Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

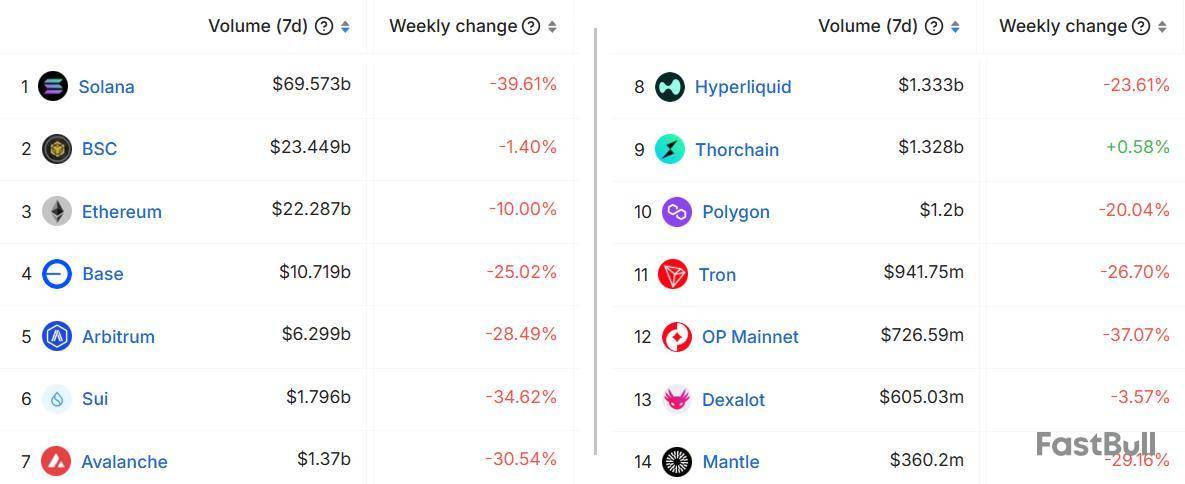

Solana’s native token SOL saw its price drop by 17.2% between Jan. 24 and Jan. 27. After touching its lowest levels in 10 days, the price recovered to $235, but this is still 26% below its Jan. 19 all-time high of $295. This recent downturn partially reflects a 40% decline in Solana’s network onchain trading activity. Despite the short-term weakness, SOL has the potential for further gains in 2025.

Solana’s competitors have shown more resilience. BNB Chain volumes dropped by just 1%, while Ethereum’s base layer saw a 10% reduction in activity over seven days. However, it’s important to note that other competitors and Ethereum layer-2 solutions also reported 25% to 30% lower onchain volumes during the same period.

Negative highlights within Solana’s ecosystem include Meteora, down 45% in volumes; Orca, down 62%; and Lifinity, which experienced a 53% decline in activity. Conversely, the Pump.fun memecoin launchpad was a bright spot, achieving a 24% increase in volume over the same timeframe. Solana's Raydium platform remained the leader, recording $35.1 billion in weekly onchain activity.

