Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

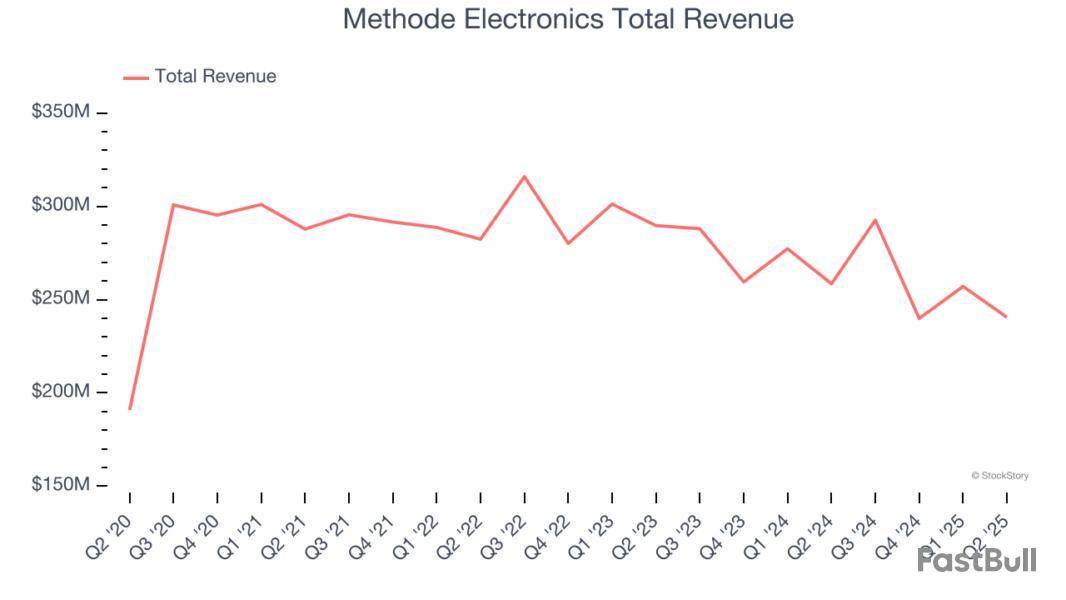

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Methode Electronics and its peers.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 13 electrical systems stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was 2.4% below.

Thankfully, share prices of the companies have been resilient as they are up 8.8% on average since the latest earnings results.

Founded in 1946, Methode Electronics is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Methode Electronics reported revenues of $240.5 million, down 7% year on year. This print exceeded analysts’ expectations by 10.8%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Management CommentsPresident and Chief Executive Officer Jon DeGaynor said, “The Methode transformation journey made further progress in the quarter and is firmly on track, as we continued to reduce costs and improve execution. A $9 million increase in operating income on $18 million in lower sales is clear evidence of that progress. Our data center business grew again and remains on pace for a strong year. The overall business delivered strong free cash flow for the third quarter in a row, and we have now reduced our net debt by $41 million over the last three quarters.”

Interestingly, the stock is up 7.7% since reporting and currently trades at $8.07.

Is now the time to buy Methode Electronics? Access our full analysis of the earnings results here, it’s free.

Enhancing commercial environments, LSI provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $155.1 million, up 20.2% year on year, outperforming analysts’ expectations by 11.6%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 16.7% since reporting. It currently trades at $22.52.

Is now the time to buy LSI? Access our full analysis of the earnings results here, it’s free.

Credited with introducing the first automatic washing machine, Whirlpool is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $3.77 billion, down 5.4% year on year, falling short of analysts’ expectations by 3%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 8.2% since the results and currently trades at $89.85.

Read our full analysis of Whirlpool’s results here.

Aiming to wrap technology and data around a historically manual and paper-based industry, Verra Mobility (NYSE:VRRM) is a leading provider of smart mobility technology to address tolls and violations, title and registration services, as well as safety and traffic enforcement.

Verra Mobility reported revenues of $236 million, up 6.1% year on year. This result beat analysts’ expectations by 1.3%. More broadly, it was a mixed quarter as it also logged a decent beat of analysts’ EBITDA estimates.

The stock is down 2.7% since reporting and currently trades at $24.23.

Read our full, actionable report on Verra Mobility here, it’s free.

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

Kimball Electronics reported revenues of $380.5 million, down 11.6% year on year. This number topped analysts’ expectations by 14.2%. It was an exceptional quarter as it also logged a beat of analysts’ EPS and EBITDA estimates.

Kimball Electronics delivered the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 51.6% since reporting and currently trades at $31.84.

Read our full, actionable report on Kimball Electronics here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

