Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

What a fantastic six months it’s been for Reddit. Shares of the company have skyrocketed 112%, hitting $265.99. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is RDDT a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On Reddit?

Founded in 2005 by two University of Virginia roommates, Reddit facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

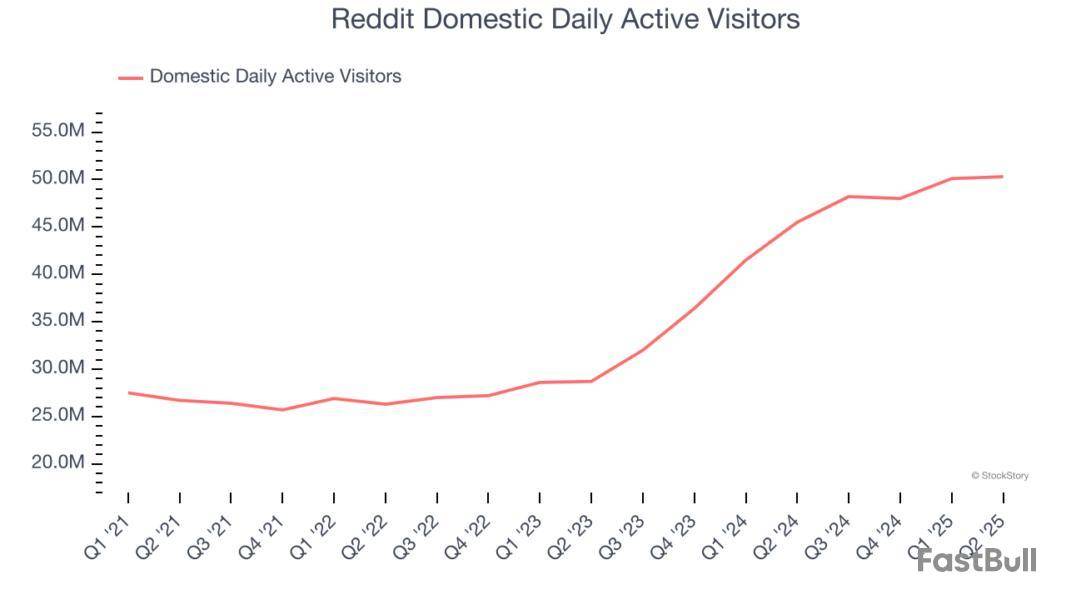

1. Domestic Daily Active Visitors Skyrocket, Fueling Growth Opportunities

As a social network, Reddit generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Reddit’s domestic daily active visitors, a key performance metric for the company, increased by 33.7% annually to 50.3 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

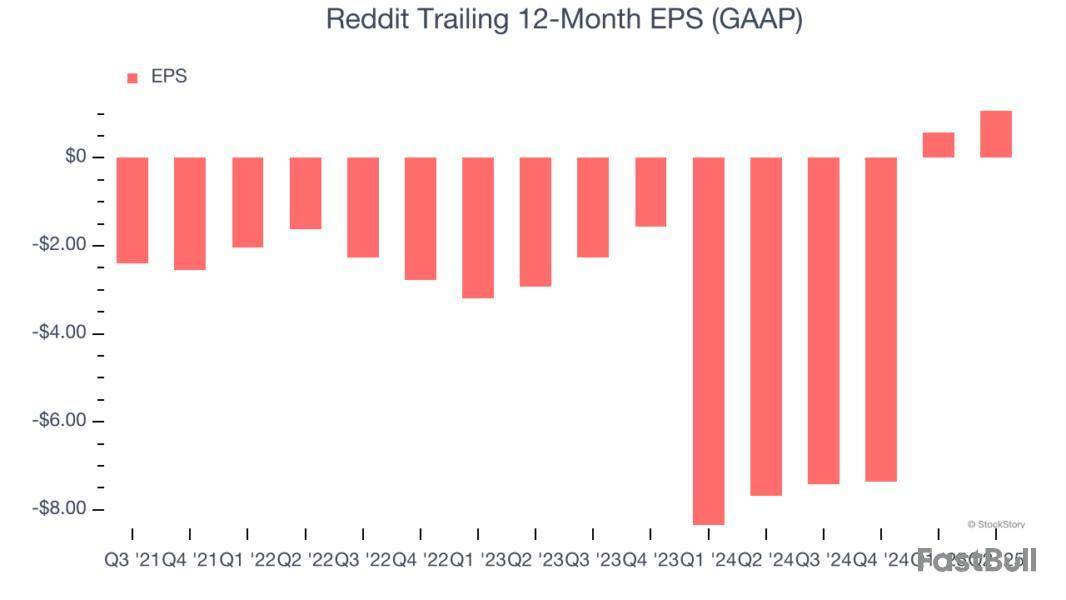

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Reddit’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

