Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

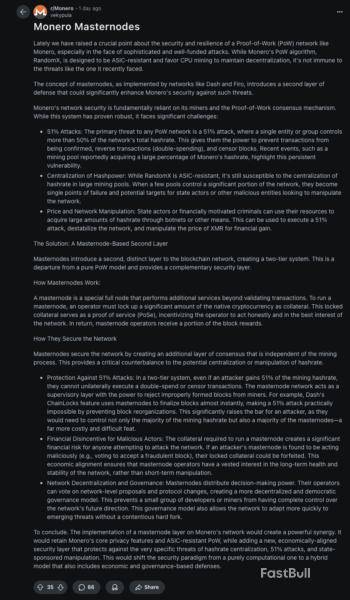

The Monero community is exploring a potential overhaul of its proof-of-work (PoW) consensus mechanism to make the network resistant to 51% attacks.

Community members suggested several proposals, including localizing mining hardware, switching to a merge mining algorithm, allowing XMR to be mined alongside Bitcoin or other major cryptocurrencies, and adopting Dash’s ChainLocks solution.

Dash’s ChainLocks uses “randomly selected masternodes” to reach a quorum on the first valid block broadcast by the network, locking the blockchain ledger into place and appending the chain only with blocks verified through the ChainLock system. This would function on top of the existing PoW Consensus.

ChainLocks prevents 51% network attacks and block reorganizations, even if proposed blocks come from selfish or malicious miners with a higher accumulated proof-of-work than the ChainLocks verified chain, Joel Valenzuela, Dash DAO core member, told Cointelegraph. He also warned:

Even those with ASICs need to have their economic priorities in place, or suffer attacks,” Valenzuela continued. Qubic, an AI-focused blockchain and mining pool, announced that it gained 51% control over Monero in August, prompting fears that the community may target other proof-of-work blockchains.

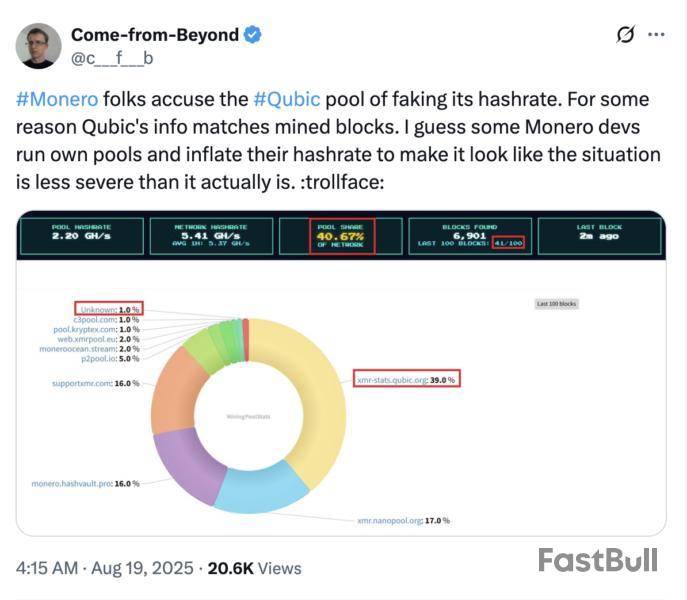

Qubic becomes the largest Monero mining pool, community votes to target DOGE next

The Qubic mining pool currently controls 2.18 gigahashes per second (GH/s), making it the miner with the most hashing power on the Monero network, according to MiningPoolStats.

Supportxmr is the second-largest mining pool by hashing power, commanding 1.18 GH/s of computing power at the time of this writing.

Monero’s community remains divided on the attack, with a portion of Monero users claiming that Qubic never achieved majority control over the network’s hashing power and only managed a limited block reorganization, not a majority takeover of the network.

Despite the denials, Kraken, a major crypto exchange, announced it was temporarily suspending Monero deposits, and, in a subsequent update, Kraken re-enabled deposits, but stipulated that 720 confirmations are required before crediting accounts with XMR.

“Given the current uncertainty around the security of the Monero network due to significant consolidation of hash rate under a single entity, Kraken may halt deposits at any time and delay crediting at its discretion,” the exchange wrote in an update on Monday.

