Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Stocks with low volatility can be a great foundation for a portfolio, especially for investors looking to reduce risk. While they don’t often make headlines, these companies provide consistency in an unpredictable market.

Finding safe investments without sacrificing returns is key, and StockStory is here to help you find the best investments. Keeping that in mind, here are three low-volatility stocks that could succeed under all market conditions.

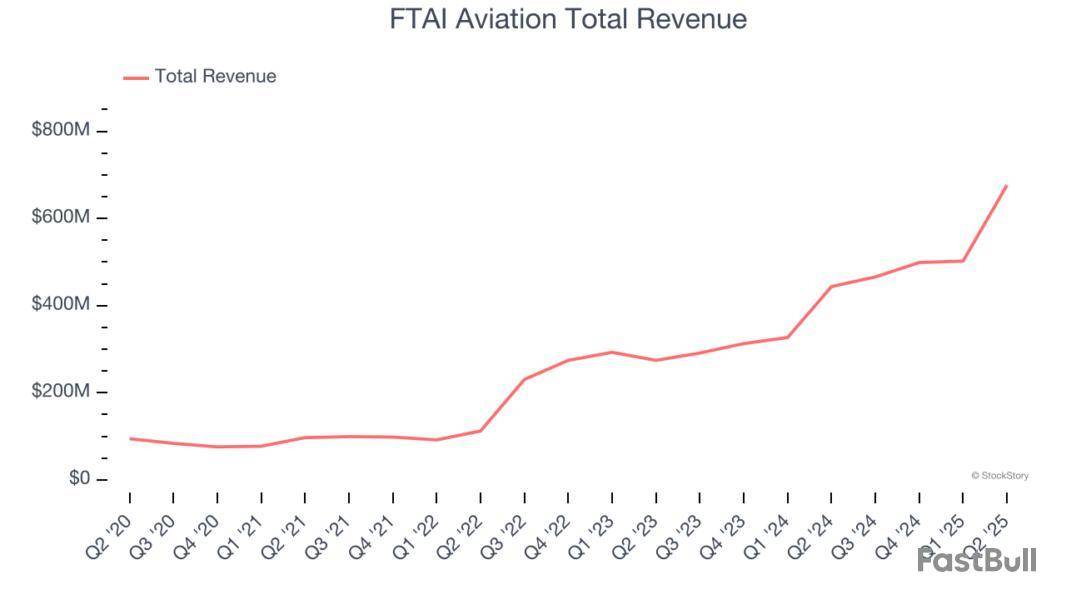

FTAI Aviation (FTAI)

Rolling One-Year Beta: 0.89

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation sells, leases, maintains, and repairs aircraft engines.

Why Is FTAI a Top Pick?

At $170 per share, FTAI Aviation trades at 31.9x forward P/E. Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Humana (HUM)

Rolling One-Year Beta: 0.90

With over 80% of its revenue derived from federal government contracts, Humana provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

Why Does HUM Stand Out?

Humana is trading at $247.70 per share, or 16.6x forward P/E. Is now the time to initiate a position? Find out in our full research report, it’s free.

The Ensign Group (ENSG)

Rolling One-Year Beta: 0.36

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

Why Do We Like ENSG?

The Ensign Group’s stock price of $175.06 implies a valuation ratio of 26.3x forward P/E. Is now a good time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Even if they go mostly unnoticed, industrial businesses are the backbone of our country. Their momentum is also rising as lower interest rates have incentivized higher capital spending. As a result, the industry has posted a 28.1% gain over the past six months, beating the S&P 500 by 9.3 percentage points.

Regardless of these results, investors should tread carefully. The diversity of companies in this space means that not all are created equal or well-positioned for the inescapable downturn. On that note, here is one resilient industrials stock at the top of our wish list and two we’re swiping left on.

Two Industrials Stocks to Sell:

Hertz (HTZ)

Market Cap: $2.11 billion

Started with a dozen Model T Fords, Hertz is a global car rental company providing vehicle rental services to leisure and business travelers.

