Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

SafePal will conduct an AMA on X on July 31st at 9:15 UTC with participation from Reown and SafePal to address accessibility and user-experience considerations for Bitcoin DAOs, the role of wallet diversity in decentralization, and the ways AppKit, in conjunction with SafePal, enables broader user participation.

SFP Info

SafePal is a cryptocurrency wallet that aims to provide a secure and user-friendly crypto asset management platform for the masses. SafePal provides hardware wallet and software wallet product lines, all paired and managed through the SafePal App, where users can easily store, manage, swap, trade, and grow their crypto wealth.

Nami Index has confirmed that the TCY asset is ready to launch alongside the upcoming THORChain 3.9 upgrade, which is scheduled for release on July 31st. The deployment will proceed in phases, starting slowly before a full rollout.

RUNE Info

THORChain is a decentralized liquidity protocol that enables users to easily exchange cryptocurrency tokens over the network without the need for intermediaries. This is achieved by creating a liquidity pool that automatically establishes prices and provides liquidity for trading.

The key feature of THORChain is its ability to facilitate secure, fast, and reliable cross-chain asset operations. This means that users can directly exchange one cryptocurrency for another, even if they exist on different blockchains.

The RUNE token in THORChain is used as collateral for validators in the network and to ensure liquidity in the liquidity pools.

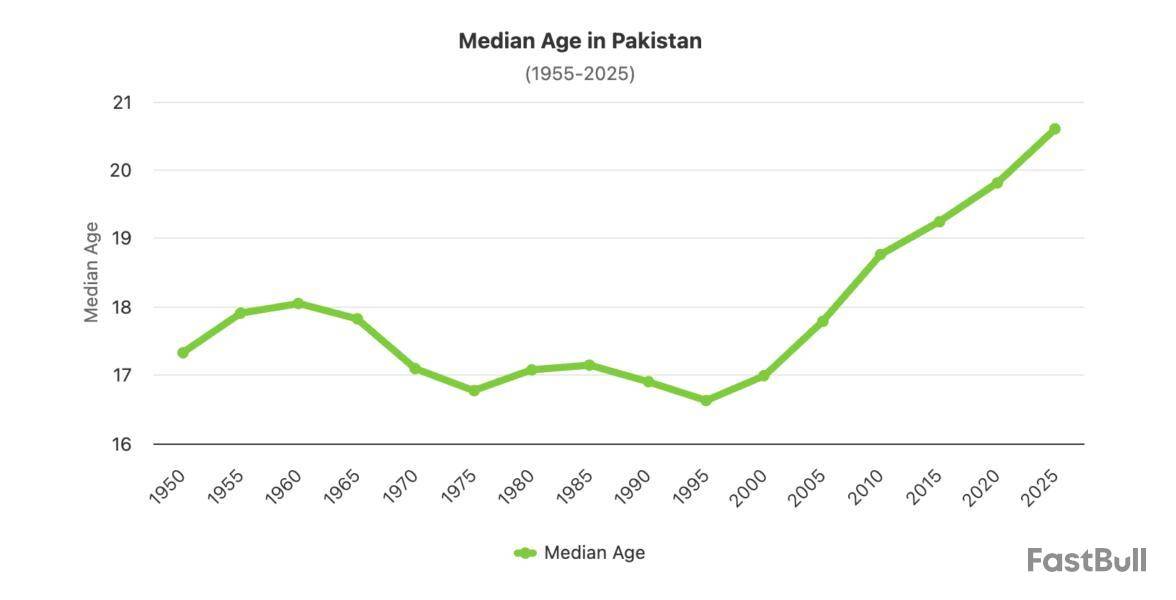

Pakistan’s demographics position the country as a major catalyst for Bitcoin adoption, allowing it to “leapfrog” developed nations, according to Bilal Bin Saqib, Pakistan’s state minister of crypto and blockchain.

“A global policy shift has happened, not just in Pakistan, but all around the world,” Bin Saqib told Cointelegraph in an exclusive interview. The government of Pakistan moved to regulate crypto in November 2024.

The country has 40 million crypto wallets and is one of the “top five” countries in terms of crypto adoption, which the minister attributed to Pakistan’s young demographic. He told Cointelegraph:

“Emerging markets are what will leapfrog the adoption of these new technologies,” the minister said, with smaller countries more likely to adopt Bitcoin due to their nimble size, allowing them to front-run developed countries. “It's easier to make a speedboat move than the Titanic,” Bin Saqib added.

Collaborative partnership with El Salvador for Bitcoin development

Pakistan and El Salvador signed a letter of intent in July to share education and knowledge about Bitcoin, digital asset infrastructure, and energy development for crypto mining, the minister said.

“The cooperation is essentially based on how emerging economies that are both under the IMF program can leverage technology and other financial instruments for national growth,” he told Cointelegraph.

Pakistan’s National Crypto Council and other regulatory bodies are seeking input on a comprehensive regulatory framework for digital assets, licensing crypto exchanges, developing a strategic Bitcoin reserve, launching a stablecoin, and mining Bitcoin using excess energy, the minister said.

Mining Bitcoin with excess and runoff energy sources

“Pakistan has a very interesting problem. We have excess electricity, which we pay capacity charges for,” the minister told Cointelegraph.

He said the country has up to 10,000 megawatts (MW) of excess energy, which is a “liability” due to the carrying costs of the electricity.

Bin Saqib said the country is allocating 2,000 MW for Bitcoin mining and AI data centers. The government is also exploring the potential to mine BTC with runoff energy from methane and other excess or stranded power sources, he added.

Bit Digital, a Nasdaq-listed crypto firm, is deepening its commitment to Ethereum as it pivots from its previous Bitcoin-centric operations.

