Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Looking back on consumer subscription stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Netflix and its peers.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer subscription stocks have performed well with share prices up 25.5% on average since the latest earnings results.

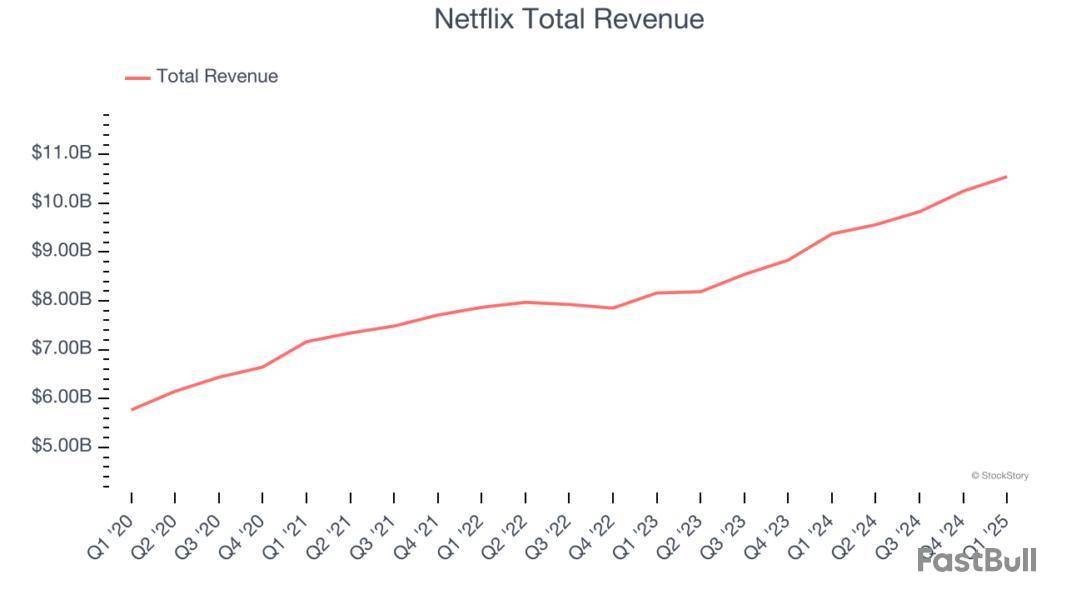

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix is a pioneering streaming content platform.

Netflix reported revenues of $10.54 billion, up 12.5% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 31% since reporting and currently trades at $1,278.

We think Netflix is a good business, but is it a buy today? Read our full report here, it’s free.

