Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance. Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Choosing the wrong investments can cause you to fall behind, which is why we started StockStory - to separate the winners from the losers. That said, here are three low-volatility stocks to avoid and some better opportunities instead.

Herbalife (HLF)

Rolling One-Year Beta: 0.40

With the first products sold out of the trunk of the founder’s car, Herbalife today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Why Are We Cautious About HLF?

Herbalife is trading at $8.98 per share, or 4.2x forward P/E. To fully understand why you should be careful with HLF, check out our full research report (it’s free).

Keurig Dr Pepper (KDP)

Rolling One-Year Beta: 0.19

Born out of a 2018 merger between Keurig Green Mountain and Dr Pepper Snapple, Keurig Dr Pepper is a consumer staples powerhouse boasting a portfolio of beverages including sodas, coffees, and juices.

Why Is KDP Not Exciting?

Keurig Dr Pepper’s stock price of $26.28 implies a valuation ratio of 12.5x forward P/E. If you’re considering KDP for your portfolio, see our FREE research report to learn more.

Assured Guaranty (AGO)

Rolling One-Year Beta: 0.66

Serving as a financial safety net for over $11 trillion in debt service payments since its founding in 2003, Assured Guaranty provides credit protection products that guarantee scheduled payments on municipal bonds, infrastructure projects, and structured finance obligations.

Why Are We Wary of AGO?

At $84.88 per share, Assured Guaranty trades at 0.7x forward P/B. Dive into our free research report to see why there are better opportunities than AGO.

Stocks We Like More

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Since March 2025, Assured Guaranty has been in a holding pattern, posting a small loss of 4.8% while floating around $83.57. The stock also fell short of the S&P 500’s 16.2% gain during that period.

Is there a buying opportunity in Assured Guaranty, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Assured Guaranty Not Exciting?

We don't have much confidence in Assured Guaranty. Here are three reasons why AGO doesn't excite us and a stock we'd rather own.

1. Declining Net Premiums Earned Reflect Weakness

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Assured Guaranty’s net premiums earned has declined by 4.3% annually over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Assured Guaranty’s revenue to drop by 29.8%, a decrease from its 8.5% annualized declines for the past two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Assured Guaranty has averaged an ROE of 7.7%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

Assured Guaranty’s business quality ultimately falls short of our standards. With its shares underperforming the market lately, the stock trades at 0.7× forward P/B (or $83.57 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

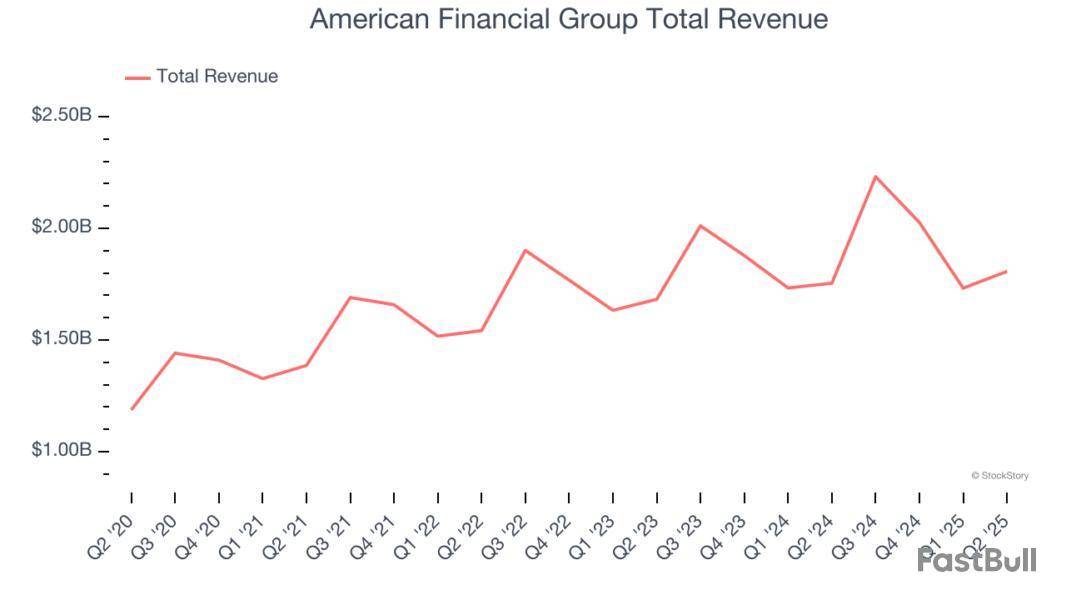

Let’s dig into the relative performance of American Financial Group and its peers as we unravel the now-completed Q2 property & casualty insurance earnings season.

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 4.9% on average since the latest earnings results.

With roots dating back to 1872 and a business model that empowers local decision-making, American Financial Group is an insurance holding company that specializes in commercial property and casualty insurance products for businesses through its Great American Insurance Group.

American Financial Group reported revenues of $1.81 billion, up 3% year on year. This print fell short of analysts’ expectations by 4.5%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ net premiums earned and book value per share estimates.

Interestingly, the stock is up 8.8% since reporting and currently trades at $135.35.

Read our full report on American Financial Group here, it’s free.

