Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

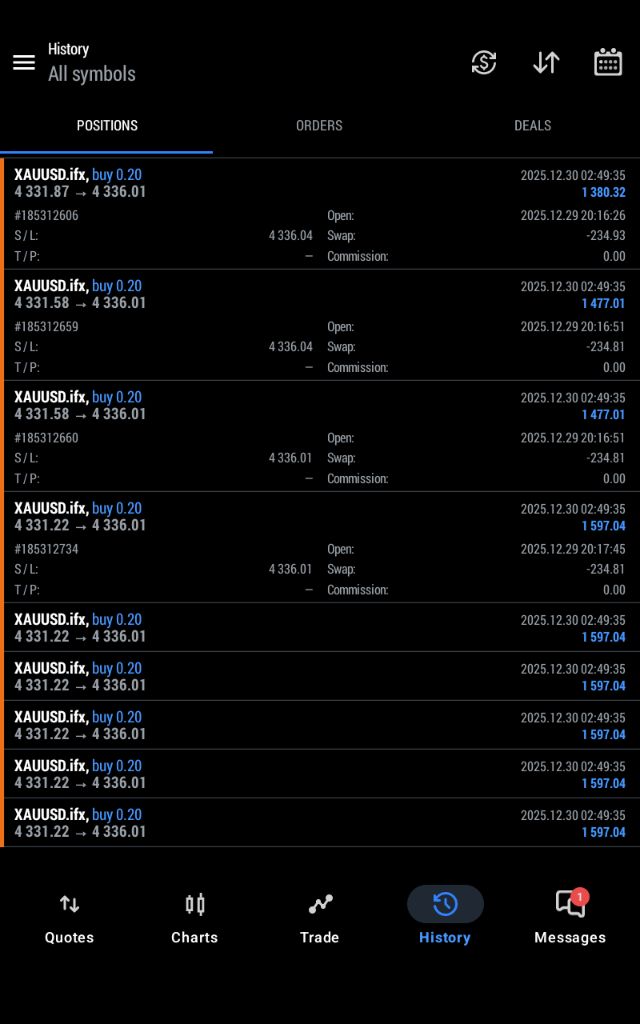

Signal Accounts for Members

All Signal Accounts

All Contests

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)A:--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)A:--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)A:--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)A:--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Pending Home Sales Index (Nov)

U.S. Pending Home Sales Index (Nov)A:--

F: --

U.S. Pending Home Sales Index MoM (SA) (Nov)

U.S. Pending Home Sales Index MoM (SA) (Nov)A:--

F: --

U.S. Pending Home Sales Index YoY (Nov)

U.S. Pending Home Sales Index YoY (Nov)A:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Dec)

U.S. Dallas Fed General Business Activity Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. Dallas Fed New Orders Index (Dec)

U.S. Dallas Fed New Orders Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Nov)

South Korea Industrial Output MoM (SA) (Nov)A:--

F: --

South Korea Retail Sales MoM (Nov)

South Korea Retail Sales MoM (Nov)A:--

F: --

P: --

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)A:--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Oct)

U.S. S&P/CS 10-City Home Price Index YoY (Oct)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index YoY (Oct)

U.S. FHFA House Price Index YoY (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)--

F: --

P: --

U.S. FHFA House Price Index (Oct)

U.S. FHFA House Price Index (Oct)--

F: --

P: --

U.S. Chicago PMI (Dec)

U.S. Chicago PMI (Dec)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

South Korea CPI YoY (Dec)

South Korea CPI YoY (Dec)--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Dec)

China, Mainland NBS Manufacturing PMI (Dec)--

F: --

P: --

China, Mainland Composite PMI (Dec)

China, Mainland Composite PMI (Dec)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Dec)

China, Mainland NBS Non-manufacturing PMI (Dec)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Dec)

China, Mainland Caixin Manufacturing PMI (SA) (Dec)--

F: --

P: --

Turkey Trade Balance (Nov)

Turkey Trade Balance (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

South Africa Trade Balance (Nov)

South Africa Trade Balance (Nov)--

F: --

P: --

you're spot on

you're spot on

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

With the 2025 calendar almost out of pages, XRP is doing the one thing that tends to happen right before a big yearly close — compressing into a triangle on the small time frame, turning what looked like random chop into a tight range where one candle can suddenly decide the mood.

