Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin (BTC) has once again reclaimed the $85,000 level, the eighth time this week it has touched this comfort zone according to CoinGecko.

But don’t be fooled by the sideways slumber. According to market watcher Titan of Crypto, Bitcoin’s bullish structure is “still intact,” with a Fibonacci-based target of $135,000 still in play for 2025.The $135K Prophecy

The analyst insists that even if BTC pulls back to key support, the megatrend remains bullish. “The path to higher highs is still open,” he posted. His bold prediction? Bitcoin is first eyeing $107,000, followed by a launch to $135,000, with or without short-term correction.

In another post, he highlighted that the cryptocurrency was “progressing within a megaphone pattern,” a broadening formation with at least two higher highs and two lower lows, indicating increasing volatility and potential trend reversals.

In his estimation, if history repeats, BTC could go up to $186,500, reflecting historical trends where the cryptocurrency’s megaphone formations preceded significant price movements, such as the 2017 peak near $20,000 followed by a correction.

However, there’s a catch. According to the trader, Bitcoin remains stuck below the Ichimoku Kumo Cloud, a stubborn resistance zone that has capped upward momentum. Adding to the tension, the Easter weekend is expected to sap liquidity from the markets, raising the risk of erratic price swings in crypto.

Over the past 24 hours, BTC has oscillated between $84,366 and $85,398, reflecting a market caught between accumulation and exhaustion. Zooming out, the seven-day performance shows a slight 2.1% uptick, which was still good enough to outperform the broader crypto market, down 0.8% in the same period.Whales Swarm

Meanwhile, as retail traders watch thesidewaysaction in frustration, whales and sharks are in a feeding frenzy, with Santiment reporting that wallets holding between 10 and 10,000 BTC now control a record high 67.77% of the asset’s supply.

Since March 22, these deep-pocketed investors have scooped up more than 53,600 BTC worth more than $4.5 billion, with the latest move being a $250 million buy-in, just hours before Bitcoin breached $85,000, sparking speculation of an incoming supply squeeze.

Adding fuel to the fire, macro investor Kyle Chasse pointed to a $106.7 trillion liquidity surge from central banks, suggesting it could push Bitcoin into overdrive. “BITCOIN IS NEXT,” he declared, framing the number one cryptocurrency as a hedge against fiat debasement.

The asset now stands at a pivotal junction. The ingredients for a rally are all there: whale accumulation, bullish technicals, and a potential liquidity boom. Still, the $85,000 resistance refuses to break.

The Bank for International Settlements’ (BIS) push to isolate crypto markets and its controversial recommendations on DeFi and stablecoins is “dangerous” for the entire financial system, warns the CEO of a blockchain investment firm.

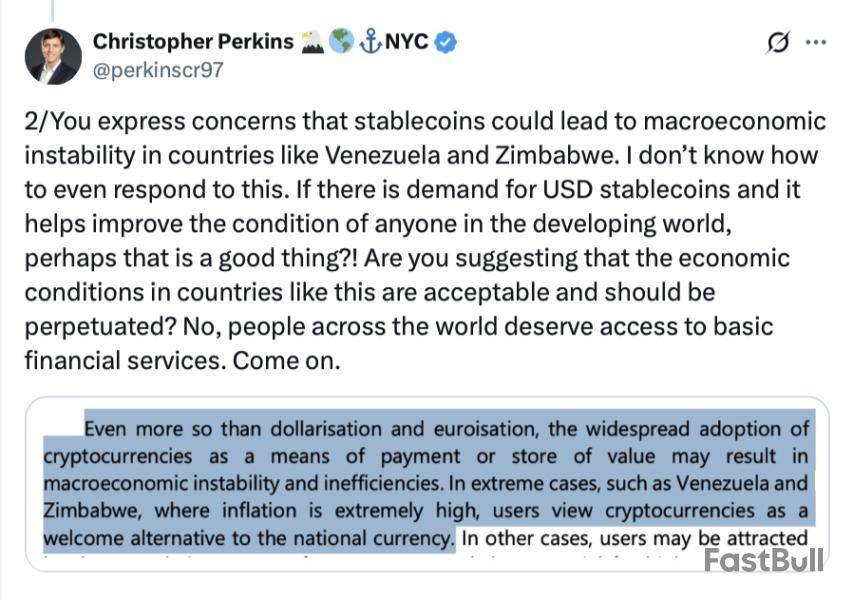

“Many of their recommendations and conclusions – perhaps due to a mix of fear, arrogance or ignorance--are completely uninformed and frankly, dangerous,” CoinFund president Christopher Perkins said in an April 19 X post, referring to the BIS April 15 report titled “Cryptocurrencies and decentralized finance: functions and financial stability implication.”