On Sunday, the Qubic community voted to make Dogecoin (DOGE) its next mining target, earning over 300 votes from community members — more than all the other options combined.

Following the vote, Sergey Ivancheglo, the founder of the Qubic network, clarified that DOGE mining “requires months of development,” and the mining pool is currently focused on mining XMR.

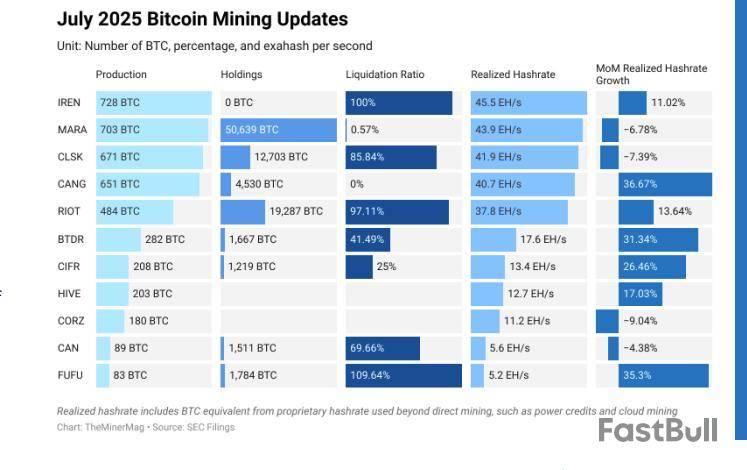

The US-led trade war is having major repercussions for the Bitcoin mining industry, with looming disputes with Customs and Border Protection (CBP) potentially exposing American companies to massive liabilities.

That was a key takeaway from The Miner Mag’s latest Bitcoin Mining Update, which examined how mining firms are navigating a complex tariff environment shaped by ongoing US-China trade tensions.

With the White House modifying tariff rates on several Asian countries, the effective duty now stands at 57.6% on China-origin mining machines and 21.6% on those from Indonesia, Malaysia and Thailand, according to the report.

The Miner Mag also revealed that two publicly listed US mining companies, IREN and CleanSpark, recently received invoices from CBP over allegations that some of their equipment originated in China.

CleanSpark warned that it could face up to $185 million in potential liabilities, while IREN is contesting a separate $100 million dispute with the agency.

Beyond tariffs, the report said that mining revenues “remain under pressure,” with the network’s hash price stuck below $60 petahashes a second and transaction fees declining below 1% of block rewards.

Amid the trade war, American Bitcoin — backed by members of US President Donald Trump’s family — exercised an option earlier this month to acquire more than 16,000 mining rigs from Chinese manufacturer Bitmain. As Cointelegraph reported, the agreement excludes any potential price impact from tariffs.

Bitcoin mining suppliers are also forced to adapt

The Bitcoin mining industry faces constant pressure to adapt — grappling with rising costs, shrinking margins and growing regulatory risks. The ongoing trade war has only accelerated this trend, pushing miners to become more sophisticated importers while diversifying their supply chains.

Some analysts suggest that US tariffs on mining equipment could dampen domestic demand for rigs, potentially giving an advantage to operators abroad. The ultimate impact, however, will hinge on how US tariff policy develops.

On the hardware front, Chinese manufacturers Bitmain, Canaan and MicroBT have all begun establishing facilities in the United States to mitigate the impact of escalating tariffs.

Canaan’s strategy stands out: The company not only shifted its headquarters to Singapore but also announced US investments aimed at sidestepping trade barriers.

Tyler and Cameron Winklevoss, twin founders of the New York-based Gemini crypto exchange, say they have donated an additional $21 million to the so-called Digital Freedom Fund PAC, in the form of over 188 bitcoins, according to an announcement on Wednesday.

The move is meant to encourage President Donald Trump’s continued support of the crypto industry, particularly as the U.S. electorate begins preparing for what will likely be a contentious midterm election season.

"The mission of the @FreedomFundPAC is to help realize President Trump’s vision of making America the crypto capital of the world,” Tyler Winklevoss wrote on X. “Since inauguration, POTUS and his Administration have been delivering on the promises they made on the campaign trail and then some. We want this unprecedented progress and momentum to continue."

