Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Nasdaq-listed SharpLink Gaming (SBET) acquired an additional 24,371 ETH on Monday, accelerating its ether accumulation strategy as the crypto market extends its bull run.

According to data from Arkham Intelligence, Ethereum worth $73.25 million was transferred from a hot wallet on Coinbase Prime to SharpLink Gaming's address.

The hot wallet's transfer records on the data platform show active transaction activity with Coinbase Prime deposits and other crypto addresses, involving Ether, Shiba Inu, and Uniswap (UNI).

Monday's Ether acquisition follows two recent purchases: 16,374 ETH on Sunday and 21,487 ETH on Friday evening. In total, SharpLink has added 62,232 ETH over the past four days, valued at around $186.4 million based on current market prices.

SharpLink did not immediately respond to The Block's request for confirmation of the ETH purchase and its current ETH holdings.

Originally a Minneapolis-based affiliate-marketing and iGaming software firm, SharpLink began its Ethereum treasury strategy in late May alongside a $425 million private placement led by crypto infrastructure developer Consensys. Joseph Lubin, Consensys CEO and Ethereum co-founder, became chairman of SharpLink.

SharpLink has so far accumulated around 294,000 ETH to date and has staked 74,464 ETH, EmberCN reported citing onchain data.

According to The Block's Ethereum price page, ether rose 0.9% in the past 24 hours to $2,970. The cryptocurrency briefly traded above $3,000 earlier on Monday, marking its first time above that level since Feb. 1. SharpLink's stock closed up 10.3% at $23.88 on Monday, up 78% in the past month, according to Google Finance data.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Nasdaq-listed Bit Digital, which recently launched its Ethereum treasury strategy, plans to raise $67.3 million through a direct offering of 22 million ordinary shares to institutional investors, with the proceeds intended for purchasing ether.

In a statement released Monday, Bit Digital said the shares are priced at $3.06 each, with B. Riley Securities acting as the placement agent. The offering is expected to close on or around July 15, according to the company.

"The Company intends to use the net proceeds from the proposed offering to purchase Ethereum," said Bit Digital.

The latest planned offering follows Bit Digital's announcement last week that it had converted its entire bitcoin treasury to ether. As of July 7, the company held approximately 100,603 ETH, valued at around $301 million based on current market prices.

Bit Digital is a crypto infrastructure company, providing services that encompass validator operations, enterprise-level custody, and yield optimization. It began accumulating and staking ether in 2022.

Meanwhile, in a Monday filing with the Securities and Exchange Commission, the company disclosed that its preliminary estimated revenue for the second quarter ranges between $24.3 million and $26.9 million.

Bit Digital's stock closed down 1.2% at $3.29 on Monday, according to Yahoo Finance data. The shares are up 32.1% over the past month.

Ether edged up 0.6% to $2,991 at the time of writing, rising 18.3% over the past week amid a broader crypto rally, according to The Block's Ethereum price page. Bitcoin, meanwhile, inched down 0.1% at $118,852.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

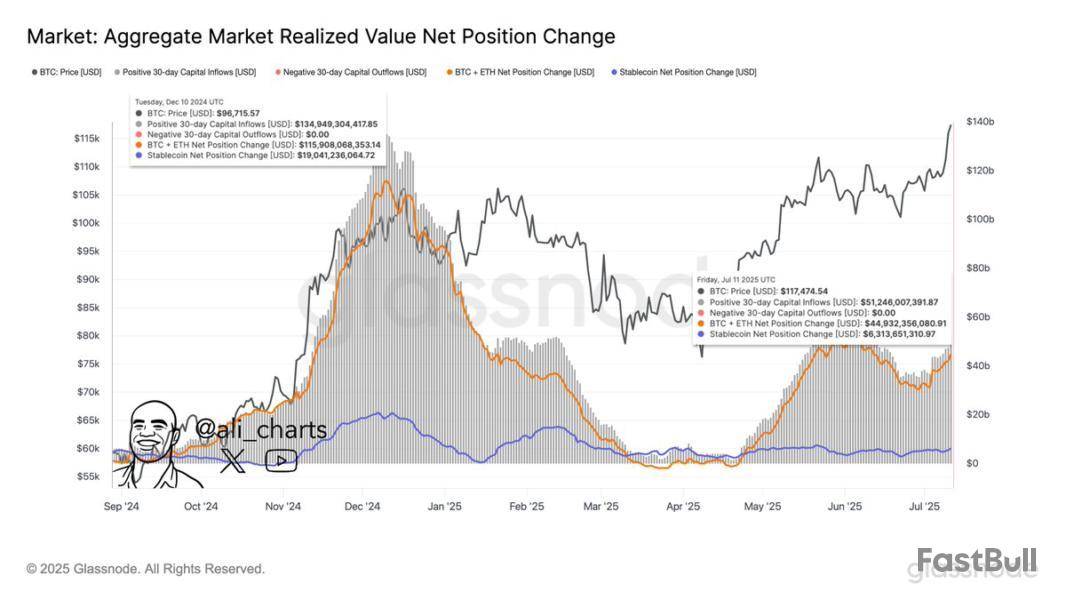

Bitcoin has set a new all-time high (ATH) around $123,000, but cryptocurrency market inflows are still far from the peak observed back in 2024.

