eyes are on what's next for its price, with key barrier levels, especially the daily SMA 200 at $0.00001835, in view.

Potential scenarios

Given the massive volume of Shiba Inu tokens previously bought between $0.000016 and $0.000019, about 516.12 trillion, the SHIB price might face strong selling pressure at this range since many of the 116,000 addresses might look to sell once the market price reaches their average cost and breaks even on their positions. This might act as resistance to a continued price increase at these prices.

If SHIB breaks above this range convincingly, it may attract additional buying pressure, potentially leading to increased gains. The next target lies between $0.000019 and $0.000024, where 178 trillion SHIB are being held by 136,040 addresses at an average cost basis of $0.000022.

On the flip side, if SHIB fails to achieve the desired breakout, a wave of profit-taking could drag prices down, possibly retesting lower support levels. Shiba Inu's next support, according to on-chain data, is envisaged between $0.000014 and $0.00016, where 18.33 trillion SHIB are being held.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up