Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Shiba Inu has seen a 0% surge in one of its closely watched ecosystem metrics, sparking questions in the crypto community.

According to Shibburn, Shiba Inu has seen a surprising 0% surge in its daily burn rate as only 69,613 tokens were burned in the past day. Contributing to this figure is a single transaction of 69,420 SHIB tokens burned.

Shibburn@shibburnSep 07, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001231 (1hr 0.31% ▲ | 24hr -0.85% ▼ )

Market Cap: $7,254,604,904 (-0.86% ▼)

Total Supply: 589,247,711,761,922

TOKENS BURNT

Past 24Hrs: 69,613 (0.00% ▼)

Past 7 Days: 20,241,091 (81.32% ▲)

The 69,613 SHIB tokens burned in the last 24 hours bear same with the figure tallied the day before. On Sept. 6, only 69,808 SHIB tokens were burned, hence the 0% surge.

However, in the last seven days, 20,241,091 SHIB tokens were burned, representing an 81.32% surge in weekly burn rate.

Out of an initial total supply of 1 quadrillion SHIB tokens, over 41% have been burned, leaving Shiba Inu's total supply at 589,247,711,692,117 SHIB.

SHIB price action

At the time of writing, SHIB was up 1.12% in the last 24 hours to $0.0000124 as price continues to consolidate near $0.000012. In the last 24 hours, 9.17 trillion SHIB or $113.74 million in SHIB has been traded, marking a 21.92% drop in trading volume as traders await the next move on the market.

Shiba Inu recently completed a death cross on its daily chart, a flip following a golden cross that emerged on its chart in late August. With the current signals being mixed for Shiba Inu, traders will turn to the broader market to adjudge the sentiment and thus predict Shiba Inu's next major move.

September remains a mixed month in terms of price performance for Shiba Inu, marking two out of four Septembers in green since 2021. Last September, Shiba Inu had a positive close with a gain of 26.97%, and the market is now eager to see if SHIB will sustain this trend.

Shiba Inu is currently up 1.80% so far this September.

Worldcoin price surged 16% in the past 24 hours, following the launch of its anonymized multi-party computation (APMC) initiative. The project includes contributions from Nethermind, the University of Erlangen-Nuremberg (FAU), and UC Berkeley’s Center for Responsible Decentralized Intelligence (RDI).

It also brings in the Korea Advanced Institute of Science and Technology (KAIST) and the University of Engineering and Technology in Peru (UTEC). The APMC launch is designed to strengthen Worldcoin’s quantum-secure technology, adding momentum to the cryptocurrency’s growth.

Worldcoin Holders Remain Bullish

Long-term holders (LTHs) are showing renewed conviction, with data from the MCA highlighting a clear preference for accumulation over selling. This behavior reflects increasing confidence in WLD’s future, particularly as major institutions endorse its security-focused developments.

The steady incline in the MCA suggests that committed holders are not only preserving but also expanding their stakes. Such behavior strengthens the foundation for WLD’s current recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

