Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Multi-chain DEX aggregator 1inch has launched on Solana, bringing its Fusion protocol, onchain swaps and six developer APIs to a network known for speed throughout crypto's industry, the project said.

The integration enables MEV-protected swaps for over 1 million Solana-based tokens, utilizing 1inch's open-source smart contracts and intent-based trading architecture. Intents refer to a blockchain user's end goal within a decentralized application or ecosystem.

Here, in 1inch's Solana rollout, users can define trade parameters, while professional market makers, also known as resolvers, compete to execute orders using a Dutch auction model — the exchange rate starts high and decreases until a resolver accepts the swap. The system aims to reduce price slippage and help optimize swap prices with expansive liquidity.

Solana’s DeFi activity zoomed ahead of other chains during the first quarter of 2025. The blockchain topped DEX trading volume, transaction counts, and active addresses, according to Dune Analytics and DefiLlama data. In the coming months, 1inch plans to roll out cross-chain swaps between Solana and 10 other supported networks, aiming to bridge Solana’s liquidity landscape with broader DeFi markets.

"Our integration with Solana moves us closer to uniting disparate chains," said Sergej Kunz, co-founder of 1inch. The DeFi protocol, which launched in May 2019 and ranks second among DEX aggregators behind Jupiter, also debuted on Coinbase-incubated Base in August 2023 and on Ethereum scaling solution Optimism in 2021.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Decentralized exchange (DEX) aggregator 1inch has launched on Solana, marking a significant step toward its vision of a “unified multichain” decentralized finance (DeFi) ecosystem.

According to a press release shared with Cointelegraph, the integration enables users to trade over 1 million Solana-based tokens directly through the 1inch decentralized application (DApp), benefiting from maximal extractable value-protected swaps, optimized rates and open-source smart contract infrastructure.

The move brings 1inch’s Fusion protocol to Solana for the first time. Fusion enables users to define their ideal swap parameters, which are then executed by competing professional market makers, or “resolvers,” using Dutch auction mechanics.

Combined with Solana’s ultra-fast block times, the setup promises more efficient and seamless trading execution than other networks.

A 1inch representative told Cointelegraph that users could expect “minimal fees” when executing swaps on Solana. “Users may expect costs of less than one cent,” they said.

1inch to launch crosschain swaps for Solana

In addition to enabling Solana-based swaps, 1inch revealed plans to roll out crosschain functionality in the coming months, aiming to allow swaps between Solana and more than 10 other blockchains already supported by 1inch.

“At this stage, there is no fixed launch date,” the 1inch representative said. “However, development is progressing well, and we expect the feature to go live in the coming months.”

The representative said that crosschain swaps will initially support the 10 blockchains already integrated into 1inch’s crosschain swap ecosystem. The final list will be confirmed closer to launch.

1inch’s expansion into Solana comes as the blockchain has outperformed Ethereum and layer-2 networks in several key DeFi metrics.

Over the past three months, it posted a 33% higher DEX trading volume ($539 billion), handled 400% more transactions, and hosted 180% more active addresses than its rivals, according to data from Dune Analytics.

“Both Solana and Ethereum play critical roles in the evolving DeFi landscape,” the 1inch representative said.

They said that while Ethereum’s network effects and liquidity depth continue to dominate today, Solana’s performance improvements and growing adoption make it a serious contender.

The integration also includes access to six APIs through the 1inch Developer Portal, giving builders tools to create new DApps and services on top of the 1inch-Solana infrastructure.

On Sept. 12, 2024, 1inch first revealed the details of its solution to crosschain interoperability issues when it published a white paper about the intent-based, crosschain interoperability protocol it was developing.

On Sept. 18, 2024, the DEX aggregator revealed “Fusion+” to allow users to swap their digital assets crosschain while retaining self-custody of the assets.

Ethereum cofounder Vitalik Buterin has shared the twin goals of the Ethereum Foundation (EF): maximizing usage and ensuring the network's resilience and decentralization.

