Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

TL;DR

Time for a New Surge?

The second-largest meme coin witnessed a solid price increase towards the end of April, when the entire cryptocurrency market recorded a substantial revival. However, in the past week, Shiba Inu (SHIB) has slipped by almost 10%, currently trading at approximately $0.0000127 (per CoinGecko’s data).

Certain factors, though, suggest that a new pump might soon replace the downtrend. The burn rate, for instance, has soared by over 300% in the past week, resulting in more than 300 million tokens sent to a null address.

While the USD equivalent of the destroyed stash remains insignificant, continuous efforts in that field will make SHIB more scarce and possibly more valuable. It is important to note that this scenario will require demand to head north or at least remain at current levels.

Shiba Inu introduced the burning mechanism in 2022. Since then, the team and community have scorched over 410 trillion tokens, leaving around 584.4 trillion in circulation.

Shibarium may also contribute to a potential price expansion for the self-proclaimed Dogecoin killer. The layer-2 scaling solution is specifically designed to advance the Shiba Inu ecosystem, and since its launch, it has reached multiple milestones. Most recently, the total number of addresses that have interacted with the protocolsurgedpast 200 million.

Daily transactions on the network have been in the millions in the past several weeks, signaling strong user engagement. Among the industry participants who believe the further development of Shibarium could positively impact the price of SHIB is the popular Bitcoin advocateJeremie Davinci.Exchange Outflows

Last but not least, we will examine Shiba Inu’s exchange netflow. Data from CryptoQuant shows that in the last three days, outflows have surpassed inflows, indicating that investors may be moving their holdings off centralized platforms and into self-custody solutions. This, in turn, reduces the immediate selling pressure.

The trend contrasts with what was observed at the end of last month, when inflows dominated from April 22 to April 29. This is usually considered a bearish factor since it increases selling pressure. Interestingly, it was during this particular period that SHIB reached its local peak before heading south after April 26.

As a bonus, we would like to refer you to a previous article, which showed that the AI-powered chatbot ChatGPT is also bullish on the asset, estimating that it “is positioned to ride the next wave.”

Mentions of the word "cryptocurrency" in SEC filings hit an all-time high of 786 in April, a 38% jump from 569 in March and an 8% increase year over year from 727 in April 2024. Between January 2024 and March 2025, the monthly average was 457.

The spike suggests that federal agencies are dedicating more attention and resources to digital assets, likely in anticipation of new frameworks or forthcoming guidance from the U.S. Securities and Exchange Commission. The hope is that increased regulatory engagement will lead to clearer, more consistent rules that support long-term industry growth and boost institutional confidence.

Mentions of "stablecoins" also surged in recent months. Between January 2024 and January 2025, SEC filings referenced the term an average of 48 times per month. But from February to April 2025, that figure more than doubled to an average of 103 monthly mentions, with 81 in February, 124 in March, and 104 in April.

The rise in stablecoin mentions reflects heightened regulatory interest in reserve standards and consumer protections. If formalized, these measures could help increase trust and expand both enterprise and retail adoption.

Altogether, crypto is evolving from a niche asset into a key component of corporate risk management and investor relations, reinforcing its growing legitimacy across institutional and regulatory sectors.

This is an excerpt from The Block's Data & Insights newsletter. Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ripple is pledging $25 million in RLUSD to support teachers in the US. The firm partnered with DonorsChoose and Teach for America, two major nonprofits in the education sector.

Technically, the donation does not entirely consist of Ripple’s stablecoin, but the exact split is uncertain. A post from DonorsChoose suggests that $10 million may be in fiat.

Ripple Spends RLUSD on Education

Teacher Appreciation Week is kicking off in the US, and the threat of cuts to education funding is growing. In this environment, Ripple identified a chance to make a meaningful contribution with RLUSD, its new stablecoin.

According to a press release from the firm, its $25 million in funding will help teachers in a few key ways.

“Proud to support US teachers and classrooms through Ripple’s $25 million commitment to DonorsChoose and Teach For America. Delivered primarily through RLUSD, it’s a meaningful example of how stablecoins can drive real-world impact—starting in the classroom,” claimed Eric van Miltenburg, Ripple’s SVP of Strategic Initiatives.