As part of the announcement, Tyler mentions that he and his brother Cameron will continue to lobby for additional legislative and regulatory shifts pertaining to the crypto industry. The Digital Freedom Fund appears to have been formed on July 11 and does not yet show a full accounting of donors as of press time, according to the Federal Election Commission website.

In particular, the Winklevoss brothers are pushing for “thoughtful Market Structure legislation” and a “Skinny Market Structure Bill” that will prevent dual regulation of crypto assets by both the Securities and Exchange Commission and Commodity Futures Trading Commission.

Such a market structure bill, perhaps like the Clarity Act under consideration, would “cement timeless, permanent ideas into law, limit government overreach, and clear the path for builders to build,” Tyler wrote. “Builders don’t need more paperwork that requires them to hire lawyers, consultants, and lobbyists. They need fundamental protections, fair treatment, and for the government to stop meddling.”

As part of this initiative, the Gemini co-founder also advocates for a “Bitcoin & Crypto Bill of Rights” that would codify Americans’ “right to own, self-custody, and transact peer-to-peer” via digital assets. In a similar vein, the Winklevoss brothers also oppose a central bank digital currency because it may become a powerful financial tool wielded by “unelected bureaucrats.”

Additionally, the brothers note that Americans have a right to banking access, regardless of their “political beliefs, religious beliefs, or the lawful business activities” and that software developers should not be held liable for how others use code they publish, maliciously or not, in an oblique reference to Operation Choke Point 2.0 and the recent Tornado Cash trial, respectively.

“We will fight for a level playing field for all. We believe in the power and morality of free markets for everyone and reject any strategy, individual, or group that attempts to engage in behavior that creates unfair regulatory moats, increases barriers to entry for market participants, or puts a thumb on the scale for one company over another,” the Winklevoss twins wrote.

Twin advocates

Notably, Cameron Winklevoss recently told The Block that he has begun to vocally oppose a16z executive Brian Quintenz’s nomination to lead the CFTC on the possible grounds that Quintenz has abused the nomination process to gain information relevant to prediction market Kalshi, where he serves on the board.

In addition to advocating for several industry-specific policies, Tyler Winklevoss also noted that the most recent cash injection will go to support Trump-aligned candidates.

“President Trump’s victory on November 5, 2024, was a historic landslide. Not only did he win the popular vote and the Electoral College, he helped Republicans win back control of the Senate and the House. This cleared the way for President Trump to execute on his agenda with unparalleled speed,” Tyler wrote.

“We want the American Golden Age and we are ready to fight for it. And we don’t just want another year of it, we want three more years of it,” he added.

In 2024, both Cameron and Tyler each donated $1 million in bitcoin to Trump’s presidential campaign, totaling $2 million. However, as the donations exceeded the federal limit of $844,600 per individual, the excess amount of $155,400 per donor was refunded.

In the following months, they together donated approximately $3.5 million in bitcoin to the MAGA Inc. Super PAC, as well as other PAC donations. The Winklevoss twins have since joined several Trump-related crypto ventures, including the American Bitcoin mining company.

Unlike traditional PACs, super PACs are not allowed to donate money directly to political candidates, and their spending must be independent of the candidates they support.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Wyoming Senator Cynthia Lummis, one of the Republicans leading the charge in support of legislation for digital asset market structure, has said a bill will end up on US President Donald Trump’s desk “before the end of the year.”

Speaking at the Wyoming Blockchain Symposium in Jackson Hole on Wednesday, Lummis said Republicans’ goals included having a market structure bill passed through the Senate Banking Committee by the end of September, followed by consideration in the Senate Agriculture Committee in October.

Both committees will address how the US financial regulators, the Securities and Exchange Commission and Commodity Futures Trading Commission, handle digital assets.

“We will have market structure to the president’s desk before the end of the year,” said Lummis. “I hope it’s before Thanksgiving.”

Republicans’ plans to pass market structure in the Senate followed the US House of Representatives approving the Digital Asset Market Clarity (CLARITY) Act in July, with 78 Democrats voting for the bill. Lummis and other Senate Republicans suggested their version of the legislation, tentatively titled the Responsible Financial Innovation Act, would “build on” the CLARITY Act.

