Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

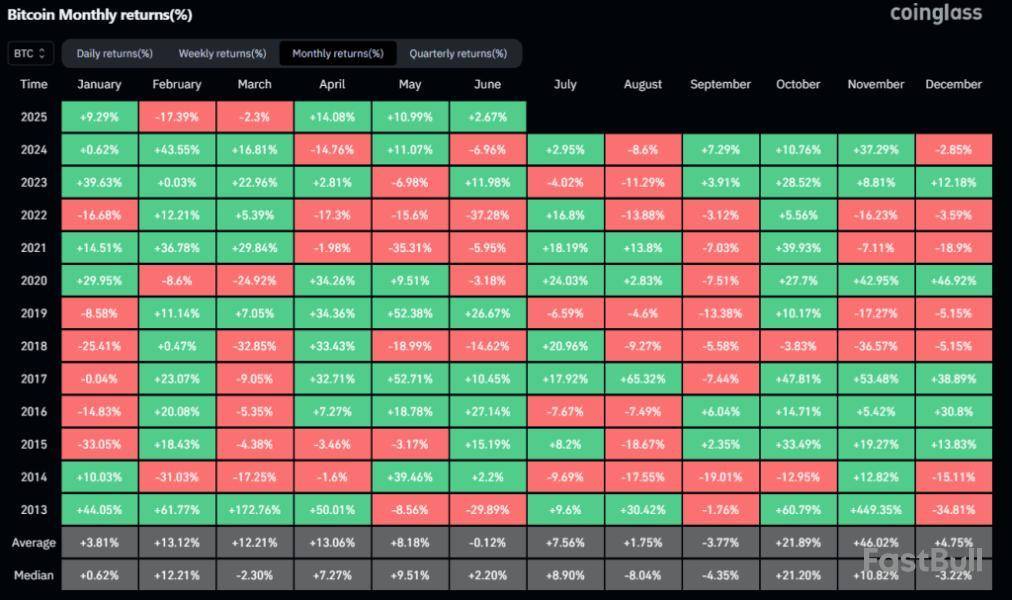

Market tactician Daan Crypto Trades (@DaanCrypto) has put a statistical spotlight on Bitcoin’s habit of dozing through June before rewarding – and sometimes punishing – traders in the following quarter. “BTC June has historically been a pretty slow month,” he wrote, noting that the just-ended period was no exception, with spot prices meandering in a narrow band and finishing “pretty flat.” The comment was accompanied by a Coinglass heat-map of monthly returns that reaches back to 2013 and vividly illustrates the summer pattern he is talking about.

What July Hides For Bitcoin

The numbers support the observation. According to the Coinglass dataset, the mean return for June over the past twelve years is essentially zero (-0.12 %), while July posts a respectable +7.56% on average and an even stronger +8.90 % on the median. August cools to a modest +1.75% mean, and September is where the sell-side pressure historically bites, averaging -3.77% with a negative median of -4.35%.

A simple frequency count underscores the asymmetry: July has finished green in eight of the last twelve years, whereas August and September managed only four positive outcomes each. Years that veterans still recall – 2017’s +65.32 % August melt-up followed by a -7.44 % September slide, or 2020’s +24.03 % July rally that surrendered to a -7.51 % September pullback – appear to have etched the “big flush-out” narrative into collective memory.

Daan’s takeaway is behavioural rather than predictive: “August & September are where we often see a big flush-out but are also the dips you often want to be buying into the end-of-the-year rally… it’s good to be aware of these seasonalities. That way you can focus more on the larger timeframe and won’t get spooked or get over-excited too easily.”

The comment arrives just as Bitcoin tests a cluster of long-timeframe resistances. In a post on Saturday he reminded followers that BTC is “close to all-time high but at resistance… [it] is yet to close a weekly or more than two consecutive daily candles above that resistance. Once it does, we can start getting excited for a larger move.”

The seasonality conversation matters because it collides with a crowded macro calendar and a notoriously illiquid holiday stretch. While historical averages do not guarantee future performance, the heat-map suggests that directional conviction often returns in October – the best-performing month on the table with a +21.89 % mean. For traders, that leaves a two-month corridor in which whipsaw moves are common and positioning discipline becomes paramount.

Daan extends the framework to altcoins via the TOTAL3 index (crypto market cap excluding Bitcoin and Ether). “The TOTAL Altcoin Market Cap has held on to its local support but is still not showing any clear trend… to really get this high timeframe move going you want to break those local highs above the ~$950 B mark. At that point you can start aiming for cycle highs.”

Whether 2025 repeats the seasonality script will hinge on the macro environment, ETF inflows and, above all, Bitcoin’s ability to convert resistance into fresh price discovery. Until that weekly close arrives, seasoned traders appear content to keep summer expectations firmly tethered to the data – exactly as Daan recommends.

