Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto asset managers 21Shares, Bitwise, and WisdomTree are opening up access to their Bitcoin and Ethereum exchange-traded products to UK retail investors for the first time.

The move comes 12 days after the Financial Conduct Authority, the UK's financial regulator, officially lifted its four-year retail ban on crypto exchange-traded notes, expanding availability beyond professional investors.

21Shares listed two physically backed products on the London Stock Exchange for each of the cryptocurrencies on Monday, including a staking component for its Ethereum ETPs and a reduced 0.1% fee for some products.

"Today's launch represents a landmark step for the UK market and for everyday investors who, for years, have been excluded from regulated crypto products," 21Shares CEO Russell Barlow said in a statement shared with The Block. "This is an important start, but not the finish line — access to Bitcoin and Ethereum is only the first step in building a more comprehensive and innovation-friendly framework for the UK."

21Shares previously listed its crypto ETPs for institutional investors in the UK last year, going on to capture 70% of total turnover on the LSE, the firm claims, with 21Shares UK Head Alex Pollak telling The Block at the time that opening up for retail would be a "game changer" moment.

Meanwhile, WisdomTree listed its physically backed Bitcoin and Ethereum ETPs on the LSE with 0.15% and 0.35% fees, respectively, similarly following their previous UK institutional product launches.

"The availability of crypto ETPs on the Main Market of the LSE demonstrates how far the market has evolved, giving investors confidence that they can access digital assets through trusted, regulated channels," WisdomTree Alexis Marinof said. "Access and transparency are essential to building trust in this asset class, and today’s milestone reinforces that belief."

Bitwise also announced that it would list its Bitcoin and Ethereum ETPs on the LSE on Tuesday, lowering the fee for its Core Bitcoin ETP to 0.05% for at least six months. "We are excited to make Bitwise Bitcoin and Ethereum ETPs available to a much wider group of investors in Europe's largest investment market through this launch on the London Stock Exchange," Bitwise Head of Europe Bradley Duke said.

Furthermore, BlackRock also listed its iShares Bitcoin ETP on the LSE on Monday, according to its website, first reported by the Financial Times. "As the UK crypto investor base is projected to approach 4 million over the next year, today's listing of exchange-traded products like iShares Bitcoin ETP unlock a securer gateway to digital assets through traditional investment platforms," BlackRock EMEA Head of Global Product Solutions Jane Sloan said per the outlet.

FCA lifts four-year retail ban on crypto ETNs

Since January 2021, the FCA prohibited the sale, marketing, and distribution of crypto derivatives and crypto ETNs to retail consumers, applying to all UK-regulated platforms and brokers. In March 2024, the FCA updated its position to allow recognized investment exchanges to list crypto asset-backed ETNs for professional investors only, restricted to entities such as investment firms and credit institutions, with stringent controls to ensure orderly trading and investor protection.

This latest development means retail investors can now access these products through UK-regulated investment platforms and brokers too, using standard brokerage accounts and tax wrappers, like ISAs and SIPPs, WisdomTree noted on Monday. The move also aligns the UK more closely with countries such as the U.S., Canada, Hong Kong, and across the EU. However, the ban on broader crypto asset derivatives for retail remains in place.

The UK has adopted a phased approach to crypto regulation, aiming to position itself as a global hub for digital assets while prioritizing consumer protection and financial stability. Comprehensive regulations covering stablecoins, trading platforms, lending, staking, and custody are also currently under consultation as part of the FCA's crypto roadmap, with full implementation expected in 2026.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Popular meme cryptocurrency Shiba Inu or, as it better known, SHIB, has managed to dodge what its enthusiasts feared most — being stuck with another zero in its price.

After a brutal "Black Friday" sell-off on Oct. 10, the meme coin dipped to below $0.00001 zone, but it was not for long, as the next week, SHIB already managed to find short-term footing around $0.0000102.

But, and it is a big one, the problem is that nothing really changed. Shiba Inu coin is still sitting 70% below where it was last December, with a market cap now around $6.9 billion, and whales keep dumping. At the start of the week their wallets had about 21 billion SHIB but now close to 92 billion.BITFINEX:SHIBUSD by TradingView">

Exchange balances also went up — 276 trillion tokens compared to 275 trillion on Sunday. So, coins are still being moved to sell.

