Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Decentralized exchange aggregator 1inch has launched native cross-chain swaps between Solana and more than a dozen Ethereum Virtual Machine (EVM) networks.

The feature, available across the 1inch dApp, Wallet, and Fusion+ API, allows users to move assets between Solana and EVM chains with built-in protection against maximal extractable value (MEV).

The new feature does not rely on cross-chain bridges, the project said. It explained that through the rollout, Solana assets can be directly swapped against EVM tokens, eliminating frictions in moving funds between ecosystems.

Usually, users require bridges to move cryptocurrencies between blockchains. These platforms create a wrapped version of the asset on the recipient network. This wrapped token is pegged to the value of the original asset and allows the sender to deploy the crypto across destination ecosystems.

However, the underlying mechanics involved are often targeted and exploited by cybercriminals. Hackers drained over $111 million from the Heco Bridge in November 2023, and the Nomad Bridge service lost roughly $190 million in an August 2022 exploit.

1inch co-founder Sergej Kunz said in a statement that removing bridges and messaging protocols should deliver a “fundamentally safer and smoother cross-chain experience.”

The launch follows 1inch’s initial Solana integration earlier this year and is designed to address liquidity fragmentation between the ecosystems. By linking Solana to Ethereum, Polygon, Arbitrum, Optimism, and other EVM chains, 1inch aims to broaden access to Solana as a DeFi hub for users and liquidity providers.

For developers, the Fusion+ API will allow trustless Solana-EVM swaps to be integrated into new projects. Retail users can access the new feature via both mobile-focused and browser-based channels through the wallet and dApp. 1inch, which processes around $500 million in daily trading volume across its aggregation platform, says its broader roadmap includes expanding interoperability to other non-EVM chains.

According to The Block’s price page, the platform’s native token 1INCH changed hands for $0.25 on Tuesday, down 23% in the last 30 days.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bullish, a digital asset platform, has completed its initial public offering (IPO) in a way that could shape the future of capital markets. Instead of relying only on banks and wires, a large portion of the IPO proceeds was settled using stablecoins, including Ripple’s RLUSD, minted on the XRP Ledger.

This marks the first-ever public listing to integrate stablecoins directly into the settlement process.

A First-of-Its-Kind IPO Settlement

Bullish raised $1.15 billion in its IPO, and much of this sum was delivered in stablecoins. Traditionally, IPO settlements involve only cash and banking intermediaries.

While the majority of funds were settled in USDC on the Solana network, Ripple’s RLUSD represented a portion of the settlement, making history for the XRP Ledger. Other stablecoins like PayPal’s PYUSD, Paxos’s Global Dollar, and Societe Generale’s Euro-backed tokens were also part of the mix.

Ripple@RippleAug 19, 2025Congrats to @Bullish on a successful IPO! 👏

A portion of the IPO proceeds were settled in $RLUSD, minted on the XRP Ledger. This is the first public listing to bring the settlement process onchain and sets a precedent for how stablecoins can shape future listings. https://t.co/AD4AkpPnLD

By bringing settlement onchain, Bullish showed how stablecoins can add speed, transparency, and efficiency to financial markets that have long depended on slower, costlier methods.

Why It Matters for Crypto and Finance

Ripple highlighted that using RLUSD in this IPO wasn’t just symbolic, it set a precedent for how future listings might work. For investors, it’s proof that blockchain-based settlement is moving from theory to real-world adoption.

Bullish’s Chief Financial Officer, David Bonanno, said the company already uses stablecoins internally for fast, secure fund transfers. This IPO was simply a larger stage to demonstrate how blockchain can power global finance at scale.

Looking Ahead

Bullish’s IPO sets a precedent for others to follow. With regulatory clarity improving and companies willing to embrace blockchain innovation, the role of stablecoins in financial markets is likely to grow.

Ripple’s RLUSD debut in this historic event adds another win for the XRP Ledger and demonstrates how crypto is slowly becoming part of mainstream finance.

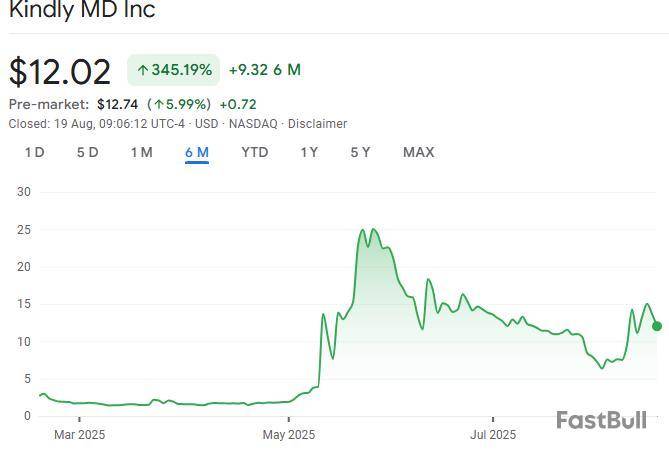

KindlyMD, a healthcare firm turned bitcoin treasury vehicle after its merger with David Bailey’s Nakamoto Holdings, purchased 5,744 BTC for about $679 million to kick off its ambitious bitcoin accumulation plan.