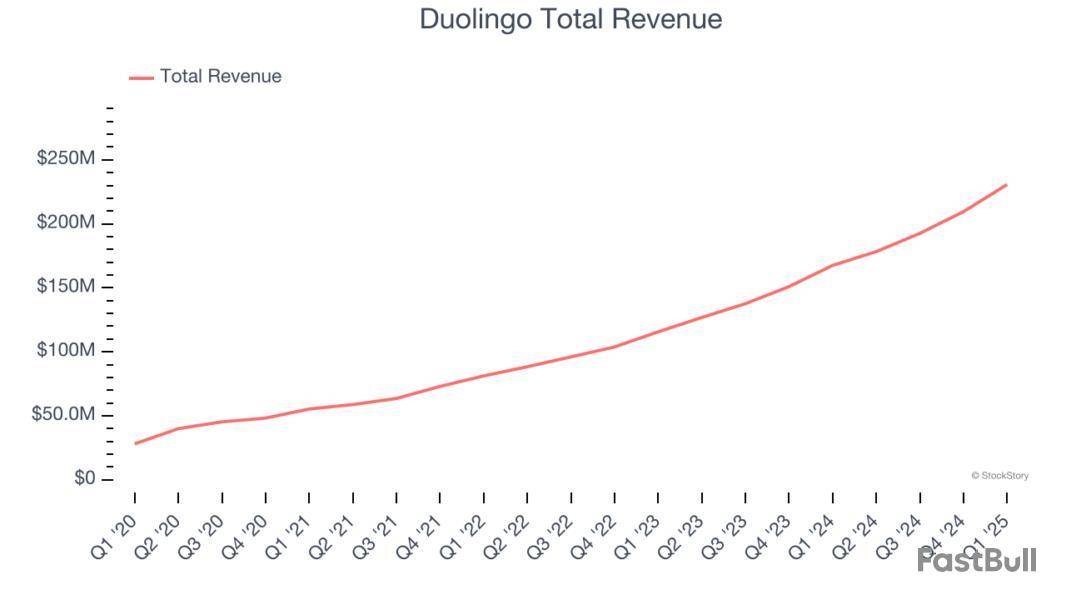

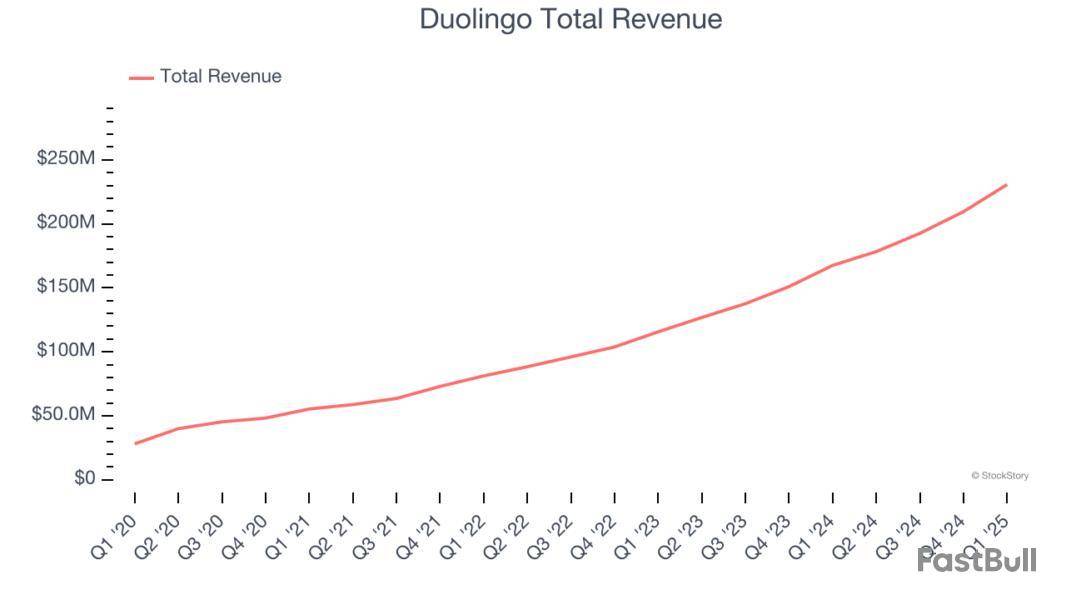

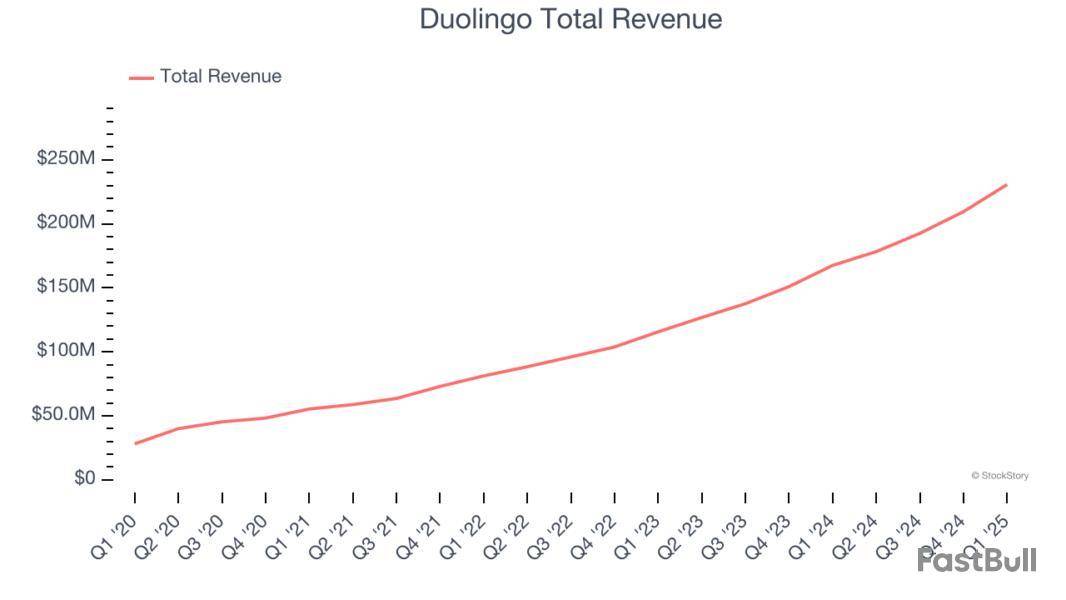

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo is a mobile app helping people learn new languages.

