Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Fed and Bank of Canada expected to lower rates while the ECB and BoJ have opted for a wait-and-see approach this week.

Markets started the last week of October on a positive note. Rumours of a trade deal between the US and China boosted global risk appetite. Safe-haven assets such as the yen and the franc came under pressure. In contrast, the yuan's proxy currencies, the Australian and New Zealand dollars, performed better. Beijing is signalling a settlement of issues related to export controls, fentanyl and shipping fees. Washington claims that 100% tariffs are off the table and that China will increase its purchases of American soybeans.

Investors will focus on central bank meetings and Donald Trump's tour of Asian countries. Monetary policy works on a geographical basis. North America intends to lower rates, while Europe and Asia plan to keep them steady. Concerns about a cooling labour market allow the futures market to predict a reduction in the Fed's rate from 4.25% to 4% and the Bank of Canada's rate from 2.5% to 2%.

The Bank of Japan is unlikely to tighten monetary policy amid the change of prime minister. Sanae Takaichi and her team believe the government and the central bank should act in unison. Coupled with improved global risk appetite, this puts pressure on the yen. However, Donald Trump intends to visit Tokyo. Given the US president's reluctance to strengthen the dollar, his visit may fuel rumours of currency intervention and slow down USDJPY.

The ECB is expected to signal the end of its policy easing cycle. According to most Bloomberg experts, the deposit rate will remain at 2% until 2027. 17% of respondents predict an increase in 2026. Divergence in monetary policy is supporting EURUSD. However, the pair is not rushing to grow. Bulls fear hawkish rhetoric from the Fed after the federal funds rate cut.

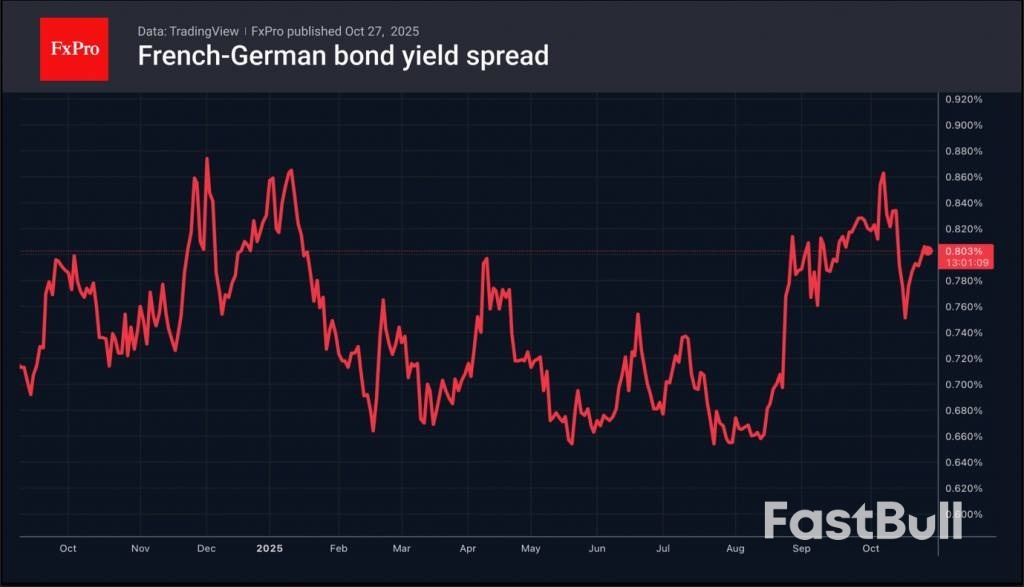

In addition, the political drama in France is not over yet. Encouraged by the postponement of pension reform, the Socialists are demanding new concessions and intend to pass a law to increase taxes on the rich. As a result, the yield spread between local and German bonds has started to widen again, reflecting increased political risks, which is putting pressure on the euro.

In the last 20 years, the price of gold has gone up almost tenfold. Anyone who bought gold in 2005, when the price was averaging US$444 per ounce, would be laughing all the way to the bank now.The price hit its highest ever level of US$4,356 per ounce two weeks ago before coming down. In fact, this year alone, gold has gained more than 58% largely due to the uncertainties in the global investment landscape.These uncertainties are due to fears of rising inflation as a result of the US tariff hikes, lower bond yields from impending cuts in US interest rates, the future direction of the US dollar and global tensions due to trade and geopolitical wars. The resultant effect is the flow of funds towards gold.

Institutional investors — central banks and hedge funds — have moved more money than ever into gold-based products to hedge against uncertainties. Gold exchange traded funds (ETFs) saw the biggest inflow in the third quarter of this year of US$26 billion (RM109 billion).According to data from the World Gold Council, year-to-date inflow into gold ETFs was US$64 billion as at September, which is a record high.During the period, the total assets under management of gold ETFs globally reached US$472 billion.Physical gold holdings of ETFs globally hit 3,838 tonnes, just below the peak of 3,929 tonnes recorded in the first week of November 2020, when the Covid-19 pandemic was at its height.

