Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crypto exchange Kraken is looking to pay users who can name the new mascot for its Ethereum Layer 2 network, Ink. The company is tapping blockchain-based “contests” platform Jokerace for the occasion, according to an announcement on Thursday.

“he’s gone too far. too many events. too much attention. and now he’s just down bad. because everyone keeps asking the one question he can’t answer. his name. now, he's spiraling… you name him,” the firm wrote on X, introducing the purple, spiky, cartoon monster that will represent the Optimism-based chain Kraken is building in-house.

JokeRace, founded in 2022 by David Phelps and Siobhán McCaffery, is a platform designed to facilitate no-code, onchain contests on over 90 EVM-compatible blockchains. Users vote on the results of anything from governance decisions, hackathon results, grant funding, and other community events.

The platform is notable for its sybil-resistant voting mechanism, where users pay per vote to prevent spam, and its ability to trigger onchain actions via smart contracts, such as token transfers or DAO proposals, based on contest outcomes. Jokerace has been used by Polygon, Farcaster, and The Block.

"The most notable piece is that we have two types of contests: enter-and-earn (earn from submitting a winning entry) and most significantly, vote-and-earn (vote on winner(s) and earn)," Phelps told The Block in a direct message. "It's part of what i call a persuasion market, or vibe market, where you get paid for curating the internet."

In July 2024, Maven 11 led a $3 million funding round, which the team said at the time would go toward expanding its marketing and business development operations. The startup is known for having a multitude of angel investors, over 100 at last count, Phelps previously told The Block.

Ink is a Layer 2 network developed by Kraken using the OP Stack. The recently formed Ink Foundation plans to launch a native INK token in 2025 to incentivize ecosystem growth and liquidity, with a capped supply of 1 billion tokens.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

TL;DR

SHIB is the Most Centralized?

According to a recent study conducted by Santiment, Shiba Inu’s top 10 wallets control a whopping 62% of the meme coin’s circulating supply.

The self-proclaimed Dogecoin-killers ranked first in that statistic, while the biggest stablecoin, USDT, came in second with 51.8%. Ethereum (ETH) is third, with its top 10 holders owning 49% of the supply, whereas PEPE is next with 39%.

SHIB might lead on this front, but that doesn’t necessarily mean that its investors and proponents should pop the champagne and celebrate. Controlling a significant portion of the supply contradicts the decentralized spirit of the crypto industry.

Additionally, this makes the asset more vulnerable to substantial price changes due to potential massive sell-offs or accumulation efforts.

“As a retail trader, it’s generally safer to hold coins with less supply held by the most elite whales. There is less risk of sudden dumps or price manipulation should an asset’s largest whales decide to exit their positions,” Santiment warned.SHIB Price Outlook

As of this writing, the price of the meme coin stands at around $0.00001159, which is a 3% decrease for the past day. Its market capitalization has slipped to just under $7 billion, making SHIB the 24th-biggest cryptocurrency in the entire market.

Essential metrics, however, suggest that the price may be gearing up for a renewed rally. In the last 24 hours, the Shiba Inu team and community have burned over 13.4 million tokens, representing a 4,000% increase compared to the figure observed on July 3.

The ultimate goal of the burning mechanism is to reduce the supply of SHIB and potentially increase the asset’s value through scarcity.

Next on the list is the decreased supply of Shiba Inu tokens on centralized exchanges. Over the past month, there has been an evident shift from such platforms toward self-custody methods, which reduces the immediate selling pressure.

Bitcoin may be breaking out—but don’t celebrate yet. Crypto analyst Cristian Chifoi warns that the current move is a deceptive setup likely to trap bullish traders before Bitcoin eventually surges toward $160,000. In his latest YouTube video titled “Bitcoin is breaking out! But why is it bad?”, Chifoi dismantles the optimism surrounding Bitcoin’s recent price action, arguing that this rally is not the start of a true bull run, but a temporary fakeout designed to mislead.

