Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

French President Macron Tells Le Monde And Other European Papers: Now Is Good Time For Europe To Launch A Means Of Joint Borrowing, For Example Via Eurobonds

Bank Of Japan Offers To Sell Y 500 Billion Japanese Government Bonds As Collateral For USA Dollar Funds-Supplying Operations In Repo Pact For 2/12 - 2/20

Kazakhstan's Net Gold And Foreign Currency Reserves $69.526 Billion In Jan (10.1% Change Month-On-Month) - Central Bank

Malaysian Palm Oil Board - Malaysia's January Palm Oil Exports 1.48 Million T, Up 11.44% From December

Malaysian Palm Oil Board - Malaysia's January Palm Oil End-Stocks 2.82 Million T, Down 7.72% From December

Malaysian Palm Oil Board - Malaysia's January Crude Palm Oil Production 1.58 Million T, Down 13.78% From December

Bank Indonesia Senior Deputy Governor: There Is Room To Cut Interest Rate Further, But Will Be Data Dependent

Japan Jan LNG Spot Contract Price At $11.30/Mmbtu-Japan Oil, Gas And Metals National Corporation (State-Owned Jogmec)

[Owl 24H Trading Volume Surpasses $14 Million] February 10Th, According To Coinmarketcap Data, Owl'S 24-Hour Contract Trading Volume Exceeded 14 Million US Dollars, With The Main Trading Platforms Being Gate ($6.27 Million), Mexc ($4.63 Million), Bingx ($1.68 Million), Etc.In Addition, Users Can Also Conduct Owl Contract Trading On Platforms Such As Aster, Weex, Kcex, Lbank, Hotcoin, Etc

Japan Trade Minister Akazawa: Plan To Visit USA Between Feb 11-14 To Discuss Japan's Investment Plan

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)A:--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)A:--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

