Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Robert Kiyosaki, author of “Rich Dad Poor Dad,” stepped back into the Bitcoin market with a bold move. According to his tweet on July 11, he purchased another Bitcoin at $110,000.

Based on reports, he’s betting that today’s price will look cheap if Bitcoin ever hits $1 million. His choice puts him in what analyst Raoul Pal calls the “Banana Zone,” where fear of missing out drives latecomers to buy at the top and then suffer losses.

Bitcoin Betting At High Prices

Kiyosaki used his “PIGs Get Fat. HOGs Get Slaughtered” rule to explain why he bought at such a high level. He plans to hold until less disciplined investors push prices even higher and then sell when they panic.

He warned that FOMO is like a disease that spreads fast through crowded markets. In his view, buying now—even if prices seem lofty—is key to making a profit later.

Robert Kiyosaki@theRealKiyosakiJul 11, 2025Another RICH DAD LESSON:

“PIGs get fat. HOGs get slaughtered.”

I state this lesson because I bought my latest BITCOIN at $110k. I am now in position for what Raoul Pal calls “the Banana Zone.”

In the Banana Zone the HOGS will rush in….driven to insanity by the dreaded…

His Early Entry And Regrets

He first bought Bitcoin at $6,000, a price he admits felt expensive at the time. He said he waited too long to learn about modern money before jumping in.

That lesson stuck. He’s open about past mistakes and uses them to guide current moves. He figures that if Bitcoin reaches $1 million, he’ll regret not adding more at $110,000. Learning From Past Mistakes

Kiyosaki recognized he “could be wrong and a sucker” after buying another Bitcoin, yet he added that he’d “rather be a sucker than a LOSER if Bitcoin does go to $1 million.”

He noted that he can handle a $100,000 loss thanks to his past work and savings. That safety net gives him room to ride out sharp drops—dips of 30–50% happen in crypto all the time. Advice For Small Investors

He urged readers to pick up bits of Bitcoin however they can. “Even if you can afford only one Satoshi today, buy it,” he said. A Satoshi is one hundred millionth of a Bitcoin.

Based on those remarks, he expects newcomers to look back and wish they’d snapped up every chance to buy. He also told people to “think for yourself” and not follow his words blindly.

Kiyosaki’s transparency with regards purchase prices gives his fanbase a clear view of his risk comfort level. The author views each trade as a learning step, not just an opportunity to make fast bucks.

By sharing his entry point at $110,000, he sets a real‑world example of how far he’s willing to go in pursuit of that $1 million goal.

Featured image from Meta, chart from TradingView

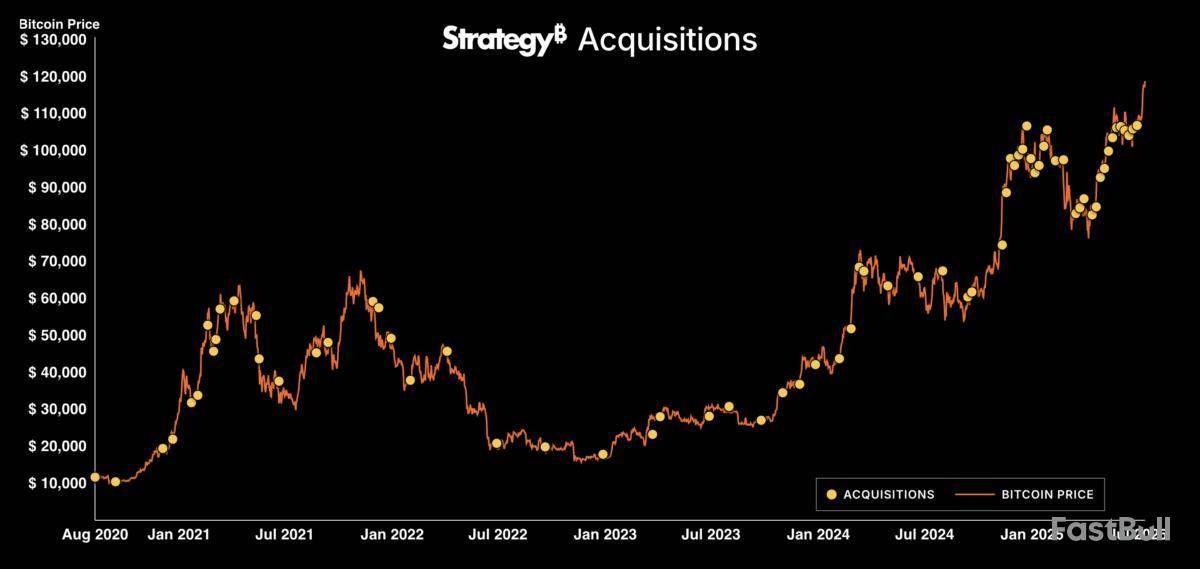

Strategy co-founder Michael Saylor signaled that Strategy would resume Bitcoin buying on Monday after the company took a week-long hiatus from accumulating the digital asset.

