Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

BNB could tap into the $2,000s, according to EGRAG CRYPTO, who found glaring similarities between $BNB’s chart movement and that of gold.

EGRAG found similarities between BNB and XRP as well, which also suggests a $2,000+ target if the momentum holds.

History may support this prediction, given that BNB’s last four-year run kept the token under the trendline, before its breakout above $700 this February. But it was June 23 when $BNB unleashed its true potential, embarking on a several-months-long run, which resulted in a $1,330 ATH two days before October 10’s market crash.

The dip that followed took the coin to $1,024, before a swift rebound above $1,300, making the beginning of the consolidation phase.

As the market recovers and $BNB pushes on, Snorter Token’s ($SNORT) presale sees increased investor participation, after raising over $4.6M since its start date.

Crypto Adoption and Speculation Fuels BNB’s 2025 Performance

2025’s crypto adoption wave is the primary catalyst behind BNB’s elevated growth rate over the past several months.

For BNB specifically, CEA Industries is currently the largest holder, with a treasury of 480,000 tokens, valued at over $412M. But it’s not the only one planning long-term $BNB accumulation.

Windtree Therapeutics already secured $200M from institutional investors to fuel its coming $BNB treasury, with the goal of offering shareholders ‘a unique opportunity to gain exposure to a BNB-focused crypto treasury strategy’.

Then we have the Chinese Nano Labs and its $500M convertible note, creating the foundation of its BNB strategy.

Nano Labs already made the headlines again one month later after securing 495,050 shares in CEA Industries to support its growing treasury.

In this context, BNB’s 2025 performance is a lot more understandable.

As analyst Nansen shows, BNB Chain leads in terms of DEX volume, with $675.9B in capital, 1,309% up since the start of October and this isn’t even the strongest point.

That would instead be the 43% increase in the number of transactions, despite a clear decline in the number of active users. This suggests one thing: growing institutional or whale investments.

BNB is clearly in the green, despite the seven-day chart saying otherwise; switch to the 1-year performance and you’ll see the bigger picture.

With BNB on the front foot for 2026 and beyond, Snorter Token ($SNORT) comes as one of the next crypto to explode in 2025’s Q4.

How Snorter Token Turns Coin Hunting Profitable

Snorter Token’s ($SNORT) goal is to address the main problems associated with coin hunting: the high risk of scams, the newcomer-repellent technical complexity, and the unreliable performance from top-tier sniping tools.

Welcome Snorter Bot, the friendly, sniper rifle-trained Aardvark with one mission in mind: track and bring down the hottest coins on the market in record time and with maximum accuracy.

Unlike professional UIs like Jupiter and Raydium, the Bot can secure the kill milliseconds after liquidity becomes available.

The friendly Aardvark also comes with integrated scam detectors, warning against suspicious projects and traps like rug pulls and honeypots.

Because it operates from its Telegram chat-only, Snorter Bot centralizes everything in one place; no more juggling different wallets, plug-ins, and browser extensions. As a beginner trader, this coin sniffer is your best hunting friend with the lowest fees of any bot at launch (only 0.85%) and its Copy Trading feature, allowing you to steal other traders’ successful strategies.

If you want to buy your $SNORT stack while the presale lasts, go to the official page and secure your tokens today.

Based on the project’s utility and long-term growth map, the most realistic price prediction for $HYPER supports a $1.02 by the end of the year. Make that $1.5 or more by 2030, for a 5-year ROI of 1,290% based on today’s price.

You can read about how to buy $SNORT right here if you want to invest.

This isn’t financial advice. Do your own research (DYOR) and invest wisely.

Authored by Aaron Walker, NewsBTC: https://www.newsbtc.com/news/bnb-aims-for-2000-as-next-crypto-to-explode-alongside-snorter-token

XRP is showing new signs of life after weeks of quiet trading. The token has drawn about $30 billion in fresh inflows, pushing prices up by nearly 4% this week. The latest activity places XRP back in focus as one of the market’s strongest large-cap performers.

Analysts see conditions forming for a steady rally that could lift XRP by as much as 135% over the coming months. Despite the improving outlook, expectations remain moderate. Most analysts do not see the token reaching double-digit prices in this cycle.

Analysts Outline a Realistic Path

On the Paul Barron Podcast, analyst Evan Aldo said that based on technical patterns, XRP could climb toward 4 as the next important level, a move that would mark a 55% rise from current prices.

If XRP manages to clear the heavy resistance zone between 4.30 and 4.50, it could open the path toward $6, roughly a 135% rise.