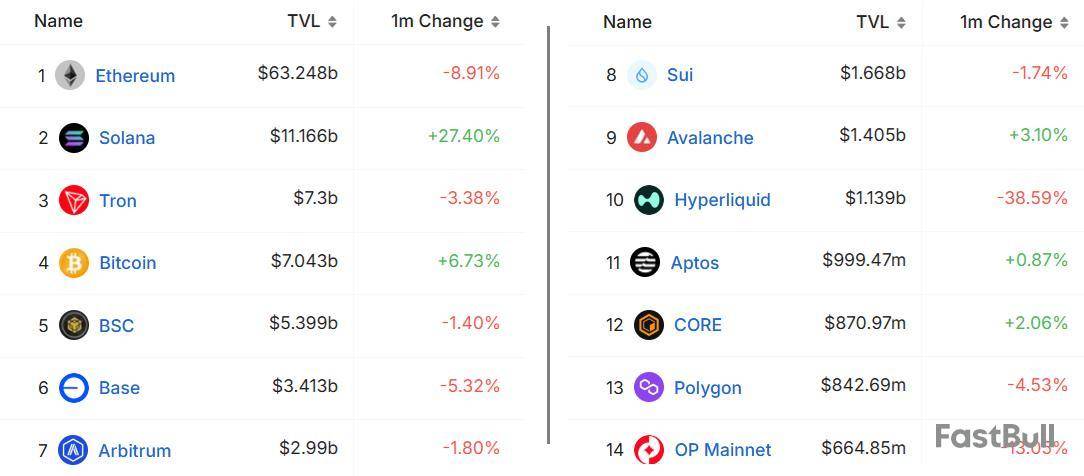

Solana TVL rose 27%, outperforming Ethereum and BNB Chain

It would be misleading to evaluate SOL’s potential upside based solely on Solana’s onchain activity, which is heavily driven by decentralized exchanges (DEXs). Activities like staking, lending, and real-world assets (RWA) applications often don’t generate consistent onchain volumes. Therefore, total value locked (TVL) provides a more comprehensive measure of network usage.

The TVL on Solana increased by 27% in the 30 days ending Jan. 28, significantly outperforming Ethereum, which declined by 9%, and BNB Chain, which slipped by 1%. This growth solidified Solana’s second-place position in the market, widening the gap with Tron. Notable contributors include Jito and Raydium, which saw deposits rise by 29%, and Binance Staked SOL, which grew by an impressive 52% during the month.

Ethereum’s recent activity decline can be linked to weaker performances in Lido, EigenLayer, and Ether.fi. Notably, staking platform EigenLayer, launched in June 2023, holds $13.6 billion in total value locked (TVL), surpassing the entire Solana ecosystem’s deposits. This highlights Ethereum's dominance and shows that some investors remain willing to pay $5 or higher transaction fees.

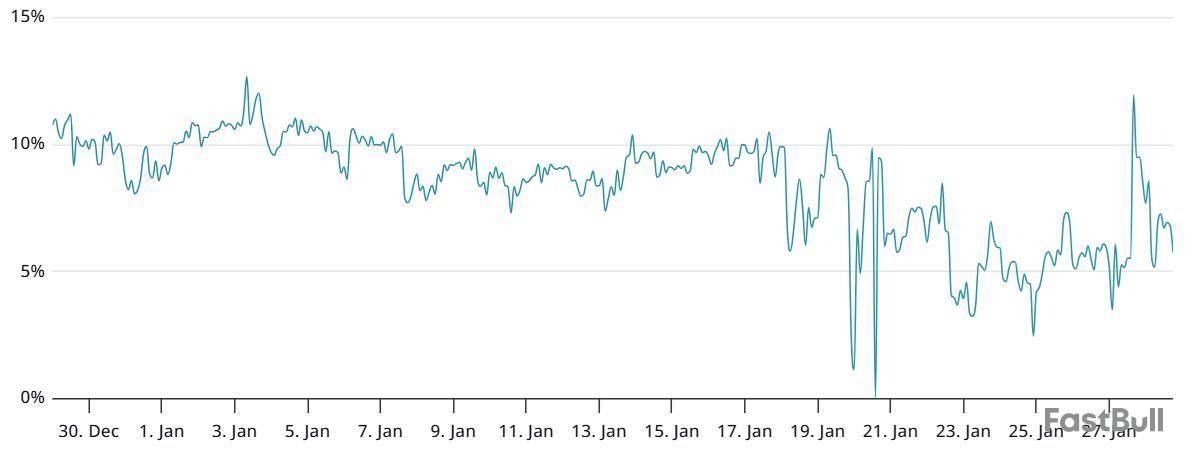

To understand Solana traders’ sentiment, it’s crucial to examine the monthly SOL futures contracts premium. Futures contracts typically trade at a 5% to 10% premium over spot markets to account for their longer settlement periods. A premium above 10% indicates strong bullish sentiment, while levels below 5% suggest weaker buyer confidence.