The firm completed its merger with Nakamoto in mid-August, combining capital from an upsized $540 million PIPE financing and a concurrent $200 million convertible note offering. After buying its first tranche of BTC at an average price of $118,204, the newly merged entity trading under the ticker NAKA says it now holds a total of 5,764.91 bitcoins.

The acquisition enters KindlyMD into the growing landscape of institutional bitcoin holders. While Michael Saylor’s Strategy still leads with more than 629,376 BTC value at over $72 billion, the addition positions KindlyMD in the top 20 publicly tracked Bitcoin treasury holders, according to The Block’s data dashboard. Indeed, the firm holds more BTC than incumbents like Semler Scientific, GameStop, and Cango Inc.

Nakamoto aims to eventually accumulate up to 5% of bitcoin’s 21 million hard-capped supply, a feat that would require purchasing over 1 million BTC. “Our long-term mission of accumulating one million Bitcoin reflects our belief that Bitcoin will anchor the next era of global finance,” said NAKA CEO and Chairman David Bailey.

The aggressive accumulation approach comes amid rising institutional demand for Bitcoin exposure and the expansion of digital asset treasuries as a new asset class.

Pioneered by Strategy, these public companies raise capital through public equity, debt, and preferred instruments that traditional investors can easily understand and hold. They then park the cash in BTC or other crypto assets as part of a corporate crypto balance sheet. So far, public entities have amassed almost 4% of BTC’s supply, or about 771,850 BTC worth roughly $89 billion, The Block’s data shows.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Thumzup (ticker TZUP), the social media firm with a recently announced crypto treasury play backed by Donald Trump Jr., will acquire Dogehash Technologies in an all-stock deal. The purchase appears to be part of Thumzup’s new direction into crypto mining.

Dogehash is an industrial‑scale blockchain miner focused exclusively on the Scrypt algorithm used by Dogecoin and Litecoin. Last week, Thumzup said it would use capital from a $50 million all common stock offering to put assets like BTC, ETH, DOGE, LTC, and XRP on its balance sheet while also funding a new mining division.

“The combined company aims to become the world's leading Dogecoin mining platform and will leverage Dogecoin Layer-2 infrastructure via staking in DeFi products within the DogeOS ecosystem to enhance miner economics and amplify yield beyond base block rewards,” Thumpzup wrote in a release.

DogeHash currently has 2,500 Scrypt ASIC miners in operation in North America using mostly renewable electricity sources, according to the announcement. It has plans to expand this fleet.

Under the terms of the agreement, Dogehash shareholders will exchange 100% of their holdings for 30.7 million shares of Thumzup stock. The company will be renamed "Dogehash Technologies Holdings, Inc." and trade on the Nasdaq under the new symbol "XDOG." The deal is expected to close by the end of the year.

In the registration statement for its $50 million offering in July, Thumzup reported that Donald Trump Jr. was a large shareholder in the company. The Trump family has an ever-growing web of relationships across the crypto industry, including in the mining sector through the American Bitcoin treasury and mining play.

TZUP is down over 30% at press time to $5.89, though remains up 132.77% over the past six months.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

A Spanish decentralized finance (DeFi) investor was hit with 9 million euros ($10.5 million) in back taxes for taking out a crypto-backed loan, according to a local media report.

In a Thursday report, Spanish news outlet Periodista Digital said it obtained documents showing the investor had already declared all cryptocurrency operations and paid $5.84 million in taxes.

Three years later, authorities issued an additional bill tied not to undeclared profits, but to the act of depositing assets into a DeFi protocol in exchange for a loan. The assets were not sold, and no profit was realized, the report said.

A tax adviser quoted in the report said that the local tax agency “has taxed something that, from any economic or legal perspective, is not income.” The adviser added that the movement of assets in the DeFi protocol was treated as realized gains and was “an interpretation with no legal basis in Spanish or European legislation.”

The report said the Spanish Agencia Estatal de Administración Tributaria (AEAT) classified a stablecoin loan as a capital gain and token transfers to protocols such as Beefy or Tarot as taxable events.

This classification, critics argued, runs counter to Article 33 of Spain’s Personal Income Tax Law, which defines capital gains as requiring an actual economic benefit and a variation in net worth.

According to the report, the situation reflects an issue with the local tax enforcement system.

