Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The highly anticipated Jackson Hole speech by Fed Chair Jerome Powell was met with massive enthusiasm by investors as they poured billions into the cryptocurrency market.

Bitcoin jumped by over five grand from bottom to top, while some of the biggest altcoins rocketed to new all-time highs.BTC Soared to Over $117K

The days leading to the event were quite grim, to say the least. Bitcoin opened the business week with an immediate price drop that drove it from over $118,000 to $115,000. Although the bulls tried to stage a quick recovery, BTC was stopped at $117,000 and driven south even harder to under $113,000 by Wednesday and Thursday.

The landscape worsened on Friday, hours before the Jackson Hole event. BTCdivedonce more, this time to its lowest position since early July of under $111,700.

As Powell took the stage, though, the situation started to change quickly. Although he didn’t confirm that there would be rate cuts in September, his statements were regarded as positive for future reductions, and BTCskyrocketedwithin minutes to over $117,000.

It has lost some traction since then and now sits below $116,000; it’s still over 2% up on the day. Its market cap is above $2.3 trillion, but its dominance over the alts has taken another hit and is down to 56.5%.ETH, BNB to New ATHs

Perhaps the most significant beneficiary of Powell’s speech from the larger-cap alts was Ethereum. The second-largest cryptocurrency had dipped below $4,200 earlier in the day but went on a massive roll, taking it to a new all-time high of roughly $4,900 (although CoinGecko hasn’t confirmed this, it occurred on most exchanges).

Binance Coin is another alt that shot up and tapped a new peak of $900. SOL has gained 10%, ADA is up by 7%, DOGE by 9%, SIU by 9%, XLM by 5.5%, and AVAX has shipped by 9%. XRP has reclaimed a crucial resistance of $3.00.

With most other altcoins charting notable gains, it’s no wonder that the total crypto market cap has added over $200 billion since yesterday’s low and is close to $4.1 trillion on CG.

The conversation around cryptocurrency in the United States has taken a remarkable turn. Crypto leaders are calling it a turning point.

After years of regulatory crackdowns and enforcement-led actions, the tone in Washington toward digital assets has shifted dramatically, signaling a path toward mainstream acceptance.

Ripple CEO Brad Garlinghouse said the difference in how policymakers now discuss digital assets compared to last year is both dramatic and palpable.

Speaking at the Wyoming Blockchain Symposium hosted by SALT and Kraken, he described the mood as far more supportive than in the past. What surprised him most was hearing several Federal Reserve governors openly speak in favor of blockchain technology, something he called a new dawn for the industry.

“I don’t think many of us had “multiple Fed governors publicly embracing crypto technology” on our bingo cards…a new dawn, indeed, says Riplpe CEO.”

John Deaton – From ChokePoint 2.0 to Mass Adoption

This shift has also been recognized by legal voices in the crypto space. Attorney and XRP advocate John Deaton captured the mood by calling it a “180.”

He recalled how the sector went from being suffocated under “ChokePoint 2.0” and enforcement actions to now being positioned for universal acceptance and mass adoption. His statement highlights the drastic changes that have occurred in a relatively short time.

“We went from the Government’s on the neck of the industry, ChokePoint 2.0, Regulation by Enforcement, and regulatory capture to universal acceptance on the path to mass adoption” Says John Deaton

Alderoty Stresses Coordinated Regulation in Post-GENIUS Act Era

Ripple’s Chief Legal Officer, Stuart Alderoty, also weighed in after participating in policy-focused panels at the event. He joined representatives from Andreessen Horowitz, the Blockchain Association, Mysten Labs, and CNBC to discuss the future of regulation in what he called a post-GENIUS Act world.

Alderoty highlighted that the most important step forward will be ensuring a coordinated approach between lawmakers and the executive branch. Such a framework, he argued, would provide clarity for the market while supporting innovation.

U.S. Positioned to Shape the Global Future of Crypto

The tone of these discussions reflects a broader change in how traditional policymakers view the role of cryptocurrencies. For years, the sector was met with skepticism and strict oversight, but the conversation is now shifting toward collaboration and long-term growth.

Supporters see this as an essential step toward aligning regulation with innovation, while critics warn that challenges such as volatility, investor protection, and consistent oversight across states remain unresolved.

If this momentum continues, the country may not only provide clarity for its own market but also play a leading role in shaping the global future of digital assets.

FAQs

What is the current U.S. government stance on crypto?The tone in Washington has shifted dramatically from regulatory crackdowns toward collaboration and support for mainstream crypto adoption and innovation.