SHIB price prints bearish pattern

The hidden bearish signal, as usual, is in the price chart, as the ominous pattern — a descending triangle — with the floor at $0.00001052, was tested in April, June and again during the October crash. That is a classic break and retest setup, which usually points lower, and if it plays out, SHIB can go straight to $0.000006.

Right now, buyers managed to hold the line and avoid the zero. But whales are still selling, on-chain numbers are down and the chart is ugly. The bounce might not last long.

By Elsa Ohlen

The recovery in Bitcoin and other cryptocurrencies picked up pace early Monday, following a week of big losses for digital assets.

Bitcoin was up 2.9% over the past 24 hours to $111,090, according to CoinDesk data. The price of the world's largest crypto dropped as low as $106,207 overnight before rebounding. It still trades about 12% below its all-time high hit earlier this month.

Smaller cryptocurrencies gained too, with Ether rising 3%, XRP 3.7%, and Solana 2.2%.

Meanwhile, futures tracking the S&P 500 and Nasdaq rose 0.3% and 0.4%, respectively.

Cryptos' move higher came amid cautiously optimistic data out of China and Japan, with the former posting third-quarter GDP growth of 4.8% Monday, in line with LSEG expectations. Meanwhile, Japan's benchmark Nikkei 225 rose 3.4% Monday to close at a record high.

Investors sold off risk assets late last week following credit concerns after two regional banks said they'd been hit by bad loans. Escalating U.S.-China trade tensions and President Donald Trump's threat of a further 100% tariffs on Chinese imports to the U.S. also hang over markets, including crypto assets.

Shares of cryptocurrencies exchanges Coinbase Global and Robinhood Markets also rose between 3% and 4% in premarket trading Monday, mirroring the price in crypto prices, even as a major outage at Amazon Web Services appeared to affect its operations. Barron's has reached out to Amazon for comment.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

John Bollinger, the inventor of Bollinger Bands and a figure whose occasional crypto market calls carry outsized weight, says Ethereum and Solana are tracing potential “W” bottoms—while Bitcoin is not. In a post on X on October 18, Bollinger wrote: “Potential ‘W’ bottoms in Bollinger Band terms in ETHUSD and SOLUSD, but not in BTCUSD. Gonna be time to pay attention soon I think.”

John Bollinger@bbandsOct 18, 2025Potential ‘W’ bottoms in Bollinger Band terms in $ETHUSD and $SOLUSD, but not in $BTCUSD. Gonna be time to pay attention soon I think.

Ethereum And Solana Price: What To Watch Now

The emphasis on “Bollinger Band terms” is doing heavy lifting here. In classic Bollinger taxonomy, a W bottom is a two-trough reversal with the second low holding above the first, often accompanied by a volatility signature that includes a prior band expansion, subsequent contraction, and a failure to register a lower low at the bands on the second leg.

The more robust versions see the second low forming inside the bands or with a positive divergence against the lower band, followed by a band “pinch” and a move through the middle band that transitions into an upper-band walk. Bollinger’s phrasing—“potential” and “time to pay attention”—signals that, in his framework, pattern recognition precedes confirmation, and that the validation trigger lies in subsequent price interaction with the middle and upper bands rather than in the raw shape of the price lows alone.

The rarity of Bollinger’s crypto commentary layered urgency onto the signal. As crypto trader Satoshi Flipper (@SatoshiFlipper) stressed, “John Bollinger, creator of Bollinger Bands, makes barely 1 crypto call per year and hasn’t made one for ETH in 3 years until yesterday. And each call he makes goes on to mark generational bottoms. He just told us SOL + ETH have bottomed, now imagine fading this legend.”

The same account detailed that Bollinger’s last notable Ethereum call dates to September 9, 2022, noting that ETH “went on to pump from $1,290 to $4,000.” That historical reference captures the prevailing market psychology: Bollinger’s infrequent, technically disciplined alerts are perceived by many traders as cycle-defining.

Context from earlier this year also helps frame the setup. On April 10, Bollinger publicly flagged a similar structure in Bitcoin, saying: “Classic Bollinger Band W bottom setting up in BTCUSD. Still needs confirmation.” In the exact same week, BTC carved out a bottom at $74,508 and proceeded to log seven straight green weekly candles, advancing roughly 55%. From Bollinger’s call into the first week of October, BTC rallied more than 70%.