“Some weeks, you don’t just HODL,” the executive wrote on Sunday. The company skipped buying BTC last week but announced a $4.2 billion capital raise. Before the break, Strategy racked up 12 consecutive weeks of BTC accumulation.

Strategy’s most recent BTC buy occurred on June 30, when the company bought 4,980 BTC for $532 million, bringing its total holdings to 597,325 BTC, valued at over $70.9 billion.

Shares of the company are trading hands at about $434 and are up over 16% this month, but still trail the all-time high of $543 per share hit in November 2024.

Bitcoin treasury companies are now major players in the Bitcoin market, scooping up BTC at a faster rate than it is mined. This demand could cause a supply shock and drive prices higher, though some analysts warn that debt-fueled institutional BTC buying is unsustainable and could trigger a systemic market downturn.

Bitcoin treasury companies outstripping newly-mined supply

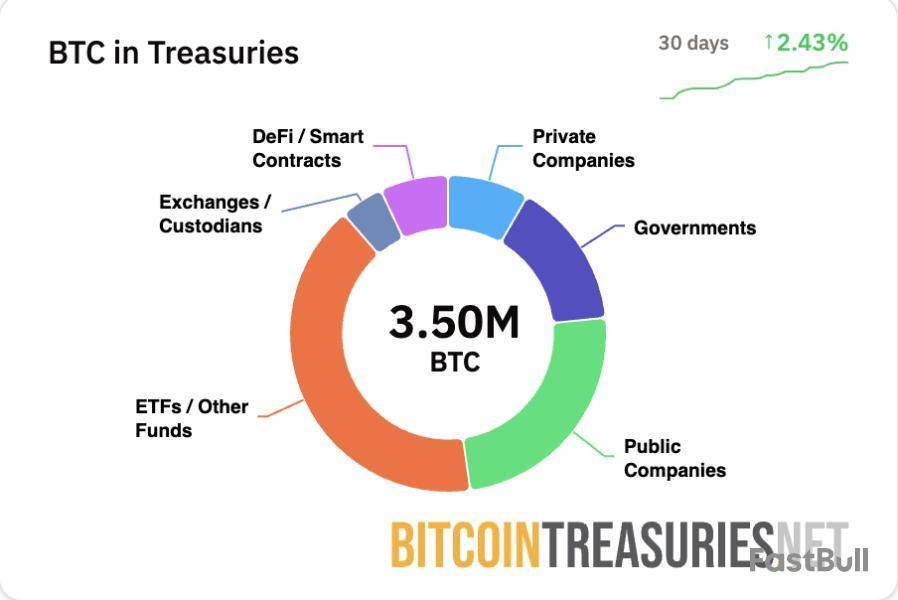

Bitcoin treasury companies bought 159,107 BTC in Q2, led by Strategy, which is the largest corporate holder of BTC, according to BitcoinTreasuries.

There are currently 3.5 million BTC held in institutional treasuries, which include public companies, private enterprises, crypto firms, government organizations, pension funds, and asset managers, data from the site shows.

In April, Adam Livingston, the author of "The Great Harvest: AI, Labor, and the Bitcoin Lifeline," said that Strategy is “synthetically halving” Bitcoin through the rapid accumulation of the digital currency.

Miners collectively produce around 450 BTC per day, or about 13,500 BTC per month, while Strategy accumulated 379,800 BTC in six months, according to Livingston.

“Strategy has accumulated 379,800 in the past 182 days. That's 2,087 BTC per day — far outpacing the miners,” Livingston wrote, while forecasting the Bitcoin treasury company to become the “financial superpower” of the future.

Ethereum has finally touched the $3,000 price level once again after spending weeks trading in a narrow range beneath $2,800. This recent breakout, although brief, marks the first time Ethereum reclaimed this level since early February. According to technical analyst Merlijn The Trader, Ethereum’s next destination after breaking past $3,000 is already in sight.

Bull Flag Breakout Points To Measured Move For Ethereum

Ethereum went through an interesting rally last week alongside Bitcoin’s push to new all-time highs. However, this Ethereum price rally, which saw it touch $3,000 again, wasn’t based on momentum spillover from Bitcoin alone. This is because Ethereum itself experienced significant institutional interest from Spot Ethereum ETFs.

