Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The euro held steady just below the $1.18 level, remaining close to its strongest level since August 2021, as investors shifted their attention to recent trade developments and signals from ECB policymakers.

US President Trump announced that Washington would begin sending formal notices to trading partners outlining tariff rates for exports to the US, shifting from earlier promises of multiple bilateral deals before a July deadline, when tariffs are set to rise.

Meanwhile, the EU expressed openness to a trade agreement with the US, while simultaneously preparing for the possibility that no deal will be reached.

On the monetary front, markets now expect just one more ECB rate cut this year.

Officials signaled rates will likely remain unchanged at this month’s meeting after eight straight deposit rate cuts since June 2024.

With inflation hitting the ECB’s 2% target, policymakers are showing caution amid ongoing global trade risks and the euro’s recent strength.

The euro slipped toward $1.17, retreating from a recent four-year high, as investors flocked to the dollar in response to a stronger-than-expected US jobs report.

At the same time, markets digested comments from European Central Bank policymakers and the minutes from the ECB’s latest policy meeting.

Speaking at the ECB Forum on Central Banking, President Christine Lagarde welcomed the June inflation print, which aligned with the central bank’s 2% target, but cautioned about “two-sided risks” linked to rising geopolitical tensions and increasing economic fragmentation.

Other ECB officials signaled that interest rates are likely to be kept on hold at this month’s meeting, following eight consecutive cuts to the deposit rate since June 2024, amid persistent concerns over global trade uncertainty, instability in the Middle East, and the euro’s recent appreciation.

Markets are now pricing in only one additional rate cut before year-end.

The euro's strength is positive for the eurozone economy despite speculation that European Central Bank officials are growing concerned over the single currency's appreciation, ING's Chris Turner says in a note. Such concerns would be that a stronger euro lowers import prices and brings down inflation while making eurozone exports more expensive, he says. However, Europe should be taking advantage of this "global euro moment" as previously hailed by ECB President Christine Lagarde, the analyst says. Global portfolios re-allocated to the eurozone "can only be a good thing for private sector borrowing costs." The euro trades flat at $1.1801 after hitting a nearly four-year high of $1.1829 on Tuesday, according to LSEG. (renae.dyer@wsj.com)

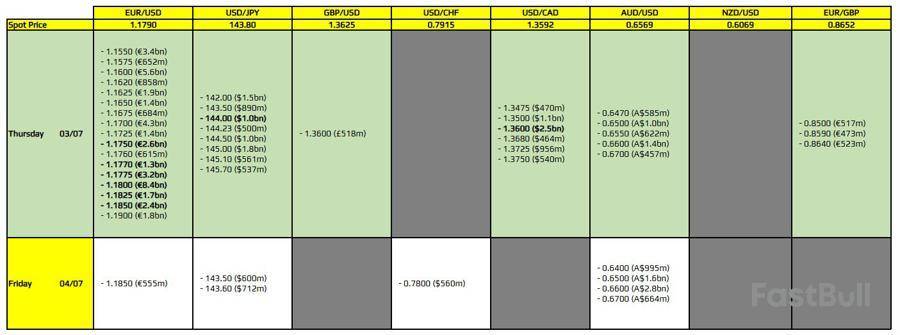

There are a couple to take note of on the day, as highlighted in bold.

With it being the final trading day of the week of sorts, since we do have a US holiday tomorrow, there are some large expiries to be wary of coinciding with the US jobs report release as well.

The first ones are for EUR/USD lumped around 1.1750 through to 1.1850. However, the massive one at 1.1800 is the most notable as warned yesterday. That is still putting a magnet on price action and will likely do so until we get to the non-farm payrolls data later in the day.

Then, there is one for USD/JPY at the 144.00 level. It's not the biggest of expiries but could well just keep a lid on price action alongside the 100-hour moving average at 143.95 currently.

And finally, there's one for USD/CAD at the 1.3600 level. The expiries here should help to keep price action more muted in European trading until we get to the US jobs report before dollar sentiment takes over.

As for tomorrow, the expiries board is relatively thin considering that broader markets are going to settle down a bit with US will be out until next week.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at www.forexlive.com.

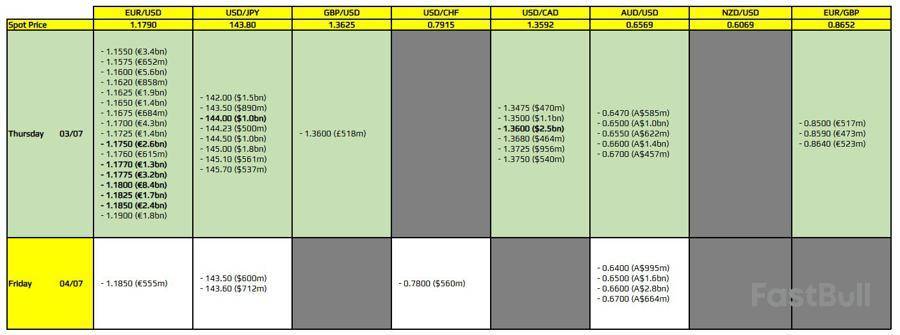

There are a couple to take note of on the day, as highlighted in bold.