The market nuance in Bollinger’s latest readout is the explicit exclusion of Bitcoin. If ETHUSD and SOLUSD are printing W-like structures in Bollinger terms while BTCUSD is not, it implies a temporary decoupling in volatility structure and relative strength. In practical terms, a non-confirming Bitcoin can either lag into a later confirmation, remain range-bound in a mid-band churn, or fail its own setup if lower-band interactions persist without recapture of the middle band.

For Ethereum and Solana, confirmation would typically look like sustained closes above the 20-period moving average (the Bollinger middle band), followed by a disciplined advance that converts the upper band from resistance into a guide. A healthy W bottom sequence tends not to produce immediate, vertical band overthrows; rather, it builds a stair-step profile with periodic mid-band checks that hold.

Failure would involve another lower-band excursion that undercuts the second trough or a volatility bloom that widens the bands without directional follow-through—both signatures of an incomplete base.

At press time, ETH traded at $4,037.

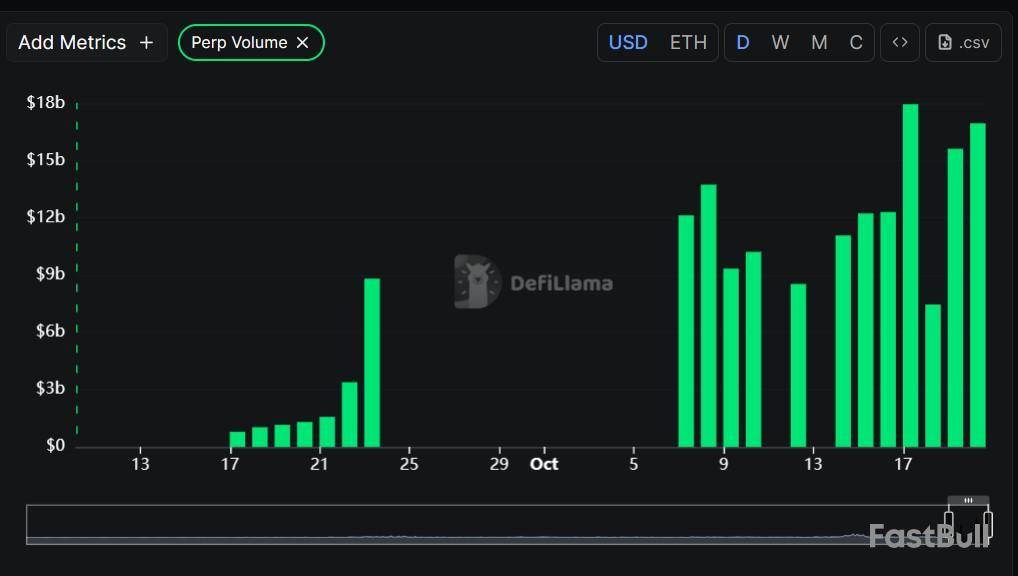

Decentralized finance (DeFi) data aggregator DefiLlama has quietly reinstated decentralized exchange (DEX) Aster to its analytics platform, weeks after delisting the project over disputed trading data.

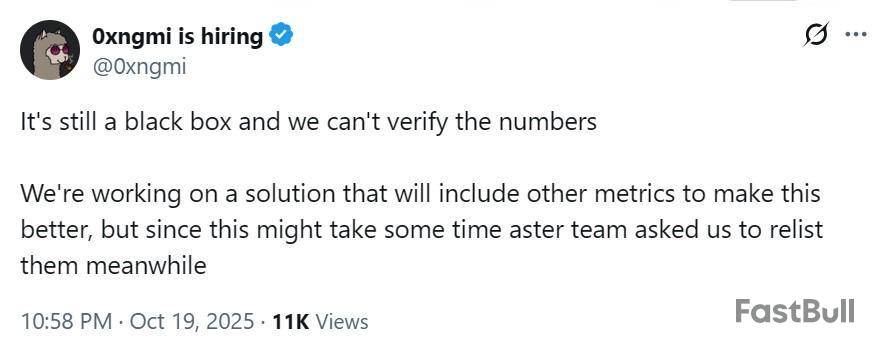

Dragonfly managing partner Haseeb Qureshi flagged the development on X, noting that there was no public discussion or announcement from either Aster or DefiLlama. Qureshi also noted “big gaps” in the historical data, and asked the pseudonymous DefiLlama founder “0xngmi” if the numbers are now legitimate.

Responding to the post, 0xngmi said the team still could not verify the numbers, describing it as a “black box.” He added that while DefiLlama is developing a new system to include more metrics, Aster’s team requested to be relisted in the meantime.