Crypto Capital Inflows Are Currently Sitting At $51 Billion

As pointed out by analyst Ali Martinez in a new post on X, there is a stark difference in capital participation between the current Bitcoin rally and the one from December 2024.

Below is the chart shared by the analyst that compares the two bull runs.

The graph captures the 30-day capital flows occurring for Bitcoin, Ethereum, and the stablecoins. For the former two assets, it tracks them using the Realized Cap indicator.

The Realized Cap is a capitalization model that calculates a given cryptocurrency’s total value by assuming that each coin in the circulating supply has its value equal to the last time it changed hands on the network. In short, what the metric represents is the amount of capital that investors of the asset as a whole have put into it.

Changes in this indicator, therefore, correspond to the entry or exit of capital into the network. As is visible in the chart, the 30-day Realized Cap change for Bitcoin and Ethereum (colored in orange) has gone up alongside the latest price rally, indicating that capital has flowed into these coins.

It’s also apparent that stablecoin flows (blue) have also noted an uptick, although the scale has been smaller. For stables, capital flow can be directly measured using the market cap, since their price is always pegged to $1 means that the Realized Cap never differs from the market cap.

In the cryptocurrency sector, capital mainly comes in through three entry points: Bitcoin, Ethereum, and stablecoins. The altcoins usually only receive a rotation of capital from these assets. Since the flows related to the three have recently been positive, the market as a whole has been getting an injection of capital.

In total, the aggregate capital inflows for the cryptocurrency sector have stood at $51.2 billion for the past month. This is certainly a sizeable figure on its own, but it pales in comparison to what was witnessed before.

As Martinez has highlighted in the chart, the monthly capital flows peaked at almost $135 billion in the December 2024 Bitcoin rally above $100,000, more than double the latest number.

Something to keep in mind, however, is the fact that the previous run was more explosive, while the latest one has come in two waves: an initial recovery surge above $100,000 that led into a consolidation phase and the current breakout into the $120,000 levels. This could, at least in part, explain why the metric has appeared relatively cool recently.

Bitcoin Price

At the time of writing, Bitcoin is trading around $121,700, up nearly 3% over the last 24 hours.

Bitcoin has reached new milestones this week, briefly breaking above the $123,000 mark earlier today before retracing slightly to $121,812 at the time of writing. This follows a week of strong gains, with BTC rising by more than 10% amid a broader uptrend in the cryptocurrency market.

Despite the minor pullback, market analysts are closely monitoring on-chain and derivatives data to assess whether momentum is building toward a more aggressive phase of the rally.

The recent surge has also benefited the broader cryptocurrency ecosystem, lifting total global crypto market capitalization to just under $4 trillion.

While Bitcoin continues to dominate in terms of volume and influence, sentiment metrics suggest that traders and investors may still be approaching with measured optimism. According to analysts, several indicators are now pointing to a potential shift in market dynamics that could influence Bitcoin’s next major move.

Market Euphoria Not Yet Confirmed

CryptoQuant contributor Joao Wedson has offered insights into the current structure of the Bitcoin market through an analysis of the price gap between spot and perpetual futures contracts on Binance.

In a recent QuickTake post, Wedson noted that the spot price of Bitcoin continues to outpace the perpetual futures price, a sign that market sentiment has not yet tipped into full euphoria. Historically, a positive gap between the two markets has signaled increased speculative activity and the onset of parabolic rallies.

“The gap is still in negative territory,” Wedson stated, “but the narrowing trend indicates that sentiment may be transitioning from cautious to more optimistic.”

The analysis implies that traders in the futures market have yet to aggressively price in further upside, possibly waiting for stronger confirmation before deploying leverage. Should this gap flip to positive territory, it could be interpreted as a sign of increased risk appetite, potentially fueling a sharper upward move.

Wedson also emphasized the importance of monitoring how derivatives markets respond in the coming days. “If the trend continues and flips positive, we could see a more intense phase of the rally driven by leveraged traders,” he wrote.

Until then, the current environment appears to reflect a market in the process of building a foundation, rather than one that has already entered a euphoric phase.

Bitcoin Profit-Taking Remains Measured

In another analysis, CryptoQuant’s Enigma Trader examined the Spent Output Profit Ratio (SOPR), a key indicator used to evaluate the extent of realized profits by Bitcoin holders.