To be clear, this donation doesn’t seem to go to any sort of blockchain-specific education. In the short term, Ripple’s press release claims that the RLUSD will support all-purpose education resources across public schools.

Later, the partners will also “support new initiatives focused on financial literacy,” but this seems like a more long-term goal.

DonorsChoose’s announcement prominently credited Ripple’s RLUSD contribution but also mentioned Good Morning America, a television program, and Eli Manning, a famous football player.

In other words, it might not be easy to prioritize financial literacy and other economics-centric education if other major donors aren’t as interested.

DonorsChoose also mentions $10 million in funding, not $25 million. Ripple’s press release states that most of the grant will be delivered in RLUSD, but it doesn’t go into specifics. The nonprofit might be indicating that $10 million was the proportion donated in fiat.

In any event, this is not Ripple’s first major charitable donation using RLUSD. In January, the firm pledged $50,000 to fight wildfires in California, but $25 million is a much larger contribution.

The massive increase in scale may reflect an increased focus on PR; for example, the firm has outwardly portrayed RLUSD as compliant with impending stablecoin regulations.

Between the SEC lawsuit getting dropped and XRP ETF optimism, Ripple is on a roll right now. This RLUSD donation has received wide praise from the crypto community, and may boost Ripple’s notoriety in the future.

As seen on the official social media post from DonorsChoose, several community members, even outside of the crypto industry, are praising Ripple for their philanthropic efforts.

Key Takeaways:

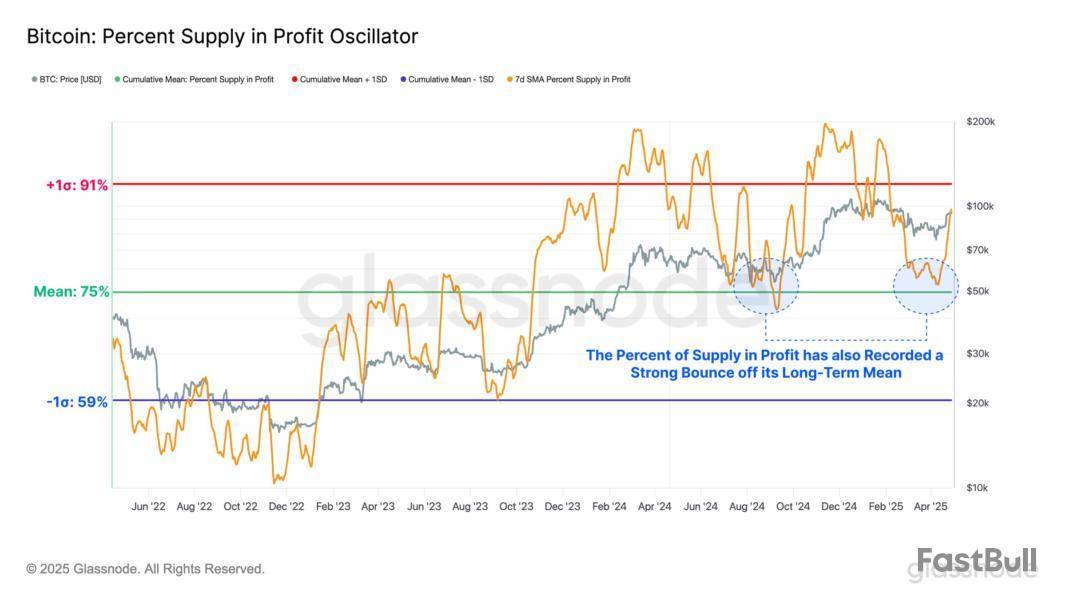

88% of Bitcoin’s supply is in profit below $95,000, indicating a reset in investor expectations.

The current price range of $75,000–$95,000 may represent a structural bottom, aligning with market conditions from Q3 2024.

The Market Value to Realized Value (MVRV) Ratio at 1.74 acts as a historical support zone, signaling cooling unrealized gains and potential for future growth.

Bitcoin’s (BTC) market dynamics are shifting, as Glassnode data reveals that 88% of the supply is currently in profit, with losses concentrated among buyers in the $95,000-$100,000 range. This high profitability, rebounding from a long-term mean of 75%, indicates a reset in investor expectations.

