Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[The Third Meeting Of The China-US High-Level Track II Dialogue Held In The United States] From February 8 To 12, 2026, Wu Ken, President Of The Chinese People's Institute Of Foreign Affairs, Led A Delegation To New York To Co-host The Third Meeting Of The China-US High-Level Track II Dialogue With A US Team Led By Evan Greenberg, Executive Vice President Of The Board Of Directors Of The National Committee On US-China Relations. During Their Stay In New York, The Delegation Also Met With Former US Political Figures, Think Tank Representatives, And Business Leaders. (China People's Institute Of Foreign Affairs WeChat Official Account)

UK Labour Party Leader Starmer: We Must Build Our Hard Power, Must Be Able To Deter Aggression And If Necessary Be Ready To Fight

EU Commission Chief Von Der Leyen: This Starts By Working With Our Closest Partners, Like The UK, Norway, Iceland Or Canada

EU Commission Chief Von Der Leyen: We Face The Very Distinct Threat Of Outside Forces Trying To Weaken Our Union From Within

Chinese Foreign Minister Wang Yi: We Don't Want To See Narrative Of Systemic Rivalry Between EU And China Amplified

Chinese Foreign Minister Wang Yi: China Wants Cooperation Not Conflict But Well Prepared To Address All Kinds Of Risks

Chinese Foreign Minister Wang Yi: Attempts To Split China From Taiwan Would Very Likely Push China And USA Towards Conflict

[State Administration For Market Regulation Summons 7 Platform Companies] On February 13, The State Administration For Market Regulation Summoned Representatives From Alibaba, Douyin, Baidu, Tencent, JD.com, Meituan, And Taobao Flash Sale, Among Other Platform Companies. The Administration Demanded That These Companies Strictly Abide By The Provisions Of The *Anti-Unfair Competition Law Of The People's Republic Of China*, The *Price Law Of The People's Republic Of China*, The *Consumer Rights Protection Law Of The People's Republic Of China*, And The *E-commerce Law Of The People's Republic Of China*, Proactively Fulfill Their Primary Responsibilities, And Further Regulate Their Platform Promotional Activities. The Administration Also Reminded These Companies To Eliminate All Forms Of "involutionary" Competition, Jointly Maintain A Fair Competitive Market Environment, And Promote The Innovation And Healthy Development Of The Platform Economy

Chinese Foreign Minister Wang Yi: The Other Prospect Is Seeking To Decouple, Sever Supply Chains In A Knee Jerk Way

Rubio Says President Has Said Its His Preference To Reach A Deal With Iran But That's Very Hard To Do

[F2Pool Co-Founder Wang Chun: Smart Money Is Now Buying Bitcoin] February 14Th, F2Pool Co-Founder Wang Chun Posted On Social Media, Saying, "Smart Money Is Now Buying Bitcoin."

Rubio Says He Does Not Think It Is Possible For Russia To Achieve What Initial Objectives It Had At The Start Of The Ukraine War

Germany Current Account (Not SA) (Dec)

Germany Current Account (Not SA) (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Jan)

U.S. Existing Home Sales Annualized MoM (Jan)A:--

F: --

U.S. Existing Home Sales Annualized Total (Jan)

U.S. Existing Home Sales Annualized Total (Jan)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Jan)

China, Mainland Outstanding Loans Growth YoY (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)A:--

F: --

P: --

Euro Zone Employment Prelim QoQ (SA) (Q4)

Euro Zone Employment Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Revised YoY (Q4)

Euro Zone GDP Revised YoY (Q4)A:--

F: --

P: --

Euro Zone Trade Balance (SA) (Dec)

Euro Zone Trade Balance (SA) (Dec)A:--

F: --

Euro Zone Employment YoY (SA) (Q4)

Euro Zone Employment YoY (SA) (Q4)A:--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Dec)

Euro Zone Trade Balance (Not SA) (Dec)A:--

F: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Retail Sales MoM (Dec)

Brazil Retail Sales MoM (Dec)A:--

F: --

P: --

U.S. Real Income MoM (SA) (Jan)