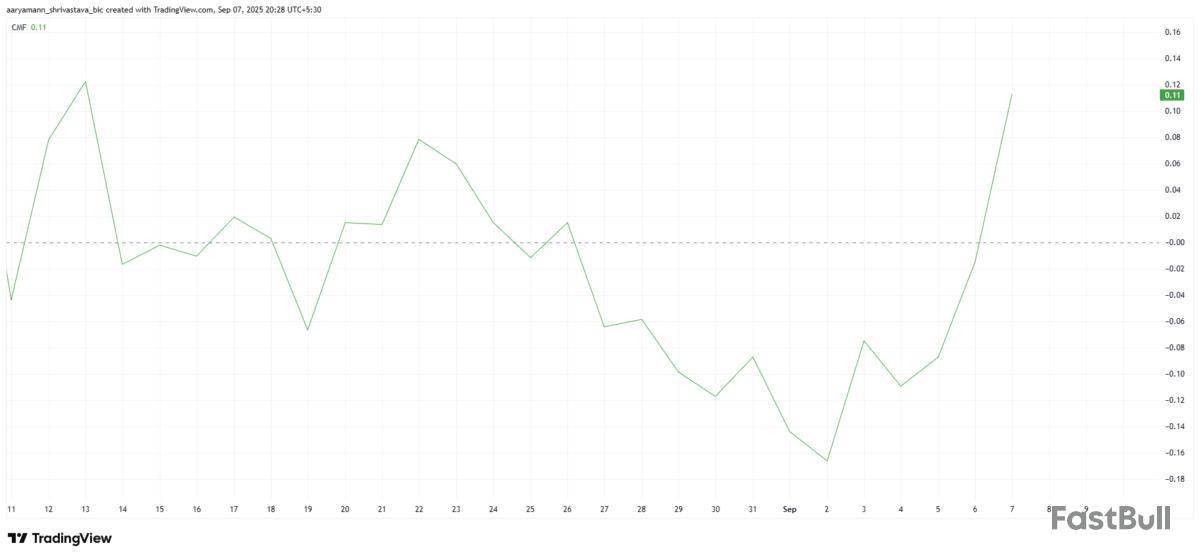

On-chain activity also supports Worldcoin’s broader momentum. The Chaikin Money Flow (CMF) indicator has recorded a sharp uptick in recent sessions, pointing to strong inflows into the cryptocurrency. A positive CMF signals sustained demand that could extend the rally.

The timing coincides directly with the APMC announcement, which appears to have catalyzed buying interest. By pushing the CMF well above the zero line, the development confirms a bullish stance for WLD in the near term.

WLD Price Can Continue Rising

WLD climbed by nearly 16% over the last 24 hours, emerging as one of the best-performing altcoins. The altcoin is changing hands at $1.06, with $1.08 acting as a key barrier that may shape its immediate price direction.

The factors mentioned above suggest that WLD could note a successful breakout above $1.08, pushing it toward $1.11, marking a monthly high. This would likely boost investor sentiment and potentially draw further capital into the asset.

On the other hand, profit-taking could reverse the recent rally. If selling pressure builds, WLD may retreat to $1.03 or lower to $0.96, wiping its recent gains and invalidating the bullish thesis.

With the crypto market showing signs of a potential rebound, Bitcoin and other top altcoins have moved to the green zone. Amid this positive price trajectory, Bitcoin whales appear to have relented from market sell-offs as data provided by on-chain monitoring firm Whale Alert shows major BTC buy activity.

The source revealed it has spotted a huge Bitcoin transaction, which involved 500 BTC being emptied from the world's largest cryptocurrency exchange Binance in a matter of minutes.

While the transaction happened during the mid hours of Sept. 7 when Bitcoin was trading at $111,132, the large BTC scooped out of Binance during the time was worth about $55,566,215.

Although the intention behind the major Bitcoin transaction was not specified, market watchers have perceived the move to be a Bitcoin buy activity from a high profile investor or an institution due to the nature of the transfer.

Bitcoin rebound restores market confidence

With the major BTC accumulation coming at a time when the leading cryptocurrency is moving upward, showing signs of a potential price resurgence, the move comes as no surprise.

While Bitcoin had experienced mixed price action during the week, surging to about $113K and falling as low as $107,000, it appears to be closing the week on a positive note.

After falling below the $110,000 mark in the previous day amid a broad market bloodbath, it appears to be regaining momentum as it returns slowly to the upside, trading at $111,374 as of press time, according to data from CoinMarketCap.CoinMarketCap">

Though slow, Bitcoin's price appears to be gradually headed for a major breakout. Hence, the whale's decision to buy and move such a large amount of BTC from a top exchange hints at a bullish shift in investor sentiment in preparation for a major price move.

Over the last day, Bitcoin has been moving slowly in its trading price, but on a positive path as it shows a decent price surge of 0.27%. However, the asset’s trading volume during the period has slumped massively by about 18.45%, suggesting that the demand for the asset is still outweighed by speculative trading from exiting investors.

XRP has seen its volume drop by 66% in the last 24 hours, sparking concerns in the market. According to CoinMarketCap data, XRP's trading volume came to $2 billion, a 66% drop over the last 24 hours.

While this might be concerning, it may not be far from the norm, given often less trading volume during the weekends.

Despite the drop in volume, XRP saw significant whale activity in the week just ended. Given that whales are still participating in the market, the drop in volume may not be so much cause for concern.

On Sept. 5, Whale Alert reported a move of 49,999,989 XRP worth $140,841,434 shifted between unknown wallets. A total of 250,000,000 XRP worth $703,901,147 was also transferred from Ripple to an unknown wallet. On Sept. 3, 50,000,010 XRP worth $140,699,855 was transferred from unknown wallet to an unknown new wallet.

Price warning?

The drop in volume might also be traders waiting on the sidelines to gain clarity in the new week before taking their positions, and might not necessarily be a price warning.

XRP's price is trading higher, up 3.03% in the last 24 hours to $2.89 despite the volume drop. XRP saw a significant surge to $2.92 in early Sunday session, extending its recovery from Sept. 1 low of $2.69.

