Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Investors can certainly boost their returns by concentrating on stocks trading between $1 and $10. However, a disciplined approach is necessary because many of these businesses are speculative and lack the underlying fundamentals to support their prices.

The downside that can come from buying these securities is precisely why we started StockStory - to isolate the long-term winners from the losers so you can invest with confidence. Keeping that in mind, here are three stocks under $10 to swipe left on and some alternatives you should look into instead.

Sprinklr (CXM)

Share Price: $8.75

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

Why Do We Think CXM Will Underperform?

Sprinklr’s stock price of $8.75 implies a valuation ratio of 2.7x forward price-to-sales. Dive into our free research report to see why there are better opportunities than CXM.

Shoals (SHLS)

Share Price: $6.56

Started in Huntsville, Alabama, Shoals designs and manufactures products that make solar energy systems work more efficiently.

Why Should You Dump SHLS?

Shoals is trading at $6.56 per share, or 14.8x forward P/E. Check out our free in-depth research report to learn more about why SHLS doesn’t pass our bar.

FuelCell Energy (FCEL)

Share Price: $4.38

Founded in 1969, FuelCell Energy is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

Why Is FCEL Not Exciting?

At $4.38 per share, FuelCell Energy trades at 0.5x forward price-to-sales. Read our free research report to see why you should think twice about including FCEL in your portfolio.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Value stocks typically trade at discounts to the broader market, offering patient investors the opportunity to buy businesses when they’re out of favor. The key risk, however, is that these stocks are usually cheap for a reason – five cents for a piece of fruit may seem like a great deal until you find out it’s rotten.

Separating the winners from the value traps is a tough challenge, and that’s where StockStory comes in. Our job is to find you high-quality companies that will stand the test of time. Keeping that in mind, here are three value stocks climbing an uphill battle and some other investments you should look into instead.

Sprinklr (CXM)

Forward P/S Ratio: 2.7x

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

Why Should You Dump CXM?

At $8.66 per share, Sprinklr trades at 2.7x forward price-to-sales. To fully understand why you should be careful with CXM, check out our full research report (it’s free).

United Parcel Service (UPS)

Forward P/E Ratio: 12x

Trademarking its recognizable UPS Brown color, UPS offers package delivery, supply chain management, and freight forwarding services.

Why Do We Pass on UPS?

United Parcel Service’s stock price of $87.79 implies a valuation ratio of 12x forward P/E. Check out our free in-depth research report to learn more about why UPS doesn’t pass our bar.

Acadia Healthcare (ACHC)

Forward P/E Ratio: 8x

With a network of over 250 facilities serving patients in 38 states and Puerto Rico, Acadia Healthcare operates facilities providing mental health and substance use disorder treatment services across the United States.

Why Is ACHC Not Exciting?

Acadia Healthcare is trading at $22.19 per share, or 8x forward P/E. Read our free research report to see why you should think twice about including ACHC in your portfolio.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