Bitcoin's price staged a recovery from its long-term cumulative mean percentage in profit, marking a notable shift. Previously, in August 2024, Bitcoin retested the 75% mean at around $60,000. This suggests that the price range of $75,000–$95,000 may represent the bottom, aligning with the structural market conditions observed in Q3 2024.

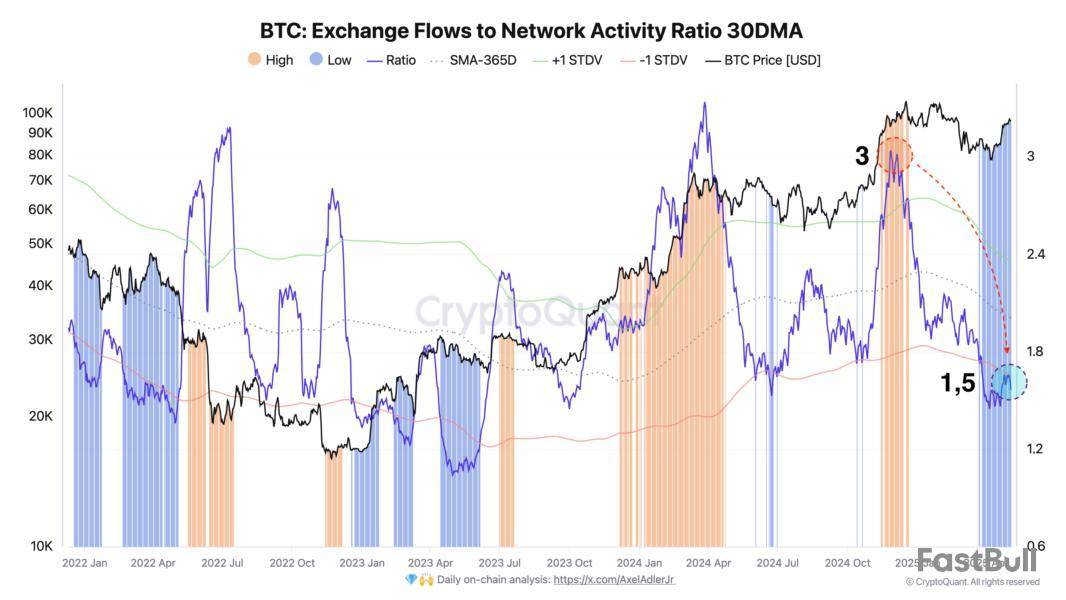

Confirming the decrease in holder sales through exchanges, the total exchange flow (inflow + outflow) to network activity ratio provides further insight. Bitcoin researcher Axel Adler Jr. explained that the chart shows a 1.5x decrease in ratio following Bitcoin’s all-time high, directly confirming that the current growth is more organic.

The analyst explained that, unlike previous price peaks, where a high ratio (marked by orange bars) signaled heavy selling, current levels show no such urgency, reinforcing a more stable market environment.

High profitability and reduced exchange inflows indicate diminished selling pressure from holders, enabling an improved holder’s mindset between $75,000 and $95,000. This suggests that investors viewed BTC as undervalued and not as an exit opportunity, which aligned with the broader bullish sentiment.

Related: Watch these Bitcoin price levels as BTC meets ‘decision point’

BTC data hint at cooling unrealized gains under $95K

Glassnode noted that the Market Value to Realized Value (MVRV) Ratio, a key market sentiment indicator, has returned to its long-term mean of 1.74. Historically, this level has been a support zone (since January 2024) during consolidation phases, signaling a cooling of unrealized gains and a potential base for future growth.