Don’t Trust The Bitcoin Pump

“From a technical standpoint, this could mean a real breakout, retest, and then continuation,” Chifoi admits. “But in my opinion, this is a false breakout which can get to a new shallow all-time high, maybe $113,000, maybe $120,000 until something like July 10 to 12—then we come back in this channel before July 20.” His thesis hinges on Bitcoin seasonality, a pattern he has explored in earlier videos, which suggests the real macro pivot will only arrive later in the month. “I’m more bullish from July 20 into the start of September,” he says.

Chifoi argues that retail traders are likely to pile in during the breakout retest phase, only to be shaken out as market makers use the liquidity to reverse the trend. “The majority of retail traders would go long here on a retest. The market makers will get their money,” he warns, predicting a trap that could drag Bitcoin down to levels near $97,000 before the real uptrend resumes.

His analysis extends beyond simple technicals. Chifoi points to macroeconomic sentiment and Fed policy as crucial context, particularly emphasizing that rate cuts would actually be a bearish signal—not bullish as commonly believed. “Rate cuts this year would not be bullish at all,” he insists. “It’s not Powell who decides, it’s the bond market who decides when the rate cuts should come… and when that is happening, it’s because they need to panic cut.”

Chifoi stresses that the best-case scenario for bulls is actually no rate cuts, at least for now. “Just keep the rates at 4.5% maybe until year end. If this happens, I’m 100% sure that the market will go higher and higher before this starts to happen.”

Beyond Bitcoin, Chifoi forecasts a synchronized move across the broader crypto market once the July 20 pivot takes place. He highlights Ethereum, XRP, DeFi tokens like CRV, and ISO-compliant coins such as IOTA, ADA, and Quant as potential beneficiaries. “Bitcoin would drag all the crypto space with it,” he says, adding that older players like Filecoin and Polkadot could also catch a bid.

Mid-Term Price Target

Looking further ahead, Chifoi describes the coming period as a “stablecoin super cycle,” with DeFi projects and yield-generating protocols positioned to gain the most from Wall Street’s hunger for yield. “In crypto, only DeFi projects get you yields,” he explains. “Wall Street is boiling up for yields.”

He also reaffirms his macro thesis that the current financial system is on track to be replaced, likening the transition to the 1930s move from gold to fiat. “After 100 years of this exact system, this should be replaced by another system with liquidity in it,” he says, envisioning a cryptographic banking future.

Despite the short-term turbulence he expects, Chifoi remains long-term bullish. His price target of $160,000 for Bitcoin by early September reflects a belief in accelerated expansion—fueled by seasonality, delayed policy pivots, and broader adoption.

In closing, Chifoi reminds his audience to zoom out and trust the high time frame signals. Referencing Bollinger Bands on the two-month chart, he notes the beginning of another expansion phase similar to late 2020. “After that, the bear market begins,” he cautions. But until then, the ride could be fast—and extremely volatile.

“The next time we cut [rates], it is a big deal and something is wrong,” he concludes. “For now, we just want the cuts going higher for longer.”

At press time, BTC traded at $108,848.

Today, July 4, 2025, total cryptocurrency market capitalization is taking a breath. Almost all of the top 100 assets, including the largest cryptocurrencies Bitcoin and Ethereum , are in the red. Meanwhile, two meme cryptos look particularly strong.

Top 100 cryptos are in red, these two meme coins outperform

NFT-linked meme coin Pudgy Penguins (PENGU) and Bonk (BONK) — one of the largest dog-themed meme cryptocurrencies — are almost unique top 100 cryptos that are in green today. Pudgy Penguins (PENGU) is surprisingly the best-performing asset in the category.CoinGecko">

PENGU price's overnight growth totals 4.5%. In a massive move, PENGU expanded weekly gains over 60% and exceeded $0.016.

Also, Bonk (BONK), a major dog-themed cryptocurrency with an active community, is in green. The BONK price added 0.6% and hit a local high at $0.00001635.