What is the key to future U.S. crypto regulation?Ripple’s CLO stresses the need for a coordinated approach between lawmakers and the executive branch for market clarity and innovation.

Why is the U.S. regulatory shift important globally?This new collaborative stance positions the U.S. to potentially lead in shaping the global future and regulatory framework for digital assets.

The crypto world has no shortage of memecoins, but PENGU is starting to stand out in ways few imagined possible. What started as a playful memecoin is now positioning itself as a serious contender in the digital asset space.

With NFT ETFs in the pipeline, top chart analysts now predict the PENGU token to hit $0.10 mark, fueled by strong bullish patterns.

PENGU: From Toys to GIFs: Mainstream Appeal

PENGU isn’t just another memecoin. Over the past year, it’s become a top crypto brand, driven by Luca Netz, the entrepreneur who transformed Pudgy Penguins by focusing on characters over logos because people don’t remember logos, they remember faces.

Arc@winningarcAug 22, 2025Why did it work?

Luca understands one of the deepest truths in marketing “People don’t remember brands. They remember characters.”

He gave us a masterclass in character-first marketing

He called it the "Pengu Proliferation Thesis" pic.twitter.com/2CiZhAFHUL

From listings on major exchanges to partnerships with well-known institutions like VanEck, Bitwise, and even Sotheby’s, PENGU has managed to build legitimacy far beyond internet jokes.

Its reach into mainstream culture is also remarkable. The brand has sold more than 2 million toys, attracted over 5 million social media followers, and generated 116 billion GIF views.

These numbers show PENGU isn’t just a niche crypto project, it’s becoming a household character.

Pudgy Penguins ETF To Get Approval By Oct

Beyond the memes, serious institutions are paying attention. Canary Capital Group has filed with the Securities and Exchange Commission for permission to launch a Pudgy Penguins exchange-traded fund (ETF) that will keep up to 15% of its assets in Pudgy Penguins NFTs.

On top of it prediction markets show 58.5% don’t expect PENGU ETF approval before October, citing a lack of utility compared to established cryptocurrencies.

PENGU Token Eyeing $0.10 Level

Looking at the Pengu price chart, top analyst Ali Martinez says it could be on the verge of a major breakout. Martinez highlighted the falling wedge formation on PENGU’s 12-hour chart, a pattern that often precedes strong bullish moves.

Ali@ali_chartsAug 22, 2025BINANCE:PENGUUSDT has it all: ETF filing, Asia growth, millions in toy sales, and a bullish flag targeting $0.10! pic.twitter.com/ikd0bPrRkh

As of now, Pengu is trading around $0.0357, the token sits just above its key support at $0.027. If this level holds, momentum could shift quickly in favor of buyers.

Martinez’s analysis shows possible stages of growth, with price levels at $0.043, $0.053, and $0.065 acting as milestones on the way to the $0.10 mark.

Still, risks remain. If PENGU fails to defend $0.027, the token could slip toward the $0.022–$0.024 range.