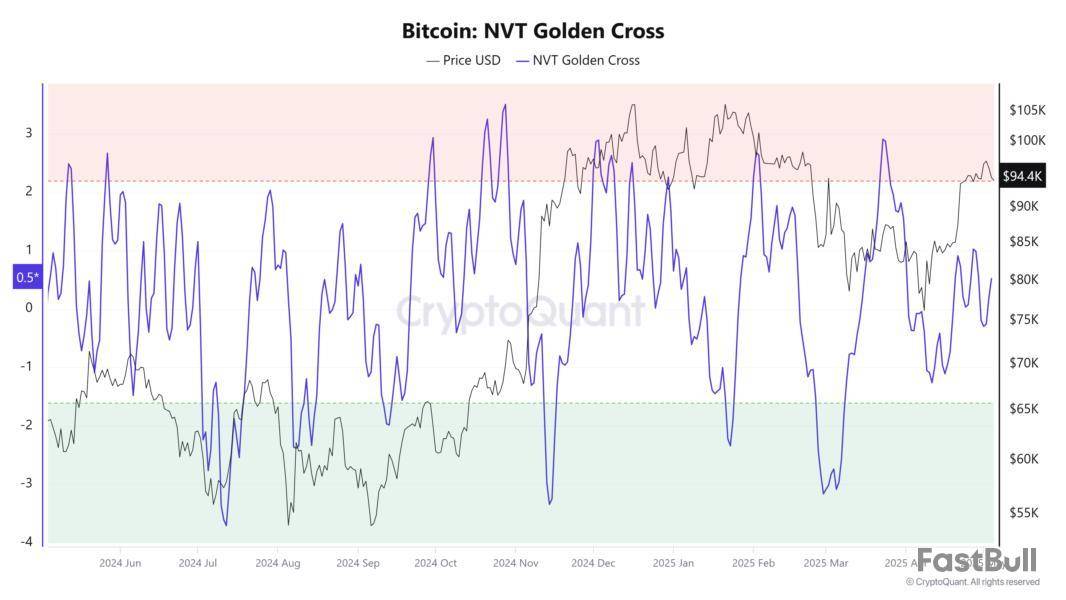

Similarly, the Network Value to Transactions (NVT) ratio is neutral at 0.5 with Bitcoin priced at $94,400, in contrast to its overbought signal when BTC was previously at this level in February 2025.

This shift in market dynamics and evolving holder behavior indicates that the current cohort of profitable investors may be less inclined to sell at these levels. This could further strengthen the bullish case of the present market structure.

Related: BTC dominance due ‘collapse’ at 71%: 5 things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Space and Time (SXT) will be listed on Binance Alpha, a major step for any cryptocurrency because Binance is one of the largest exchanges. This listing can significantly boost SXT’s visibility and liquidity, potentially driving its price higher. Early access and promotions linked to Binance Alpha Points could further enhance demand. However, price impact will also depend on wider market conditions and early investor reactions. A listing often brings an initial price spike, so keeping watch on trading patterns could be important for traders. source

Binance@binanceMay 05, 2025Get ready! Binance Alpha will be the first platform to feature Space and Time (SXT)! Trading will open on May 8th, with the exact time to be announced.

Users who meet the Alpha Points threshold will receive their airdrop within 10 minutes after trading starts. The threshold… pic.twitter.com/x0KfLPq029

CopXToken (COPX) is getting listed on CoinUp.io, bringing it to a broader audience. Listings can drive new interest and purchases of the token due to increased accessibility and trading ease. CoinUp.io might not be as large as Binance, but it still can attract traders seeking new opportunities. If the token catches traders' interest, its price might rise. However, if demand doesn’t pick up or is overwhelmed by sellers taking profits, any price increase could be short-lived. Traders should monitor trading volumes and market sentiment post-listing. source

COPX.AI@Copx_AIMay 03, 2025https://t.co/XcKbik3XhQ (CopXToKen)

Global Debut is Here

Official Launch on May 15, 2025

Simultaneously listed on https://t.co/ku0HZNGwqk @CoinUpOfficials and https://t.co/nHUqHQ6AD2 @XTexchange — two major exchanges!

Empowered by AI. Shaping the future, winning the now!… pic.twitter.com/juzX75rYJU

Goldfinch and Fidu are set to announce their biggest partner integration yet, making investors excited about the potential impact on price. Partnerships usually bring new resources, increased adoption, and added credibility. These can lead to higher demand and price increases. However, the true impact depends on the partner’s identity and the specifics of the collaboration. If the partner is a major player, this could be a big boost for both FIDU and GFI. Keep an eye on the announcement for more details. source

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up