“We’re working on a solution that will include other metrics to make this better, but since this might take some time aster team asked us to relist them meanwhile,” 0xngmi wrote.

Aster data dispute sparked transparency debate

Aster was initially delisted two weeks ago after inconsistencies were detected in its on-chain trading data. This raised concerns that part of its reported activity are unverified.

On Oct. 6, 0xngmi said the platform does not make it possible to get data on who is making and filling orders. This means that the data platform couldn’t distinguish wash trading from legitimate activity.

The Aster delisting from the data platform, sparked a broader debate about the power of data providers. Aster supporters accused DefiLlama of being centralized, while critics questioned whether Aster's jump into the limelight was genuine or manufactured.

The delisting incident reflected an ongoing challenge in measuring the truth in decentralized markets. Such disputes showed how quickly data-related questions can impact trust.

Aster relisting left data gaps

While Aster’s metrics is now live on DefiLlama, are once again visible on the platform, the missing historical data left gaps.

This means that longitudinal comparisons, like market-share trends, fee leaderboards or comulative revenue charts, are fragmented. For traders and model builders who rely on these metrics, the gaps effectively resets Aster’s historical footprint.

After being reinstated, Aster still stood at the top of the leaderboards in the 24-hour perp volume and seven-day perp volume list. It’s followed by its biggest rivals Hyperliquid and Lighter.

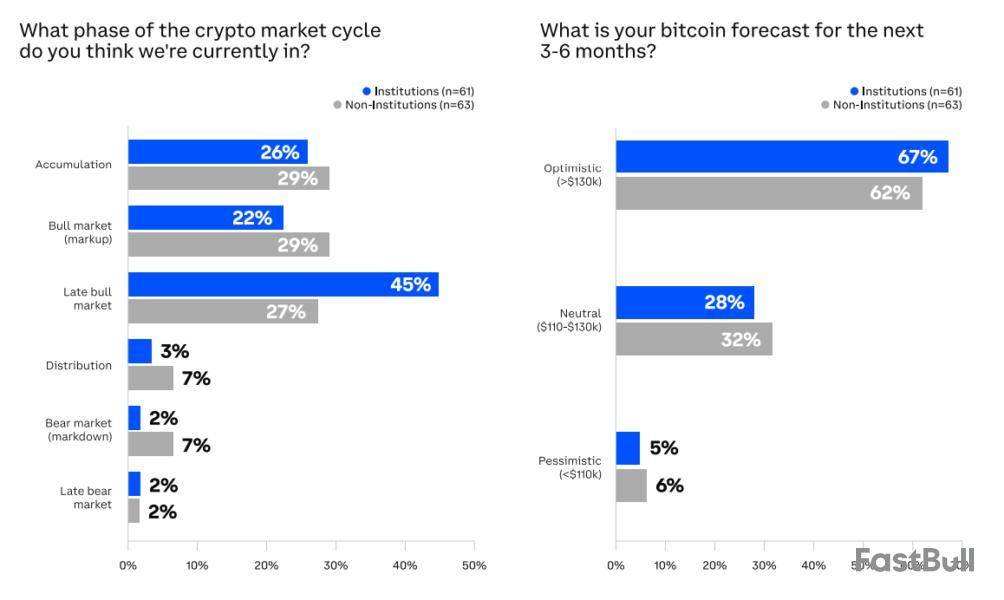

A majority of institutional and non-institutional investors maintain an optimistic outlook on Bitcoin for the next three to six months. This finding comes from a joint report released Monday by Coinbase and the on-chain data platform Glassnode.

The report indicates a “cautiously optimistic stance” for the cryptocurrency market in the fourth quarter of 2025.

Near-Term Gains, But an End in Sight?

The report identifies several tailwinds supporting a Bitcoin upswing. These include robust global liquidity, a strong macroeconomic background, and favorable regulatory dynamics.

However, the authors temper this optimism by pointing to the need for a cautious market approach. This caution follows the massive $19 billion leverage flush event on October 10.

A key investor focus, the US Federal Reserve’s interest rate policy, is expected to see two further rate cuts this year. Coinbase projects that these two cuts could attract approximately $7 trillion currently held in Money Market Funds (MMFs) back into risk-on assets.

Liquidity Squeeze Ahead

On the liquidity front, the global M2 money supply index, a key measure of worldwide liquidity, showed positive signals at the start of the quarter. However, the situation has since shifted.