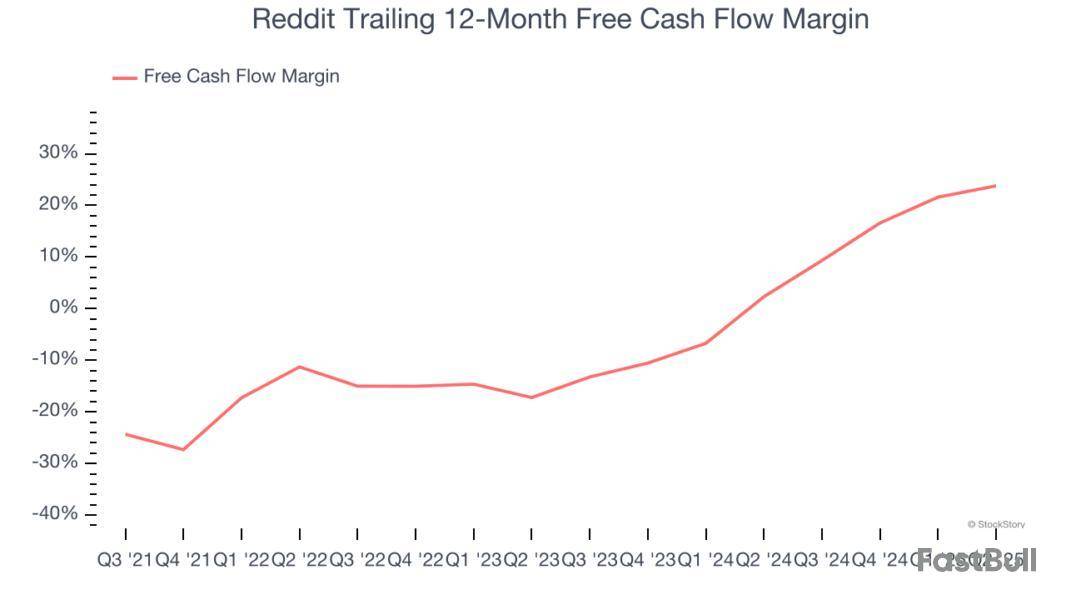

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Reddit’s margin expanded by 35.1 percentage points over the last few years. This is encouraging because it gives the company more optionality. Reddit’s free cash flow margin for the trailing 12 months was 23.8%.

Final Judgment

These are just a few reasons why Reddit is a cream-of-the-crop consumer internet company, and with the recent surge, the stock trades at 69.7× forward EV/EBITDA (or $265.99 per share). Is now a good time to buy despite the apparent froth? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

The latest Market Talks covering Equities. Published exclusively on Dow Jones Newswires throughout the day.

1330 ET - Backing software providers to clean energy-infrastructure operators is a safer way to capitalize on the industry's expansion as it avoids the risks of investing in unproven technologies, says John Tough, managing partner at Energize Capital, a climate-focused investment firm in Chicago. "We're more bullish on the industrial technologies that are already here because of how hard it is to get anything new done," Tough says. "Software is great at helping [existing] industries scale." As example, he cites Energize's investment in Nozomi, a cybersecurity company focused on heavy industries such as water treatment and power. Mitsubishi Electric last week agreed to acquire the business in a $1 billion deal. Nozomi is "helping build all the reshoring and remanufacturing coming into the United States-technologies that are already viable," Tough adds. (luis.garcia@wsj.com; @lhvgarcia)

1314 ET - Ralph Lauren sees its women's business as one of its biggest growth opportunities over the next three years, executives say during an investor call. The segment hit $2 billion in sales in fiscal 2025, making Ralph Lauren one of the few apparel brands to hit that mark, Chief Product and Merchandising officer Halide Alagöz says. Still, the company has about 1% of the global premium market for women, so there is a lot of room to expand. Growth in women's is expected to outpace the total company's growth within the next three years, Alagöz says. (katherine.hamilton@wsj.com)

1228 ET - Similarweb data suggest Reddit is seeing more-than-expected active users and accelerating ad portal visits, which should drive higher revenue, say Oppenheimer analysts. Through investments in facilitating onboarding and better in-app searching, Reddit is doing a better job of converting visits to logged-in users, which is its primary driver of revenue. Third-party data suggest a 1.6 million net increase in logged-in daily active users for 3Q, 1.1 million above Wall Street's consensus. Data also show an acceleration of visits to Reddit's ad portal with improving return on investment driving higher ad spend. Oppenheimer raises its price target to $300 from $215. Reddit shares rise 0.5% to $264.97. (nicholas.miller@wsj.com)

1209 ET - Canadian Industry Minister Melanie Joly says she will meet next week with the CEOs of Anglo-American and Teck Resources to discuss their proposed merger, adding she hasn't heard much from either company about why the transaction would provide a net benefit to the national economy. "We think that we need to have further conversations with the companies," Joly says. The Anglo-Teck deal needs Canadian regulatory approval to proceed, under the country's foreign-investment law, which dictates any foreign-led deal needs to show it will provide a so-called "net benefit" to the economy. The merger also marks a test of recent Canada policy that foreign-led deals involving critical minerals--such as copper, zinc and molybdenum, all of which Teck produces--would only be approved in exceptional circumstances. (paul.vieira@wsj.com; @paulvieira)