Why Do We Steer Clear of HTZ?

At $6.83 per share, Hertz trades at 3.9x forward EV-to-EBITDA. Dive into our free research report to see why there are better opportunities than HTZ.

Rivian (RIVN)

Market Cap: $17.81 billion

The manufacturer of Amazon’s delivery trucks, Rivian designs, manufactures, and sells electric vehicles and commercial delivery vans.

Why Does RIVN Give Us Pause?

Rivian’s stock price of $14.66 implies a valuation ratio of 3x forward price-to-sales. Read our free research report to see why you should think twice about including RIVN in your portfolio.

One Industrials Stock to Buy:

FTAI Aviation (FTAI)

Market Cap: $17.11 billion

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation sells, leases, maintains, and repairs aircraft engines.

Why Do We Love FTAI?

FTAI Aviation is trading at $166 per share, or 30.7x forward P/E. Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

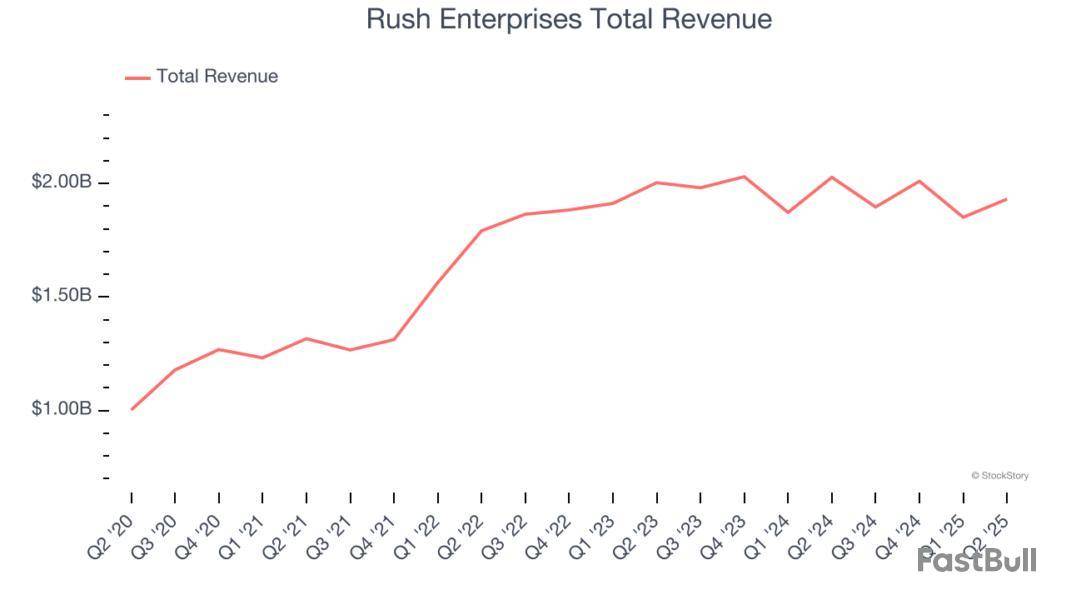

Let’s dig into the relative performance of Rush Enterprises and its peers as we unravel the now-completed Q2 industrial distributors earnings season.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 25 industrial distributors stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was 2.6% below.

In light of this news, share prices of the companies have held steady as they are up 4.7% on average since the latest earnings results.

Headquartered in Texas, Rush Enterprises (NASDAQ:RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Rush Enterprises reported revenues of $1.93 billion, down 4.8% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA and EPS estimates.

“The second quarter of 2025 continued to present challenges for commercial truck operators and the broader industry that supports them. While there have been sporadic signs of recovery from the freight recession that has impacted over-the-road carriers for more than two years, freight rates remain depressed, and overcapacity persists. In addition, ongoing economic uncertainty, particularly around U.S. trade policy and its potential impact on the supply chain and overall economy, combined with a lack of clarity regarding engine emissions regulations, has led many customers to delay vehicle acquisition and maintenance decisions,” said W.M. “Rusty” Rush, Chairman, Chief Executive Officer and President of Rush Enterprises,

Rush Enterprises delivered the slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $53.58.