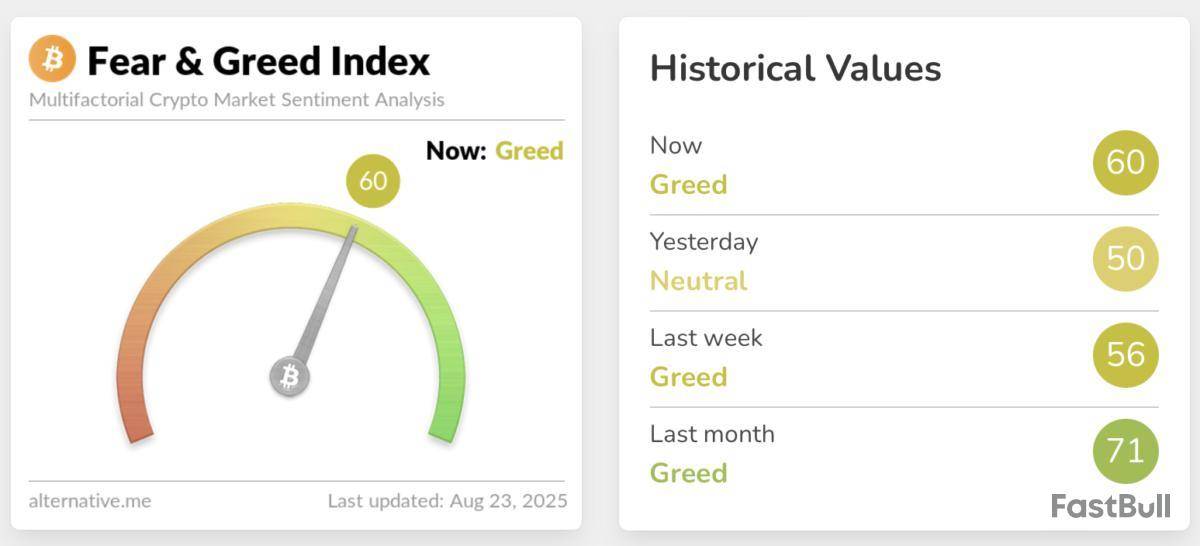

Crypto sentiment returned to “Greed” on Saturday as the crypto market surged, following dovish comments from US Federal Reserve Chair Jerome Powell that raised speculation of a possible rate cut in September.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, rose to a “Greed” score of 60 on Saturday, up 10 points from Friday’s “Neutral” reading of 50, after briefly dipping into Fear earlier in the week.

The rebound came after Powell’s speech at the annual Jackson Hole economic symposium on Friday, where he said that the current conditions in inflation and the labor market “may warrant adjusting” the Fed’s monetary policy stance.

ETH is the “most rate-sensitive aspect of crypto”

After Powell’s speech, Bitcoin (BTC) surged 5% to $117,300, liquidating $379.88 million in shorts. Meanwhile, Ether (ETH) reclaimed its 2021 all-time highs of $4,878, reaching as high as $4,851, representing an 11.51% increase over the 24 hours, according to CoinMarketCap.

In an X post on the same day, Axie Infinity co-founder Jeffrey “Jiho” Zirlin called Ether the “most rate-sensitive aspect of crypto.”

“As interest rates drop, the spread between what can be earned by depositing your stablecoins in DeFi vs. depositing your USD in a bank widens,” he said.

According to the CME FedWatch Tool, 75% of market participants anticipate a rate cut at the Sept. 17 Fed meeting. Trading resource The Kobeissi Letter said, “It appears Fed Chair Powell is setting the stage for a September rate cut.”

Historically, Fed rate cuts increase liquidity and make riskier assets like crypto more attractive.

Crypto market participants were expecting the surge

However, St. Louis Fed President Alberto Musalem told Reuters on Friday that he still needs more time to decide whether he will support an interest rate cut.

"I will be updating my outlook and balance of risks all the way up and until two days, three days before the meeting," he said.

Earlier the week, several crypto market participants anticipated a crypto market spike if Powell hinted at a rate cut.

Author Jason Williams said on Wednesday, if Powell “comes in soft and leans that rate cuts are likely, we turbo rip.”

Crypto Banter trader Ran Neuner said “Jackson Hole will shape crypto’s direction moving forward,” before adding, “Trump is pushing for a rate cut with good reason, but will Powell listen?”

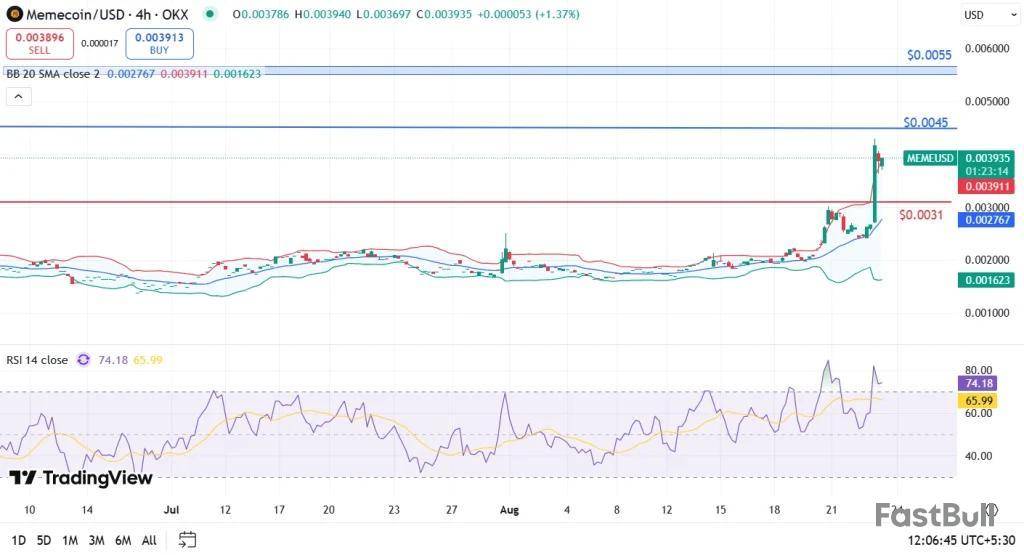

Memecoin, the native token of the Memeland ecosystem by 9GAG, has taken traders by surprise with a 63.75% surge in the past 24 hours. This has pushed its price to $0.003949 and market cap to $209.52 million. Talking about business, the daily trading volume shot up 236% to $515.18 million. As traders piled into memecoins following talk of potential 2026 memecoin ETFs. Although MEME isn’t directly tied to the ETF, the hype surrounding speculative tokens is definitely hard to miss.