On Binance’s 15-minute chart, the price is near $1.8656, wedged between a descending dynamic resistance around $1.88 and a rising floor that comes in near $1.84.

That compression matters because it is happening after a midmonth slide that pulled XRP from the low-$2 zone into the high-$1s, printed a fast flush toward the $1.78 area, and then snapped back into compression instead of continuing lower.

BINANCE:XRPUSD by TradingView">

The math on this setup is simple enough to predict what may happen next.

So, a break from a tight triangle often carries a measured move, and the version circulating puts a 10% swing on the table. From $1.86, that projects into the $2.04 area, which is why the round-number $2 marker as the “by year-end” target suddenly sounds less like a dream and more like a job that just needs one push through resistance.

Don't rely on arithmetic

However, the geometry is not a promise, and triangles have a habit of punishing anyone who treats lines as destiny. If buyers fail to defend $1.84 per XRP and the range opens downwards, the story will turn into a retest of $1.80 first, and then of the previous flush zone near $1.78.

As we enter the final stretch of 2025, the situation is clear: either the price of XRP breaks out of the triangle quickly, or it remains boxed in for so long that the move occurs after the year-end narrative has expired.

JPMorgan Chase has reportedly frozen bank accounts linked to two venture-backed stablecoin startups after identifying exposure to sanctioned and high-risk jurisdictions.

The accounts belonged to BlindPay and Kontigo, two stablecoin startups backed by Y Combinator that primarily operate across Latin America, according to a report by The Information. Both companies accessed JPMorgan’s banking services through Checkbook, a digital payments firm that partners with large financial institutions.

Per the report, the freezes occurred after JPMorgan flagged business activity tied to Venezuela and other locations subject to US sanctions.

A spokesperson for JPMorgan reportedly said the decision was not driven by opposition to stablecoins themselves. “This has nothing to do with stablecoin companies,” the spokesperson told The Information. “We bank both stablecoin issuers and stablecoin-related businesses, and we recently took a stablecoin issuer public,” the spokesperson added.

Related: Strike CEO debanked by JPMorgan, Lummis sounds ‘Chokepoint 2.0’ alarm

Chargeback surge triggers JPMorgan account closures

Checkbook CEO PJ Gupta reportedly told The Information that BlindPay and Kontigo were among several firms linked to a surge in chargebacks that prompted the bank to close accounts. According to Gupta, the spike was driven by rapid customer onboarding. “They opened the floodgates and a bunch of people came in over the internet,” he said.

The account freezes come as JPMorgan and Checkbook deepen their partnership. In November 2024, the two companies announced that Checkbook would join the J.P. Morgan Payments Partner Network, enabling corporate clients to send digital checks. Checkbook also expanded its B2B payment offerings earlier in 2024, targeting sectors such as legal services, government and banking.

As Cointelegraph reported, cryptocurrencies are becoming a core part of the economy in Venezuela as citizens turn to digital assets to shield themselves from a collapsing currency and tighter government controls.

Cointelegraph reached out to JPMorgan for comment, but had not received a response by publication.

Related: JPMorgan exploring crypto-backed loans amid stablecoin push

Winklevoss accuses JPMorgan of retaliating against Gemini over criticism

In July, Gemini co-founder Tyler Winklevoss claimed JPMorgan Chase paused the crypto exchange’s re-onboarding process in response to his public criticism of the bank’s new data access policy. Winklevoss accused the bank of engaging in anti-competitive behavior that could damage fintech and crypto firms.

Meanwhile, JPMorgan is weighing plans to offer crypto trading, including spot and derivatives products, to its institutional clients as interest grows amid a more favorable US regulatory environment.

Ripple, the blockchain payments company behind XRP, is once again in the spotlight as reports suggest that it may be preparing for a possible initial public offering (IPO) in 2026.

Industry analysts now rank Ripple among the biggest potential public listings, with valuations estimated near $50 billion

Here’s what Ripple’s leadership is saying about these IPO talks.