BIS recommendations exposes TradFi to risks of “unimaginable scale”

“Crypto is not communism,” Perkins said, pushing back against the BIS’s call for a “containment” approach to isolate crypto from traditional finance and the broader economy.

“It’s the new internet that provides anyone with a connection access to financial services,” Perkins said. “You cannot control it anymore than you control the internet,” he added.

Perkins warned that a containment approach to crypto would expose the traditional financial system to massive liquidity risks “of unimaginable scale,” especially when the crypto market operates in real-time, 24/7, while traditional financial markets shut down after trading hours.

The report warned that the number of investors and amount of capital in crypto and DeFi have “reached a critical mass,” with investor protection becoming a “significant concern for regulators.”

Perkins pushed back against the BIS’ claim that DeFi presents significant challenges, arguing instead that it represents a “significant improvement” over the “opacity” and imbalances of the traditional financial system.

Responding to the BIS’s concern about the anonymity of DeFi developers, Perkins questioned its relevance:

Perkins also critiqued the BIS’s concern around stablecoins that it could lead to “macroeconomic instability in countries like Venezuela and Zimbabwe.”

“If there is demand for USD stablecoins and it helps improve the condition of anyone in the developing world, perhaps that is a good thing,” Perkins said.

Perkins wasn’t alone in criticizing the controversial report. Lightspark co-founder Christian Catalini also weighed in, posting a series of critiques on X that same day. Catalini summed up the report with the analogy:

“Think: writing parking regulations for a fleet of self‑driving drones — earnest work, two technological leaps behind.”

Over the past trading week, Bitcoin (BTC) failed to make any significant price breakout, experiencing rejections at the $86,000 price region. While the market suffered no major price pullback, the high level of sideways price movement indicates a strong investor uncertainty.

Interestingly, popular market analyst with X username Daan Crypto has provided an insightful technical analysis on the BTC market, highlighting the present barriers that are restricting an upward price movement.

Bitcoin Multiple Barriers: 200-Day EMA, 200-Day MA, And Diagonal Trendline In Focus

Since hitting a new all-time high in late January, Bitcoin has slipped into heavy correction, losing over 22% of its market price. The majority of the price loss has been linked to international trade tariff crises, which have forced investors to seek relief in less risky assets.

However, a pause in new tariffs and an onset in global negotiations soon accompanied a price rebound seen in early April. Albeit, Bitcoin is now struggling to break out of the $84,000-$86,000, forming a tight consolidation range.

In performing a technical analysis on the current BTC market, Daan Crypto has identified the three resistance factors that have been active in the specified price zone.

The first price opposition is a diagonal downtrend line formed by Bitcoin’s consistent lower lows and lower highs amidst the price correction in the past three months. To establish any intent of a trend reversal, Bitcoin bulls must force a convincing price breakout above this long-standing diagonal resistance.

Other critical indicators are the 200-day Exponential Moving Average (EMA) and 200-day Simple Moving Average (MA), both of which provide an average of the past 200 days’ prices, with the EMA giving more weight to recent prices.

The 200-day EMA is important in spotting medium-to-long-term trend changes as it reacts faster to any price change than the 200-day MA, which is a classic long-term indicator. However, Bitcoin must move above both indicators to break out of its consolidation and perhaps experience a full price recovery.

Bitcoin Ultimate Resistance At $90,000-$91,000

Despite Bitcoin’s struggles in the $84,000-$86,000 price zone, Daan Crypto has warned that the asset’s ultimate test of a price reversal is at the $90,000-$91,000 price range, which served as a key support in the earlier phase of the bull cycle.

