Wednesday’s market has seen notable movements in various stocks, particularly in the mega-cap and large-cap categories. Stocks like Visa Inc (NYSE:V) and Mastercard Cl A (NYSE:MA) experienced declines, while Circle Internet Group Inc (CRCL) surged. Here are the highlights of some of the most significant stock movers across market cap ranges, reflecting intra-day stock performance.

Mega-Cap Movers (Market Cap $200B+):

- Mastercard Cl A (MA): -3.65%

- Visa Inc (V): -3.14%

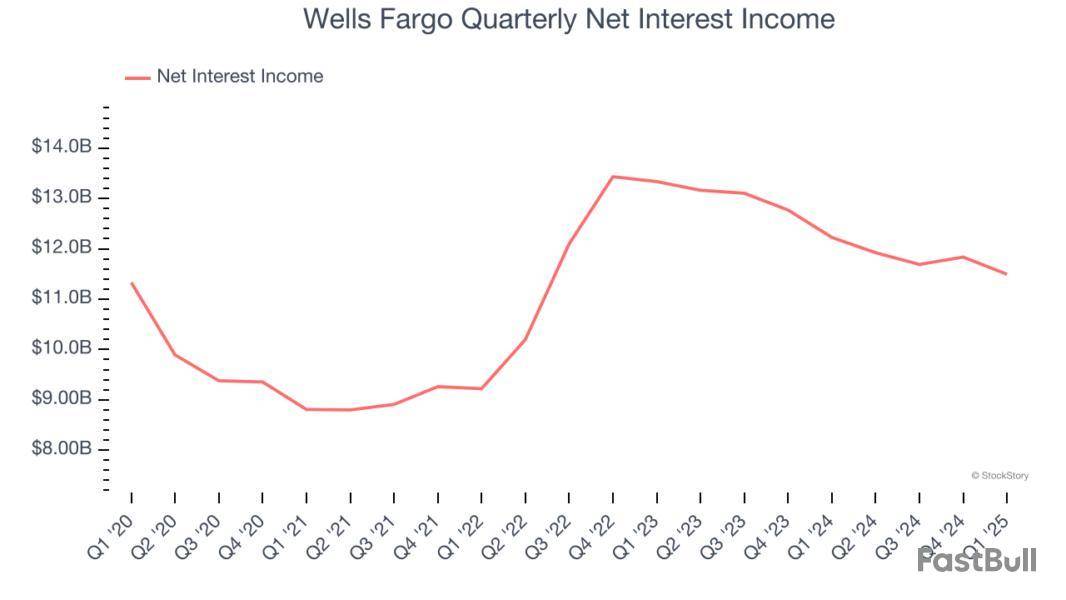

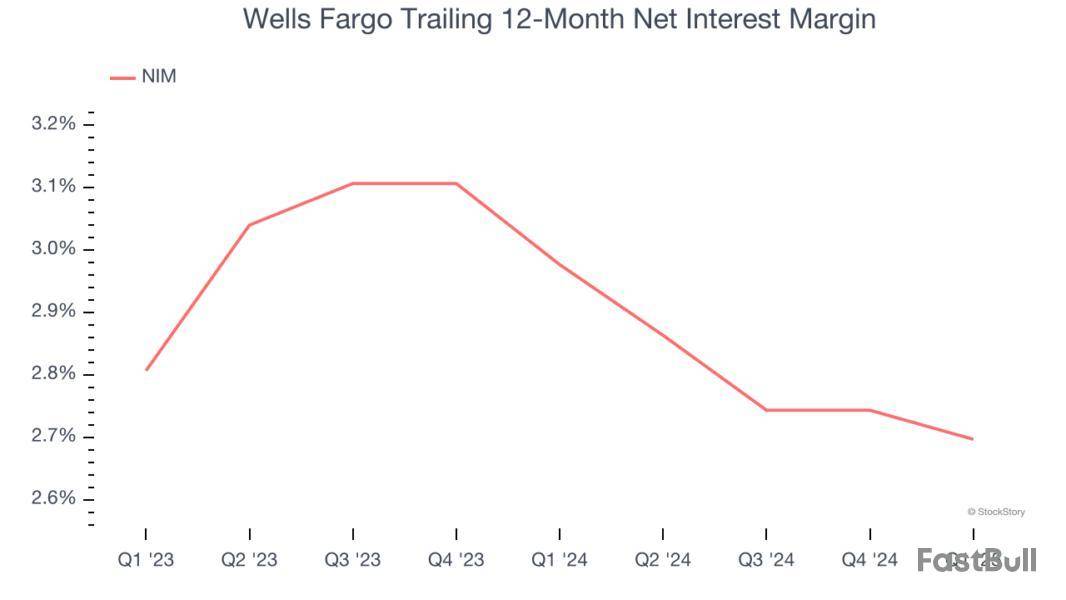

- Wells Fargo (WFC): +2.98%

- Servicenow Inc (NYSE:NOW); NowVertical Group to Participate in Bristol Capital Hosted Webinar to Showcase Business Overview: -1.83%

Large-Cap Stock Movers (Market Cap $10B-$200B):

- Regencell Bioscience Holdings (RGC): -23.07%

- Circle Internet Group Inc (CRCL): +21.72%

- Silversun Tech (QXO); William Blair initiates QXO stock with outperform on acquisition strategy: +14.76%

- Coinbase Global (NASDAQ:COIN): +14.99%

- Chime Financial (CHYM): -7.04%

- Credo Technology Holding (CRDO): +6.85%

- Ctrip.com International (NASDAQ:TCOM): -6.35%

- Marvell Technology Group Ltd (NASDAQ:MRVL); Empower Semiconductor partners with Marvell for AI power solutions: +6.97%

- World Wrestling Entertainment (NYSE:TKO): +5.49%

- Sharkninja (SN): +5.28%

Mid-Cap Stock Movers (Market Cap $2B-$10B):

- LZ Tech Holdings (LZMH): +38.1%

- SVF Investment 3 (SYM): +18.95%

- Oscar Health (OSCR): +18.37%

- Genworth Finl (NYSE:GNW): +14.11%

- Scholar Rock Holding Corp (NASDAQ:SRRK); Scholar Rock’s apitegromab preserves lean mass during weight loss: +15.38%

- New Providence Acquisition Corp N (ASTS); Vi and AST SpaceMobile partner to expand satellite connectivity in India: +10.39%

- GMS Inc (NYSE:GMS); GMS reports mixed Q4 results amid soft end market conditions: +10.53%

- Upstart Holdings Inc (NASDAQ:UPST): +10.51%

- Valeant Pharma (NYSE:BHC): +8.81%

- Blue Safari Group Acquisition Corp (BTDR); Bitdeer announces $300 million convertible notes offering: -7.09%

Small-Cap Stock Movers (Market Cap $300M-$2B):

- CONL (CONL): +29.81%

- Guild Holdings Co (GHLD); Bayview to acquire Guild Holdings for $1.3 billion in all-cash deal: +25.7%

- Sustainable Opportunities Acqui (TMC): +26.93%

- SS Innovations International (SSII): +27.19%

- Jyong Biotech (MENS): -17.41%

- Slide Insurance Holdings (SLDE): +16.53%

- Anbio Biotechnology (NNNN): +15.82%

- Centricus Acquisition (ARQQ): +20.89%

- Gogo Inc (NASDAQ:GOGO): +16.6%

- MER Telemanagemen (SBET): -13.62%

For real-time, market-moving news join Investing Pro.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.