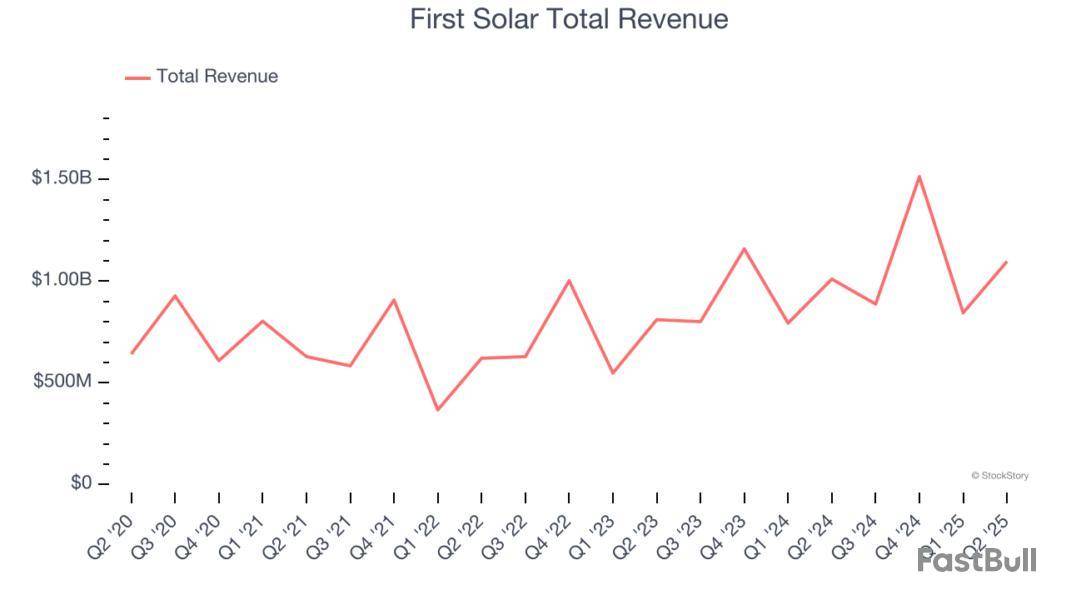

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at First Solar and the best and worst performers in the renewable energy industry.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 15 renewable energy stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 7.7% while next quarter’s revenue guidance was in line.

Luckily, renewable energy stocks have performed well with share prices up 18.7% on average since the latest earnings results.

Headquartered in Arizona, First Solar specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

First Solar reported revenues of $1.10 billion, up 8.6% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was a strong quarter for the company with full-year revenue guidance exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

“In our view, the recent policy and trade developments have, on balance, strengthened First Solar’s relative position in the solar manufacturing industry,” said Mark Widmar, Chief Executive Officer.

Interestingly, the stock is up 13.9% since reporting and currently trades at $199.60.

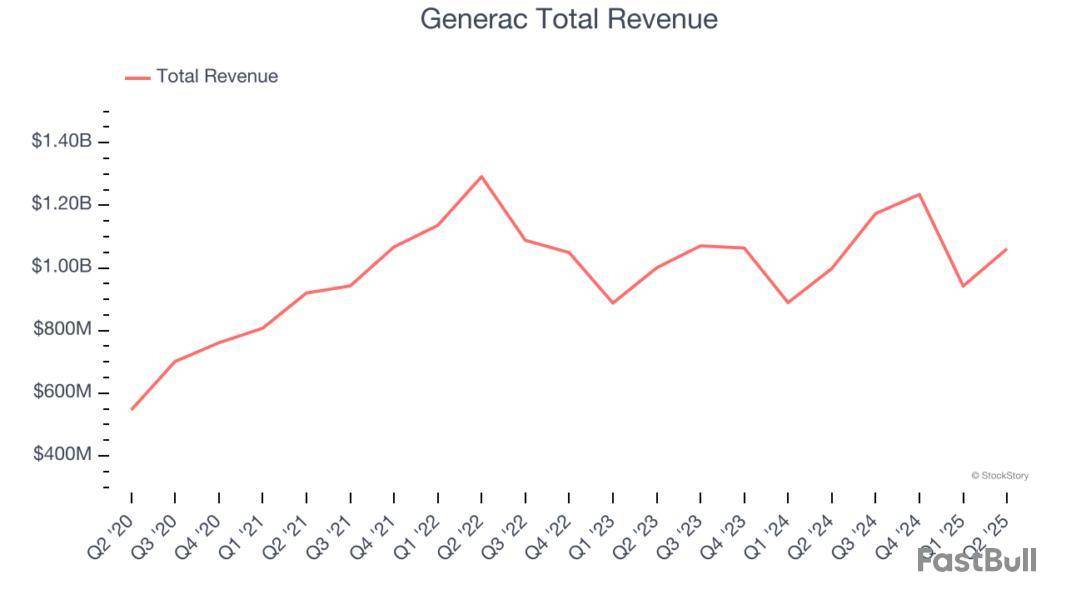

With its name deriving from a combination of “generating” and “AC”, Generac offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $1.06 billion, up 6.3% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 27.6% since reporting. It currently trades at $193.13.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

One of the first EV charging companies to go public, Blink Charging is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $28.67 million, down 13.8% year on year, exceeding analysts’ expectations by 35.2%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Blink Charging delivered the biggest analyst estimates beat but had the slowest revenue growth in the group. As expected, the stock is down 2.9% since the results and currently trades at $1.