What’s Driving MEME Higher?

MEME Price Analysis

MEME price has rallied from a 24-hour low of $0.002405 to a high of $0.004115, breaking above the 23.6% Fib retracement at $0.0036. The token now trades just below its first key resistance at $0.0045, with the next barrier at $0.0055. On the downside, $0.0031 serves as strong support.

Momentum indicators paint an overheated picture. MEME’s RSI14 hit 74.18, a level that traditionally signals overbought conditions. In memecoins, however, such readings often precede “meme frenzy” phases rather than sharp corrections. Meanwhile, the MACD histogram rose to 0.00018688, its highest since July. Further confirming a strong bullish crossover that aligns with this week’s explosive 104% rally.

A decisive close above $0.0045 could set the stage for a push toward $0.0055. This is while failure to hold above $0.0036 might trigger profit-taking. Traders are clearly chasing momentum, and the ETF narrative is amplifying the rally.

FAQs

Is MEME overbought right now?Yes, RSI suggests MEME is overbought, but memecoins often stay hot longer than expected.

What price levels should traders watch for MEME?Key support is at $0.0031, while resistance stands at $0.0045 and $0.0055.

Could the ETF rumor keep boosting MEME?Speculation may continue to fuel short-term gains, though regulatory delays could cool sentiment later.

Solana has surged back above $200, showing stronger upside than most of the top 10 cryptocurrencies. This rally is supported by increasing network usage, liquidity inflows, and favourable technical patterns that highlight Solana’s resilience compared to peers like Ethereum and Cardano. On the other hand, the Solana TVL has surged since the beginning of 2025, suggesting a strong backing from the bulls that may positively impact the SOL price in the coming days.

Since July, Solana has broken above the key $202 resistance for the third time, with the latest breakout emerging as the most decisive and powerful move yet. Hence, the traders now focus on whether SOL can build momentum toward the $300 target by the end of Q3 2025. Key resistance zones, volume trends, and market sentiment will play a decisive role in shaping Solana’s next big move.

Why Solana Is Outperforming Other Top 10 Cryptos

Solana’s rebound above $200 isn’t just another price spike—it reflects a structural advantage over other leading cryptocurrencies. The network consistently handles 80M–100M daily transactions, while Ethereum averages barely 1M, showing why traders and developers prefer Solana for speed and scalability. Its daily active wallets exceed 5M, which is several times higher than most competitors in the top 10.

On the DeFi front, Solana’s Total Value Locked (TVL) has surged past $8.5B in 2025, cementing its position as the second-largest DeFi chain after Ethereum. Meanwhile, NFT activity continues to thrive, with over $1B in quarterly trading volume, supported by Solana’s low fees and fast confirmations. This combination of network strength, user adoption, and ecosystem expansion explains why Solana has rallied harder than Bitcoin, Ethereum, or Cardano, making it one of the standout performers in the ongoing crypto bull cycle.

Is SOL Price Ready to Launch to $300?

Regardless of the ‘Chaos’ in the market, the SOL price continues to trade within a bullish range, signifying the rising dominance of the buyers over sellers. On the contrary, the sellers have always challenged the rally at $210, pushing the levels back to the support at $180. The current breakout appears to be a little diverse, as it is backed by strong buying volume, with the technicals favoring the rise.

As seen in the chart, the SOL price rally remains stuck within an ascending triangle and is trying to break the barrier ahead of the pivotal resistance. The levels at $202 have been a strong threshold in recent times, and hence a daily close above the range is expected to revive hopes of entering the resistance zone between $220 and $225. No doubt the token holds a record of a couple of failed attempts in the recent past, but the current conditions vary.

The RSI is yet to reach the upper threshold, much different from the previous attempt to break the resistance. Meanwhile, the MACD indicates the buying pressure has just begun to mount, while the previous attempts occurred either when the buying pressure reached its peak or when it had begun to fade. Hence, technically, the Solana price appears poised to reach $220 in the coming week, and a sustained rise above $250 could pave the way for a new ATH above $300 by the end of Q3, 2025.