Other meme coins in the top 100 are far from demonstrating such gains. Shiba Inu lost 3.6% overnight and touched $0.00001136, while Dogecoin and Pepe are both down by 4.3%.

Net crypto capitalization sees large drop

Dogecoin , the largest meme cryptocurrency, reached $0.1631, setting a local low, while Pepe bottomed at $0.000009565.

Meanwhile, the aggregated capitalization of the cryptocurrency market sees far worse losses. In just 24 hours, crypto markets erased almost 5.5% of their value.

Bitcoin , the largest cryptocurrency, dropped by 1.5%, while Ethereum said farewell to 3% of its cap.

As of press time, Bitcoin is changing hands at $107,741, while Ethereum is sitting at $2,502 on low trading volume.

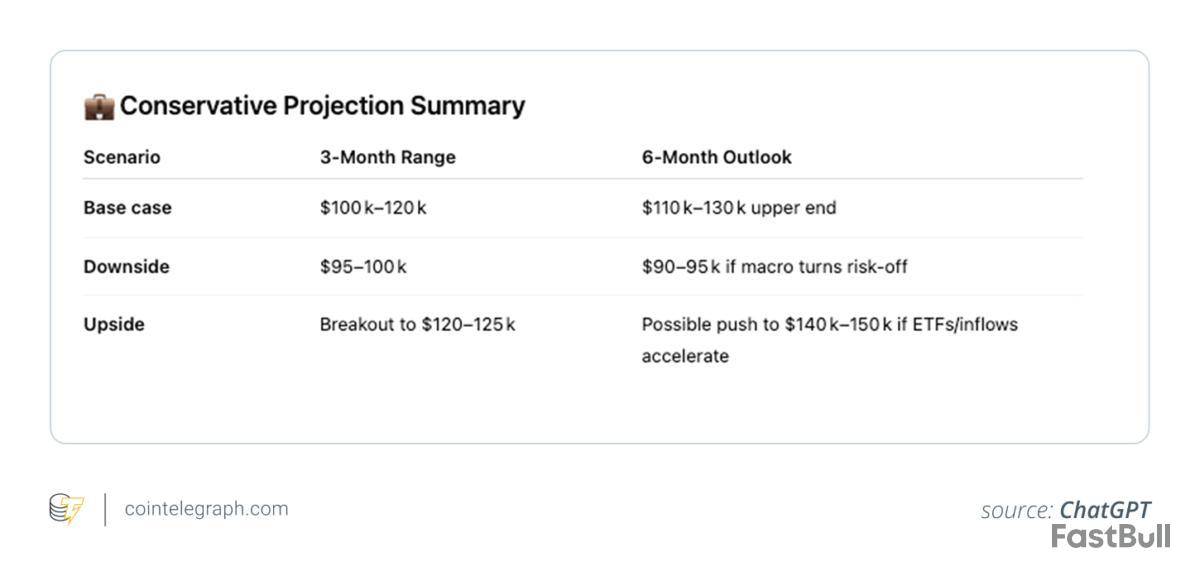

How ChatGPT helps analyze Bitcoin trends

ChatGPT is a generative AI model developed by OpenAI, built on the GPT‑4 architecture. It’s designed to generate human-like responses across a wide range of topics, using knowledge drawn from an enormous training set of text, books, code and online content.

When it comes to cryptocurrency, ChatGPT doesn’t have real-time access to Bitcoin price feeds or live market charts, but that doesn’t mean it’s useless for traders. With the right inputs — historical price data, sentiment indicators and technical metrics — ChatGPT becomes a powerful analytical tool.

It can help structure Bitcoin price forecasts, identify trends or even simulate crypto trading strategies when paired with the right data.

This is where ChatGPT Bitcoin analysis becomes useful. Its strength lies in interpreting context: combining past performance, technical indicators and market sentiment to support better decision-making.