No matching data

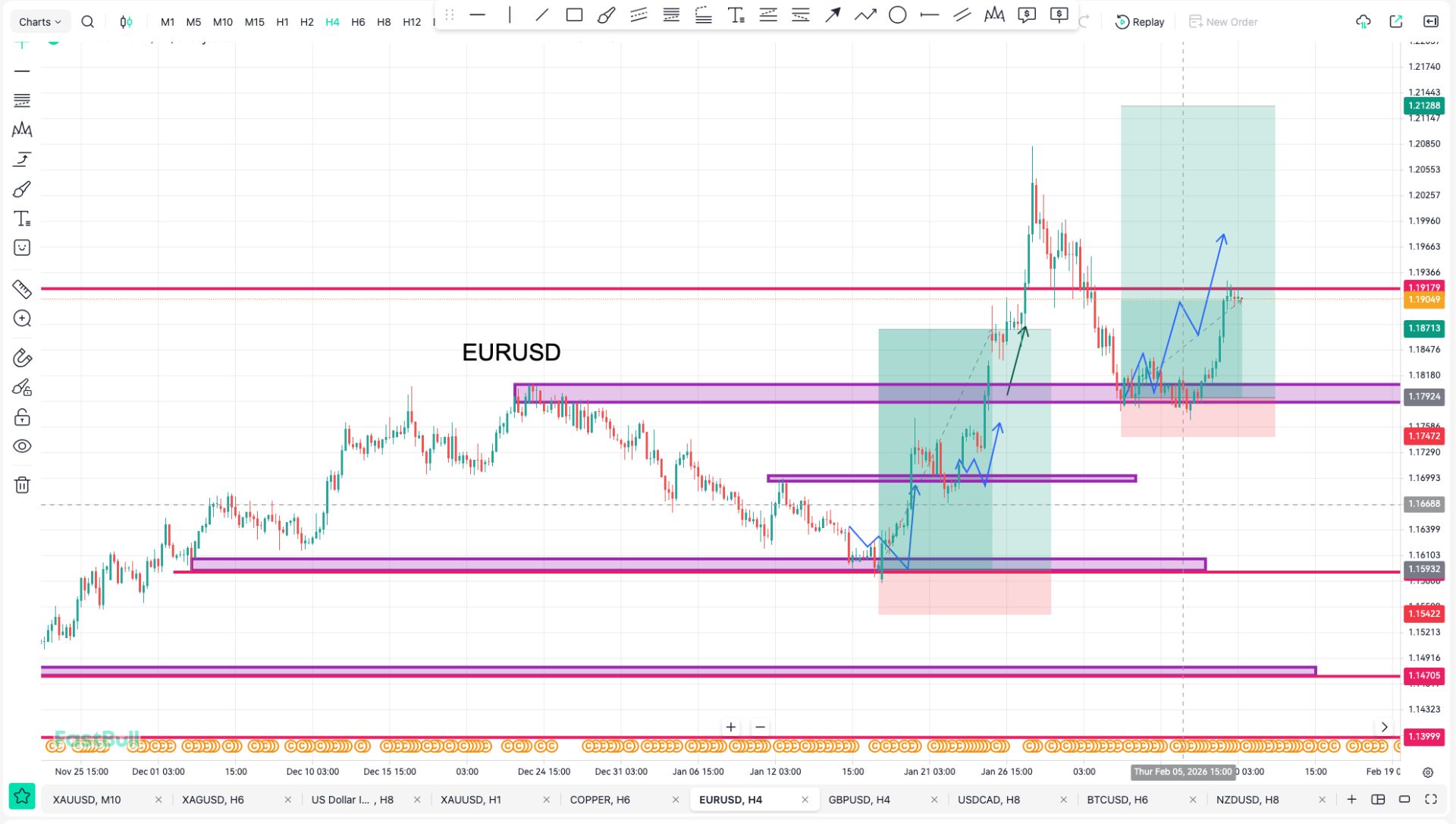

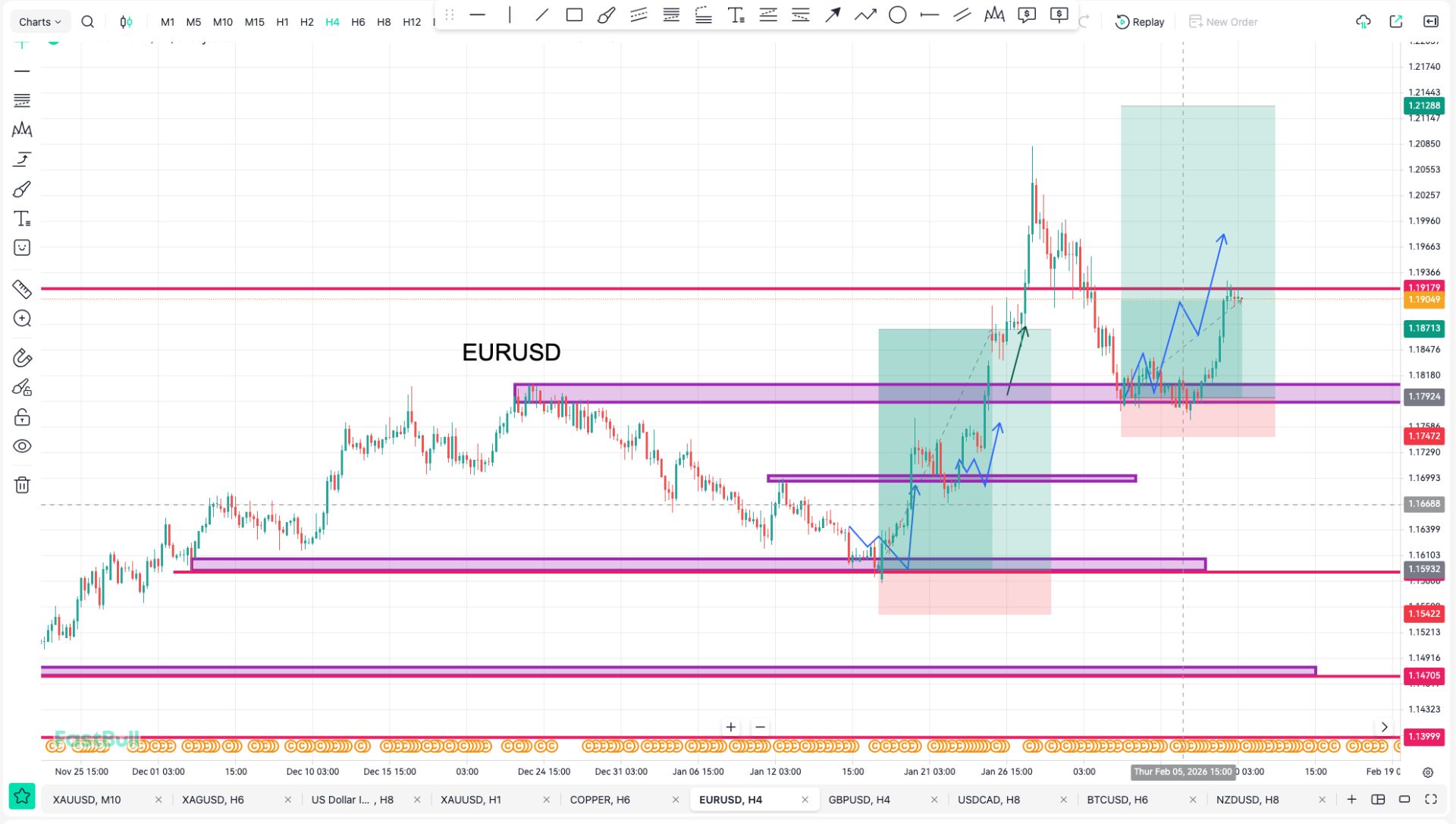

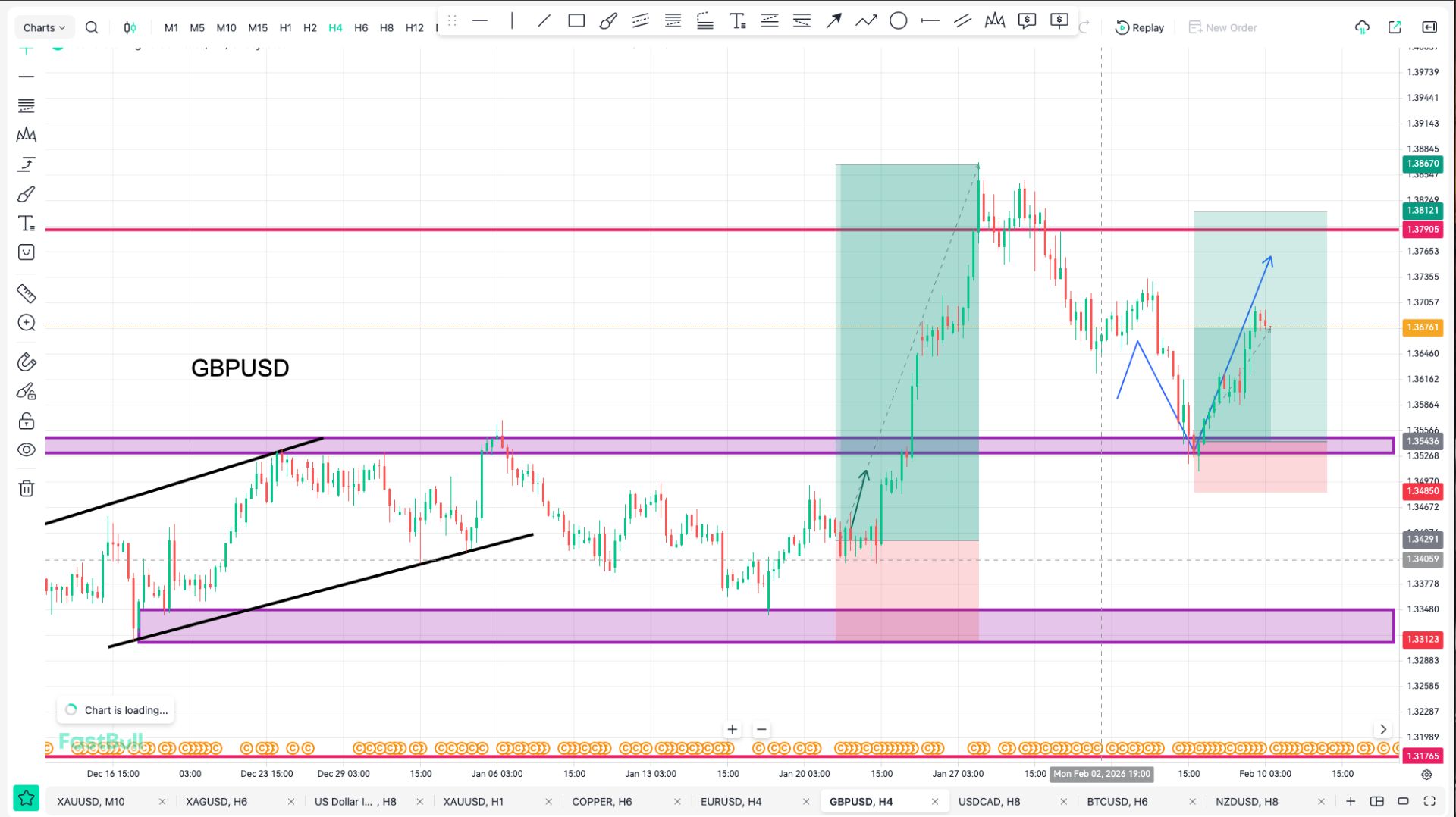

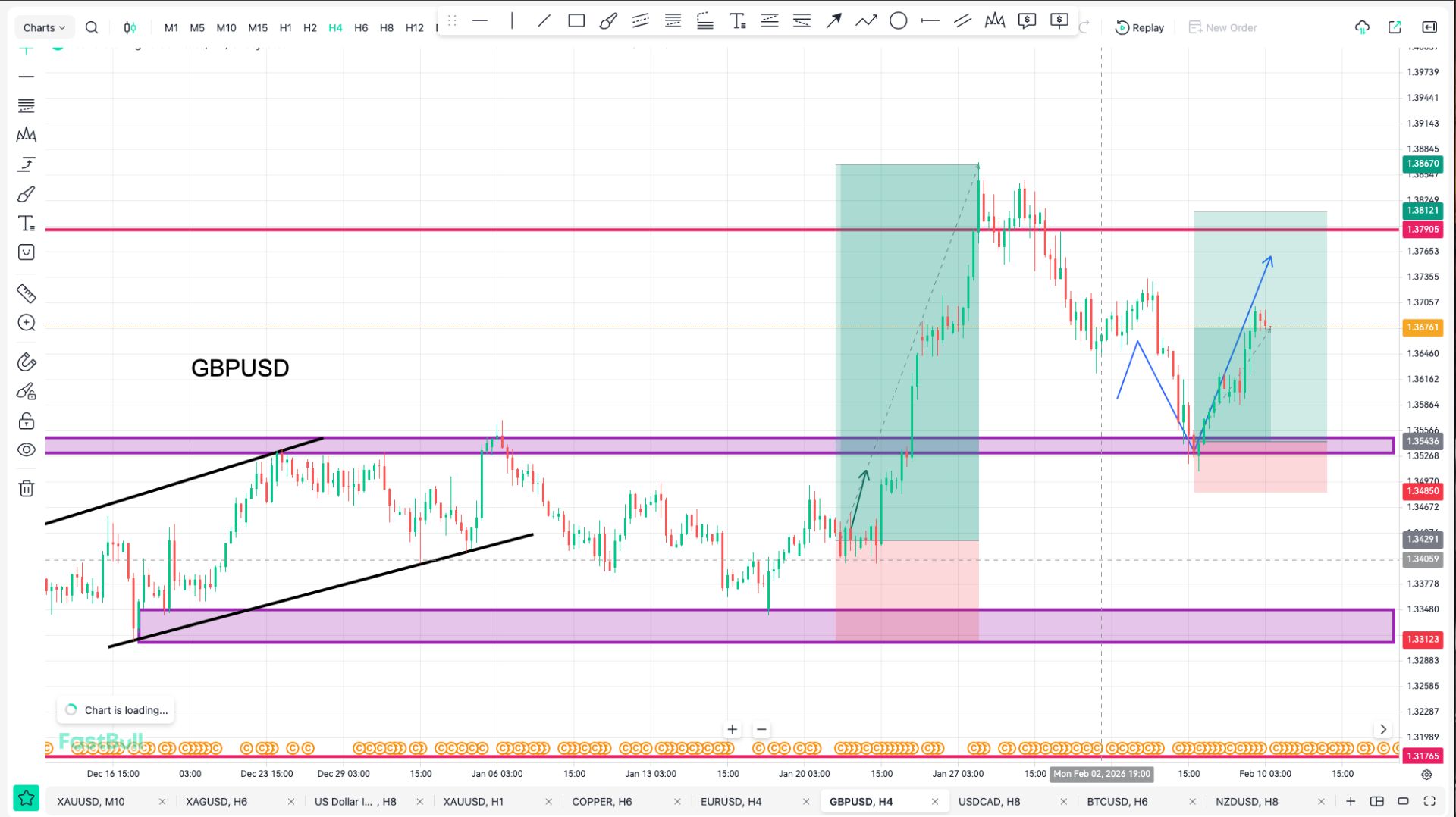

The US Dollar has been rallying steadily since its pre-FOMC lows, with Powell’s not-so-dovish speech last week marking the start of a V-shape reversal from the sharp pre-meeting downfall.

The US Dollar has been rallying steadily since its pre-FOMC lows, with Powell’s not-so-dovish speech last week marking the start of a V-shape reversal from the sharp pre-meeting downfall.Despite another appearance from the Fed Chair at a Rhode Island conference on Tuesday—where his strong emphasis on employment could have been read as a dovish catalyst—markets didn’t budge.Instead, the DXY finished higher that day, signaling that markets already priced in Powell’s words and participants are now looking for something else.

The decisive move came from this morning’s Jobless Claims beat, combined with even higher Q2 GDP, which markets saw as another reason to extend the Dollar’s buyback.The greenback