At press time, BTC traded at $107,344.

Stablecoin issuer Circle has applied to establish a national trust bank in the United States that, among other duties, would oversee the firm’s USDC reserve on behalf of its US issuer.

If the application is approved by the US Office of the Comptroller of the Currency (OCC), Circle’s First National Digital Currency Bank would be authorized to operate as a federally regulated trust institution, Circle said in a statement on Monday.

Circles Digital Bank also hopes to strengthen the infrastructure that “supports the issuance and circulation” of USDC and offer digital asset custody services to institutional customers, the stablecoin issuer added.

National Trust Banks can’t accept cash deposits or issue loans. However, they can offer custodial services and operate nationally under the oversight of the OCC, rather than having to apply for individual state-based money transmitter licenses or specific digital currency licenses, according to law firm Dave Wright Tremaine.

GENIUS Act compliance

Circle said a federally regulated trust charter would also help it meet requirements under the proposed GENIUS Act, which passed the US Senate on June 17 and moved to the House of Representatives, where it will face another vote before possibly becoming law.

Circle co-founder and CEO Jeremy Allaire said Circle is taking “proactive steps to further strengthen our USDC infrastructure” and “align with emerging US regulation for the issuance and operation of dollar-denominated payment stablecoins.”

National Trust Bank applications to the OCC are subject to a 30-day comment period, and the regulator usually decides to approve or reject within 120 days after receipt of a complete application.

Other crypto firms also eye bank charters

Circle isn’t the only crypto firm hoping to create a national trust bank under the oversight of the OCC.

Eleanor Terrett, the host of the Crypto in America podcast, said in an X post on Monday that there are several other crypto firms, including the digital currency wing of financial services giant Fidelity, that are applying for a national bank charter license from the OCC.

Circle has been considering a bank charter since at least 2022 and was also named in The Wall Street Journal report on April 21 as one of several crypto firms considering applying for a bank charter or license.

Anchorage Trust Company became the first crypto firm to receive a license from the OCC in January 2021, converting into Anchorage Digital Bank.

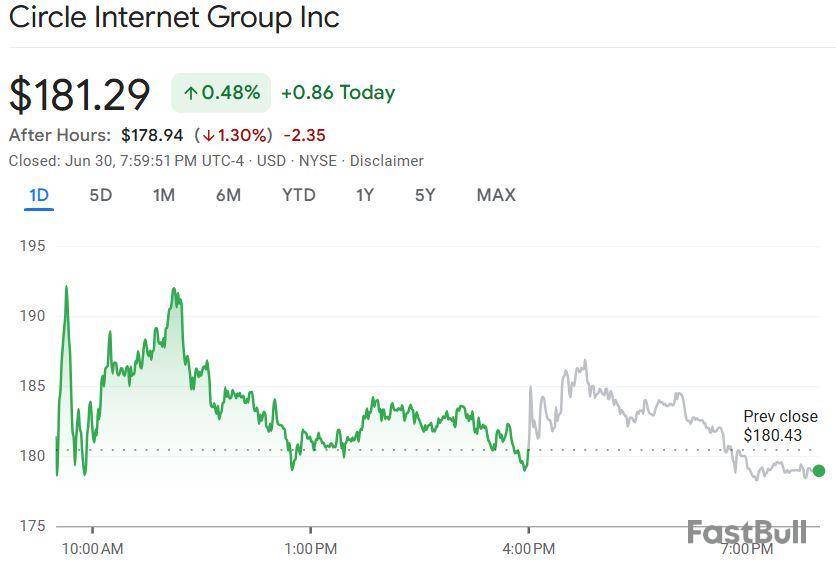

Circles’ stock trades flat

Circle Internet Group (CRCL) shares have traded flat in the last trading session, rising 0.48% to $181, Google Finance data shows. In after-hours trading, the stock dropped 1.30% to $178.

After going public, Circle stock made a strong entry into the market on June 5, climbing 167% during its first trading session on the New York Stock Exchange.

Bitcoin price started trading in a range below the $108,800 zone. BTC is now consolidating and might aim for a move above the $108,000 resistance.

Bitcoin Price Eyes Fresh Gains

Bitcoin price started a fresh increase above the $105,500 zone. BTC gained pace and was able to climb above the $106,500 and $107,200 levels to enter a positive zone.

The bulls pushed the price above the $108,000 resistance and the price tested the $108,800 zone. A high was formed at $108,792 and the price recently corrected gains. There was a move below the $107,500 level. A low was formed at $106,800 and the price is now consolidating losses.

There was a recovery above the 23.6% Fib retracement level of the downward move from the $108,792 swing high to the $106,800 low. Bitcoin is now trading below $107,500 and the 100 hourly Simple moving average.