According to data from SoSoValue, US-based Spot Ethereum ETFs recorded a combined $907.99 million in inflows last week, their best week since the products launched in July 2024. Thursday, July 10, alone was highlighted by inflows of $383.10 million, making it the largest single-day inflow for any Ethereum ETF in 2025 so far.

In a post shared on the social media platform X, crypto analyst Merlijn pointed to a confirmed bull flag breakout on Ethereum’s daily candlestick timeframe chart. Interestingly, the technical setup proposed by the analyst follows a falling wedge reversal that preceded the current uptrend.

According to the chart attached to his analysis, the falling wedge that led to the reversal was formed from the December 2024 highs to the April 2025 lows, with the breakout occurring in mid-May. The breakout eventually saw Ethereum entering into a tight flag-like consolidation that spanned between May and June, until the most recent breakout above $2,700.

That pattern has now resolved to the upside, and the next technical level of interest is a measured move based on the price action that formed the pole of the bull flag. This measured move places the next technical level of price interest at $3,834.

Image From X: Merlijn The Trader

80% Of ETH Now In Profit

On-chain indicators further validate Ethereum’s current strength. According to data from on-chain analytics platform Santiment, Ethereum’s price action has been dancing around the $3,000 mark since Friday, crossing it multiple times intraday. During this back and forth, 124.13 million ETH out of the 155.04 million total supply crossed into profitability, which represents 79.96% of all tokens. This reading is particularly interesting as it is the highest percentage recorded since January 2025.

Image From X: Santiment

The same data shows Ethereum is just 13 million coins away from matching the total supply in profit at its previous all-time high of profitability recorded in December 2024. This shift toward a profit-heavy network state tends to encourage holding behavior and long-term conviction, which could translate into reduced sell pressure in the coming week. This, in turn, could see Ethereum close a daily candle above $3,000 and move toward the $3,834 price target during the new week.

At the time of writing, Ethereum is trading at $2,960, up by 17.5% in the past 24 hours.

Featured image from Unsplash, chart from TradingView

Key points:

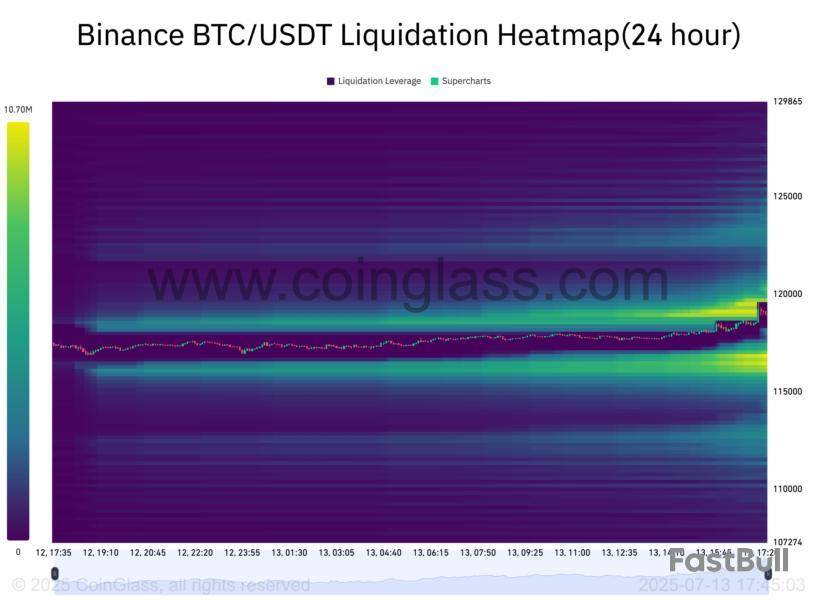

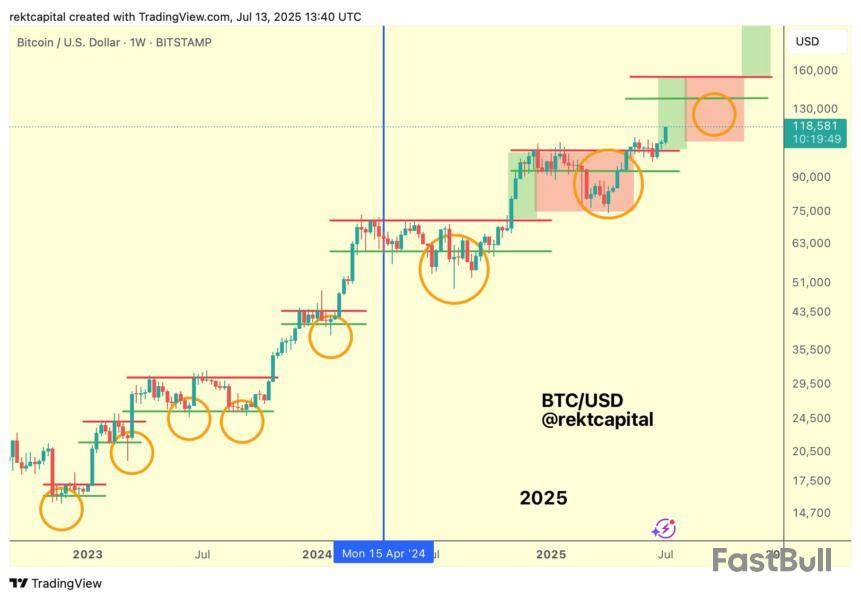

Bitcoin tags fresh record highs into the weekly close as liquidations punish shorts.

BTC price areas of interest include a support test of $115,000.

Hopes build that will copy its seven-week “discovery uptrend.”

Bitcoin hit new all-time highs on Sunday as BTC price volatility returned into the weekly close.

BTC price spikes to new record near $19,500

Data from Cointelegraph Markets Pro and TradingView showed reaching $119,444 on Bitstamp.

The pair eclipsed its previous record peak from two days prior as it crossed the $119,000 mark for the first time, liquidating shorts as it went.

The latest data from monitoring resource CoinGlass put short BTC liquidations at over $20 million in a single hour.

“Going to get interesting next week. We've got a lot of big liquidity clusters above and below the current price. We just took out a good bunch at the $119K+ region,” popular trader Daan Crypto Trades reacted in a post on X.

Daan Crypto Trades eyed two key liquidation-related zones to watch next: $115,500-116,500 and the area above $120,000.

Cointelegraph@CointelegraphJul 13, 2025🚨 ALERT: 24h liquidations hit $208M as 95K traders wrecked.

The biggest single loss was a $1.49M BTCUSDT position on Bybit. pic.twitter.com/0Rg6PXKHtP

“$BTC has a major resistance level between $119K-$120K. But after that, there's a lot of upside,” trader and investor Niels, cofounder of Web3 accelerator and incubator Ted Labs, continued.

Room for 50% gains?

Others zoomed out, with trader BitBull staying firmly optimistic on the immediate outlook for BTC price action.

“There's no reason to be bearish on $BTC here. The strongest weekly breakout since November 2024, which led to a 50% pump last time,” he told X followers.

BitBull flagged multiple bullish catalysts impacting Bitcoin, including record institutional inflows, the upcoming US “Crypto Week” and rumors over the resignation of Federal Reserve Chair Jerome Powell.

“Week 1 in Bitcoin's Price Discovery Uptrend 2 is slowly coming to an end. Week 2 begins tomorrow,” popular trader and analyst Rekt Capital added.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Cardano, the 10th-largest cryptocurrency by market capitalization, has surged 29% in the last seven days amid renewed bullish sentiment across the crypto market. At the time of writing, ADA was up 3.79% in the last 24 hours to $0.7398.

The recent price rally has brought ADA to a key technical level, testing the 200-day simple moving average (SMA) on the daily chart at $0.749. This level is acting as immediate resistance, and all eyes are now on whether ADA can break above it to continue its upward trajectory.

Cardano surpassed this level after a rapid increase on Friday to a high of $0.777 but then encountered resistance, causing a retreat.

If Cardano successfully breaks above this major barrier, it could open the door for a continued rally toward $0.90 or even $1.20, according to crypto analyst Ali. Such a move would mark a significant recovery for the token, which has been consolidating for several months.

Ali@ali_chartsJul 13, 2025Cardano $ADA is breaking through a key resistance level, opening the door for a rally to $0.90–$1.20! pic.twitter.com/4dj8jQfJFN

Ali wrote in a recent tweet, "Cardano is breaking through a key resistance level, opening the door for a rally to $0.90–$1.20."

Trillions to enter altcoin space

Cardano founder Charles Hoskinson recently made a bold prediction that has sparked excitement across the crypto space: Trillions of dollars might soon flood the altcoin market.

In a tweet on Friday, when Bitcoin surged to an all-time high above $118,000, Cardano founder Charles Hoskinson wrote, "Remember I said the gigachad bullrun is coming. We are going to see $250,000 bitcoin and trillions enter the space for the alts. Genius and Clarity acts will be the catalyst."

Hoskinson's comments come as Cardano gains traction in both price and development. Cardano ecosystem growth alongside governance, upcoming improvements and an expanding developer community are setting the stage for what could be a breakout phase for ADA and the broader altcoin sector.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up