A successful reclaim of this range would place Bitcoin back into the bullish trading zone, signaling a potential resumption of the broader bull market. At press time, BTC continues to trade at $84,868 following a 0.13% gain in the past day. Meanwhile, the daily trading volume is down by 42.34% and valued at $12.52 billion.

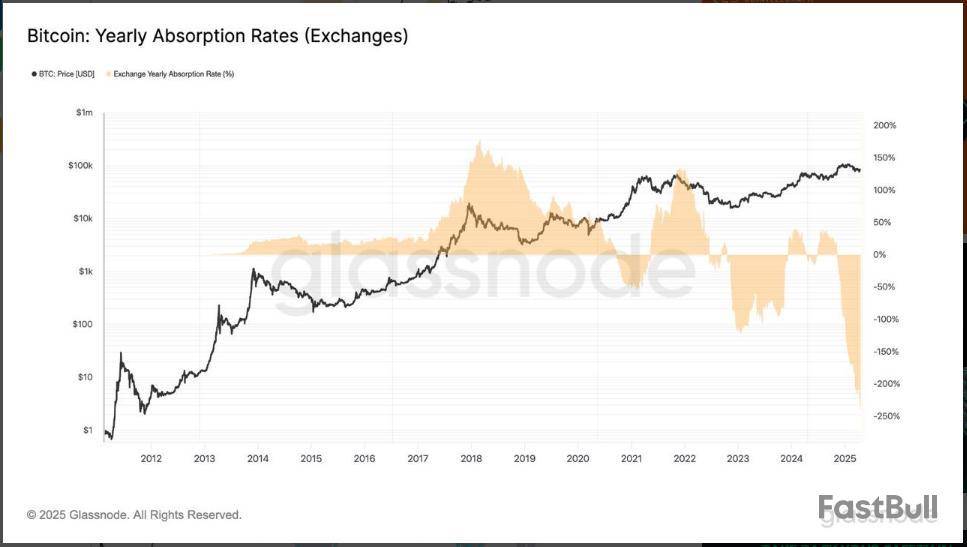

Large investors are buying Bitcoin at record levels, which may be the precursor to a price explosion. Recent statistics indicate that these large holders, or “whales,” are acquiring around three times the amount of daily Bitcoin produced by miners as the cryptocurrency sits at key price levels.

Whales Purchase At Record Levels While Exchanges Witness Outflows

According to Glassnode information, investors possessing between 100 and 1,000 Bitcoins are buying up the cryptocurrency aggressively. These giant holders are at present taking on over 300% of the annual supply emission of Bitcoin.

Meanwhile, large crypto exchanges are seeing steady outflows of Bitcoin. This indicates that increasing numbers of whales and large holders are taking their assets to long-term storage instead of leaving them on hand for trading. Market observers view this exodus from exchanges as a sign of improving confidence in the long-term worth of Bitcoin.

Most of these large investors have persisted in buying when prices drop, viewing downturns as opportunities to increase their positions rather than sell. Onchain analysts have reported that this activity is reminiscent of trends during Bitcoin’s 2020 bull cycle.

Technical Indicators Reflect Key Resistance Points

Bitcoin is now testing its 50-day and 200-day exponential moving averages as points of resistance. Based on previous examination by analysts, these levels are approximately $85,500.

A pullback could occur if Bitcoin does not manage to breach the technical barriers. The next important support lies at about $80,000 on the upper trendline of the current wedge formation.

A narrow price range has existed for some time, between about $75,000 and $85,000. This period of lackluster volatility, combined with substantial buying pressure, may well suggest that accumulation is occurring behind the scenes in anticipation of a large price move.Three-Month Correction Follows Typical Bull Market Trend

The price of Bitcoin is now back to correction after almost three months since reaching highs near $100,000 earlier in the year. The price has seen a drop of nearly 30% since then.

According to analysts, this drop follows the typical trend of previous bull markets. A decrease of 25-35% occurring midway through the cycle would usually denote a situation from which the prices would then continue up once again.