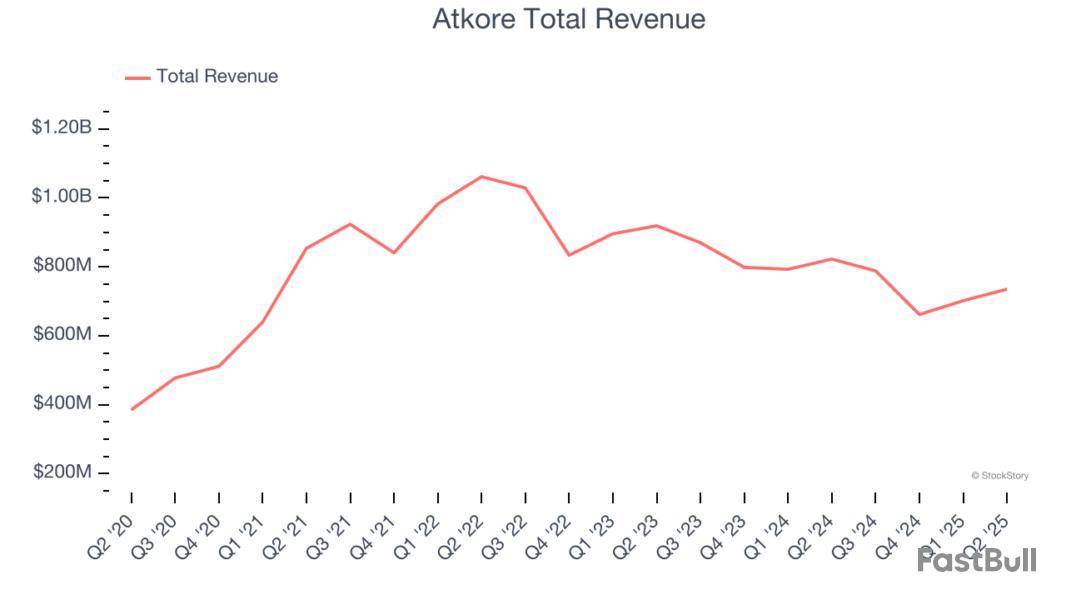

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Atkore and its peers.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 13 electrical systems stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was 2.4% below.

Thankfully, share prices of the companies have been resilient as they are up 6.2% on average since the latest earnings results.

Protecting the things that power our world, Atkore designs and manufactures electrical safety products.

Atkore reported revenues of $735 million, down 10.6% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates and full-year EBITDA guidance slightly missing analysts’ expectations.

“Atkore delivered another strong quarter of financial results, achieving Net Sales, Adjusted EBITDA and Adjusted EPS towards the top end of the ranges we presented during our last earnings call in May,” commented Bill Waltz, Atkore’s President and Chief Executive Officer.

Unsurprisingly, the stock is down 23.6% since reporting and currently trades at $58.50.

Read our full report on Atkore here, it’s free.

Enhancing commercial environments, LSI provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $155.1 million, up 20.2% year on year, outperforming analysts’ expectations by 11.6%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 17.8% since reporting. It currently trades at $22.74.

Is now the time to buy LSI? Access our full analysis of the earnings results here, it’s free.

Credited with introducing the first automatic washing machine, Whirlpool is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $3.77 billion, down 5.4% year on year, falling short of analysts’ expectations by 3%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 3.5% since the results and currently trades at $94.43.

Read our full analysis of Whirlpool’s results here.

Founded in 1980, Sanmina is an electronics manufacturing services company offering end-to-end solutions for various industries.

Sanmina reported revenues of $2.04 billion, up 10.9% year on year. This result beat analysts’ expectations by 3.1%. Aside from that, it was a mixed quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EBITDA estimates.

The stock is up 19% since reporting and currently trades at $117.01.

Read our full, actionable report on Sanmina here, it’s free.

Aiming to wrap technology and data around a historically manual and paper-based industry, Verra Mobility (NYSE:VRRM) is a leading provider of smart mobility technology to address tolls and violations, title and registration services, as well as safety and traffic enforcement.

Verra Mobility reported revenues of $236 million, up 6.1% year on year. This number surpassed analysts’ expectations by 1.3%. Zooming out, it was a mixed quarter as it also logged a decent beat of analysts’ EBITDA estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 2% since reporting and currently trades at $24.42.

Read our full, actionable report on Verra Mobility here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

What Happened?

A number of stocks fell in the afternoon session after concerns about the health of the U.S. economy grew following a significant downward revision of job market data.

The Labor Department reported that employers added 911,000 fewer jobs from April 2024 through March than initially estimated. These "benchmark revisions" are issued annually to more accurately account for new and defunct businesses. The report detailed that the leisure and hospitality sector added 176,000 fewer jobs, professional and business services 158,000 fewer, and retailers 126,000 fewer. This weaker-than-expected data has fueled investor anxiety, as it suggests businesses may be becoming more reluctant to hire amid economic uncertainty. The numbers issued are preliminary, with final revisions scheduled for February 2026.

JPMorgan Chase CEO Jamie Dimon added that the U.S. economy is "weakening," though he stopped short of predicting a recession. "Whether it's on the way to recession or just weakening, I don't know," he said. Dimon's remarks are closely watched, given his influence as head of one of the nation's largest banks.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On The Toro Company (TTC)

The Toro Company’s shares are not very volatile and have only had 4 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The previous big move we wrote about was 15 days ago when the stock gained 4.8% on the news that it received analyst upgrades from both DA Davidson and Longbow Research. DA Davidson raised its rating on the lawn care equipment manufacturer to Buy from Neutral, setting a price target of $93. The firm cited several positive factors, including strong late-spring sales according to dealer data and favorable trends in the company's residential segment. Additionally, a DA Davidson survey of golf courses suggests a promising 2025 season for Toro. Separately, Longbow Research also upgraded the stock to Buy from Neutral, assigning a higher price target of $100. The upgrades reflect a more positive outlook on improving market conditions ahead of Toro's upcoming earnings call next week.

The Toro Company is down 0.2% since the beginning of the year, and at $78.89 per share, it is trading 10.8% below its 52-week high of $88.44 from December 2024. Investors who bought $1,000 worth of The Toro Company’s shares 5 years ago would now be looking at an investment worth $967.62.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up