Sign Shows Ripple Preparing for a 2026 IPO

According to multiple sources, Ripple is reportedly holding advanced internal discussions around a potential IPO in 2026. These are not rumors or casual considerations, but signs that the company may be actively preparing for a public listing.

The company has also strengthened its internal structure, with better reporting and governance, which are common steps before going public. At the same time, Ripple is expanding bank partnerships and payment services to build steady, real-world revenue.

Indeed, Ripple continues to position XRP as a liquidity tool within its payment system. IPO-ready companies usually highlight utility and long-term value rather than market hype.

Ripple Ranks Among Top IPO Candidates for 2026

Adding to the excitement, market data and industry visuals now place Ripple among the largest potential IPOs heading into 2026. According to recent comparisons, Ripple ranks ninth among top private companies expected to go public, with an estimated valuation of $50 billion.

The list includes major global names such as SpaceX, OpenAI, ByteDance, and Stripe, highlighting just how significant Ripple’s position has become.

Analysts point to strong momentum, improving regulation, and growing global adoption as key reasons Ripple continues to stand out.

Ripple Leadership Pushes Back

Despite growing speculation, Ripple executives have consistently denied IPO rumors. Ripple President Monica Long has said the company has “no plan and no timeline” to go public, stressing that Ripple is well-funded and does not need public markets to raise capital.

Even Ripple CEO Brad Garlinghouse has echoed this view, noting that any IPO discussion would be a long-term consideration, not an immediate move.

Other Crypto Firms Move Closer to IPO

According to recent research reports, public markets are becoming the preferred next step for mature crypto firms. Circle has already gone public, and other major names such as Kraken, Grayscale, and BitGo have filed paperwork or entered advanced talks.

In Asia, Dunamu, the operator of Upbit, is also preparing a public debut through a merger. This broader trend has fueled speculation that Ripple could follow a similar path.

FAQs

Would a Ripple IPO affect how XRP is governed or used?A Ripple IPO would not change how XRP Ledger operates, since the network is open-source and not owned by Ripple. However, Ripple’s business decisions after an IPO could influence how aggressively it promotes XRP-based payment products.

What regulatory hurdles could still delay or prevent a Ripple IPO?Ripple would need sustained regulatory clarity in major markets, especially the U.S., where crypto-related disclosures face close scrutiny. Any unresolved legal or compliance issues could slow the timing of a public listing.

Who stands to benefit most if Ripple eventually goes public?Early private investors and long-term employees with equity would likely see the most direct financial impact. Banks and payment partners could also benefit indirectly from greater transparency and public-market credibility.

What signals should investors watch next regarding Ripple’s IPO plans?Key indicators include hiring for finance or compliance leadership, audited financial disclosures, or public comments shifting from denial to conditional openness. These steps often precede formal IPO filings.

After the latest market pullback, Dogecoin is attempting to hold a crucial support area to open the door for a recovery rally. However, some analysts have suggested that the cryptocurrency’s bleeding may not be over and a move to lower levels looms.

Dogecoin Chart Signals Short-Term Caution

On Friday, Dogecoin saw another 4.2% intraday decline to from the $0.126 area amid the ongoing market volatility. The cryptocurrency has retraced over 50% from the early October highs, losing multiple key support zones in the past two months.

After losing the $0.135 level nearly two weeks ago, DOGE has been the $0.120-$0.135 price range, failing to break past the range’s high despite various attempts. Now, the largest memecoin by market capitalization is attempting to hold the crucial $0.120 support zone to prevent further bleeding.

Therefore, some market observers have advised caution during the last week of the year. In an X post, analyst More Crypto Online affirmed that Dogecoin “is still a falling knife” as it appears that its corrective move is not done yet.

“There’s no evidence that wave B has bottomed,” he explained, which suggests that a 20% drop toward the next key supports, the $0.096 and $0.08 levels, could be likely. Per the post, “Caution is recommended until the price shows a first micro 5-wave move to the upside.”

Similarly, analyst Crypto Jobs warned that investors should stay cautious as Dogecoin does not display a bullish reversal structure and has weak buying volume, unlike multiple other altcoins.