The probability of XRP reaching the 4 range is viewed as high, while the upper target near $6 remains more uncertain. Still, the overall structure supports a steady upward trend rather than a short-lived spike.

XRP’s Stability Stands Out

While many digital assets remain volatile, XRP has continued to demonstrate stability. This consistency makes it appealing to both long-term holders and institutional investors who prefer less speculative positions.

XRP’s ongoing role in cross-border payments and tokenization projects also strengthens its long-term outlook. These use cases add credibility to the token and help explain the continued flow of capital into the market.

A Push Toward New Highs

The main question now is whether XRP can break past its previous record near $3.80. Technical indicators say it can, but much depends on broader market sentiment and regulatory clarity in the months ahead.

For now, the setup looks favorable. The market appears to be aligning for a steady climb rather than a speculative spike. As Aldo put it, “It’s tough to call the exact top, but the momentum is there. If XRP clears 4, it could move fast.”

Crypto asset manager Algoz has doubled its assets under management (AUM) to more than $200 million and will launch a Cayman Islands-based fund with a US Feeder, FinanceMagnates.com learned exclusively.

Algoz Doubles AUM to $200M, Opens Cayman Fund for US Institutions

The Israeli-based firm, registered as a Commodity Trading Advisor (CTA) with the National Futures Association (NFA), said the new fund structure will allow US professional institutions to invest in its quantitative trading strategies. Algoz crossed the $100 million AUM threshold in the first half of this year, managing more than 50 self-managed accounts for institutional clients. Now, the AUM doubled.Tal Teperberg, Group CEO at Algoz

"Our Self managed account solution has been superb, propelling us to over $200 million in AUM,” CEO Tal Teperberg commented in a statement shared with FinanceMagnates.com. “However, we discovered many family office and allocators simply didn't have a mandate to invest in an SMA and so we believed the time was right to make a battle hardened and successful Market Neutral strategy available to a much wider investment group.”

The new Cayman fund will run Algoz's Market Neutral strategy, which the company says generates returns with low volatility regardless of broader cryptocurrency price movements. The fund will accept investments in US dollars, Bitcoin, Ethereum, XRP, and Solana.

The firm targets family offices, institutional allocators, and digital asset treasury companies looking for alternatives to simply holding tokens. Fund assets will be held through Algoz's custody protection product and traded using an off-exchange settlement system designed to reduce counterparty risk.

Custody Partnership Addresses Institutional Concerns

Algoz partners with Zodia Custody, the digital asset custodian backed by Standard Chartered, National Australia Bank, and Northern Trust, to provide segregated cold storage for client assets. The arrangement follows a pattern the firm established in 2023 when it launched its Quant Pro product to eliminate counterparty risks that have deterred institutional investors.

"Investors will still get our custody protection model, thanks to our partnership with Zodia, and now be able to invest in a regulated, managed, and audited fund structure. We are excited for the prospect of this fund," Teperberg said.

The master-feeder structure using a Cayman exempted company with a US Feeder vehicle has become common for crypto investment funds seeking to accommodate both US taxable investors and international clients. The arrangement allows professional investors to allocate capital through familiar regulatory frameworks while maintaining exposure to digital asset strategies.

Firm Built Infrastructure After Exchange Collapses

Algoz developed its off-exchange settlement approach and custody protections following high-profile failures of crypto exchanges including FTX. The 2022 collapse exposed how exchanges commingled customer funds, prompting regulatory action against major platforms by the Securities and Exchange Commission.

The firm's Quant Pro product, launched in 2023, uses off-exchange settlements through Bitfinex and custody infrastructure that keeps client assets separate from exchange and management company balance sheets. Stephen Wundke, Global Business Development Director at Algoz, said at the time that if all three parties in the relationship failed, customers would still retain their coins.

"The wallet holds the coins entrusted and protects it from being hacked or malfeasant. It protects it in the way it would, but it's held in trust. It's not the asset of the custodian," he commented.

Algoz requires a minimum investment of $100,000 from professional and accredited investors. The firm allows clients to change strategies once per month without cost and permits withdrawals without the 30- to 90-day lockup periods common in traditional hedge funds.

The company was founded in 2016 by Teperberg and registered with the CFTC and NFA as a CTA. It also holds SWAP firm registration with the NFA. The firm manages more than 40 institutional accounts and has said it plans to scale capacity to $500 million in AUM.

Circle Internet Group (ticker CRCL) has tapped crypto security platform Safe as a "premier institutional storage solution" for its USDC stablecoin.