With it being the final trading day of the week of sorts, since we do have a US holiday tomorrow, there are some large expiries to be wary of coinciding with the US jobs report release as well.

The first ones are for EUR/USD lumped around 1.1750 through to 1.1850. However, the massive one at 1.1800 is the most notable as warned yesterday. That is still putting a magnet on price action and will likely do so until we get to the non-farm payrolls data later in the day.

Then, there is one for USD/JPY at the 144.00 level. It's not the biggest of expiries but could well just keep a lid on price action alongside the 100-hour moving average at 143.95 currently.

And finally, there's one for USD/CAD at the 1.3600 level. The expiries here should help to keep price action more muted in European trading until we get to the US jobs report before dollar sentiment takes over.

As for tomorrow, the expiries board is relatively thin considering that broader markets are going to settle down a bit with US will be out until next week.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at investinglive.com.

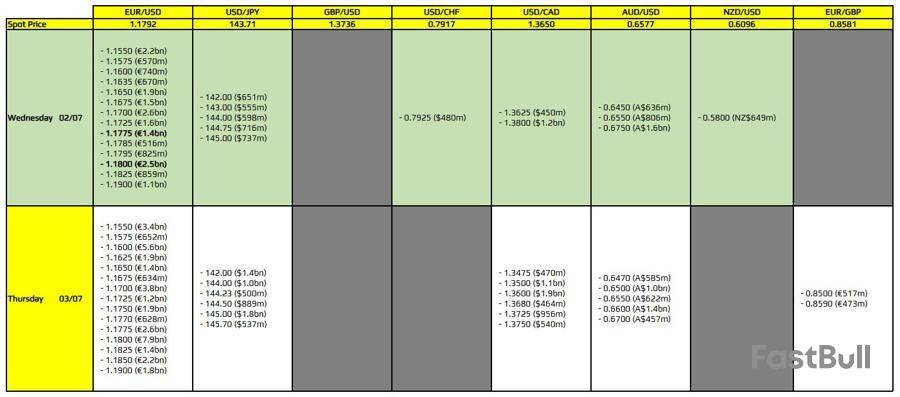

There are just a couple to take note of on the day, as highlighted in bold.

That being for EUR/USD at the 1.1775 and 1.1800 levels. The one at the figure level is in focus again, similar to yesterday and will also be a factor tomorrow with nearly €8 billion in expiries rolling off just before the long weekend in the US. The expiries are likely to place a magnet on price action ahead of the US jobs report tomorrow at least. That unless we get any major headline surprises to shake things up.

However, do keep an eye out for dollar sentiment in general. It is on the softer side still and we could yet see further vulnerabilities or perhaps some positioning plays before the non-farm payrolls data.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at www.forexlive.com.

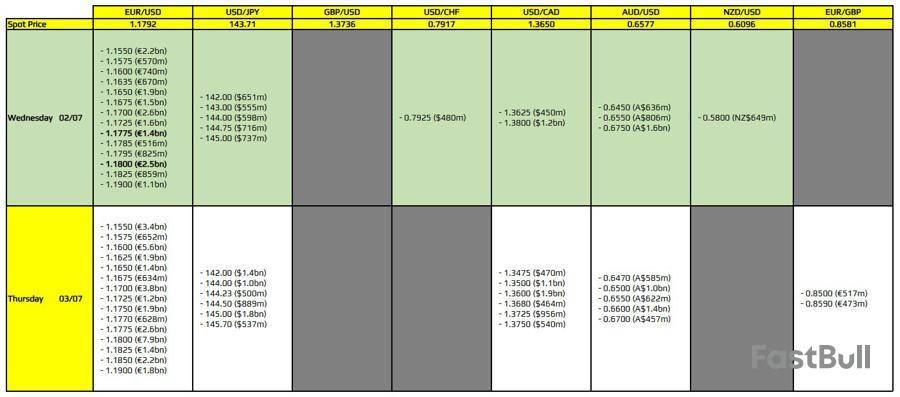

There are just a couple to take note of on the day, as highlighted in bold.

That being for EUR/USD at the 1.1775 and 1.1800 levels. The one at the figure level is in focus again, similar to yesterday and will also be a factor tomorrow with nearly €8 billion in expiries rolling off just before the long weekend in the US. The expiries are likely to place a magnet on price action ahead of the US jobs report tomorrow at least. That unless we get any major headline surprises to shake things up.

However, do keep an eye out for dollar sentiment in general. It is on the softer side still and we could yet see further vulnerabilities or perhaps some positioning plays before the non-farm payrolls data.

For more information on how to use this data, you may refer to this post here. This article was written by Justin Low at investinglive.com.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up