The first goal revolves around ensuring that users benefit from Ethereum's underlying properties.

Some examples of "meaningful usage" include using Ethereum-based tokenized assets and decentralized finance for savings, wealth building, as well as payments. This could solve issues related to unreliable fiat infrastructure.

Ethereum could also be used for decentralized social media networks, decentralized autonomous organizations (DAOs) and decentralized artificial intelligence.

The post, which was co-written with Ethereum Foundation President Aya Miyaguchi, has also outlined the goals of maximizing Ethereum's resilience. This would involve ensuring ecosystem autonomy, value alignment, team diversity and network robustness. Of course, decentralization remains a key component since it would eliminate single points of control or failure.

"The EF must change with the ecosystem, adapting to the community’s needs while maintaining our core principles," the organization said.

Ethereum continues to struggle with its image after its disastrous performance in 2025. However, as reported by U.Today, quantitative trading firm Presto believes that ETH will eventually be able to substantially outperform BTC this year.

Australian financial intelligence agency AUSTRAC has called on digital currency exchanges (DCEs) that are no longer operating to voluntarily withdraw their registrations, warning that failure to do so could result in cancellation.

AUSTRAC Cracks Down on Dormant Crypto Exchanges

DCEs, including those operating cryptocurrency ATMs, must be registered with AUSTRAC to legally offer services exchanging cash for cryptocurrency and vice versa. Currently, 427 DCEs are registered, but the agency has expressed concern that a significant number appear inactive. AUSTRAC has begun contacting businesses it believes are no longer trading.Brendan Thomas, the CEO of AUSTRAC

Brendan Thomas, AUSTRAC’s chief executive, said inactive registrations could be exploited by criminals seeking to use dormant businesses for illicit activities. “Businesses registered with AUSTRAC are required to keep their details up to date; this includes details about services that are no longer provided,” Thomas said.

He added that maintaining an accurate register is essential for protecting consumer confidence and ensuring that only legitimate businesses operate in the sector.

“Our intelligence shows cryptocurrency can be exploited by criminals for money laundering, scams and money mule activities, and we’re seeing far too many people falling victim to scams involving digital currency,” Thomas stated.

Use It or Lose It

AUSTRAC has the authority to cancel a registration if it determines a business is no longer providing DCE services. Cancellations are published on the agency’s website. Thomas noted that if a business intends to resume operations, it may reapply for registration at any time.

Following its review, AUSTRAC plans to launch a publicly searchable register, allowing consumers to verify whether a digital currency exchange is registered and under regulatory oversight. “

We want to make sure the public isn’t misled about the services a business is legally allowed to provide,” Thomas said. “Members of the public should feel confident that they can identify legitimate cryptocurrency providers that are registered and subject to regulatory oversight and that we are driving criminals out of this industry.”

Crypto Focus

In February, AUSTRAC announced that it had taken action against 13 remittance and digital currency exchange providers and was investigating more than 50 additional firms.

The regulator, which is tasked with detecting, preventing, and disrupting criminal activity within the financial system, intervened after these platforms failed to adequately report suspicious transactions.

The current enforcement efforts reflect decisions made late last year, when AUSTRAC prioritized cracking down on cryptocurrency ATMs for 2024. The agency had flagged cryptocurrencies as posing increased risks for money laundering, scams, and money mule operations.

The concept of a Russian ruble stablecoin received special attention at a major local crypto event, the Blockchain Forum in Moscow, with key industry executives reflecting on some of the core features a ruble-backed stablecoin might require.

Sergey Mendeleev, founder of the digital settlement exchange Exved and inactive founder of the sanctioned Garantex exchange, put forward seven key criteria for a potential “replica of Tether” in a keynote at the Blockchain Forum on April 23.

Mendeleev said a potential ruble stablecoin must have untraceable transactions and allow transfers without Know Your Customer (KYC) checks.

However, because one of the criteria also requires the stablecoin to comply with Russian regulations, he expressed skepticism that such a product could emerge soon.