Spain’s crypto tax enforcement

Spain’s tax agency has been warning crypto holders about taxes for years, sending 328,000 warning notices for taxes on crypto for the 2022 fiscal year in 2023, followed by 620,000 similar notices a year later. Local regulation also required local crypto users to declare their foreign crypto holdings by the end of March 2024.

According to June reports, AEAT can access and seize crypto holdings if tax obligations are not met. The report suggested Spanish citizens do not have a fair recourse path when the tax agency makes a mistake.

Spain’s first line of appeal in tax disputes is the Tribunal Económico-Administrativo Central (TEAC), an administrative body under the Ministry of Finance. In 2020, the European Court of Justice (ECJ) held that the TEAC is not an independent “court or tribunal” for European Union law.

The report added that TEAC is an administrative tribunal under the authority and control of the local Ministry of Finance. The government appoints the tribunal’s officials, who are appointed by and dependent on the same authority whose decisions they review, the ECJ said.

Nasdaq-listed healthcare service provider and Bitcoin treasury firm KindlyMD has acquired $679 million worth of Bitcoin for its corporate reserve.

KindlyMD acquired 5,744 Bitcoin for approximately $679 million at a weighted average price of $118,204 per Bitcoin, the company announced Tuesday.

The purchase was made using private investment in public equity (PIPE) proceeds and reflects KindlyMD’s “disciplined Bitcoin treasury strategy,” the company said.

The $679 million buy marks the company’s first Bitcoin investments since completing its merger with David Bailey’s Bitcoin firm, Nakamoto Holdings, last Friday.

KindlyMD’s purchase is more than 13 times larger than the latest acquisition by Michael Saylor’s Strategy, which said Monday it had bought $51.4 million worth of Bitcoin at an average price of $119,666. Strategy remains the largest public Bitcoin holder.

Still, the 5,769 Bitcoin represents a small fraction of KindlyMD’s plan to acquire 1 million BTC.

Cointelegraph@CointelegraphAug 18, 2025Is Bitcoin Headed for a 2025 Peak? Or is the 4-Year Cycle Dead? https://t.co/DckFjvkJIx

Bitcoin is the “ultimate reserve asset” for corporations and institutions: David Bailey

The new company’s long-term mission to acquire 1 million Bitcoin reflects a “belief that Bitcoin will anchor the next era of global finance,” said David Bailey, CEO and chairman of KindlyMD.

Bailey also served as a key crypto adviser during US President Donald Trump’s campaign and was largely credited with the president’s favorable Bitcoin shift.

Earlier this month, he said he wants to raise $200 million for a political action committee (PAC) to advance Bitcoin’s interests in the US.

KindlyMD’s stock, however, fell more than 12% since the merger was first announced on May 12, according to Google Finance data.

The company’s move comes as other firms accelerate Bitcoin treasury strategies. Japanese investment firm Metaplanet recently said it plans to raise $3.7 billion to fuel its own corporate strategy of buying 210,000 BTC by 2027.

Developments such as corporate Bitcoin adoption and potential inclusion of digital assets in US 401(k) retirement plans could help push Bitcoin to $200,000 by the end of 2025, according to André Dragosch, head of European research at crypto asset manager Bitwise.

“This “bullish” development may be even “bigger than the US Bitcoin ETF approval itself,” signaling another $122 billion worth of new capital, assuming a modest 1% portfolio allocation, Dragosch told Cointelegraph during the Chain Reaction X spaces show on Monday.

Peter Brandt has been around long enough to see hundreds of Bitcoin models come and go. This week, however, he singled out one that caught his eye.

"Analyst Colin Talks Crypto" shared the chart, which uses Tether’s market share to predict Bitcoin tops on an inverted log scale. Brandt did not just nod politely; he called it "outstanding" and "brilliant," adding that the only thing that matters now is whether it actually predicts the next peak.

Colin’s setup goes back about a decade. Each time Tether dominance pushed against the upper curve of his chart, Bitcoin was close to reaching a major peak. This has been true at the double peak of 2021, the failed run at $70,000 in 2024 and the push over $100,000 last December.

He now expects another touch later this year, which, according to his calculations, could coincide with Bitcoin trading in the $140,000–$150,000 range around October.

But there's a twist

The catch is that this model does not predict prices — it signals timing. It tells when the market looks overheated, not how high it will go. Regardless of other metrics, the analyst says he will take profits on the next touch, although he still cross-checks with sentiment, liquidity and his broader CBBI index.

For now, he argues that the mood is still too muted for this to be the cycle's final top, which is why he thinks there is more room left to run.

It is unusual for Brandt to publicly praise a local indicator, and it raises the question of whether Tether dominance can really serve as a market compass. If Bitcoin hits Colin’s October target, this chart could transition from an experiment to a front-page reference.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up