Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US PCE inflation up next, but will consumption data matter more?UK budget and CPI in focus after hawkish BoE decision.Euro turns to flash PMIs for bounce as rally runs out of steam.Inflation numbers out of Tokyo and Australia also on the agenda.

The cryptocurrency sphere has experienced continuous pressure over the last 95 days due to significant BTC price fluctuations. As altcoin holders grapple with diminishing values, the impending implementation of tariffs by Donald Trump on April 2 looms large, raising concerns about its effects on the crypto market.

In recent communications, Trump hinted at a potentially positive outcome, suggesting that April 2 could be a turning point. Previously, he had maintained that tariff flexibility was off the table; however, he has revisited this stance, proposing a mutual approach to tariff negotiations.

This change in tone has garnered a positive reception, particularly as the EU has deferred retaliatory actions. The market has priced in adverse scenarios, making any form of tariff leniency beneficial for cryptocurrency valuations. Such developments indicate a potential for recovery in the sector.

As discussions progress, the intersection of trade policy and cryptocurrency dynamics could set the stage for notable shifts, impacting market confidence and investment strategies moving forward.

Reports indicate SHIB exchange reserves are at unprecedented lows, impacting the cryptocurrency landscape as of March 21, 2025.

The decline in SHIB reserves could influence market stability, though recent price trends show upward movement despite the absence of senior developer comments.

Recent reports suggest SHIB reserves on exchanges have reached historic lows, yet market prices remain stable. Data analysis tools have offered this evidence, though direct sources have not confirmed.

The Shiba Inu community and developers have not shared official updates about exchange reserves. Recent metrics indicate market resilience, showing a 1.2% 24-hour increase despite reserve concerns.

The decline in reserves may have limited immediate effects on SHIB holders. Continued market activity presents a confident front, while exchanges maintain operational norms.

Without official commentary, financial analysts observe a cautiously optimistic outlook. Market movements suggest changes in trader behavior might affect cryptocurrency trends.

Similar reserve levels have previously hinted at market consolidations. Past occurrences showed varied outcomes based on market conditions and trader activity.

Experts recommend monitoring trends to predict future outcomes. Historical data indicates price dynamics may stabilize if trader activity supports the existing market framework.

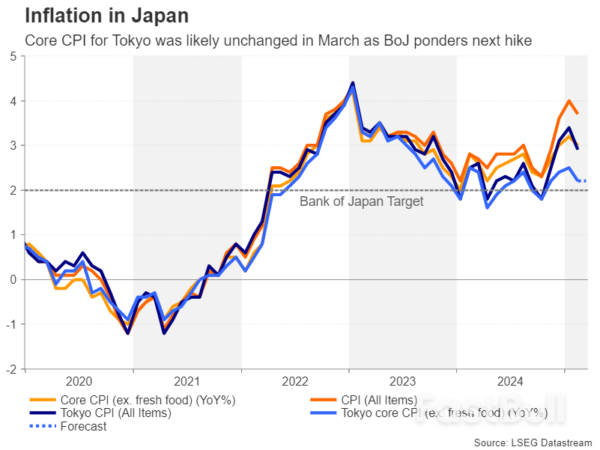

Just when it appeared that the yen scare could be easing, Japan has reported an uptick in core inflation.

Data released early Friday showed Japan's core inflation, which stripes out prices for fresh food, rose 3% year-on-year in February, moderating from January's 3.2% but beating the consensus forecast for 2.9%. The headline consumer price index eased to 3.7% from 4%.

Overall, both indices remained well above the Bank of Japan's 2% inflation target, validating the central bank chief Haruhiko Kuroda's declaration of victory over decades of deflation. Notably, since November, Japan’s headline inflation has been running hotter than that of the U.S.—almost 100 basis points (bps) higher now.

The sticky inflation, plus wage hikes from the shunto wage negotiations, have bolstered calls for BOJ rate hikes. In other words, a potential yen rally, known to destabilize risk assets, including cryptocurrencies, is back on the table.