Gold is popular among Asian families, particularly in South Asia. India is the largest consumer of gold in Asia as it is viewed as a sign of luxury, prosperity and divinity. It is given as a gift during joyous occasions, from the birth of a baby to weddings and birthdays.But many from India and other parts of Asia also buy gold jewellery for investment purposes, and the jewellery tends to be passed on from one generation to another.

The inheritance of gold comes with its fair share of problems, however.

The precious metal needs to be stored safely. A safe deposit box in a bank is ideal but there are annual charges for the service. And it is not easy to divide the gold equally — a piece of jewellery or gold wafer coin cannot be broken into two or three pieces.The logical way to divide the inheritance equally is probably to sell the gold. But how many would have taken advantage of the bull run in gold and sold some of the precious metal? Most probably, only a minority.The primary reason is the emotional attachment to gold. Also, many believe its value will only rise over the long term, so why sell when they have no need for money?

It is true that the price of gold will only rise in the long term. It has been proven time and time again that it hits a new peak whenever there is a global crisis.But every time gold hits a new peak, it tends to correct by between 30% and 40% before finding some stability and rising again to a new high. The process takes years.In January 1996, gold hit US$406 per ounce and trended downwards to a low of US$255 in August 1999, which is more than three years. It reached another peak in August 2012, when it closed at US$1,828 amid the US financial crisis. It drifted downwards to a low of US$1,060 in December 2015, a drop of more than 40% from its peak.

The current rally can trace its start to the pandemic. Gold almost hit US$2,000 in August 2020. It settled at a low of US$1,600 in October 2022, when there were signs of the pandemic being at its tail end.

The gold price has been on a bull run since March 2024, after Donald Trump won the Republican nomination for the US presidency.

Real gold investors would have taken some money off the table. The institutional funds and investors who are not emotionally attached to their gold portfolio would have realised some of the investments, which are usually in the form of gold wafer coins, bars, futures or any other investment instruments with gold as an underlying asset.The precious metal does not pay any dividends. It glitters and is useful as a hedge against uncertainties. But when the uncertainties start to clear up, its glitter tends to fade. It is unlike the equity markets, where optimism grows when there is more certainty on economic and interest rate policies and the earnings of companies.

However, gold's saving grace is that even when it is on a declining trend, the magnitude of its fall is not as great as that of investments in the equity markets. That is why gold will always remain relevant, albeit being a long-term game.In the last few days, gold has fallen more than 8% from its high of US$4,356, its biggest drop in more than 10 years. Those who went into gold in the last few months will learn the hard way that it is an investment for the long term. term returns.

Whether the correction is only a temporary blip or will go on for a few months or years is left to be seen. But gold as an asset class will not lose its shine over the long term.The equity markets are at an all-time high. Digital coins and other asset classes are all in a bubble, especially in the US. The fear of inflation and a slowdown of the economy is very much prevalent.If and when the bubble bursts, the flight towards gold will resume. Until then, those who have gone into the asset class as an investment will have to ride the current dip.

As for those who bought gold many years ago and are still holding it, they should not be afraid to liquidate some of it and put their money into other, undervalued asset classes.

German business confidence improved to its highest level since 2022 at the start of the fourth quarter, bolstering hopes that Europe's largest economy is finally emerging from two years of contraction.

An expectations index by the Ifo institute rose to 91.6 in October from a revised 89.8 in September, a release Monday showed. That's above the 90 median estimate in a Bloomberg survey. A measure of current conditions unexpectedly fell.

"Companies remain hopeful that the economy will pick up in the coming year," Ifo President Clemens Fuest said in a statement. "However, the current business situation was assessed as slightly worse."

The numbers add to surveys published Friday showing German private-sector activity unexpectedly jumped in October to its highest level since 2023, putting the euro-area on a firmer footing.

Germany saw output shrink for two years, with only marginal growth — if any — expected in 2025. In particular, the manufacturing sector is still suffering from structural problems like red tape and higher US tariffs.

A more pronounced pick-up is forecast, helped by massive public infrastructure and defense spending as well as the European Central Bank's recent interest-rate cuts. Policymakers have lowered borrowing costs eight times this cycle, though have kept them on hold since June and are expected to leave them unchanged again on Thursday.

But the Bundesbank and the country's leading research institutes warned this month that Chancellor Friedrich Merz's ruling coalition must implement more fundamental reforms to strengthen the economy, boost competitiveness and lift long-term growth prospects.

It's "time to speed up on the path to reform," Bundesbank President Joachim Nagel said. "To reignite productivity and foster growth, the government must take decisive action."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up