Featured image from Pexels, chart from TradingView

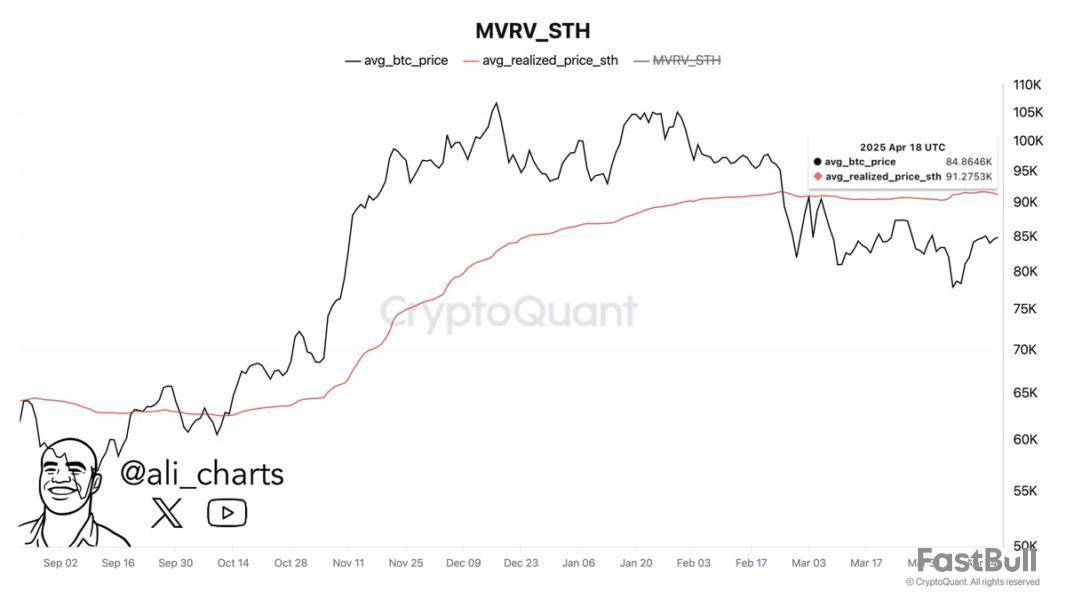

Bitcoin prices gained by only 0.95% in the past week amidst an intense market consolidation. The premier cryptocurrency is struggling to break out of the $85,000-$86,000 price range following an impressive price rally in the second week of April. However, popular crypto analyst Ali Martinez has identified the major price resistance for the current Bitcoin uptrend.

Bitcoin STH Realized Price At $91,000 Presents Major Make-Or-Break Moment

In a recent post on X, Martinez states that Bitcoin faces a key resistance level at the $91,275 following a price rebound in early April. Notably, the asset surged by 17.33% after reaching a price low of $75,000 on April 9. However, BTC has since entered a consolidation following this feat, producing no significant price movement in either direction.

Over the past week, the crypto market leader moved only between $84,000 to $86,000, forming a tight range-bound market. However, amidst these struggles, Martinez states that Bitcoin short-term holders realized the price lies at $91,275, indicating the pivotal resistance to the recent market resurgence lies ahead.

For context, the short-term holders’ realized price is the average price at which new buyers (i.e, new investors of Bitcoin over the past 155 days) acquired their BTC. It is an important technical indicator used to evaluate short-term market sentiment and behavior.

When a market price is above the STH realized price, it indicates a bullish momentum as recent buyers are in profit and are likely to hold. In this case, the STH realized price serves as a strong support level, with new market entrants often defending their entry zone.

However, when Bitcoin’s price is below the STH realized price as currently seen in the market, the realized price forms a significant psychological price resistance. This is because many short-term holders may choose to exit once the market breaks even, increasing the selling pressure around that zone.

Therefore, Bitcoin reclaiming $91,275 is essential to validate a sufficient bullish potential to fuel a complete price reversal.

Bitcoin Price Overview

At the time of writing, Bitcoin is trading at $84,872, reflecting a price growth of 0.14% in the last day. Meanwhile, the premier cryptocurrency is down by 1.34% on its monthly chart as bearish pressure continues to wane.