A break and close above the daily SMA 50 at $3.04 might clear the path for a rise to $3.40 and then $3.66. On the other hand, a drop below $2.69 could cause XRP to drop toward $2.20.

In recent news, Bitwise has listed five new crypto ETPs on Six Swiss Exchange, including Bitwise Physical XRP ETP (GXRP) which allows investors to gain exposure to XRP in the same way that an ETF does.

Rumors swirled this week that Tether, the issuer of the world’s largest stablecoin, had begun selling its Bitcoin holdings in exchange for gold. The speculation spread after a YouTuber claimed that Tether’s quarterly reports showed a sharp drop in its Bitcoin stash. Tether’s leadership, along with key industry voices, says the story is false.

The Rumor Mill

The claims started with Clive Thompson, a YouTuber who analyzed Tether’s auditor BDO’s reports. He said that Tether’s Bitcoin holdings appeared to shrink between the first and second quarters of 2025.

On paper, that looked like a sell-off of more than 9,000 BTC. Thompson suggested the missing coins had been swapped for gold.

Samson Mow, CEO of Jan3, quickly pushed back on X. He argued that the drop had been misunderstood and that Tether had not sold.

What Really Happened

According to Mow, the decline was explained by Tether’s decision to move 19,800 BTC into its XXI initiative, a long-term investment arm.

Adjusting for those transfers, Tether actually ended the second quarter with more Bitcoin than it held at the end of the first quarter. By Mow’s calculations, Tether’s net position increased by at least 10,424 BTC once July’s movement was included.

“Seems everyone is desperate for bearish Bitcoin news these days,” Mow wrote. “Tether is mega bullish on Bitcoin on all metrics.”

CEO Paolo Ardoino Sets the Record Straight

Tether CEO Paolo Ardoino backed Mow’s explanation in his own statement on X.

“Correct. Tether did not sell any Bitcoin,” Ardoino said. “As Samson explained, it contributed part of its stash into XXI. While the world continues to get darker, Tether will continue to invest part of its profits into safe assets like Bitcoin, gold and land.”

Paolo Ardoino 🤖@paoloardoinoSep 07, 2025Correct.

Tether didn't sell any Bitcoin. As Samson says below, it contributed part of its stash into XXI.

While the world continues to get darker, Tether will continue to invest part of its profits into safe assets like Bitcoin, Gold and Land.

Tether is the Stable Company. https://t.co/4KxdeNEsOE

Ardoino stressed that Bitcoin remains at the center of Tether’s strategy. Profits will continue to be reinvested into Bitcoin, alongside gold and real estate, which the company views as reliable stores of value.

Why It Matters

Tether plays an outsized role in the crypto market. Its stablecoin USDT is one of the most traded assets worldwide, making the company’s investment decisions closely watched by traders and critics alike.

The conversation around crypto exchange-traded funds (ETFs) is no longer about if they will expand beyond Bitcoin and Ethereum, but when. Analysts say the U.S. Securities and Exchange Commission (SEC) is preparing to broaden the playing field, and if that happens, Wall Street could soon see a rush of new altcoin ETFs.

Which Tokens Are Ready?

According to Bloomberg ETF analyst James Seyffart, several tokens appear ready to fit within the SEC’s developing framework. These include well-established names such as Chainlink , Stellar , Bitcoin Cash , Avalanche , Litecoin , Polkadot , Solana , Dogecoin , and Shiba Inu .

Ripple’s XRP and Cardano’s ADA also look like strong candidates, thanks to their futures markets and relatively deep liquidity. Bitcoin and Ethereum, already ETF staples, would of course remain at the center of this ecosystem.

Seyffart explained that many of these tokens already meet what are known as “generic listing standards,” meaning they could be fast-tracked once approval is granted.

Lessons From Ethereum’s Slow Start

Still, there are lessons to be learned from the Ethereum ETF rollout. After the overwhelming success of Bitcoin ETFs, expectations for Ethereum products were sky-high. Instead, the Ethereum ETFs launched into a sluggish market last July and failed to generate significant inflows.

Part of the problem was timing. Wall Street advisers barely had time to understand Bitcoin ETFs before Ethereum was added to the mix. In addition, staking, a key feature of Ethereum, was not available in a traditional ETF wrapper. Seyffart says that once staking becomes formally allowed, demand could pick up sharply.

The analyst then said that if the SEC truly opens the ETF floodgates, Wall Street could see a quick expansion of altcoin investment products. But not every token will shine. Demand is likely to be concentrated in a handful of well-known assets such as Solana, XRP, and Cardano, with broader diversification coming through basket products.