U.S. Real Income MoM (SA) (Jan)A:--

F: --

U.S. Core CPI YoY (Not SA) (Jan)

U.S. Core CPI YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. Core CPI MoM (SA) (Jan)

U.S. Core CPI MoM (SA) (Jan)A:--

F: --

P: --

U.S. CPI MoM (Not SA) (Jan)

U.S. CPI MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. CPI MoM (SA) (Jan)

U.S. CPI MoM (SA) (Jan)A:--

F: --

P: --

U.S. CPI YoY (Not SA) (Jan)

U.S. CPI YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. Core CPI (SA) (Jan)

U.S. Core CPI (SA) (Jan)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Jan)

U.S. Cleveland Fed CPI MoM (SA) (Jan)A:--

F: --

P: --

Russia CPI YoY (Jan)

Russia CPI YoY (Jan)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Jan)

U.S. Cleveland Fed CPI MoM (Jan)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Saudi Arabia CPI YoY (Jan)

Saudi Arabia CPI YoY (Jan)--

F: --

P: --

Japan GDP QoQ (SA) (Q4)

Japan GDP QoQ (SA) (Q4)--

F: --

P: --

Japan GDP Annualized QoQ (SA) (Q4)

Japan GDP Annualized QoQ (SA) (Q4)--

F: --

P: --

Japan Real GDP QoQ (Q4)

Japan Real GDP QoQ (Q4)--

F: --

P: --

Japan Nominal GDP Prelim QoQ (Q4)

Japan Nominal GDP Prelim QoQ (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Feb)

U.K. Rightmove House Price Index YoY (Feb)--

F: --

P: --

Japan Industrial Output Final YoY (Dec)

Japan Industrial Output Final YoY (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Dec)

Japan Industrial Output Final MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Dec)

Euro Zone Industrial Output MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output YoY (Dec)

Euro Zone Industrial Output YoY (Dec)--

F: --

P: --

Euro Zone Total Reserve Assets

Euro Zone Total Reserve Assets--

F: --

P: --

Canada New Housing Starts (Jan)

Canada New Housing Starts (Jan)--

F: --

P: --

Canada Manufacturing New Orders MoM (Dec)

Canada Manufacturing New Orders MoM (Dec)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Dec)

Canada Manufacturing Unfilled Orders MoM (Dec)--

F: --

P: --

Canada Manufacturing Inventory MoM (Dec)

Canada Manufacturing Inventory MoM (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Jan)

Canada Trimmed CPI YoY (SA) (Jan)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes U.K. 3-Month ILO Employment Change (Dec)

U.K. 3-Month ILO Employment Change (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Jan)

U.K. Unemployment Claimant Count (Jan)--

F: --

P: --

U.K. Unemployment Rate (Jan)

U.K. Unemployment Rate (Jan)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Dec)

U.K. 3-Month ILO Unemployment Rate (Dec)--

F: --

P: --

Germany CPI Final YoY (Jan)

Germany CPI Final YoY (Jan)--

F: --

P: --

Germany CPI Final MoM (Jan)

Germany CPI Final MoM (Jan)--

F: --

P: --

Germany HICP Final YoY (Jan)

Germany HICP Final YoY (Jan)--

F: --

P: --

Germany HICP Final MoM (Jan)

Germany HICP Final MoM (Jan)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Dec)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Dec)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Dec)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Dec)--

F: --

P: --

U.K. Labor Productivity (Q3)

U.K. Labor Productivity (Q3)--

F: --

P: --

South Africa Unemployment Rate (Q4)

South Africa Unemployment Rate (Q4)--

F: --

P: --

No matching data

Trump comments turbocharged a weakening USD trend late Tuesday, although subsequent price action was choppy as these were likely casual remarks.

Summary: Trump comments turbocharged a weakening USD trend late Tuesday, although subsequent price action was choppy as these were likely casual remarks. This high momentum breakout has stolen focus from the JPY for the moment as the key USD pair on the move, and we face a nervous wait for the Japanese election on February 8.