Duolingo reported revenues of $230.7 million, up 37.7% year on year, outperforming analysts’ expectations by 3.4%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Duolingo pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The company reported 130.2 million users, up 33.4% year on year. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $401.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it’s free.

Spun out from Netflix, Roku makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $1.02 billion, up 15.8% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 25.1% since the results and currently trades at $84.20.

Read our full analysis of Roku’s results here.

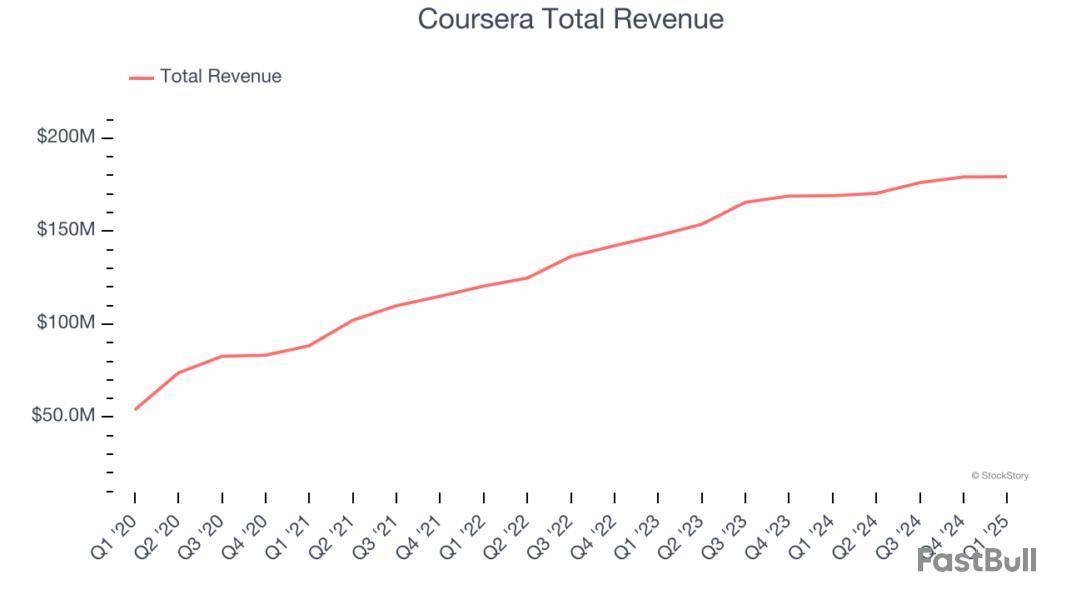

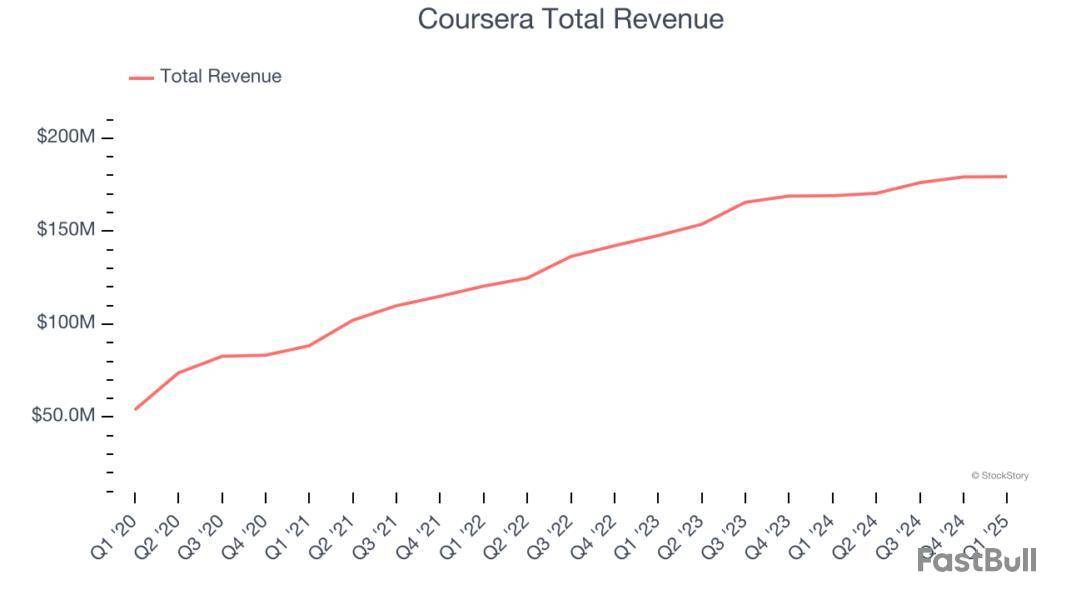

Founded by two Stanford University computer science professors, Coursera is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $179.3 million, up 6.1% year on year. This result beat analysts’ expectations by 2.3%. Overall, it was a strong quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations.