The DAI model praised

Mendeleev proposed that a potential Russian “Tether replica” must be overcollateralized similarly to the Dai stablecoin model, a decentralized algorithmic stablecoin that maintains its one-to-one peg with the US dollar using smart contracts.

“So, any person who buys it will understand that the contract is based on the assets that super-securitize it, not somewhere on some unknown accounts, but free to be checked by simple crypto methods,” he said.

Another must-have feature should be excess liquidity on both centralized and decentralized exchanges, Mendeleev said, adding that users must be able to exchange the stablecoin at any time they need.

According to Mendeleev, a viable ruble-pegged stablecoin also needs to offer non-KYC transactions, so users are not required to pass their data to start using it.

“The Russian ruble stablecoin should have the opportunity where people use it without disclosing their data,” he stated.

In the meantime, users should be able to earn interest on holding the stablecoin, Mendelev continued, adding that offering this feature is available via smart contracts.

Russia opts for centralization

Mendeleev also suggested that a potential Russian version of Tether’s USDt (USDT) would need to feature untraceable and cheap transactions, while its smart contracts should not enable blocks or freezes.

The final criterion is that a potential ruble stablecoin would have to be regulated in accordance with the Russian legislation, which currently doesn’t look promising, according to Mendeleev.

“Once we put these seven points together [...] then it would be a real alternative, which would help us at least compete with the solutions that are currently on the market,” he stated at the conference, adding:

Possible solutions

While the regulatory side is not looking good, a potential Russian version of USDT is technically feasible, Mendeleev told Cointelegraph.

“Except for anonymous transactions, everything is easy to implement and has already been deployed by several projects, but it’s just not unified in one project yet,” he said.

The crypto advocate specifically referred to interesting opportunities by projects like the ruble-pegged A7A5 stablecoin, unblockable contracts at DAI, and others.

Regulation is necessary but not enough, Mendeleev said, adding that the most difficult part is the trust of users who must see the ruble stablecoin as a viable alternative to major alternatives like USDT.

Recent reports suggest that the deputy head of Russia’s Finance Ministry’s financial policy department urged the government to develop ruble stablecoins.

Elsewhere, the Bank of Russia has continued to progress its central bank digital currency project, the digital ruble. According to Finance Minister Anton Siluanov, the digital ruble is scheduled to be rolled out for commercial banks in the second half of 2025.

The overall demand and interest for the spot Bitcoin ETFs in the US has returned in full force as the products have recorded an impressive streak of seven consecutive days of net inflows.

On April 28, though, many showed signs of weakness, while BlackRock’s IBIT stole the show with a multi-month record.IBIT Sees Almost $1B in Inflows

Data from Farside Investors shows that IBIT attracted a mindblowing $970.9 million in net inflows yesterday. This became the highest figure achieved since just after the US elections (November 7) when investors allocated over $1.1 billion into the product, and the second-biggest ever.

In contrast, most other ETFs were in the red, including Fidelity’s FBTC, Bitwise’s BITB, Ark Invest’s ARKB, and Grayscale’s GBTC. ARKB’s losses were the most substantial, with $226.3 million leaving the fund. The day was positive, with $591.2 million in net inflows, but that’s all due to BlackRock’s IBIT.

Consequently, the world’s largest Bitcoin ETF’s AUM has skyrocketed to just over $42 billion. On average, the fund has attracted $130.2 million per day ever since its establishment in January last year.

The ETFs continue their streak that started on April 17. After weeks and weeks of bleeding out amid Trump’s escalating Trade War against almost every country, which was later reduced to just China, theBTC-tracking financial vehicleshaveregisteredseven consecutive days of net inflows now. Within this timeframe, they have attracted over $3.7 billion.

Bloomberg’s ETF expert, Eric Balchunas, commented on the substantial inflows toward IBIT, saying this was a “two steps forward mode after taking one step back.”

Damn. ETFs are in two steps fwd mode after taking one step back, which is the pattern we predicted from the get-go. https://t.co/bNRorN3qMf

— Eric Balchunas (@EricBalchunas) April 29, 2025

ETH ETFs to Reverse the Trend?