While a major market resistance lies at $91,000, Bitcoin faces an immediate opposition at the $86,000 price zone, breaking past which could spur a sharp price rise to $91,000. However, a price fall below the support at $84,500 could result in a further price slide to $84,000 with the potential to trade as low as $83,300.

Mantra CEO plans to burn teams tokens in bid to win community trust

Mantra CEO John Mullin said he is planning to burn all of his teams tokens in order to win back the trust of the networks community following the sudden collapse of the Mantra (OM) token on April 13.

Im planning to burn all of my team tokens and when we turn it around the community and investors can decide if I have earned it back, Mullin posted to X on April 16.

Mantra set aside 300 million OM, 16.88% of the tokens nearly 1.78 billion total supply, for its team and core contributors. They are currently locked and were scheduled to be released in stages between April 2027 and October 2029, according to an April 8 blog post.

Oregon targets Coinbase after SEC drops its federal lawsuit

Oregon Attorney General Dan Rayfield is planning a lawsuit against crypto exchange Coinbase, alleging the company is selling unregistered securities to residents of the US state, after the United States Securities and Exchange Commission’s (SEC) dropped its federal case against the exchange.

According to Coinbase’s chief legal officer, Paul Grewal, the lawsuit is an exact copycat case of SECs 2023 lawsuit against the exchange, which the federal agency agreed to drop in February. Grewal added:

In case you think Im jumping to conclusions, the attorney general’s office made it clear to us that they are literally picking up where the Gary Gensler SEC left off seriously. This is exactly the opposite of what Americans should be focused on right now.

TRUMP tokenholders face 90% decline from peak as unlock begins

TRUMP tokenholders face steep losses as the first vesting unlock goes live on April 18, releasing 40 million tokens, worth roughly $309 million, into circulation at a 90% discount from its peak.

The unlocked tokens account for 20% of the current circulating supply and could introduce fresh volatility as a previously illiquid portion of the supply hits the market. According to CoinGecko, the TRUMP token price has fluctuated between $7.46 and $7.83 in the past 24 hours.

April 18 marks the first unlock event for the TRUMP token, with steady, smaller unlocks following from that date.

Crypto rug pulls have slowed, but are now more devastating: DappRadar

There has been a 66% year-on-year decrease in the number of crypto rug pulls this year compared to 2024, but recent data shows the size of each rug pull has been increasing.

Rug pulls have dropped in frequency year-over-year, with early 2024 recording 21 separate incidents, compared to only seven so far in 2025, according to an April 16 report from blockchain analytics platform DappRadar.

However, since the beginning of 2025, the Web3 ecosystem has lost nearly $6 billion to rug pulls, according to DappRadars report. However, the report attributes 92% of that to Mantras OM token collapse, which the founders have strongly denied was a rug pull.

In comparison, during the same period in early 2024, three months into the year, total losses from rug pulls hit $90 million.

Sam Bankman-Fried’s latest California prison once housed Al Capone

Former FTX CEO Sam SBF Bankman-Fried has moved from a transit facility to a California prison that once housed infamous gangster Al Capone.

According to the Federal Bureau of Prisons website, officials moved Bankman-Fried from the Federal Transfer Center in Oklahoma City briefly to the Federal Correctional Institution in Victorville before transferring him to a facility in Terminal Island in Los Angeles, California.

The federal institution was once home to criminals like former Theranos chief operating officer Ramesh Balwani and Capone, who was convicted of tax evasion in 1931.

OpenAI is building ‘X-like social network’ to rival Elon Musk Report

Large language model developer OpenAI is reportedly working on a new social media network, putting the company on a collision course with Elon Musks X and Mark Zuckerbergs Meta Platforms.

Citing anonymous sources, The Verge reported on April 15 that OpenAI is developing an X-like social network that combines ChatGPTs image generation tools and a social feed, presumably to allow users to share their AI-generated pictures with a broader audience.

Its unclear whether OpenAI will spin out a new social media platform or roll the features into ChatGPT, the sources said.