Is now the time to buy Rush Enterprises? Access our full analysis of the earnings results here, it’s free.

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation sells, leases, maintains, and repairs aircraft engines.

FTAI Aviation reported revenues of $676.2 million, up 52.4% year on year, outperforming analysts’ expectations by 5.8%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

FTAI Aviation pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 45.4% since reporting. It currently trades at $166.

Is now the time to buy FTAI Aviation? Access our full analysis of the earnings results here, it’s free.

Originally a manufacturing company, Watsco today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

Watsco reported revenues of $2.06 billion, down 3.6% year on year, falling short of analysts’ expectations by 7.2%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Watsco delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 13% since the results and currently trades at $404.30.

Read our full analysis of Watsco’s results here.

Founded as Lollicup, Karat Packaging distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $124 million, up 10.1% year on year. This print met analysts’ expectations. More broadly, it was a slower quarter as it recorded a significant miss of analysts’ EPS estimates and revenue guidance for next quarter missing analysts’ expectations.

The stock is down 5.4% since reporting and currently trades at $25.21.

Read our full, actionable report on Karat Packaging here, it’s free.

Spun off from National Oilwell Varco, DistributionNOW provides distribution and supply chain solutions for the energy and industrial end markets.

DistributionNOW reported revenues of $628 million, flat year on year. This result surpassed analysts’ expectations by 2.6%. It was a stunning quarter as it also recorded a beat of analysts’ EPS and EBITDA estimates.

The stock is flat since reporting and currently trades at $15.25.

Read our full, actionable report on DistributionNOW here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

What Happened?

A number of stocks fell in the afternoon session after a weaker-than-expected U.S. consumer confidence report for September sparked concerns about the economic outlook.

The Conference Board's Consumer Confidence Index dropped to 94.2, its lowest reading since April. This decline was driven by a more pessimistic view of both current and future conditions. The Present Situation Index, which assesses current business and labor market conditions, fell by 7.0 points. More critically, the Expectations Index, a gauge of the short-term outlook, also decreased. This index has remained below 80 since February 2025, a level that historically signals a potential recession on the horizon. The weakening confidence reflects consumers' growing concerns about the labor market, which could translate to reduced spending and broader economic slowing.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Rivian (RIVN)

Rivian’s shares are extremely volatile and have had 32 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 11 days ago when the stock dropped 2.5% on the news that reports surfaced that its software joint venture with Volkswagen had run into significant problems, creating delays for the German automaker's new electric models.

According to Germany's Manager Magazin, Audi's Q8 e-tron and electric A4 models faced delays of at least a year, while Porsche's electric K1 SUV was postponed indefinitely. This development cast a shadow over a key strategic partnership for the electric vehicle maker. Compounding the negative sentiment, Rivian also lowered its full-year delivery forecast to between 40,000 and 46,000 vehicles, a drop from the 51,579 units delivered in 2024. The company also widened its projected EBITDA loss for 2025 to a range of $2 billion to $2.25 billion, signaling deeper financial headwinds ahead.

Rivian is up 10.6% since the beginning of the year, but at $14.66 per share, it is still trading 13.4% below its 52-week high of $16.92 from May 2025. Investors who bought $1,000 worth of Rivian’s shares at the IPO in November 2021 would now be looking at an investment worth $145.54.

(15:32 GMT) FTAI Aviation Price Target Raised to $185.00/Share From $160.00 by RBC Capital

FTAI Aviation Ltd. (FTAI) is currently at $180.49, up $1.60 or 0.89%

All data as of 12:29:53 PM ET

Source: Dow Jones Market Data, FactSet

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at FTAI Aviation and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 26 industrial distributors stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was 2.6% below.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation sells, leases, maintains, and repairs aircraft engines.