On Jan. 27, SOL futures briefly spiked to a 12% annualized premium but quickly dropped back to 6%. This relatively low premium, despite a 21% price rally over the past 30 days, suggests a lack of enthusiasm among investors. Some analysts argue that recent SOL price gains were largely driven by memecoins and the launch of the Official Trump (TRUMP) token.

Regardless of whether risk aversion stems from uncertainties in global economies or stock markets, the odds of SOL reaching a new all-time high in the short term appear slim. Some analysts point out that recent SOL price gains were largely driven by memecoins and the Official Trump (TRUMP) launch.

Potential drivers for SOL’s future price appreciation include the migration of stablecoins from Tron to Solana and the increasing adoption of Web3 applications, particularly in the artificial intelligence sector.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Cryptocurrency exchange Binance has come under scrutiny from governments in multiple countries in recent years, with authorities in France launching the latest legal challenge.

On Jan. 28, authorities in France reportedly opened an investigation into the exchange over allegations of money laundering and tax fraud. The money laundering is reportedly associated with drug trafficking. The investigation is looking into a period between 2019 and 2024 but is not limited to France and will include all European Union countries.

It is not the first time Binance has been in the crosshairs of the French government. The country has been examining the company’s activities since 2022, with the exchange reportedly failing to have adequate Know Your Customer procedures to check on users and possible money laundering activity.

A Binance spokesperson told Cointelegraph that this latest challenge is a continuation of a legal probe dating back years:

“While we do not usually comment on legal proceedings as a matter of policy, Binance fully denies the allegations and will vigorously fight any charges made against it,” the exchange added.

According to data compiled by Cointelegraph, Binance has faced authorities in at least 10 countries between 2021 and 2025, with allegations ranging from violation of Anti-Money Laundering (AML) laws to unregistered operations.

Related: Binance updates crypto rules in Poland to meet new MiCA requirements

Between 2023 and 2024, the exchange ran into problems with at least six nation-state governments: Australia, Belgium, Canada, India, Nigeria and the United States. The most high-profile case took place in the US, where Binance agreed to pay the government $4.3 billion for violating local AML laws and operating as an unregistered money transmitter.

Binance CEO Richard Teng told Cointelegraph that there were “gaps in compliance” as the team scaled from six members to eventually thousands, and its user base grew to more than 166 million as of December 2023. Teng considers these “historical issues” and said that user funds, security and safety remain “sacrosanct.”

Binance is the world’s largest crypto exchange by trading volume. According to CoinGecko, the platform processed over $21 billion in digital asset trades on Jan. 27 alone.

By November 2024, the exchange had increased its compliance team to 645 full-timers, a 34% rise in headcount. The move was part of its “intensified commitment to regulatory adherence” and “ongoing transformation” since its settlement with the US government in 2023.

Binance’s spokesperson noted that its advances in Anti-Money Laundering and compliance have already been recognized by leading authorities, including the Financial Crimes Enforcement Network (FinCEN), the US Department of Justice and the Office of Foreign Assets Control (OFAC).

After facing a significant crash to $3.7, XRP bulls are making a strong comeback, attempting to break above resistance levels and establish a new price target. With this in mind, a crypto analyst forecasts that if the asset surpasses this resistance, it could skyrocket to $3.85, potentially climbing even higher to hit the $6.5 mark.

XRP Bulls Push Toward $3.85 ATH Price

During the bull run in 2018, the XRP price hit its current All-Time High (ATH), skyrocketing to the $3.84 level. Now, a TradingView crypto analyst, identified as ‘Mindbloome-Trading,’ has shared a recent forecast, suggesting that XRP could surge past its ATH price to $3.85 in 2025.

The analyst’s bullish XRP price prediction is based on key resistance and support levels, with the expectation that the cryptocurrency can break above these levels. He shared a detailed video chart analysis, highlighting the altcoin’s price action on a monthly, weekly, daily, and 4-hour basis.