is up roughly 0.40% on the session, reclaiming a key pivotal level that had been holding back momentum.Some technical aspects warrant signs of change in the previous trend. The question will now be whether the change will be more temporary or the start of a new trend.The index’s double bottom, formed right ahead of last Wednesday’s FOMC meeting, is now acting as a solid base.

Layered onto this market backdrop is a strangely tense geopolitical environment.Nothing major has erupted yet, but Eastern European nations continue to report threats from Russia, and US Secretary of War (precedingly Secretary of Defense) Pete Hegseth has convoked all generals for a meeting next week—no reason announced.Whether this is an operational matter or a potential political headwind, it adds a layer of uncertainty that could further bolster dollar demand.All in all, the US dollar rally is changing current market flows, and particularly when looking at the charts of the first three quarters, any higher continuation may continue rewire markets quite remarkably.

With some geopolitics quietly simmering and a few technical signs, one can expect lots of change going forward.Before anything, let’s have a look at the US Yields to see what’s the story with the Federal Reserve expected cuts since the beginning of August.

We spot a rejection zone that has formed since FOMC right around the 3.50% mark, with the 2-Year Yield now up above 10 bps (basis points) since the Wednesday FOMC.Failing to breach the Liberation day lows (3.45%), a more positive picture is drawing from the latest round of US data which reduces angst about the labor market, hence less need for rate cuts.The dollar becomes more attractive as yields increase, but the story is more complex.Markets might be getting afraid that still extreme deficits will prevent an economy slowdown.It is for that reason that FED speakers keep mentioning their decision making as data dependent, which in turns provides more confidence in the Federal Reserve’s independence, hence an increase dollar demand.

Dollar Index Multi-timeframe outlook

DXY Daily Chart

A week after the FOMC candle, the double bottom got confirmed by the following price action: The DXY is up 2.42% since marking new 2025 lows at 96.20.Today’s huge +0.70% performance easily broke through previous highs and now goes to test August 1 highs (before the huge miss in the July NFP).The upcoming price action will have a huge influence on other assets, particularly in the case of a dollar breakout.A Head and Shoulders pattern has formed and time will tell if it will complete – The fundamentals do seem to corroborate with that theme for now..

Prices have broken and retested the August downward trend before flying higher in today’s session.Ongoing mean-reversion gives the USD a break in its ascend.Participant will now look to see if prices get rejected much further, with a consolidation near today’s highs giving increased odds of upside breakout.Such a scenario could point to 99.25, target of the Head & Shoulders or even higher, depending on how strong the price action gets.

Positioning in the Dollar is always very complex and leads to tricky action.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up