“We [...] want to honor as much of the House’s work as we can on CLARITY because they had a robust bipartisan vote,” said Lummis on Wednesday. “And we don’t want to disrupt that very much. So we’re going to use the CLARITY Act as the base bill [...] CLARITY will probably end up being what passes, but CLARITY as tweaked by the Senate.”

Lummis’ remarks echoed those of Senate Banking Committee Chair Tim Scott, who spoke at the Wyoming Blockchain Symposium on Tuesday. The South Carolina senator speculated that “between 12 and 18 Democrats [were] at least open to voting for market structure” once the Senate committees sent the bill for a floor vote.

Senate to also consider CBDC bill

The CLARITY Act was one of three pieces of legislation passed by the House in July as part of Republicans’ “crypto week” plans. In addition to the market structure bill, the House approved the GENIUS Act to regulate payment stablecoins and the Anti-CBDC [Central Bank Digital Currency] Surveillance State Act.

The GENIUS Act, having already been passed by the Senate, was signed into law by Trump the following day. However, the anti-CBDC bill received the least amount of support among the three bills from House Democrats — only two “yays” out of all 212 members present.

Lummis and other Republican senators in the majority have signaled their intention to first focus on market structure, suggesting that any bill to regulate CBDCs could be delayed into 2026.

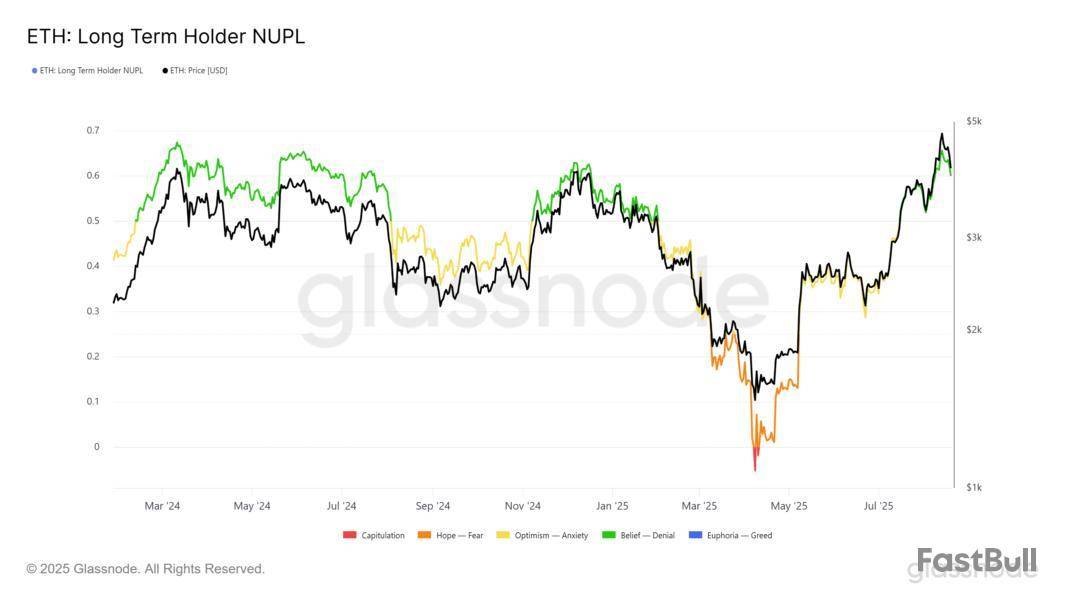

Ethereum has faced a significant decline in its price, dropping from a high of $4,750 to the current price of $4,200.

Despite this, the decline might not be over. Ethereum could experience further downtrends in the coming days, with several indicators signaling potential selling pressure.

Ethereum Holders Could Cause A Crash

Long-term holders (LTHs) of Ethereum are currently seeing a surge in profits, as indicated by the MVRV Long/Short Difference, which has reached a yearly high. Normally, when this indicator falls deep into the negative zone, it signals that short-term holders (STHs) are gaining profits, making them prone to selling.

However, Ethereum’s indicator is in the positive zone, suggesting that LTHs are enjoying substantial profits. This positive movement generally signals strength but can also indicate that LTHs may consider taking profits, leading to potential selling pressure.