The TradingView analyst announced that XRP is in a bull run and showing signs of a strong upward rally. The cryptocurrency had previously broken the $2.6 price, transforming this level into a crucial support area for driving its market momentum.

Forming a new resistance level at $2.7, the crypto expert disclosed that the asset must break this threshold to initiate a swift climb to $3.15. In his video analysis, he identified the price points at $3.0, $3.11, and $3.14 as critical resistance levels that, if XRP can surpass, could push it to a new all-time high target of $3.85.

While the analyst is confident that XRP can hit his projected price target, he also believes that the cryptocurrency could rally even higher, potentially hitting the $6.55 mark. He explained that this surge would be highly possible, as the subsequent increase in XRP’s market capitalization would be a fair and well-supported progression. The TradingView expert also acknowledged that for the cryptocurrency to reach the forecasted $3.85 ATH, several bullish catalysts would be necessary, including a positive upward trend in Bitcoin.

Possible Market Dip Ahead

As XRP bulls attempt to trigger a price rally toward $3.85, Mindbloome-Trading has shared an alternative bearish scenario for the cryptocurrency if it fails to break above key resistance levels. According to the TradingView analyst, the current resistance XRP is facing is strong, raising the likelihood that the cryptocurrency may struggle to overcome it, potentially limiting its upward momentum.

He predicts that if the altcoin fails to surpass the resistance level at $3.13 and $3.15, the cryptocurrency could face a sharp correction, potentially dropping to $3.00 or even lower, with $2.85 being the possible target. As of now, the XRP price is trading at $3.1, reflecting an 11.22% increase over the past 24 hours, according to CoinMarketCap.

French fintech company Spiko has deployed its money market funds on Arbitrum One, bringing institutional-grade investment assets to the layer-2 blockchain.

According to a Jan. 28 announcement, Spiko’s tokenized US and EU T-Bill Money Market Funds are now available on Arbitrum One. The funds are regulated under the European Commission’s Undertakings for Collective Investment in Transferable Securities (UCITS), which provides a framework for selling mutual funds.

Net assets held by Spiko’s US T-Bills Money Market Fund have grown by 8% over the past 30 days, reaching more than $50 million, according to RWA.xyz. The fund offers an annual percentage yield (APY) of 4.37%.

Its EU T-Bills Money Market Fund has a total of $95.1 million in assets, seeing growth of 10.9% over the past month.

The market for tokenized US Treasury assets is growing rapidly, with Ondo Finance announcing on Jan. 28 that it was deploying its Short-Term US Government Treasuries (OUSG) on the XRP Ledger. The combined value of tokenized Treasury assets is currently $3.43 billion, according to RWA.xyz data.

RWA tokenization could thrive under Trump administration

US President Donald Trump’s pro-cryptocurrency policies could also extend to real-world asset tokenization (RWA), according to attorney Eli Cohen, who works with tokenization platform Centrifuge.

Cohen told Cointelegraph that the new administration could deliver “a very public renouncement and repudiation” of anti-crypto policies, which could further encourage RWA market participation.

“This will open up banking and brokerage channels to spur the creation of many more tokenized products,” said Cohen.

Although fintechs and blockchain companies are fueling the RWA tokenization boom, traditional financial institutions will be the main catalysts of mainstream adoption, according to Bitfinex Securities head of operations Jesse Knutson.

“It’s the more nimble institutions, the fast movers, like the family offices, those kind of guys. I think they’ll have an outsized impact in these early days,” Knutson told Cointelegraph on the sidelines of the Plan B Lugano conference in November.

“But eventually — the benefits of tokenization — they’re going to pull in the mainstream institutional investors,” he said.

The team behind Aerodrome, a decentralized exchange on Base, suspended two contributors from participating in the airdrop for VVV, the token for Erik Voorhees's privacy-focused artificial intelligence project Venice.

"The timing of a small percentage of the trading activity around the VVV launch was flagged by internal monitoring in less than 30 minutes — triggering an internal investigation," Aerodrome wrote on the social media platform X on Tuesday. "This investigation resulted in the suspension of two contributors within three hours of launch. We are continuing the investigation and will take all appropriate further action."