Ripple & XRP: $6 billion transfers, ETF hype and record market activity

Ripple and XRP had a busy week marked by big on-chain movements, XRP ETF speculations and fresh activity on the ledger. This kept the third biggest cryptocurrency in the headlines as one of the most active assets in the market.

Key points:

Ripple's September escrow unlock was massive, with more than $6.08 billion worth of XRP moving across wallets. In a series of unlocks, 500 million XRP ($1.38 billion), 300 million XRP ($830 million) and 200 million XRP ($553 million) were shuffled on-chain. Ultimately, 700 million tokens were sent back to escrow, resulting in a net release of 300 million XRP, worth around $830 million at the beginning of the week.

In the meantime, XRP ETF speculation is back to center stage. Data from Polymarket puts the odds of approval at nearly 94%, and filings for seven different XRP-linked funds are now in the SEC’s pipeline. For Nate Geraci, an ETF veteran who predicted the launches of Bitcoin and Ethereum ETFs, expectations for demand are too low as institutional traction is already visible on CME. Just in August, futures linked to XRP hit an unprecedented milestone, becoming the fastest contracts ever to cross $1 billion in open interest.

However, skeptics point out that major players like BlackRock and Fidelity have avoided the XRP market, focusing instead on Bitcoin, Ethereum and most recently Solana.

Market activity has supported the overall buzz around the altcoin. In early September, XRP’s daily volume surged 44% to $6.57 billion, briefly reversing its price direction before falling back below $3. Currently, the token is at $2.84, down 22% from July’s peak of $3.65.

Bitcoin: $100,000 crash warnings, $400 million ETF outflows and cycle top debate

Bitcoin's week was filled with some serious drama. From the ominous warnings of a possible $100,000 slump to the recent data pointing to ETF products losing millions, it's been a wild ride. And as for the analysts, they are divided on whether this latest correction is a sign of a cycle top for the main cryptocurrency or just another reset.

Key points:

The most alarming headline came from Bloomberg's Mike McGlone, who suggested Bitcoin could lose as much as $100,000 if the market turns bearish. That call happened at the same time as the market rejected the $113,000 price point, which has now turned into a ceiling after a few failed attempts to break higher. After that, BTC dipped back down to the lower end of its current range, leaving investor sentiment a mixture of hope and uncertainty after the summer rally.

The ETF data didn't help. In just two days, there were $400 million in net outflows from spot Bitcoin funds, which erased gains made earlier in August. The drain raised questions about whether institutional demand is already fading or if the outflows are just a pause before September's macro events. Either way, the timing made the bearish stories that came up again this week seem more convincing.

But the outlook isn't one-sided as a counterargument popped up, saying that a price correction doesn't automatically mean a cycle top. Actually, history shows that these cycles often include sharp dips before going higher. Supporters of this view say that Bitcoin is still way above its July lows and that long-term on-chain metrics still look good.

Equities tied to Bitcoin treasuries also put pressure on the market. According to recent Bitwise data, companies with big BTC holdings are down 75% from their peak valuations. This shows that exposure to digital assets has been rough even for publicly traded firms. The slide makes it seem like institutional holders might still be having a hard time dealing with volatility, even though regulated products have launched.

Shiba Inu : Breakout patterns, "Sparktember" buzz and bearish crossroads

Popular meme coin Shiba Inu spent this week stuck in the same support zone, and the charts are showing a turning point that now may be only a few days away. The price was stable at around $0.0000123, with a floor at $0.00001159 and resistance just under $0.000013. The setup looks like a classic triangle that's about to run out of space.

Key points:

The pattern is clear on the daily chart. SHIB has been stuck between rising lows and falling highs, with volume drying up as both buyers and sellers step aside. That leaves the token waiting for a trigger. If the floor at $0.00001159 cracks, SHIB could slip toward the $0.000010 level, undoing months of support. However, a break higher through $0.000013 could open up the opportunity for bulls to reach $0.00001698 and potentially even the $0.00002052 zone, which has previously capped off other price surges.

The community's "Sparktember" theme maintained the mood despite a decline in network transactions and engagement on-chain. SHIB accounts on X promoted a calendar of slogans, all tied to the idea of a Q4 rebound.

The risk is that hype alone might not be enough. The technical pressure has been building, and the longer SHIB fails to clear the resistance, the greater the chance of a breakdown. Adding another zero to the SHIB price by dropping under $0.00001 would be a symbolic blow to sentiment, while a pivot higher could spark the first real move since midsummer.

For now, SHIB is still stuck at $0.0000123, but that won't last much longer. The breakout direction will decide if September lives up to its nickname or turns into another failed setup.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up