Thespot Ethereum ETFsalso felt the consequences of the global economic uncertainty prompted by the tariffs imposed by Trump. However, similar to their BTC ETF counterparts, they have shown some signs of a trend reversal, albeit not in the same impressive manner.

In the past three trading days (April 24, 25, and 28), they have registered net inflows worth $231.7 million. BlackRock’s ETHA leads the pack once again, with $40 million on April 24, $54.4 million on April 25, and $67.5 million on April 28.

In fact, the figure from yesterday was the highest since February 4, when the fund attracted a whopping $276.2 million.

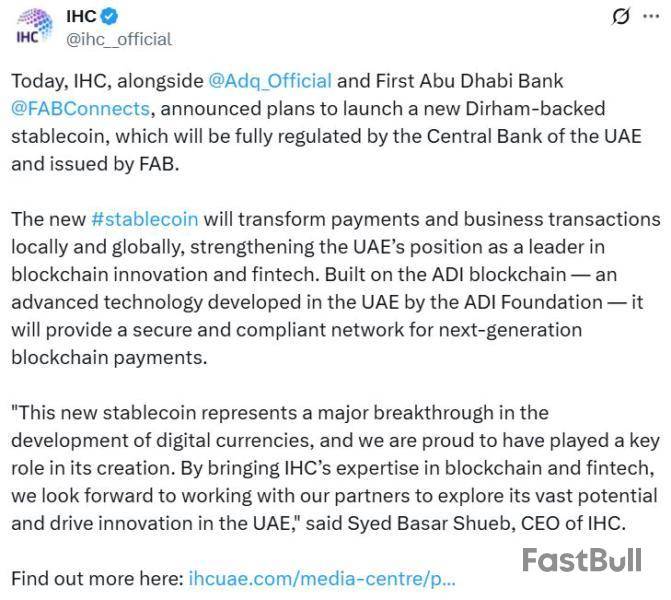

A trio of major Abu Dhabi institutions, including the Emirate’s sovereign wealth fund, have teamed up to launch a new dirham-pegged stablecoin.

Abu Dhabi’s sovereign wealth fund ADQ, the United Arab Emirates' largest bank, First Abu Dhabi Bank (FAB), and the massive conglomerate the International Holding Company, have partnered to launch the stablecoin, pending regulatory approval, three companies said on April 28.

The trio said the stablecoin would be regulated by the UAE’s central bank and backed by the country’s currency, the dirham. It will also support use cases such as machine-to-machine and artificial intelligence.

The goal is to place the UAE at the “forefront of global blockchain innovation,” while also strengthening the digital infrastructure, according to ADQ.

If it gets the nod from regulators, the new stablecoin will operate on the ADI blockchain, created by the ADI Foundation, a nonprofit organization dedicated to helping established financial systems and governments advance and adopt blockchain technology.

Established in 2018, ADQ is a sovereign wealth fund focused on critical infrastructure and global supply chains. Meanwhile, IHC is one of the UAE’s largest investment firms and conglomerates with a market value of over $243 billion that has ties to the ruling family of Abu Dhabi, the country’s capital.

FAB is the largest bank in the UAE, formed in 2017 through a merger between First Gulf Bank (FGB) and National Bank of Abu Dhabi (NBAD).

Countries line up to challenge US dollar stablecoins

Other countries have also announced plans to launch stablecoins backed by currencies other than the US dollar.

The market cap of US dollar-denominated stablecoins crossed $230 billion in April, an increase of 54% since last year, with Tether (USDT) and USDC (USDC) dominating 90% of the market.

A Russian finance ministry official has floated a plan for the country to develop its own stablecoin after a freeze on wallets linked to the sanctioned Russian exchange Garantex by US authorities and stablecoin issuer Tether.

However, an April 23 report from investment banking giant Citigroup predicts the stablecoin supply will remain US dollar-denominated, with non-US countries promoting national or central bank digital currency.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up