"As institutions increasingly move onchain, they need trusted, scalable infrastructure to manage capital with confidence. Safe has already proven itself as an important platform for USDC adoption at scale, and this partnership underscores the growing demand for regulated, secure digital dollars in institutional treasury management and DeFi," Circle Chief Commercial Officer Kash Razzaghi said in a statement on Tuesday.

Safe, formerly Gnosis Safe, is a multisig-based "smart account" platform that secures over $60 billion in digital assets, including at least $2.5 billion in USDC, today. The new partnership will help position "USDC at the core of the Safe ecosystem," making it “a home for institutional stablecoin DeFi,” Safe founder Lukas Schor said.

According to Dune data, Safe has already processed $25 billion worth of USDC transfers this year, on pace to double its 2024 volume.

"Safe's programmable multi-signature technology, which already powers nearly 4% of all Ethereum transactions, provides the institutional-grade security required for large-scale treasury operations while maintaining direct access to DeFi's deepest liquidity pools, where USDC is a dominant asset," the teams wrote.

The total stablecoin market cap surpassed $300 billion for the first time earlier this month, with Circle’s USDC accounting for nearly a quarter of that amount.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The United Kingdom’s Financial Conduct Authority (FCA) has revealed a roadmap to help asset managers adopt blockchain technology for fund tokenization.

In a Tuesday announcement, the regulator said the initiative aims to “provide firms with additional clarity” to adopt tokenization and “drive innovation and growth in asset management.”

“Tokenization has the potential to drive fundamental changes in asset management, with benefits for the industry and consumers,” said Simon Walls, executive director of markets at the FCA. “There are many things that firms can do under our existing rules and more that become possible with the changes we propose enacting now,” he added.

According to the FCA, tokenized products can increase competition, reduce costs and broaden investment access, particularly to private markets and infrastructure. By digitizing fund operations, asset managers could also lower reconciliation and data-sharing costs.

FCA outlines roadmap for tokenized funds

The FCA’s plan includes guidance for operating tokenized fund registers under existing rules via the UK Blueprint model, a simplified dealing framework for processing both traditional and tokenized fund units and a roadmap for blockchain-based settlement.

The regulator also intends to explore how regulation may need to evolve as tokenization becomes more widespread. “The UK has the opportunity to be a world-leader here and we want to provide asset managers with the clarity and confidence they need to deliver,” Walls said.

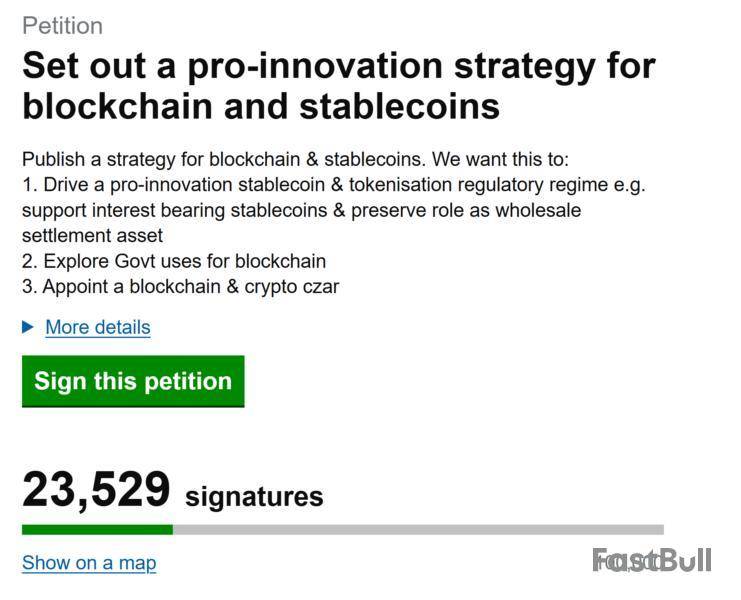

Last month, Coinbase asked users to support a public petition calling on the UK to develop a pro-innovation strategy for blockchain and stablecoins. The petition called for a framework including stablecoin and tokenization regulation, blockchain adoption and the appointment of a blockchain “czar.”

UK faces criticism over crypto policy

The UK’s approach to crypto regulation has drawn criticism from industry stakeholders. In June, analysts from the Official Monetary and Financial Institutions Forum (OMFIF), an independent think tank, warned that Britain has squandered its early lead in distributed ledger finance.

In July, Coinbase also released a satirical video titled “Everything is Fine,” taking aim at Britain’s financial system. The footage used lyrics and music that brag about the country’s strong finances while depicting scenes of inflation, poverty and financial struggles.