FTAI Aviation reported revenues of $676.2 million, up 52.4% year on year. This print exceeded analysts’ expectations by 5.8%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

“FTAI delivered an excellent quarter, generating over $400 million in positive Adjusted Free Cash Flow,” said Joe Adams, Chairman and CEO(1).

FTAI Aviation scored the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 55.7% since reporting and currently trades at $177.77.

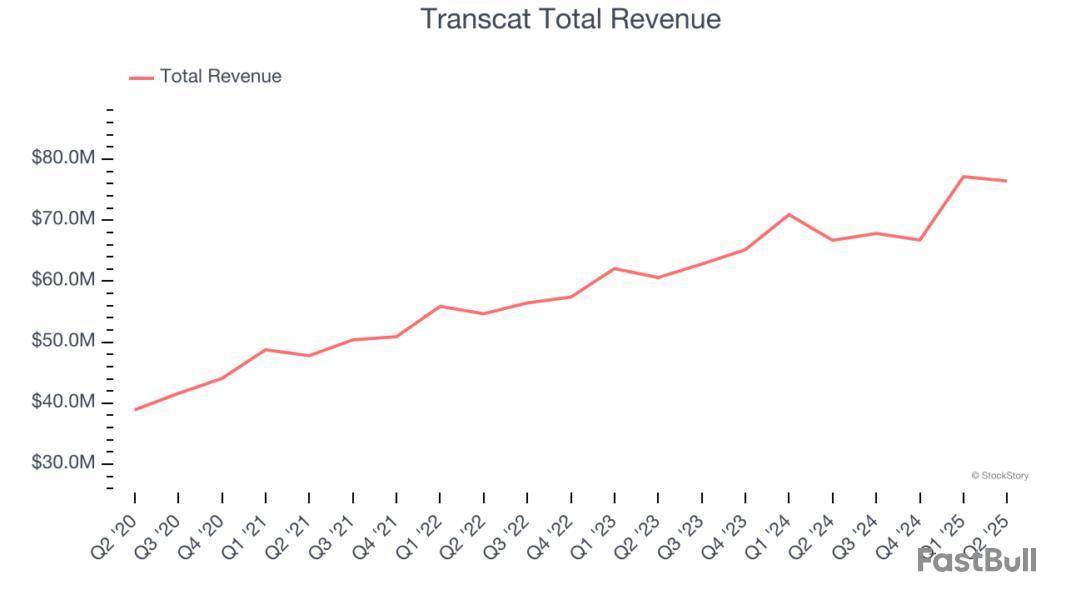

Serving the pharmaceutical, industrial manufacturing, energy, and chemical process industries, Transcat provides measurement instruments and supplies.

Transcat reported revenues of $76.42 million, up 14.6% year on year, outperforming analysts’ expectations by 5.7%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.8% since reporting. It currently trades at $75.45.

Is now the time to buy Transcat? Access our full analysis of the earnings results here, it’s free.

Originally a manufacturing company, Watsco today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

Watsco reported revenues of $2.06 billion, down 3.6% year on year, falling short of analysts’ expectations by 7.2%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

Watsco delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 16.1% since the results and currently trades at $389.70.

Read our full analysis of Watsco’s results here.

Founded in 1947, Richardson Electronics is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $51.89 million, up 9.5% year on year. This number lagged analysts' expectations by 3.7%. Zooming out, it was actually a strong quarter as it produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 2.2% since reporting and currently trades at $10.01.

Read our full, actionable report on Richardson Electronics here, it’s free.

Producing bomb casings and tracks for vehicles during WWII, MRC offers pipes, valves, and fitting products for various industries.

MRC Global reported revenues of $798 million, flat year on year. This print topped analysts’ expectations by 1.7%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and EPS in line with analysts’ estimates.

The stock is flat since reporting and currently trades at $14.25.

Read our full, actionable report on MRC Global here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up