He explained that momentum is bearish despite holding the key $0.12 level, adding that, as long as DOGE’s price stays under the $0.14-$0.15 area, bulls won’t be in control and the bearish set up and downtrend structure will remain intact.

No buy pressure at the moment, without volume. No bull structure… Under the main downtrend & channel, seeing another dump toward the $0.100 – $0.09500 lower support looks realistic. Sideway phase ongoing on the short term [H4 outlook]. We may also see some bullish move before a possible next wave downward.

DOGE’s Price Breakdown Imminent?

Market watcher BitGuru considers that DOGE’s deep correction is completed. He pointed out that the cryptocurrency is currently sitting in a major demand zone, between the $0.120-$0.130 levels, where liquidity has already been swept.

Based on this, he forecasted that a reclaim of the late November levels could set the stage for a recovery rally toward the $0.18 resistance. On the contrary, failing to hold the current levels would hint that Dogecoin will continue in a prolonged consolidation phase.

Meanwhile, Trader Tardigrade highlighted that the cryptocurrency’s price has reached the target of its previous symmetrical triangle pattern after breaking down from the formation earlier this month.

Now, Dogecoin is forming a new pattern and “searching for a new trend,” he added. According to the trader, DOGE has been forming another symmetrical triangle pattern on the H4 chart over the past two weeks, which could resolve in a 15% move toward a bearish or bullish trend.

Notably, Friday’s pullback sent the cryptocurrency below the pattern’s lower boundary, which sits around the $0.123 mark, signaling that a drop toward the $0.10-$0.11 area is possible if price doesn’t bounce soon.

As of this writing, Dogecoin trades at $0.122, a 7.3% decline in the weekly timeframe.

Crypto analysts are anticipating XRP’s price to trade sideways heading into the new year, at least until more bullish catalysts emerge.

“We maintain a view that the latter half of 2026 will provide more constructive conditions for risk assets in general, but in the short term, we have a slightly bearish tilt on altcoins until BTC consolidates or forms a bottom,” Nansen senior research analyst Jake Kennis told Cointelegraph.

Kennis is holding off on specific price predictions for 2026 amid market uncertainty but pointed to several catalysts that could drive XRP (XRP) higher, including potential spot ETF approvals, deeper integration with global payment rails, and “increased efforts to make XRP a liquidity or bridge asset.”

XRP may not start off with a “strong new trend,” says exec

XRP is down 14.63% since Jan. 1, trading at $1.84 at the time of publication, according to CoinMarketCap.

Meanwhile, Jesus Perez, CEO of Posidonia21 Capital Partners, told Cointelegraph that XRP may record sideways price action as we head into the new year. “We see XRP holding around current levels in a constructive market scenario, rather than initiating a strong new trend,” Perez said.

“XRP’s upside will likely depend more on narrative persistence and market sentiment than on fundamental transformation,” Perez said.

XRP ETFs have been performing strong recently

“While discussions around staking have emerged, the lack of a clear yield mechanism continues to represent a structural limitation compared to competing assets,” he added.

Earlier this month, US-based spot XRP ETFs surpassed $1 billion in assets, which CEO of crypto price index provider CF Benchmarks, Sui Chung, said is “because of the familiarity.”

“It has a long track record,” Chung said.

Overall, market analysts are anticipating a mix for 2026. Some say Bitcoin’s current conditions may make it hard for the broader crypto market to reach new all-time highs.

As the first crypto ETFs targeting Bitcoin (BTC) and Ethereum (ETH) near their second anniversary in the US, Galaxy Digital has made optimistic predictions regarding future inflows, projecting that they will outpace 2025 figures.

Institutional Adoption Expected To Skyrocket

In its 2026 forecast report, which concentrates on 26 critical areas, the firm anticipates that net inflows into US spot crypto ETFs will exceed $50 billion. This comes on the heels of a successful 2025, which saw net inflows reach $23 billion.

Galaxy Digital believes that as institutional adoption continues to grow, these figures will accelerate in 2026. Wirehouses lifting restrictions on advisor recommendations and Vanguard introducing crypto funds, are expected to facilitate this. BTC and ETH exchange-traded funds alone are forecasted to surpass their 2025 inflow levels.