The report warns that a liquidity contraction is expected in early November. This is due to the combined effects of the US government shutdown and the Federal Reserve’s Quantitative Tightening (QT).

Beware the Macroeconomic Headwinds

The report cites a survey of 120 global investors, revealing that 67% of institutional investors and 62% of non-institutional investors are optimistic about Bitcoin’s prospects over the next 3 to 6 months.

However, a clear difference emerges regarding the cycle’s sustainability. Nearly half (45%) of institutional investors believe the market is in the “late-stage bull.” This is signaling an expectation that the growth cycle will soon conclude. In contrast, only 27% of non-institutional investors share this view.

When asked about the primary “Tail Risk” for the crypto market in the near term, both institutional (38%) and non-institutional (29%) respondents cited the macroeconomic environment. This indicates a shared concern among different investor groups.

On the other hand, it is also important to note that this survey was conducted between September 17 and October 3, before the October 10 crash.

Analysts Stand By Lofty Year-End Forecasts

The “Uptober” rally that many investors anticipated appears to be faltering amid the sudden escalation of US-China tensions. Consequently, year-end Bitcoin price forecasts from major financial institutions are under intense scrutiny.

In early October, Citigroup projected a year-end Bitcoin price of approximately $133,000, conditional on continued ETF inflows and increased demand from DAT firms. Standard Chartered offered an even higher forecast, predicting Bitcoin could hit $200,000 if weekly ETF inflows maintain the $500 million level.

Similarly, JPMorgan projected a year-end price of $165,000, arguing that Bitcoin was undervalued relative to gold. Goldman Sachs also looked to gold for a reference point, suggesting that if gold were to reach $5,000 per ounce, Bitcoin could potentially surge to $220,000.

Barry Silbert, the founder and CEO of Digital Currency Group (DCG), gave his opinion about BlackRock potentially launching a Zcash-based exchange-traded fund (ETF). His comments coincided with a recent price breakout in the price of Zcash (ZEC), a leading privacy coin.

Barry Silbert’s take on Zcash ETF

In an X post, Silbert said, personally speaking, he loves the fact that BlackRock, the world's largest asset manager, would never launch a Zcash ETF.

This statement is in response to an X user who shared an enthusiastic take on Zcash. The user argued that Zcash is "revenge" against corrupt governments, banks, venture capital and mainstream crypto’s drift from cypherpunk ideals.

Barry Silbert@BarrySilbertOct 19, 2025I personally love the fact that BlackRock will never, ever launch an ETF for Zcash https://t.co/FRFfndeAP6

In contrast, Silbert thinks it is very unlikely that Zcash would attract a BlackRock ETF. Recall that BlackRock has aggressively entered crypto via ETFs.

However, the firm has focused on assets that align with regulatory ease, massive liquidity and institutional appeal. In 2024, BlackRock launched spot ETFs for Bitcoin and Ethereum .

Still, BlackRock has not revealed plans to launch another altcoin ETF focused on Solana, XRP or even Dogecoin. Privacy coins like Zcash are even further off their radar, considering the challenges they pose to regulatory efforts.

Notably, Zcash uses zero-knowledge proofs to shield transactions. It enables true privacy where senders, receivers and amounts are hidden on the blockchain.

While this action is revolutionary for users seeking financial sovereignty, it is a challenge for U.S. regulators. This is because they prioritize transparency to combat money laundering and illicit finance.

Therefore, launching an ETF may expose BlackRock to scrutiny over untraceable flows. This is something they have avoided with BTC and ETH, which are more auditable.

Despite the statement from Silbert, supporters still think it is only a matter of time before Zcash gets adopted into the ETF space.

Another set, however, claimed Zcash does not need an ETF. They emphasized that the true value of Zcash lies in real cryptographic innovation and privacy-focused technology.

Zcash in bullish rebound mode

Amid the ETF discussions, Zcash has continued in its hyper-bullish rebound mode. As of press time, ZEC trades at $240.25, up more than 10% over the previous day.

On the monthly charts, the value of ZEC surged 378.9%. ZEC is now ranked the 30th-largest cryptocurrency by market cap, which is valued at $3.9 billion.

ZEC began this bullish move earlier this month, with the price jumping over 27% in a day to around $94. Shortly after, ZEC added about 350% in just two weeks to over $268.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up