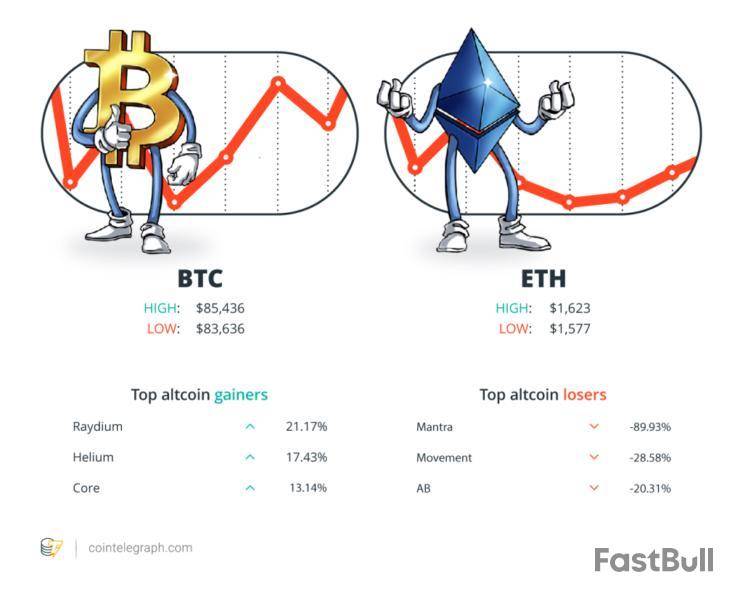

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $84,513, Ether (ETH) at $1,592 and XRP at $2.07. The total market cap is at $2.63 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Raydium (RAY) at 21.17%, Helium (HNT) at 17.43% and Core (CORE) at 13.14%.

The top three altcoin losers of the week are Mantra (OM) at 89.93%, Movement (MOVE) at 28.58% and AB (AB) at 20.31%. For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

Powells termination cannot come fast enough.

Donald Trump, US President

The ETFs and Saylor have been buying up all dumps from the tourists, FTX refugees, GBTC discounters, legal unlocks, govt confiscations and Lord knows who else.

Eric Balchunas, senior ETF analyst at Bloomberg

I was using Bitcoin to make a bunch of those investments, and you would think, if you invested in Coinbase you would have done really well. Had I just held the Bitcoin, I actually would have done better than making those investments.

Barry Silbert, CEO of Digital Currency Group

Im planning to burn all of my team tokens and when we turn it around the community and investors can decide if I have earned it back.

JP Mullin, co-founder and CEO of Mantra

When the sentiment finally resets, its likely to happen rather quickly and we remain constructive for the second half of 2025.

Coinbase researchers

We have actually received quite a number of approaches by a few governments and sovereign wealth funds on the establishment of their own crypto reserves.”

Richard Teng, CEO of Binance

Prediction of The Week

Altcoins may rally in Q2 2025 thanks to improved regulations: Sygnum

Altcoins may see a resurgence in the second quarter of 2025 as regulations for digital assets continue to improve, according to Swiss bank Sygnum.

In its Q2 2025 investment outlook, Sygnum said the space has seen drastically improved regulations for crypto use cases, creating the foundations for a strong alt-sector rally for the second quarter. However, it added that none of the positive developments have been priced in.

Read also Columns Wall Street disaster expert Bill Noble: Crypto spring is inevitable Features Satoshi may have needed an alias, but can we say the same?In April, Bitcoin dominance reached a four-year high, signaling that crypto investors are rotating their funds into an asset perceived to be relatively safer.

FUD of The Week

Hacker mints $5M in ZK tokens after compromising ZKsync admin account

A hacker compromised a ZKsync admin account on April 15, minting $5 million worth of unclaimed airdrop tokens, according to a statement from the official ZKsync X account. The attack was described as isolated, with no user funds affected.

Following an investigation, ZKsync detailed the incident on April 15, disclosing that the compromised account had administrative control over three airdrop distribution contracts. The attacker exploited a function called sweepUnclaimed() to mint 111 million unclaimed ZK tokens, increasing the total token supply by 0.45%. As of the latest update, the attacker still held control of most of the stolen funds.

Only 11% of El Salvadors registered Bitcoin firms operational

Only 20 of the 181 Bitcoin service providers registered with El Salvadors central bank are operational, with the rest failing to meet the countrys requirements under its Bitcoin Law.