Did you know? In 2025, around 77% of consumer devices already use some form of AI.

How to predict Bitcoin with AI

How exactly do traders predict Bitcoin with AI, specifically, with ChatGPT?

Many begin by feeding it structured prompts that include market sentiment, on-chain metrics and technical analysis indicators.

For instance, crypto trend prediction with GPT might start by parsing news headlines, sentiment on X, Reddit discussions or expert commentary. This allows ChatGPT to gauge whether the overall mood is bullish or bearish, a key insight in a market where Bitcoin volatility trends often follow shifts in narrative.

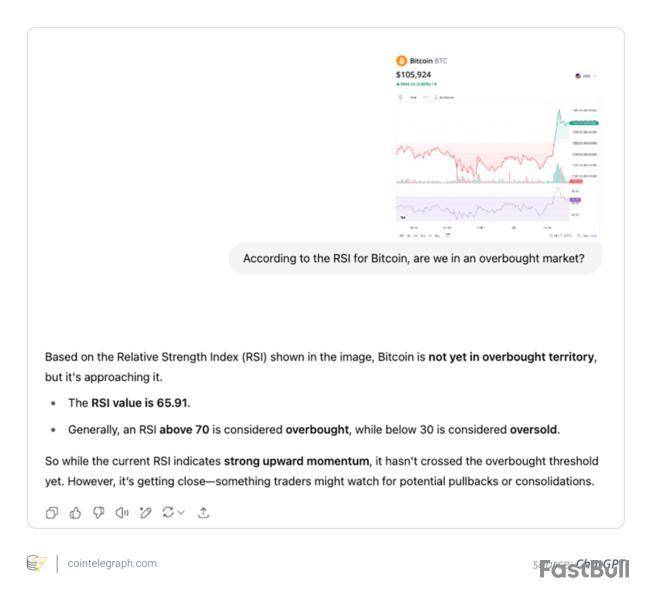

When given technical indicators such as the relative strength index (RSI), moving average convergence/divergence (MACD), moving averages or trading volume, ChatGPT financial tools can contextualize them using historical relationships. For example, if RSI exceeds 70 and volume surges, ChatGPT might flag the market as overbought — a classic signal of potential pullback based on Bitcoin price history.

Integrating onchain analytics like whale wallet activity, hashrate trends or exchange inflows/outflows can enhance this picture. ChatGPT can help interpret such data and suggest whether accumulation or distribution phases are forming, especially when paired with external tools like TradingView or LunarCrush.