As of writing, the dollar-yen (USD/JPY) pair traded at 149.22, having bounced nearly 300 pips in a sign of renewed yen weakness since March 11, according to data source TradingView.

That said, the narrowing or declining U.S.-Japan 10-year bond yield spread supports yen strength. Japanese yields have been rising across the curve, offering bullish cues to the yen. As of writing, Japan’s 10-year bond yield held above 1.5%, and the 30-year yield was above 2.5%, both at multi-decade highs.

A renewed yen strength could translate into risk aversion, the likes of which we saw in August last year.

The largest altcoin Ethereum (ETH) has been lagging behind Bitcoin and its market for a long time as it struggles to combat the declines it has experienced.

Leaving investors disappointed with its poor performance, ETH's supply on cryptocurrency exchanges has dropped to very low levels.

Cryptocurrency analysis platform Santiment said in its latest assessment that ETH supply on exchanges has fallen to its lowest level since November 2015.

“Thanks to the many DeFi and staking options, Ethereum holders have reduced the available supply on exchanges to almost 8.97 million. This is the lowest level in nearly 10 years (November 2015). There is 16.4% less ETH on exchanges compared to just 7 weeks ago.”

Santiment said that ETH has been rapidly leaving crypto exchanges, with exchange balances 16.4% lower since the end of January.

This is considered a signal that investors are moving ETH to cold storage wallets for long-term holding and that the Ethereum price will increase in the future.

At this point, analysts note that a significant drop in ETH supply on exchanges is commonly known as a supply shock and signals a potential price increase. However, the price increase will only occur if demand remains strong or increases to outweigh the decreasing supply.

While the decline in exchange supply gives investors hope for ETH, analyst Scott Melker, nicknamed “The Wolf of All Streets”, stated that ETH is at a critical crossroads and said, “Either Ethereum bounces from here and these levels become a generational bottom, or everything is over for ETH.”

The EUR/USD pair is trending downward, approaching 1.0829 on Friday as investors evaluate the latest developments in US Federal Reserve monetary policy.

On Wednesday, the Federal Reserve held its current interest rate and overall monetary policy framework unchanged. However, the central bank signalled that two rate cuts could be expected later this year. In its commentary, the Fed highlighted growing risks to economic recovery, employment stability, and inflation trends.

Fed Chair Jerome Powell downplayed concerns about the inflationary impact of tariffs imposed by the Trump administration, describing them as temporary. Powell also emphasised that the Fed would not rush into further rate cuts, reinforcing a cautious approach to monetary easing.

Adding to market uncertainty, Trump’s retaliatory tariffs – targeting countries that have imposed duties on US goods – are set to take effect on 2 April. Over the past 24 hours, the US dollar has strengthened amid fears of slowing global economic growth and escalating trade tensions. These factors have reinforced risk-averse sentiment among investors.

On the H4 chart, EUR/USD declined to 1.0815, followed by a correction to 1.0860. A further decline towards 1.0765 is highly likely, with this level remaining the primary target. The MACD indicator supports this scenario. Its signal line is below zero, sloping sharply downward, indicating potential new lows.

On the H1 chart, EUR/USD broke through the 1.0864 level and formed a bearish wave structure, reaching 1.0815. Today, a corrective move towards 1.0860 (testing from below) is likely. Once this correction concludes, the pair could resume its downward trajectory, targeting 1.0811. This movement marks the third wave of the downtrend. After reaching this level, another retracement towards 1.0864 is possible. The Stochastic oscillator supports this outlook, with its signal line below 20 and trending upward towards the 50 level.

The EUR/USD pair remains under pressure as the Fed’s cautious stance and global trade tensions bolster the US dollar. Technical indicators suggest further downside potential, with key support levels at 1.0765 and 1.0811. Investors should monitor upcoming economic data and trade developments for additional insights into the pair’s direction.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up