Local media outlet El Mundo cited data from the Central Reserve Bank of El Salvador, showing that 11% of the service providers are operational. According to the central banks database, the rest of the providers are classified as non-operational.

The data showed that at least 22 non-operational providers have failed to meet most of the countrys Bitcoin Law requirements, which mandate that providers implement stringent supervision of their financial systems.

Read also Features Is Ethereum left and Bitcoin right? Features Caitlyn Jenner memecoin masterminds celebrity price list leakedENS founder warns of Google spoof that tricks users with a fake subpoena

The founder and lead developer of Ethereum Name Service has warned his X followers of an extremely sophisticated phishing attack that can impersonate Google and trick users into giving out login credentials.

The phishing attack exploits Googles infrastructure to send a fake alert to users informing them that their Google data is being shared with law enforcement due to a subpoena, ENS Nick Johnson said in an April 16 post to X.

It passes the DKIM signature check, and GMail displays it without any warnings – it even puts it in the same conversation as other, legitimate security alerts, he said.

Top Magazine Stories of The Week

Your AI digital twin can take meetings and comfort your loved ones

It sounds like science fiction, but a range of new projects will replicate your personality and intellect today as an autonomous AI agent.

Uni students crypto grooming scandal, 67K scammed by fake women: Asia Express

Cryptos biggest names fend off rumors of grooming degen gamblers on Chinese schools; nine scammers sentenced for tricking 67,000 Indian men into believing they were rich Indian women, and more.

Crypto more taboo than OnlyFans, says Violetta Zironi, who sold song for 1 BTC

Meet an artist selling her songs for Bitcoin and Ethereum, even as most music fans shun music ownership in favor of streaming.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

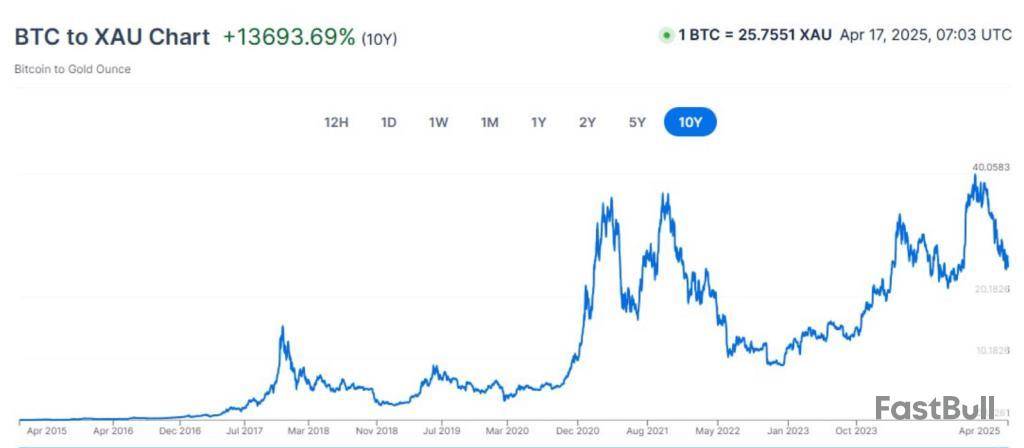

Bitcoin has risen dramatically over the last 10 years against gold, with a rise of an incredible 13,693%, according to the financial statistics shared by crypto entrepreneur Ted.

The figures demonstrate the alarming divergence between the two assets from April 2015 and April 2025. In particular, this striking ascent of Bitcoin has caught the eye of investors spread around the globe.

Bitcoin Vs. Gold: From Equal Footing To Massive Gap

Ten years ago, gold and Bitcoin were at similar prices. In April 2015, Bitcoin moved between $200 and $250, whereas gold was ranging around $1,200 to $1,300 per ounce.

The fortunes of these investments have since become totally different. Bitcoin has soared to about $84,000 per coin, up some 33,500% in the ten-year period. The cryptocurrency briefly peaked at nearly $109,000 during the timeframe.