Small update today as sources cited by all major media in Asian Friday suggest that Trump is set to nominate former Fed Governor Kevin Warsh as the next Fed Chair in Washington today to replace Chair Powell when his term ends in May. It's an interesting choice, given Warsh, who has been a top three candidate since the beginning of Trump's second administration, is not seen as particularly dovish or crying for large rate cuts, seemingly the only qualification for the job in Trump's eyes. After Wednesday's FOMC, for example, Trump took to social media to complaining about the need for a much lower rate and calling Powell a "moron".

The choice may reflect Treasury Secretary Bessent's council to choose someone with a steady hand and a thorough knowledge of the institution, suggesting to Trump that more Fed rate cuts could trigger a disorderly slide in the US dollar, with the advice weighing more heavily after the rough USD slide this week after Trump's own comments that shrugged off the recent USD weakness. Bessent may have also pointed out to Trump that the wild ramp in metals prices has a lot to do with the fear that his administration will manage its currency and fiscal situation poorly, a distinct inflation risk.

Warsh was a Fed governor from 2006 to 2011 and quit in protest over later rounds of deepening commitment to unconventional policy like quantitative easing. It will be very interesting to see how Trump spins this nomination. Let's remember, only Trump hatchet-man Stephen Miran and the dovish Christopher Waller (seen at one point as a front runner to replace Powell) argued for a rate cut at the FOMC meeting – it's a committee decision.

Market reaction: The reaction thus far has been quite modest, which should give the USD bears some comfort. EURUSD tested and held the first key 1.1900 area (arguably, 1.1800 is permissible without a full bull trend reversal), and USDJPY tested above 154.00 which likewise held as resistance (we still need to wait for the price action after the February 8 Japanese election for a strong read on the status of the yen). Elsewhere, the reaction was far stronger, with choppy risk sentiment crumbling again after the announcement, sending US equity market futures sharply lower. Likewise, precious metals are selling off once again and the Aussie, which had enjoyed the backdrop, was one of the weaker currencies overnight (more below).

AUDUSD has retrenched to the psychologically significant 0.7000 area after a fairly brutal run higher across many of the rest of the G10 currencies over the last two weeks. The apparent Trump choice of Warsh is weighing on USD bearish conviction as it appears a rather more responsible pick, given that Warsh is considered an inflation hawk and the most hawkish of the potential Trump picks to replace Powell. The next test for the Aussie is next Tuesday's RBA meeting – could the huge repricing of the currency weigh in the RBA's decision on Tuesday? The market is leaning for a hike, which is about two-thirds priced in. A no-go on a rate move could see a further consolidation in AUD pairs, seeing AUDUSD testing perhaps 0.6900 or lower, but a "hawkish hold" that firmly sets up an anticipated hike at the following RBA meeting could soften the damage for AUD pairs. Of course, the RBA could just steam ahead with a rate hike and AUD could find support at higher levels if commodities prices likewise find a low and the USD remains broadly weak. No anticipation of a major reversal and AUD unless we see a collapse in metals prices, an ugly risk sentiment in equity markets and a rally in global bonds.