In a July 25 filing with the US Securities and Exchange Commission (SEC), the company proposed a significant increase in authorized share capital, from 340 million to 1 billion ordinary shares.

Bit Digital Proposes $10 Million Raise to Expand Ethereum Reserves

According to the filing, the new capital will primarily fund Ethereum acquisitions. The firm stated that its goal is to raise approximately $10 million, with a shareholder vote scheduled for September 10.

The company also clarified that proceeds from the proposed share issuance will support broader corporate initiatives, including mergers and acquisitions, employee compensation, dividend distributions, and general operations.

Bit Digital believes that its current share capital structure restricts its ability to scale, particularly in alignment with its long-term growth strategy centered around Ethereum.

This proposal reflects a dramatic transformation in the company’s strategic direction. Once known for its Bitcoin mining business, Bit Digital now views Ethereum as a core treasury asset.

Earlier in July, the firm sold 280 Bitcoin from its reserves, reallocating roughly $172 million to boost its Ethereum holdings.

Following this move, Bit Digital’s Ethereum balance surged from 24,434 ETH to over 100,600 ETH. An additional purchase of 19,683 ETH on July 18 further lifted its total to approximately 120,306 ETH.

This places it among the top 10 Ethereum treasury reserve holders, behind SharpLink and BitMine. Cumulatively, these kinds of firms hold more than 2.3 million ETH, valued at nearly $9 billion.

Nonetheless, Bit Digital’s aggressive accumulation strategy demonstrates the company’s growing conviction in Ethereum’s future.

“ETH can offer a rare combination of capital appreciation and native yield, making it an institutional titan. Its value is reinforced by strong onchain utility and a global community of developers. No other asset, including BTC, matches the depth of its ecosystem and built-in earning potential,” Bit Digital stated.

Beyond Ethereum accumulation, the company actively stakes its holdings and operates Ethereum validators, transforming its treasury into a yield-generating asset base.

Stafi will conduct an AMA on X on July 29th at 13:00 UTC to address the implications of listing FIS on the Hyperliquid platform.

The event will allocate a total of 500 FIS in rewards and will focus on outlining the prospective advantages for the community.

Refer to the official tweet by FIS:

StaFi Protocol@StaFi_ProtocolJul 24, 2025🎙Join StaFi X Space AMA👇$FIS On @HyperliquidX: What's the real benefit for the community?

🗓 Date: 1PM UTC, July 29, 2025

🎁 500 $FIS in rewards

📜 AMA Rules:

1ï¸âƒ£ Follow @StaFi_Protocol

2ï¸âƒ£ Join our Discord: https://t.co/e8N9kfjlJq

3ï¸âƒ£ Like & Repost… pic.twitter.com/GAwPnrMxnP

FIS Info

StaFi (Staking Finance) is the world’s first decentralized platform designed to solve the problem of liquidity in the staking process. The project was created on the basis of blockchain technology and implements a number of innovative solutions in the field of financial services.

Main features and characteristics of StaFi:

rToken: A token which is a standard token used for staking. When a user stakes via StaFi, they receive an rToken in exchange for the staked tokens. rToken can provide liquidity while the underlying token continues to be staked.

Liquidity in staking: One of the main problems with staking is that the staked tokens become unavailable for trading or other transactions. StaFi allows users to get around this problem by providing them with rTokens that can be freely traded or used in other applications.

Security: StaFi uses a number of mechanisms to keep user funds safe, including a decentralized validation model and special punishment schemes for unscrupulous validators.

Network Diversity: StaFi supports staking for a variety of blockchain networks, including Ethereum, Polkadot, Cosmos, and more.

The FIS Token is a native token of the StaFi platform that allows holders to participate in the governance of the ecosystem by voting on key proposals. The token serves as collateral for validators to secure the network, and is also used to pay fees, incentivize participants, and provide liquidity in DeFi applications.

Litecoin will hold a live stream on July 26th at 23:00 UTC.

The event is expected to feature the founder, Charlie Lee, manager, Alan Austin.

LTC Info

Litecoin is a peer-to-peer cryptocurrency that was created by Charlie Lee, a former Google engineer, and was launched in 2011 as an alternative to Bitcoin. It is often referred to as the "silver" to Bitcoin's "gold" due to its similarities to Bitcoin but with some key differences.

Like Bitcoin, Litecoin operates on a decentralized network using blockchain technology. It allows users to make secure, fast, and low-cost transactions directly between parties without the need for intermediaries such as banks. Litecoin transactions are verified by network nodes through cryptography and recorded on the blockchain.

One significant difference between Litecoin and Bitcoin is the hashing algorithm used for mining. Litecoin utilizes a different hashing algorithm called Scrypt, which requires less computational power and allows for faster block generation times. As a result, Litecoin transactions are typically confirmed more quickly compared to Bitcoin.

Another difference is the total supply of coins. While Bitcoin has a maximum supply of 21 million coins, Litecoin has a maximum supply of 84 million coins. This higher supply and faster block generation make Litecoin more suitable for smaller transactions and everyday use.

Litecoin has gained popularity for its efficient transaction processing, lower fees, and strong community support. It has been integrated into various payment systems and is accepted by numerous merchants as a form of payment. Additionally, Litecoin has been used as a testing ground for implementing new features and technologies, such as Segregated Witness (SegWit) and the Lightning Network, which aim to improve scalability and enhance the overall functionality of cryptocurrencies.

Overall, Litecoin serves as a digital currency that provides a faster and more lightweight alternative to Bitcoin, with a focus on everyday transactions and wider adoption in the cryptocurrency ecosystem.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up