On the upside, immediate resistance is near the $107,400 level. There is also a bearish trend line forming with resistance at $107,400 on the hourly chart of the BTC/USD pair. The first key resistance is near the $108,000 level and the 50% Fib level of the downward move from the $108,792 swing high to the $106,800 low.

A close above the $108,000 resistance might send the price further higher. In the stated case, the price could rise and test the $108,800 resistance level. Any more gains might send the price toward the $110,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $108,000 resistance zone, it could start another decline. Immediate support is near the $106,800 level. The first major support is near the $106,500 level.

The next support is now near the $105,500 zone. Any more losses might send the price toward the $105,000 support in the near term. The main support sits at $103,500, below which BTC might gain bearish momentum.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $106,800, followed by $106,500.

Major Resistance Levels – $108,000 and $108,800.

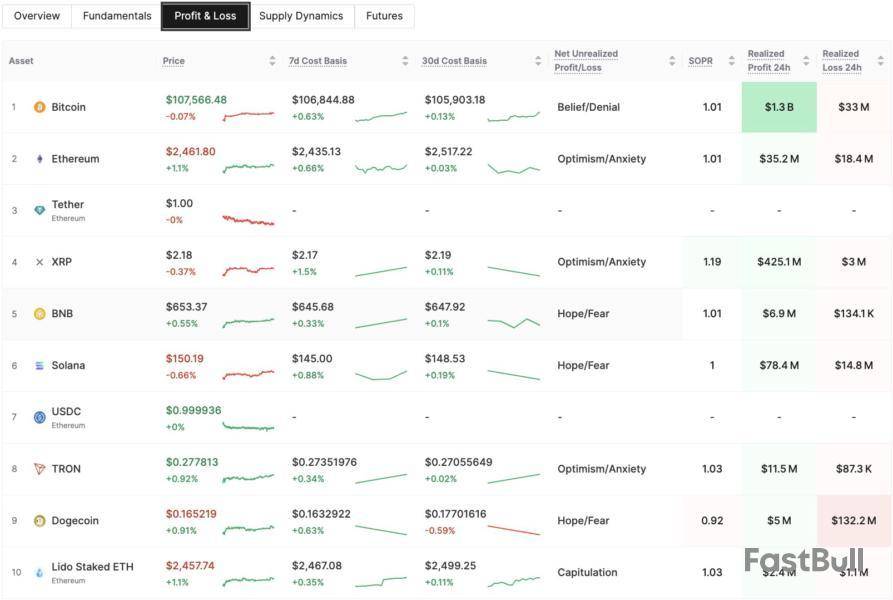

On-chain data shows Dogecoin is the only cryptocurrency among the top 10 where investors are currently realizing more losses than profits.

Dogecoin Investors Realized $124 Million In Loss Over The Last 24 Hours

In a new post on X, the on-chain analytics firm Glassnode has shared how the major cryptocurrencies compare against each other in terms of the Realized Loss and Realized Profit metrics.

These indicators measure, as their names already imply, the amount of loss/profit that the investors on a given network are realizing through their transactions right now.

The metrics work by going through the transfer history of each coin being sold to see what price it was moved at prior to this. If this previous value is less than the price that the coin’s now being sold at, then the token’s sale is leading to profit realization. On the other hand, it being higher suggests loss realization.

The Realized Profit sums up the difference between the two prices involved in all sales of the former type, while the Realized Loss does the same for the latter ones.

Now, here is the table shared by the analytics firm that shows how the 24-hour values of the two metrics currently stack up for the top 10 coins by market cap:

As is visible above, the scale of the Realized Loss and Realized Profit differs greatly between the different assets, but one pattern is consistent: the latter outweighs the former, implying a trend of net profit-taking from the investors.

One asset, however, doesn’t fit the mold: Dogecoin. The 24-hour Realized Loss for the memecoin stands at around $132 million, while the Realized Profit is much lower with a value of just $5 million.

As such, it would appear that while the participants in the rest of the sector have been harvesting gains, DOGE holders have been panic capitulating at a loss instead.

Among these top coins, the investors of Bitcoin have realized the largest profit, with the indicator’s value sitting at a whopping $1.3 billion. The Realized Loss is also restricted to just $33 million for the number one cryptocurrency, indicating selling has been heavily lopsided toward profit-taking.

Things are more balanced for Ethereum, the digital asset ranked number two. Its Realized Loss of $18.4 million is roughly half that of its Realized Profit of $35.2 million.

The fact that profit realization is so dominant for the likes of Bitcoin, however, might actually be a bearish sign. Historically, such market conditions have made tops more likely. A dominance of loss-taking, on the other hand, can facilitate reversals to the upside. As such, while not a given, Dogecoin may not be in a bad position, at least in this regard.

DOGE Price

Dogecoin touched the $0.170 mark during the weekend, but the memecoin has seen a retrace under $0.165 to kick off the week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up