According to the post, SOPR levels have remained moderately above 1 as BTC hit new highs, suggesting that some profit-taking is occurring, but not at a rate that disrupts the broader trend. The analyst observed that a spike in SOPR around July 3–4 coincided with short-term holders taking profits.

However, this activity did not result in significant downward pressure on price. “This behavior points to a healthy price discovery process,” Enigma Trader noted, adding that such conditions typically support continued upward movement when demand remains intact.

Featured image created with DALL-E, Chart from TradingView

The price of Bitcoin has gone into overdrive, producing the kind of relentless breakout that investors and traders hope for. The last few weeks have seen Bitcoin smash through all significant resistance levels on its way to setting new all-time highs, leaving analysts frantically trying to determine where this move might ultimately stall.

As of press time, Bitcoin is trading above $122,000 an incredible amount that demonstrates how rapidly market sentiment can shift to euphoria when the biggest cryptocurrency in the world gains traction. The price alone is not the most remarkable feature of this rally; the complete lack of any lingering technical resistance is. Now that every previous ceiling has been broken, Bitcoin is in uncharted territory with no supply zones from the past left to consistently cap upside. Chart by TradingView">

Given this dynamic, $150,000 is the next psychological target paving the way toward further parabolic growth. Increased trading volumes, sustained spot buying and a rising RSI that indicates strong bullish conviction all support the current move. Although some may consider the overbought signals to be alarming, it is important to keep in mind that breakouts to all-time highs frequently feed off one another, with momentum traders piling in, short sellers giving up and sidelined capital eventually being drawn into the rally.

The most significant conclusion is that there are no obvious technical obstacles that could obstruct Bitcoin's growth. BTC now only faces the boundaries of buyer enthusiasm and market liquidity, as opposed to previous rallies when several resistance levels were stacked overhead.

Simply put, exhaustion — the point at which the surge of demand eventually subsides and profit-taking quickens — is the only thing that is likely to halt this breakout. Bitcoin appears poised to keep rising toward $150,000 until that time comes. While investors should continue to exercise caution, there is no denying that the current breakout is among the most significant and potent in the asset's history.

XRP's aggressive stance

As buyers aggressively distribute their funds, XRP almost reached the long-awaited $3 level. However, there is a price for this surge: the relative strength index (RSI) is now firmly entrenched in the overbought zone, indicating that the rally may be losing steam.

The RSI has crossed over 83 on the daily chart, which is a level that usually indicates an overheated market. Simply put, there are no more buyers willing to push XRP's price higher, especially since trading volumes are not accelerating significantly enough to support this final leg up.

As traders lock in profits and sentiment cools, there is a serious chance that XRP will experience a corrective pullback if it does not break above $3 in the upcoming days. Technically speaking, $3 is the line in the sand. Bulls' next logical upside target will appear around $3.30 if they can recover and hold this resistance.

This scenario, however, is dependent on a resurgence of purchasing fervor, which has not happened on a large scale yet. A retracement back toward the $2.40-$2.60 range is more likely if there is not enough volume to support the push. It is crucial to realize that overbought readings frequently signal a pause or correction but do not always indicate an instant reversal.

In particular, if XRP consolidates below $3 for an extended period of time and the overbought conditions worsen, market participants should brace themselves for increased volatility. In the medium term, XRP is still technically bullish, but the short-term setup is stretched.

This rally runs the risk of stalling and reversing some of the recent gains unless buyers move decisively to confidently clear the $3 resistance. The first indicators that the tide is turning will be volume and RSI, so investors should keep a close eye on these metrics.

SHIB needs more

Even the most fundamental milestones are being difficult for Shiba Inu to surpass while Bitcoin recently broke through its all-time high. The underperformance of many altcoins and Bitcoin's historic rally are starkly different as the meme coin has failed to rise above the three-month high it set back in May.

SHIB's price has been trying to move above the $0.00001450 resistance level, which it tested several times in the spring from a technical standpoint. Nevertheless, despite Bitcoin's spectacular surge above $120,000, SHIB is still constrained by this barrier and only records slight gains in comparison to the general market frenzy.

It is difficult to overlook the difference: SHIB simply moved sideways when Bitcoin reached all-time highs, unable to capitalize on the bullish sentiment that usually boosts speculative assets.

There is some potential in the current configuration. SHIB may be able to move toward the psychological $0.000018 level and beyond if it can eventually overcome this obstinate ceiling. Traders should, however, maintain realism. Bitcoin's corrections since the beginning of the year have not moved money into the altcoin, as many expected.

Rather than providing cash for speculative runs, each BTC retracement has typically pulled altcoins down in lockstep. This suggests that the market is still very focused on Bitcoin. Institutional flows are mainly staying with the majors like Bitcoin and Ethereum, as is seen by the lack of a significant capital rotation into smaller coins like SHIB.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up