Responding to Aerodrome's post, Voorhees wrote on X, "Really appreciate Aerodrome's transparency on this. They reached out and let us know when they found out."

On Jan. 27, Venice launched VVV on the Coinbase-incubated Ethereum Layer 2 network Base. A public pool on Aerodrome provides the liquidity, and half of the 100 million tokens at launch were intended for Venice users as well as web3 AI projects built on Base, The Block previously reported.

According to the crypto data tracker DeFiLlama, Aerodrome controls the majority of the total value locked on Base, amassing a $1.04 billion TVL as of Jan. 28.

The Block's Data Dashboard shows that Aerodrome contributed $29.1 billion, or nearly 9%, of the total DEX spot volume in December

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Court: N.D. California

Case: 22-CV-07781

The lawsuit against Compound DAO is now in the discovery phase, as both sides examine the evidence.

On May 11, 2021, Compound DAO and its partners sold unregistered COMP tokens to investors through the protocol and promoted sales on the secondary market to boost demand.

Following this, dropped over 85%.

Then, on December 8, 2022, shareholders filed a claim against Compound DAO and its partners.

We’re keeping track of all updates and will notify investors about potential recovery.

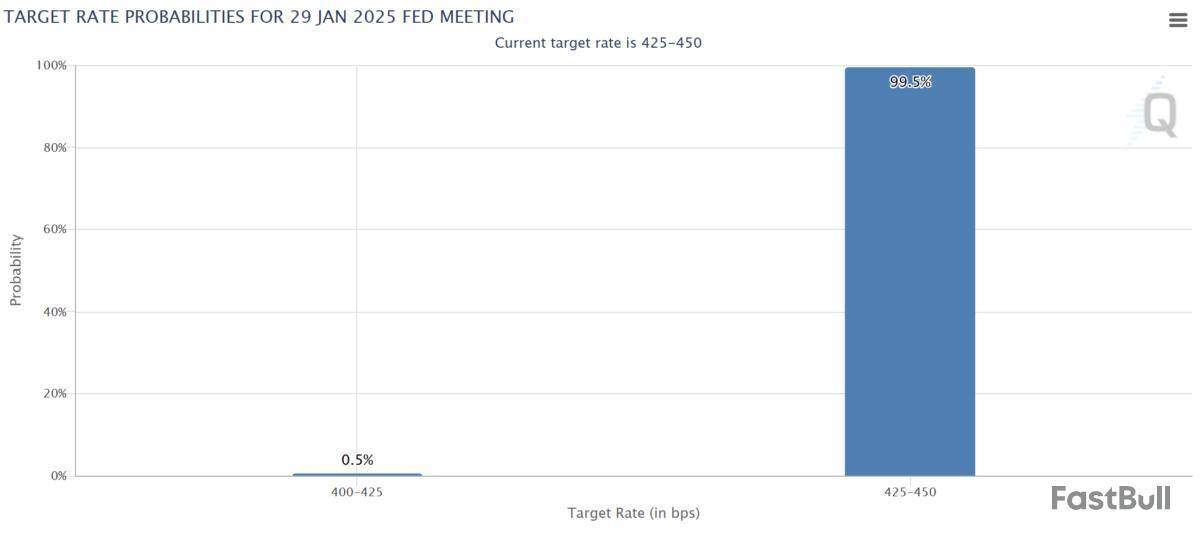

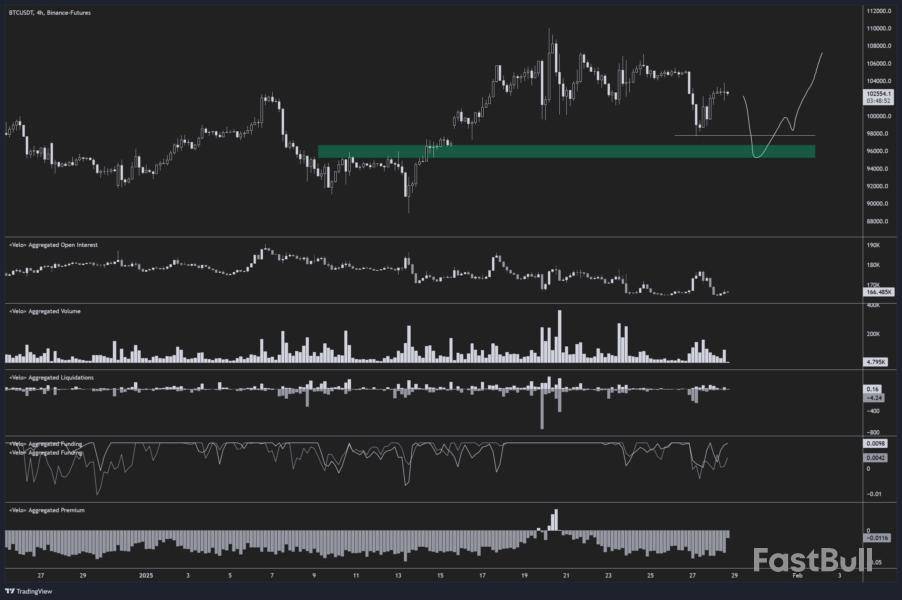

After a brief drop below $100,000, Bitcoin's (BTC) price closed its daily candle at $102,000 on Jan. 28. Over the past 24 hours, the crypto asset has consolidated above the six-figure range, as the market braced itself for the upcoming Federal Open Market Committee (FOMC) meeting.

CME’s FedWatch tool has predicted that there is a 99.5% chance that the Fed will keep its interest rates unchanged at 4.25% to 4.50%.

Bitcoin moves “priced in” ahead of FOMC

In December 2024, minutes from the FOMC meeting indicated that the Fed would take a more measured approach in 2025. Further rate cuts will depend on whether new data suggests economic weakness and lower inflation.

For the better part of four weeks, multiple analysts believed that the markets have already “priced in” unchanged interest rates. Thus, the attention is more focused on the tone of Fed chair Jerome Powell’s statements.