The company reported 175.3 million active customers, up 18% year on year. The stock is up 10.8% since reporting and currently trades at $8.51.

Read our full, actionable report on Coursera here, it’s free.

With courses ranging from investing to cooking to computer programming, Udemy is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Udemy reported revenues of $200.3 million, up 1.8% year on year. This print surpassed analysts’ expectations by 1.5%. It was a strong quarter as it also put up EBITDA guidance for next quarter exceeding analysts’ expectations.

Udemy had the weakest full-year guidance update among its peers. The company reported 17,216 active buyers, up 7.1% year on year. The stock is flat since reporting and currently trades at $6.85.

Read our full, actionable report on Udemy here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how consumer subscription stocks fared in Q1, starting with Coursera .

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer subscription stocks have performed well with share prices up 24.5% on average since the latest earnings results.

Founded by two Stanford University computer science professors, Coursera is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $179.3 million, up 6.1% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

“Stepping into the role of CEO of Coursera, a company at the forefront of transforming learning, has been thrilling. We welcomed more than seven million new learners, marking a first quarter record and underscoring the global demand for job-relevant skills and trusted education,” said Coursera CEO Greg Hart.

The stock is up 8.9% since reporting and currently trades at $8.36.

Is now the time to buy Coursera? Access our full analysis of the earnings results here, it’s free.

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo is a mobile app helping people learn new languages.

Duolingo reported revenues of $230.7 million, up 37.7% year on year, outperforming analysts’ expectations by 3.4%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Duolingo achieved the fastest revenue growth and highest full-year guidance raise among its peers. The company reported 130.2 million users, up 33.4% year on year. The market seems happy with the results as the stock is up 17.9% since reporting. It currently trades at $471.57.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it’s free.

Spun out from Netflix, Roku makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $1.02 billion, up 15.8% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a slower quarter as it posted a slight miss of analysts’ number of total hours streamed estimates and a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 20.3% since the results and currently trades at $80.99.

Read our full analysis of Roku’s results here.

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix is a pioneering streaming content platform.

Netflix reported revenues of $10.54 billion, up 12.5% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The company reported 305.6 million users, up 13.3% year on year. The stock is up 26.2% since reporting and currently trades at $1,231.

Read our full, actionable report on Netflix here, it’s free.

With courses ranging from investing to cooking to computer programming, Udemy is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Udemy reported revenues of $200.3 million, up 1.8% year on year. This result topped analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

Udemy had the weakest full-year guidance update among its peers. The company reported 17,216 active buyers, up 7.1% year on year. The stock is up 2.9% since reporting and currently trades at $7.08.

Read our full, actionable report on Udemy here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Looking back on consumer subscription stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Duolingo and its peers.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer subscription stocks have performed well with share prices up 24.5% on average since the latest earnings results.

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo is a mobile app helping people learn new languages.

Duolingo reported revenues of $230.7 million, up 37.7% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Duolingo pulled off the fastest revenue growth and highest full-year guidance raise of the whole group. The company reported 130.2 million users, up 33.4% year on year. Unsurprisingly, the stock is up 17.9% since reporting and currently trades at $471.57.

Founded by two Stanford University computer science professors, Coursera is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $179.3 million, up 6.1% year on year, outperforming analysts’ expectations by 2.3%. The business had a strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 8.9% since reporting. It currently trades at $8.36.

Is now the time to buy Coursera? Access our full analysis of the earnings results here, it’s free.

Spun out from Netflix, Roku makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $1.02 billion, up 15.8% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 20.3% since the results and currently trades at $80.99.

Read our full analysis of Roku’s results here.

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix is a pioneering streaming content platform.

Netflix reported revenues of $10.54 billion, up 12.5% year on year. This print was in line with analysts’ expectations. It was a strong quarter as it also produced EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The company reported 305.6 million users, up 13.3% year on year. The stock is up 26.2% since reporting and currently trades at $1,231.

Read our full, actionable report on Netflix here, it’s free.

Started as a physical textbook rental service, Chegg is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $121.4 million, down 30.4% year on year. This result topped analysts’ expectations by 5.8%. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but a decline in its users.

Chegg achieved the biggest analyst estimates beat but had the slowest revenue growth among its peers. The company reported 3.19 million users, down 31.5% year on year. The stock is up 103% since reporting and currently trades at $1.38.

Read our full, actionable report on Chegg here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up