The ongoing profit for LTHs puts Ethereum in a precarious position. As these holders are sitting on substantial gains, their decision to sell could exacerbate downward price movement.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum’s LTH NUPL (Net Unrealized Profit/Loss) is currently at an 8-month high, reflecting a historical pattern. The NUPL indicator shows the difference between realized profits and losses for long-term holders, and the recent rise suggests significant gains for these holders.

However, historical trends show that when the NUPL crosses the 0.60 mark, Ethereum’s price has faced a reversal. This indicates that Ethereum could experience a price decline if the current trend continues, as the profits noted by LTHs might encourage them to sell.

With Ethereum’s LTH NUPL at an elevated level, there’s an increased likelihood that long-term holders may sell their positions, amplifying the market correction. The past has shown that this is a strong signal for potential price drops, and Ethereum may be poised for a similar scenario.

ETH Price May Drop to $3,000

Ethereum’s price has already seen a decline, with the current price at $4,219. If the downtrend continues, it could fall below the key $4,000 level. The larger concern, however, is the potential drawdown caused by long-term holders deciding to sell. If the LTHs start taking profits, it could put significant pressure on Ethereum’s price.

Looking at Ethereum’s past price movements, the NUPL indicator shows that when LTHs created a market top, Ethereum’s price dropped below $3,000, reaching lows of around $2,800. If this pattern repeats itself, Ethereum’s price could experience a similar decline, making $3,000 a critical level to watch.

On the other hand, if Ethereum’s LTHs hold onto their positions and resist selling, the market could see a bounce. If Ethereum manages to reclaim support at $4,222, it could push back toward $4,500, potentially invalidating the current bearish outlook. This would depend on whether the LTHs remain confident and do not trigger further selling pressure.

A significant wave of profit-taking has swept through cryptocurrency markets, with long-term investors capitalizing on recent all-time highs.

Fresh on-chain data reveals that holders of major assets have collectively sold off approximately $2.8 billion in gains, contributing to a widespread market cooldown.$2.8B in Realized Profits as Major Coins Face Selling Pressure

Analytics firm Glassnode reported on August 20 that holders of more than one month booked billions in profits across top digital assets, including Bitcoin (BTC), Ethereum (ETH), Ripple’s XRP, Solana (SOL), and Tron (TRX).

Bitcoin set the pace, with holders registering a massive $1.5 billion in realized profits on July 18, the largest such event since December 2024. ETH followed suit, peaking at $575 million on August 16, with the figure also marking its most substantial profit-taking spike of the current market cycle.

Solana mirrored this activity, seeing more than $105 million in profits realized on August 17, its largest since early 2025, while XRP hit a $375 million profit-taking event on July 24, echoing behavior from its late 2024 rally.

According to Glassnode, this collective action shows a strategic decision by experienced investors to lock in gains following a prolonged upward trend, directly influencing the current price pressure.

The timing of the reaping comes alongside increased volatility in the market. As previously reported by CryptoPotato, BTC dropped below $113,000 for the first time since early August,draggingdown other cryptocurrencies, including ETH, which went below $4,200, while XRP was pushed under the $3.00 support. Meanwhile, Cardano (ADA) was among the hardest hit, plunging 8% to $0.85, while the overall market shed more than $70 billion in capitalization overnight.Market Sentiment, Short-Term Pain, and the Road Ahead

Interestingly, the selloff has also come at a time when there is a stark shift in crowd psychology. Data shared today by Santimentshowedthat social media sentiment toward BTC has turned sharply negative, hitting its lowest since June. Historically, such fear-driven phases have often marked local bottoms, with contrarian traders stepping in to take advantage of the increasing panic in the market.

Short-term data further shows the divide between long- and short-term participants. A recent CryptoQuant report noted that investors who have held Bitcoin for less than five months had realizedlossesfor the first time since the start of the year. Such events, according to the platform’s analysts, either flush out weaker hands before a rebound or risk deeper corrections if selling accelerates.

Meanwhile, Tron is offering a counterpoint. Despite heavy long-term profit-taking earlier this month, short-term TRX holders are sitting on gains of more than 30%, sparking optimism for continued momentum.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up