From bots to AI agents: Evolving Bitcoin trading with ChatGPT

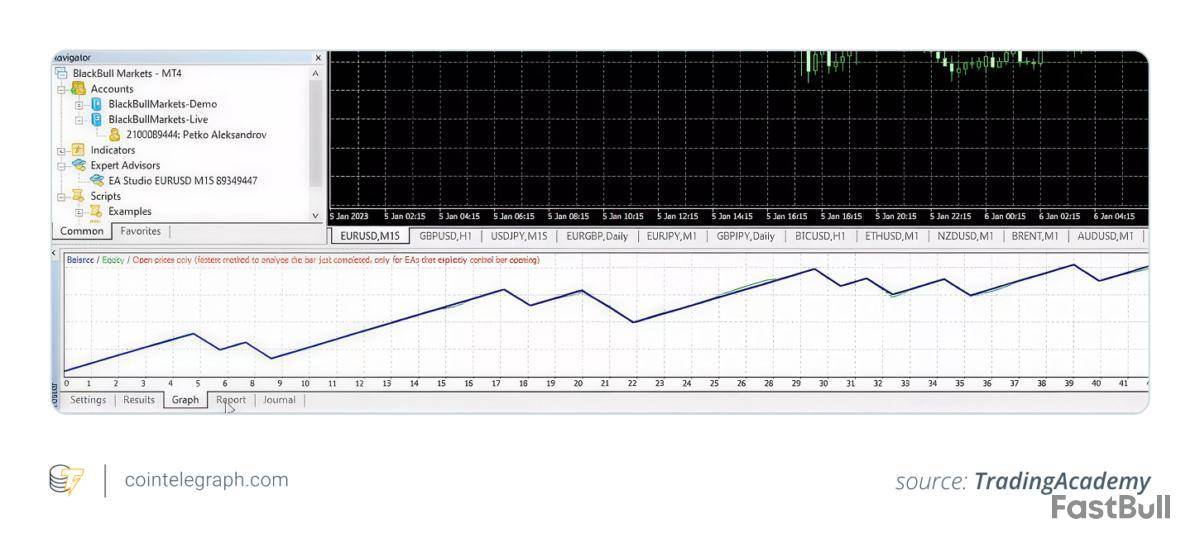

Some advanced traders build AI Bitcoin trading strategies that combine ChatGPT with APIs or dashboards.

These setups let ChatGPT pull from multiple data sources — like social sentiment APIs, technical indicators or trading signals — and generate backtestable models or even functional code for ChatGPT trading bots and ChatGPT-powered AI agents.

In this setup, the trader becomes the architect while ChatGPT acts as the signal synthesizer, combining disparate data points into actionable insights.

This type of workflow sits at the cutting edge of AI in cryptocurrency, where trading bots vs. AI becomes a question of adaptability: Traditional bots follow rules, while ChatGPT can evolve strategies in response to shifting conditions.

What the research says about ChatGPT crypto trading insights

Multiple studies suggest that AI — and even ChatGPT-enhanced systems — can outperform both manual and conventional machine learning models in predicting crypto price movements.

A peer-reviewed study published in Frontiers in Artificial Intelligence compared various forecasting models for Bitcoin from 2018 to 2024.

The machine learning Bitcoin forecast using a neural ensemble strategy returned a staggering 1,640%, compared to just 305% for standard machine learning models and 223% for a buy-and-hold approach.

Even after applying a 1% per-trade cost, the net return was over 1,580%, showcasing the edge of dynamic, AI-driven strategies.

Transformer-based architectures (akin to GPT) that fuse onchain analytics with Bitcoin market sentiment from social data have also outperformed legacy models in both return and risk control. These tools reduce drawdowns by anticipating volatility through real-time sentiment and technical signals.

But here’s the key: These results don’t come from ChatGPT alone. Instead, they reveal the potential of using ChatGPT for crypto trading insights when it’s embedded in a broader system — one that includes real-time data, prompt logic and post-analysis validation.

Real‑world machine learning Bitcoin forecast: How traders predict Bitcoin with AI

Some of the most compelling ChatGPT crypto trading insights come from real setups used by active traders.

For instance, a case study on TradingView used OpenAI’s GPT-based “o3 Pro” model to assess the Sui (SUI) token. The system analyzed 38 real-time indicators — covering technical metrics, Binance order-book flows, on-chain usage and social sentiment — to produce a structured, real-time forecast. It flagged breakout compression near key support and resistance levels, offering a valuable AI crypto forecast.

These setups are increasingly common. Traders input screenshots of candlestick charts, readouts from indicators like RSI or Bollinger Bands and API-based data sets from platforms like LunarCrush or TradingView. ChatGPT trading bots built around these workflows can then draft buy/sell signals, PineScript strategies or even generate tailored MQL5 code (the programming language used to build custom trading algorithms for MetaTrader 5).

Some communities now maintain prompt libraries that walk users through nine distinct workflows, ranging from strategy development and backtesting to journaling trades or detecting fakeouts across multiple timeframes.

By combining human intuition with AI tools for traders, these hybrid environments demonstrate how predicting Bitcoin with AI doesn’t mean full automation — it means deeper, faster synthesis of data and sentiment.

Did you know? AI models like ChatGPT organize meaning across 66 dimensions, forming mental “maps” of ideas, much like the human brain groups related concepts. That’s how they know an “apple” is closer to “fruit” than to “laptop,” even though both might show up in your shopping cart.