The industry pressure appears to have paid off. Last week, the FCA lifted its 2019 ban on crypto exchange-traded notes (ETNs) for retail investors, allowing trading on FCA-approved, UK-based exchanges.

Furthermore, the Bank of England is reportedly easing proposed limits on corporate stablecoin holdings, considering exemptions for firms needing larger fiat-backed reserves.

A cryptocurrency analyst and Bitcoin maximalist, Knut Svanholm, has criticized Bitcoin Core v30.0’s expansion of the OP_RETURN limit to 100,000 bytes for multiple outputs per transaction. Svanholm argues the move will enable "shitcoining" like crowdfunding and staking on Bitcoin’s layer 1 and increase costs for peer-to-peer transfers.

Bitcoin maximalists warn against diluting Bitcoin’s core mission

Notably, the Bitcoin Core v3.0 introduces technical changes, removing the 80-byte limit and reducing relay fees. The changes will make it easier and cheaper to store data, build metaprotocols and execute more complex applications.

These kinds of developments are typically done on other chains like Ethereum. Although some developers consider this a technical enhancement, Bitcoin purists like Svanholm view it as an ideological threat.

He specifically referred to developers like Electron Arc-20 who are celebrating the development. Svanholm maintained that the functions are non-Bitcoin-native features that resemble altcoin — "shitcoin" — behavior.

Knut Svanholm ∞/21M@knutsvanholmOct 14, 2025They're spelling it out.

The changes in Core v30 make it easier for them to "Enable new forms of crowdfunding, staking, and digital economies on Bitcoin L1."

Make no mistake, this is shitcoining, and it is a net negative to Bitcoin. Any "use case" that isn't making sending and… https://t.co/JDITyS5AT6

The Bitcoin maximalist believes that using Bitcoin for speculative or nonessential purposes dilutes its core mission. He insists that the primary intended use case of Bitcoin should be for sending and receiving sats privately and cheaply. Svanholm says everything else, such as DeFi, staking, crowdfunding and NFTs, is all abuse cases that clutter the network and increase transaction costs.

He called on users in the ecosystem to resist and reject Bitcoin Core v30, a new take on the controversial stance in the community. He suggested that users switch to Bitcoin Knots, an alternative implementation that does not include these changes that have caused controversy.

According to him, this is the only way to keep the Blockchain pure and prevent pollution of the ecosystem. "The shitcoiners are running out of gullible morons to scam... now they have to find new fools in the Bitcoin space," he stated.

Developers divided as community debate on Core v30 intensifies

Knut Svanholm is not alone in this opinion. Recently, Luke Dashjr, a prominent developer famous for his work on Bitcoin Knots, also kicked against the move. Dashjr considers running Core v30 as an endorsement of child sexual abuse materials, a claim that makes many ponder whether the community will ever unite in its ideologies.

However, a pro-Core v30 developer, Jimmy Song, does not agree that running the software poses an existential threat to the asset. Song insists that there will always be bad actors who could leverage some features, but it will not kill Bitcoin.

While the debate rages, the Bitcoin community was recently stunned when five sequential blocks were mined on the blockchain within 20 minutes. The four-minute average time puzzled many.

OKX will list PAX Gold (PAXG) on October 15th at 7:00 UTC.

PAXG Info

PAX Gold (PAXG) is an ERC-20 stablecoin anchored by physical gold reserves. Running on the Ethereum blockchain, it is managed and custodied by the Paxos Trust Company, under the regulatory oversight of the New York State Department of Financial Services. PAXG offers a digital alternative to traditional gold investments, allowing users to engage with gold assets in the decentralized finance space.

Each PAXG token is representative of one troy ounce of a 400-ounce London Good Delivery gold bar, secured in renowned vaults like Brink’s. To maintain transparency and trust, third-party audits are conducted monthly to ensure the equivalence of Paxos' gold holdings and the circulating PAXG supply. The findings from these audits are openly published on Paxos’ official website. Additionally, the PAXG infrastructure undergoes regular audits to ensure the robustness and security of its smart contracts.

Beyond its representational value in gold, PAXG as an ERC-20 token boasts compatibility with Ethereum wallets, DeFi platforms, and DEXs. Unlike traditional gold holdings, PAXG ownership omits the need for storage or custody fees, charging users only a minimal transaction fee and Ethereum gas costs. Each token bears a serial number linked to a specific gold bar, and this data can be accessed using the PAXG lookup tool. For flexibility, holders can convert their PAXG into fiat, other crypto assets, or even physical gold at prevailing market rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up