If the Fed chair maintains a strict or hawkish stance, Bitcoin is expected to see a spike in bearish volatility.

The downside target for Bitcoin lies around 94,000 once equal lows (EQLs) are swept around the $97,000 region. The $94,000 range marks an untested 4-hour fair value gap. If the FVG range is breached, BTC can drop under its previous range low at $88,900, which may signal the start of a new bearish directional bias.

Byzantine General, a futures market analyst, had a similar opinion, expecting BTC prices to possibly retest the $94,000 to $92,000 before the FOMC meeting.

Related: Bitcoin far from 'extreme' FOMO at above $100K BTC price — Research

Can Trump influence the Fed’s outlook?

One key difference between the previous and upcoming FOMC meeting is that this will be the first Fed gathering under Trump’s administration. Last week, the 47th US president publicly demanded that the Federal Reserve should consider cutting interest rates, citing declining oil prices.

Additionally, Tomas, a macroeconomics analyst, also said that it is “hard to believe” that Powell will be more hawkish relative to the December 2024 press conference. The analyst said,

Hence, this outlook may not be “priced in,” according to market commentators. Any indication of a dovish sentiment could send Bitcoin higher in the charts and establish a higher high pattern in the mid-term chart.

A 4-hour candle close above equal high (EQHs) at $107,000 would take BTC above the descending trendline resistance as illustrated in the chart, and a confirmed break of structure (BOS) will be attained.

This would allow Bitcoin to move toward another all-time high value above $110,000, with the crypto asset entering another price discovery period in February.

Regardless, it should be noted that the Federal Reserve is an independent entity, and it does not need to consider the US President’s opinion. Market speculations are currently bullish, but a clear picture will only be available after the FOMC meeting.

Related: Absence of Bitcoin ‘panic selling’ suggests BTC drop below $98K is a short-term blip: Analyst

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up