1135 ET - Gold prices surged past $3,700 a troy ounce on Tuesday, hitting a fresh record high amid a weaker U.S. dollar and firm expectations that the Federal Reserve will cut interest rates. Futures rise 0.1% to $3,722 an ounce, after hitting $3,739.90 an ounce in intraday trading earlier. "Should the central bank's guidance fall short of dovish market expectations, gold could face near-term selling pressure," says Eric Chia, strategist at brokerage Exness. "However, any confirmation of multiple cuts would strengthen its rally, potentially leading to new highs." The rally is also supported by central-bank buying, ETFs inflows and geopolitical tensions contributing to growing demand for safe-haven and inflation-hedging assets. (giulia.petroni@wsj.com)

1124 ET - Global equities allocations are at a 7-month high, indicating rising investor optimism, Bank of America's global fund manager survey for September shows. A net 28% of institutional investors favor equity allocations over other assets, a 7-month high, BofA says. (miriam.mukuru@wsj.com)

1122 ET - The proportion of investors who considered the dollar to be overvalued rose to a three-month high in September, Bank of America's global fund manager survey shows. Some 49% of investors said the dollar is overvalued, up from 44% last month. The survey also showed investors remain underweight the dollar, expecting it to underperform. (renae.dyer@wsj.com)

1121 ET - Sterling is seen as the most overvalued in almost 10 years, according to Bank of America's September global fund manager survey. The survey shows a net 12% of investors now think sterling is overvalued, flipping from a net 3% undervalued a month ago. The currency is considered the most overvalued since December 2015. Sterling has appreciated about 1% against the dollar in the month to date and 9% so far this year, LSEG data show. It last trades up 0.3% at $1.3642, having earlier reached a two-month high of $1.3671. (renae.dyer@wsj.com)Expectations of a global "hard landing" are rising, according to Bank of America's global fund manager survey for September. "Expectations of U.S. 'Hard Landing' Rise, BofA Fund Manager Survey Shows — Market Talk," at 1440 GMT, incorrectly said the expectations related only to the U.S. economy in the headline and text. The correct version follows: 1518 GMT - The proportion of investors expecting a 'hard landing' for the global economy doubles, although it remains low, Bank of America's global fund manager survey for September shows. A 'hard landing' is a rapid slowdown in economic growth, possibly leading to a recession. A total of 10% of investors polled in the September BofA survey expect a hard landing in the global economy, up from 5% in the August survey. (miriam.mukuru@wsj.com)

1112 ET - A majority of investors expect a 'soft landing' for the global economy, according to Bank of America's global fund manager survey for September. A total of 67% of investors anticipate this scenario, where the economy slows but avoids a recession and inflation is contained. Moreover, 18% expect 'no landing,' where the economy continues to grow. A total of 10% of investors polled expect a sharp decline in global economic growth, or a 'hard landing,' the survey shows. (miriam.mukuru@wsj.com)

1109 ET - A second inflation wave is considered the biggest tail risk--an event that has a low probability of happening--according to 26% of investors polled in Bank of America's global fund manager survey for September. This is closely followed by the risk of the U.S. Federal Reserve losing independence and U.S. dollar debasement, cited by 24% of those polled. Another 22% of investors cite a disorderly rise in bond yields. The risk of a trade war triggering a global recession is fading, with just 12% citing this as the biggest tail risk in September, down from 29% in August, BofA says in a press release accompanying the survey. (jessica.fleetham@wsj.com)

1107 ET - Ralph Lauren's updated strategic growth plan, unveiled ahead of today's investor meeting, is mostly similar versus its 2022 plan, according to Jefferies. The company's three-year revenue guidance was in line with expectations, while its operating margin view was in line or slightly below estimates, the analysts say, as management "retained its prudent stance given the uncertain environment and conservative tendency." The analysts say they expect to see continued brand momentum near-term, and believe the company's strategy--however familiar it may be--should continue to drive growth. Ralph Lauren is off 1.2%. (katherine.hamilton@wsj.com)

Similarweb data suggest Reddit is seeing more-than-expected active users and accelerating ad portal visits, which should drive higher revenue, say Oppenheimer analysts. Through investments in facilitating onboarding and better in-app searching, Reddit is doing a better job of converting visits to logged-in users, which is its primary driver of revenue. Third-party data suggest a 1.6 million net increase in logged-in daily active users for 3Q, 1.1 million above Wall Street's consensus. Data also show an acceleration of visits to Reddit's ad portal with improving return on investment driving higher ad spend. Oppenheimer raises its price target to $300 from $215. Reddit shares rise 0.5% to $264.97. (nicholas.miller@wsj.com)

(16:11 GMT) Reddit Price Target Raised to $300.00/Share From $215.00 by Oppenheimer

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up