Read our full analysis of Blink Charging’s results here.

Pioneering the use of lithium-ion batteries for grid storage, Fluence helps store renewable energy sources with battery systems.

Fluence Energy reported revenues of $602.5 million, up 24.7% year on year. This result came in 21.1% below analysts' expectations. Taking a step back, it was still a strong quarter as it recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Fluence Energy had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 18.2% since reporting and currently trades at $7.57.

Read our full, actionable report on Fluence Energy here, it’s free.

Started in Huntsville, Alabama, Shoals designs and manufactures products that make solar energy systems work more efficiently.

Shoals reported revenues of $110.8 million, up 11.7% year on year. This number beat analysts’ expectations by 6.3%. Overall, it was an exceptional quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and full-year revenue guidance exceeding analysts’ expectations.

The stock is up 26.9% since reporting and currently trades at $6.81.

Read our full, actionable report on Shoals here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

What Happened?

A number of stocks fell in the morning session after President Donald Trump announced his administration would not approve new solar or wind power projects, causing a sell-off in the renewable energy sector. The move came after President Donald Trump posted on his social media platform, Truth Social, that "We will not approve wind or farmer destroying Solar," adding, "The days of stupidity are over in the USA!!!" This statement escalated his campaign against renewable energy development. The remarks prompted a sector-wide sell-off, pressuring solar and wind stocks broadly. Other renewable energy companies also saw their shares plummet following the announcement, reflecting investor concern over the future of green energy projects under his administration.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On First Solar (FSLR)

First Solar’s shares are extremely volatile and have had 36 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 2 days ago when the stock dropped 4.9% on the news that investors took some profits off the table as markets awaited signals on future monetary policy from the Federal Reserve's Jackson Hole symposium later in the week.

The downturn in the market was largely attributed to a significant sell-off in megacap tech and chipmaker shares. Nvidia, Advanced Micro Devices (AMD), and Broadcom all saw notable drops, dragging down the VanEck Semiconductor ETF. Other major tech-related companies like Tesla, Meta Platforms, and Netflix were also under pressure.A key reason for this trend is that much of the recent market gains have been concentrated in the "AI trade," which includes these large technology and semiconductor companies. So this could also mean that some investors are locking in some gains ahead of more definitive feedback from the Fed.

First Solar is up 3.1% since the beginning of the year, but at $192.18 per share, it is still trading 24.9% below its 52-week high of $255.75 from September 2024. Investors who bought $1,000 worth of First Solar’s shares 5 years ago would now be looking at an investment worth $2,594.

What Happened?

Shares of solar energy systems company Shoals fell 6.8% in the afternoon session after President Donald Trump announced his administration would not approve new solar or wind power projects, causing a sell-off in the renewable energy sector.

The move came after President Donald Trump posted on his social media platform, Truth Social, that "We will not approve wind or farmer destroying Solar," adding, "The days of stupidity are over in the USA!!!" This statement escalated his campaign against renewable energy development. The remarks prompted a sector-wide sell-off, pressuring solar and wind stocks broadly. Other renewable energy companies also saw their shares plummet following the announcement, reflecting investor concern over the future of green energy projects under his administration.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy Shoals? Access our full analysis report here, it’s free.

What Is The Market Telling Us

Shoals’s shares are extremely volatile and have had 62 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 3 days ago when the stock gained 9.7% after it announced the groundbreaking of a major solar and energy storage project in Australia. The company, in partnership with PCL Construction and Gentari, has started work on the Maryvale Solar and Energy Storage Project in New South Wales. This facility is notable for being one of Australia's largest DC-coupled solar and battery energy storage systems. It is expected to deliver approximately 243 MW of solar generation capacity, which will be paired with 172 MW of battery storage. This significant project highlights Shoals' expansion and leadership in providing key electrical systems for the global energy transition market. The positive development was also complemented by recent analyst optimism, with Guggenheim recently raising its price target on the stock from $6.00 to $8.00.

Shoals is down 4.4% since the beginning of the year, and at $5.79 per share, it is trading 11% below its 52-week high of $6.50 from September 2024. Investors who bought $1,000 worth of Shoals’s shares at the IPO in January 2021 would now be looking at an investment worth $186.73.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up