Crypto prices today reflect a market buzzing with momentum after Federal Reserve Chair Jerome Powell’s dovish remarks at the Jackson Hole Economic Symposium.

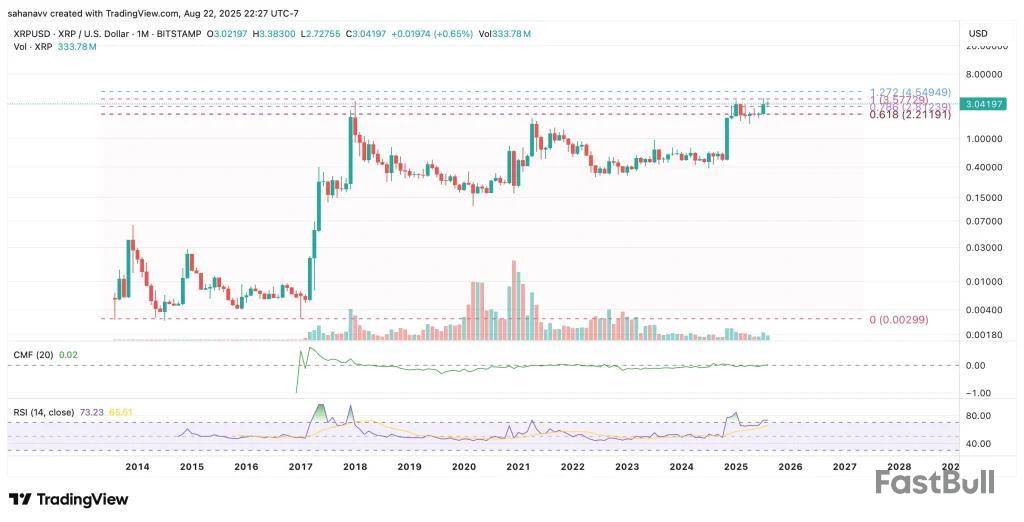

Ethereum stole the spotlight, smashing through its old record to hit a new all-time high above $4,880 with double-digit gains. Bitcoin followed suit, climbing 4.2% to $117,220, while XRP regained ground at $3.05.

XRP Price today is caught in a tug of war as post-Fed optimism lifts the broader crypto market, but the ongoing SEC lawsuit continues to cloud investor sentiment.

The token has been struggling to hold momentum after dipping below consolidation, with traders watching key zones like $2.77 for support and $3.21 as the next resistance.

However, according to analyst CasiTrades, the market quickly regained momentum as buyers stepped in almost instantly. Despite the dip, bullish divergences held strong, signaling that selling pressure was already losing steam.

When Will XRP Price Hit All-Time-High?

Analyst explained that the dip forced a reset in XRP’s price mapping. Previously, the next resistance target was $3.41, but with the fresh move, the immediate focus has shifted to $3.21.

The analyst noted that momentum is now extremely strong, suggesting XRP could face only a minor reaction at $3.21 before pushing higher. In fact, he expects the level to act more as a temporary pause rather than a ceiling.

A potential test of $3.168, the top of the recent consolidation range, could also occur as part of this move.

Minor Pullbacks Expected

Zooming out, the analyst pointed out that this latest development aligns perfectly with the broader macro picture for XRP. The overall trend is still pointing toward new highs, and retracements are likely to remain shallow.

Analyst further mapped out possible pullbacks in the 0.118–0.236 Fibonacci range but emphasized that these dips are more like speed bumps rather than major setbacks. Once XRP flips $3.21 into support, the path to higher resistance levels, and eventually new highs, becomes much clearer.

Overall, the analyst summed up the sentiment by stressing that the bullish setup is well-aligned with the broader altcoin market, which has also been firing up. For XRP, reclaiming $3.21 could set the stage for a run at $3.41 and beyond, with the long-term goal still pointing toward new highs.

FAQs

What is XRP price today?XRP trades around $3.05 after Fed remarks boosted crypto, with support at $2.77 and resistance at $3.21.

When could XRP hit a new all-time high?Analysts suggest reclaiming $3.21 could pave the way toward $3.41 and higher in the near term.

How is Ethereum performing compared to XRP?Ethereum hit a new all-time high above $4,880, leading the altcoin rally alongside XRP gains.

Is the broader altcoin market bullish?Yes, altcoins are gaining momentum, aligning with XRP’s bullish setup and the wider altcoin market trend.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up