In addition to Bitcoin and Ethereum, Galaxy Digital reports an anticipated wave of new crypto ETFs, particularly in the spot altcoin products.

Galaxy Digital Forecasts Over 100 New Crypto ETFs

The firm estimates that over 50 spot altcoin exchange-traded funds, along with another 50 crypto ETFs that do not focus on single coins, will debut in the US.

Following the US Securities and Exchange Commission’s recent approval of generic listing standards, the number of spot altcoin ETF launches is expected to gain momentum in 2026.

In 2025, more than 15 spot crypto ETFs were launched for various altcoins, including Solana (SOL), XRP, Hedera (HBAR), Dogecoin (DOE), Litecoin (LTC), and Chainlink (LINK).

Galaxy Digital anticipates that notable assets yet to file their spot ETFs will soon follow suit, and in addition to single-asset products, the market is also likely to see the introduction of multi-asset ETFs and leveraged crypto ETFs. Over 290 Crypto Companies Ready For US IPO

Beyond Crypto ETFs, Galaxy Digital also predicts that more than 15 cryptocurrency companies will pursue initial public offerings (IPOs) or uplist in the US. Over the past year, 10 crypto-related firms, including Galaxy itself, successfully went public or uplisted.

The firm notes that more than 290 crypto and blockchain companies have completed significant private funding rounds since 2018, positioning them to seek US listings as regulatory conditions improve.

Among the companies believed to be potential candidates for initial public offerings or uplisting in 2026 are CoinShares, BitGo (which has already filed), Chainalysis, and FalconX.

At the time of writing, Bitcoin is trading at $87,480, which is a 30% retracement from the all-time highs reached in October, and a 3% drop over the past month. Similarly, the gap between Ethereum’s current trading levels of $2,930 and its all-time highs is 40%, with a 3% drop over the past 30 days.

Featured image from DALL-E, chart from TradingView.com

An analyst has pointed out how XRP could be set up for a potential 10% move based on a technical analysis (TA) pattern in its 15 minutes price.

XRP Has Possibly Been Trading Inside A Symmetrical Triangle

In a new post on X, analyst Ali Martinez has talked about a Triangle that XRP has been trading inside on the 15-minute timeframe. A “Triangle” is a TA pattern that appears whenever an asset consolidates between two converging trendlines.

The upper line of the pattern tends to be a source of resistance, while the lower one that of support. An escape beyond either boundary usually signals a breakout in that direction.

Triangles can be of a few different types based on the orientation of their trendlines. Triangles that have one line parallel to the time-axis fall in either the Ascending or Descending categories. The pattern is an Ascending Triangle when the upper level is the parallel line, while it’s a Descending Triangle if the consolidation range shrinks to a downside.

When both trendlines approach each other at a roughly equal and opposite slope, the pattern formed is known as a Symmetrical Triangle. This is the case that’s relevant in the current discussion.

In a Symmetrical Triangle, the consolidation shrinks in an exactly sideways manner. As an asset moves through this pattern, its range gets narrower until it compresses down to a single point around the midline.

Now, here is the chart shared by the analyst that shows the Symmetrical Triangle that the 15-minute price of XRP has been traveling inside recently:

As displayed in the above graph, the 15-minute XRP price retested the lower level of the Symmetrical Triangle on Christmas and found support at it. This could be a potential sign that the channel is holding for now.

As mentioned earlier, any level of a Triangle not holding up can signal a continuation of trend in that direction. This means that a surge above the channel can be a bullish sign, while a fall under it a bearish one.

For Ascending and Descending Triangles, it’s usually considered that they have a direction bias attached to them, with Ascending Triangles being more likely to lead to bullish breakouts, while Descending Triangles to bearish breakdowns.

In Symmetrical Triangles, though, the two lines are roughly identical, just mirrored, so breakouts could be equally probable in both directions. As such, it’s hard to say where XRP might escape from this Symmetrical Triangle.

As for what might be the magnitude of the move a breakout could lead to, the analyst has noted it could potentially be of 10%. This is based on the fact that breakouts from consolidation channels are considered to end up being of the same length as the distance between the trendlines.

XRP Price

At the time of writing, XRP is trading around $1.84, down 3.3% over the last week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up