Limits of ChatGPT in Bitcoin price prediction

Despite its strengths, ChatGPT Bitcoin analysis is fundamentally constrained by design.

Because ChatGPT lacks direct access to real-time data, it cannot deliver live market calls or react instantly to volatile swings. Bitcoin market sentiment, order book data, macroeconomic news — none of it is streamed directly into the model. Instead, all insights depend on the user’s ability to feed in structured data from external sources.

This limitation also means ChatGPT cannot reliably detect market manipulation. Sophisticated schemes like spoofing, wash trading or flash crashes often unfold too quickly and subtly for a text-based model to identify, especially without live onchain analytics or real-time feeds.

Another well-documented issue is overconfidence. In several cases, users report that ChatGPT will initially resist making predictions until given exhaustive prompts, but once it does respond, it might deliver outputs that sound authoritative yet remain untested or speculative. This can lead to hallucinations, fabricated but plausible-sounding insights that carry risk if acted upon blindly.

Finally, broader research from BCG and Harvard Business School warns against overreliance on generative AI. In high-stakes tasks requiring strategic judgment, GPT-4 users sometimes performed 23% worse than control groups — a cautionary tale for crypto traders considering replacing intuition with automation.

Bitcoin price prediction: ChatGPT is a tool, not a prophet

Can ChatGPT predict Bitcoin’s next move? Not directly. But it can help you become a better analyst.

With properly structured prompts and high-quality inputs, ChatGPT can surface patterns, interpret sentiment, decode technical signals and accelerate strategy development. It bridges the gap between intuition and data, but it doesn’t eliminate the need for human oversight.

In the debate of trading bots vs. AI, ChatGPT doesn’t replace bots — it helps you build smarter ones. It won’t deliver absolute answers, but it can offer structured, explainable perspectives, especially when used alongside traditional crypto technical analysis methods.

When trading on today’s volatile markets, ChatGPT financial tools are best viewed as part of a broader arsenal — where AI helps parse complexity but doesn’t shoulder responsibility alone.

Pepe , the frog-themed meme coin, has witnessed fluctuations in its price outlook within the last 48 hours. The meme coin, which shed one zero, has now reverted gaining gain as volatility hit the ecosystem amid a spike in selling pressure.

PEPE falls below key threshold

According to CoinMarketCap data, Pepe has added another zero in the last 24 hours as the price plunged by 10% following the massive sell-off on the broader market. As of press time, the PEPE price was changing hands at $0.000009658, representing an 8.58% decline from its previous value.PEPE Daily Price Chart | Source: CoinMarketCap">

Pepe’s performance had stunned the broader meme coin market as it soared to new highs. Notably, it peaked at $0.00001033 before profit-taking sentiment triggered sell pressure, resulting in rapid reversals.

This has also negatively impacted trading volume, as investors pulled back following the crash. Volume has declined by 47.41% to $751.56 million within the same time frame. This indicates very weak buying conviction among investors.

The massive drop in volume has dashed all hopes that PEPE could retest the price level that it achieved in May 2025. The frog-themed meme coin had soared to a high of $0.00001380 on the back of bullish sentiment some two months ago.

However, the current market has seen investors lean toward Bitcoin, whose dominance currently stands at 64.6%. This might explain the significant profit-taking move by market participants as they seek stability.

Can whales save PEPE’s price outlook?

Since May, when the Pepe price slipped, it has struggled to find stability above the $0.000010 level. The meme coin lost approximately 60% of its value relative to the all-time high (ATH) of $0.00002825 that it attained in December 2024. This made it one of the worst performers in the ecosystem in May.

Pepe’s poor performance might stand a chance at reversal if ecosystem whales stop dumping their holdings on exchanges. This action negatively impacts the price outlook due to increasing selling pressure. If these large holders opt to mop up a good volume of PEPE in circulation, the price might reverse.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up