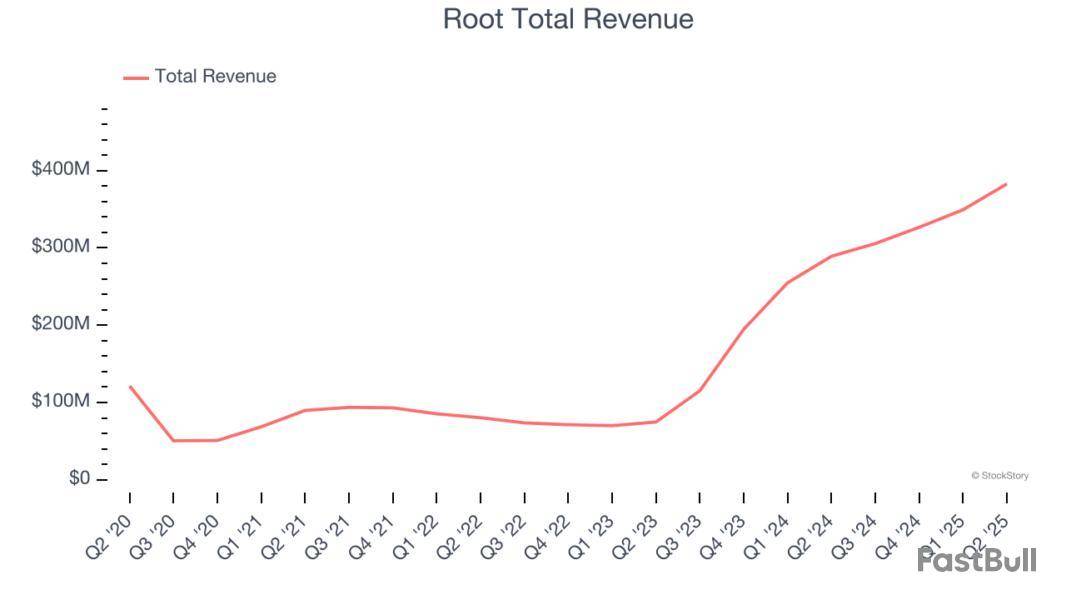

Pioneering a data-driven approach that rewards good driving habits, Root is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $382.9 million, up 32.4% year on year, outperforming analysts’ expectations by 7.5%. The business had an incredible quarter with a beat of analysts’ EPS and net premiums earned estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 15.5% since reporting. It currently trades at $104.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Selective Insurance Group

Founded in 1926 during the early days of automobile insurance, Selective Insurance Group is a property and casualty insurance company that sells commercial, personal, and excess and surplus lines insurance products through independent agents.

Selective Insurance Group reported revenues of $127.9 million, down 89.3% year on year, falling short of analysts’ expectations by 90.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS and book value per share estimates.

Selective Insurance Group delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 13.1% since the results and currently trades at $78.63.

Read our full analysis of Selective Insurance Group’s results here.

Serving as a financial safety net for over $11 trillion in debt service payments since its founding in 2003, Assured Guaranty provides credit protection products that guarantee scheduled payments on municipal bonds, infrastructure projects, and structured finance obligations.

Assured Guaranty reported revenues of $281 million, up 39.1% year on year. This result topped analysts’ expectations by 51.2%. More broadly, it was a softer quarter as it recorded a significant miss of analysts’ EPS and net premiums earned estimates.

Assured Guaranty achieved the biggest analyst estimates beat among its peers. The stock is down 1.3% since reporting and currently trades at $83.57.

Read our full, actionable report on Assured Guaranty here, it’s free.

Tracing its roots back to 1889 when California was experiencing its first major real estate boom, First American Financial provides title insurance, settlement services, and risk solutions for residential and commercial real estate transactions across the United States and internationally.

First American Financial reported revenues of $1.84 billion, up 14.2% year on year. This print surpassed analysts’ expectations by 4.9%. It was a very strong quarter as it also put up a beat of analysts’ EPS estimates.

The stock is up 13.6% since reporting and currently trades at $65.46.

Read our full, actionable report on First American Financial here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Wall Street has set ambitious price targets for the stocks in this article. While this suggests attractive upside potential, it’s important to remain skeptical because analysts face institutional pressures that can sometimes lead to overly optimistic forecasts.

Unlike the investment banks, we created StockStory to provide independent analysis that helps you determine which companies are truly worth following. That said, here is one stock likely to meet or exceed Wall Street’s lofty expectations and two where analysts may be overlooking some important risks.

Two Stocks to Sell:

Noodles (NDLS)

Consensus Price Target: $2 (186% implied return)

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company is a casual restaurant chain that serves all manner of noodles from around the world.

Why Do We Pass on NDLS?

At $0.70 per share, Noodles trades at 2.1x forward EV-to-EBITDA. To fully understand why you should be careful with NDLS, check out our full research report (it’s free).

Assured Guaranty (AGO)

Consensus Price Target: $105.75 (28.2% implied return)

Serving as a financial safety net for over $11 trillion in debt service payments since its founding in 2003, Assured Guaranty provides credit protection products that guarantee scheduled payments on municipal bonds, infrastructure projects, and structured finance obligations.

Why Are We Wary of AGO?

Assured Guaranty is trading at $82.49 per share, or 0.7x forward P/B. Dive into our free research report to see why there are better opportunities than AGO.

One Stock to Buy:

Wingstop (WING)

Consensus Price Target: $396.43 (49% implied return)

The passion project of two chicken wing aficionados in Texas, Wingstop is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Why Is WING a Top Pick?

Wingstop’s stock price of $266.02 implies a valuation ratio of 61.4x forward P/E. Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up