Ted@TedPillowsApr 17, 2025If someone tries to tell you gold is better than Bitcoin…

Just show them this:

In 2015, 1 BTC = 1 ounce of gold.

Today? That same Bitcoin is up 13,693% in 10 years.

Let the numbers speak. pic.twitter.com/8JipH5IsNr

Gold, on the other hand, has preserved its image of reliability over volatility, rather than offering spectacular gains. The precious metal increased by only 156% over the same period. From the market onlookers, gold’s worth proposition is still anchored on its consistent, inflation-proof behavior spanning very long timescales.

Historical Context Demonstrates Divergent Patterns Of Growth

Going back even farther shows an even greater disparity in the growth rates. According to a market analyst on social media platform X, the price of gold was only $20.67 per ounce in 1933. As for 2025, the price has gone up somewhat to around $3,330 an ounce, which is indeed a steep rise but a gradual increase over a period of almost a century.

Bitcoin has had a completely different history. From a price of $1 in 2011, it came up to $84,000 by 2025. With such rapid appreciation rates, both excitement and skepticism have been brought forth by financial analysts debating the worthiness of such growths.Sheer Disparity In Size

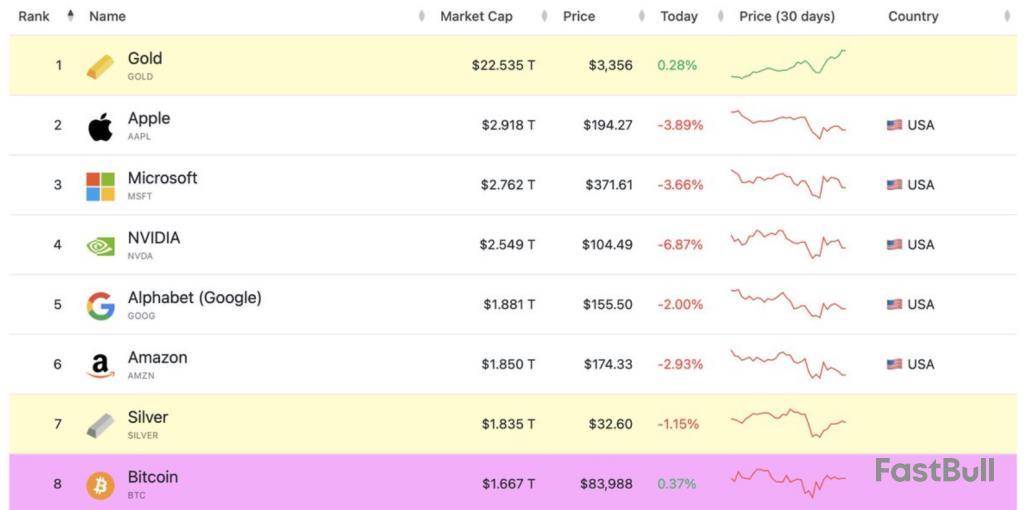

According to analyst Belle, a stark contrast in the behavior is due to the sheer difference in the size of their market. Gold has roughly a market capitalization of a little over $22 trillion. Due to this great size, gold provides an element of stability, rendering the market less sensitive to individual transactions or flows of short-term investments.

Belle@Bitt_BelleApr 17, 2025GOLD added $1 trillion to its market cap in one day. That’s nearly the entire value of #Bitcoin right now.

This shows how massive traditional markets are & how early we still are with Bitcoin. Even a small shift into $BTC could send it flying. pic.twitter.com/YsjSgOZKjx

Bitcoin’s market capitalization is at approximately $1.667 trillion—large but still only a fraction of gold’s. This reduced size makes Bitcoin more sensitive to capital flows. Gold recently saw an impressive $1 trillion rise in market capitalization over one day, but this was a much smaller percentage move than the same dollar flow would trigger in Bitcoin’s value.Same Dollar Flow, Different Price Impact

Meanwhile, the math in terms of market capitalization generates intriguing price movement scenarios. Based on calculations reported, if Bitcoin were to get a $1 trillion boost in market capitalization—comparable to the recent one-day increase in gold—its price per unit might rise from $84,000 to $135,000.

Featured image from The Ledn Blog, chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up