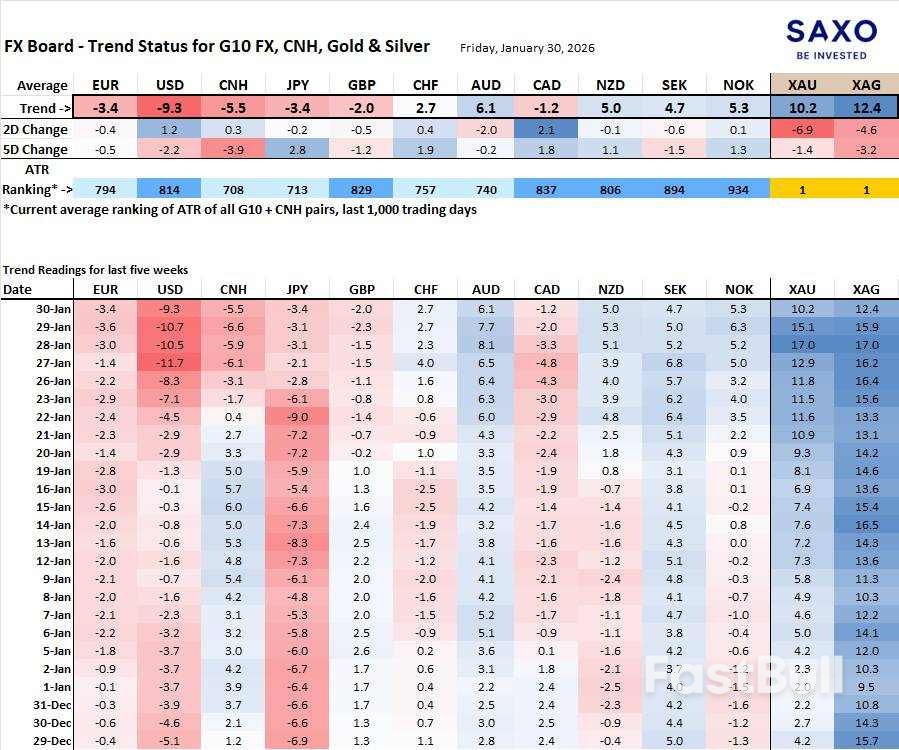

Source: Saxo

Source: SaxoFX Board of G10 and CNH trend evolution and strength.Note: If unfamiliar with the FX board, please see a video tutorial for understanding and using the FX Board.

US dollar weakness dominates – again, the reading is exaggerated because we have seen volatility expansion with this breakout, and our trend readings are volatility adjusted on a longer term time frame – so the reading does a good job of indicating how significant the move is relative to the prior quiet. Elsewhere, the AUD still a top performer, but note the loss of momentum over the last two sessions – next week is key for the currency.

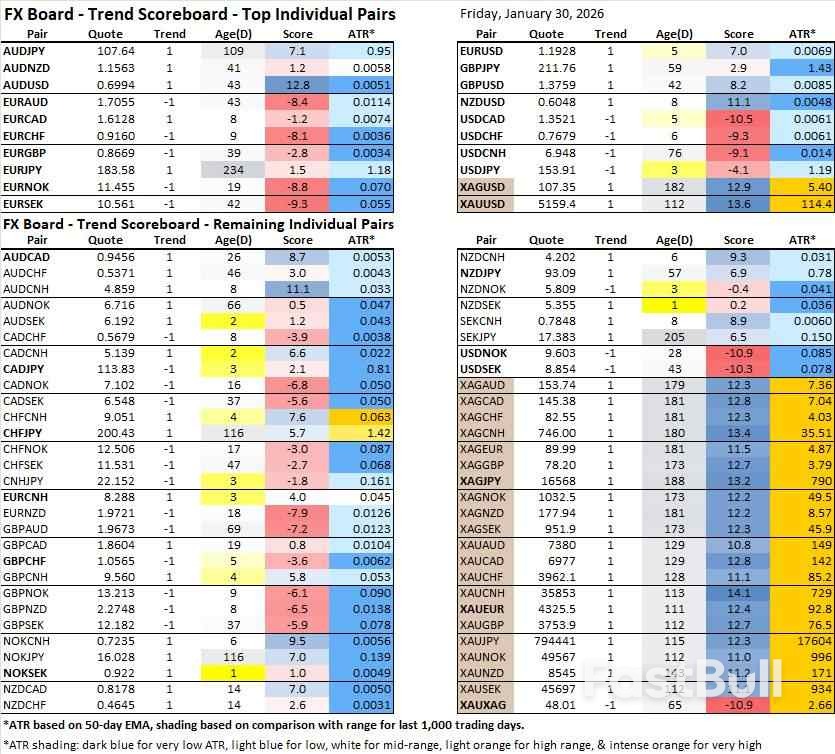

Table: NEW FX Board Trend Scoreboard for individual pairs.No brand new trends for the major individual pairs at the top of the table, although we will watch the JPY crosses closely in the coming week and beyond in anticipation of the Japanese election on February 8. Further down the table, note the NOKSEK attempt to establish a new uptrend after yesterday's close.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up