Markets

Analysis

User

24/7

Economic Calendar

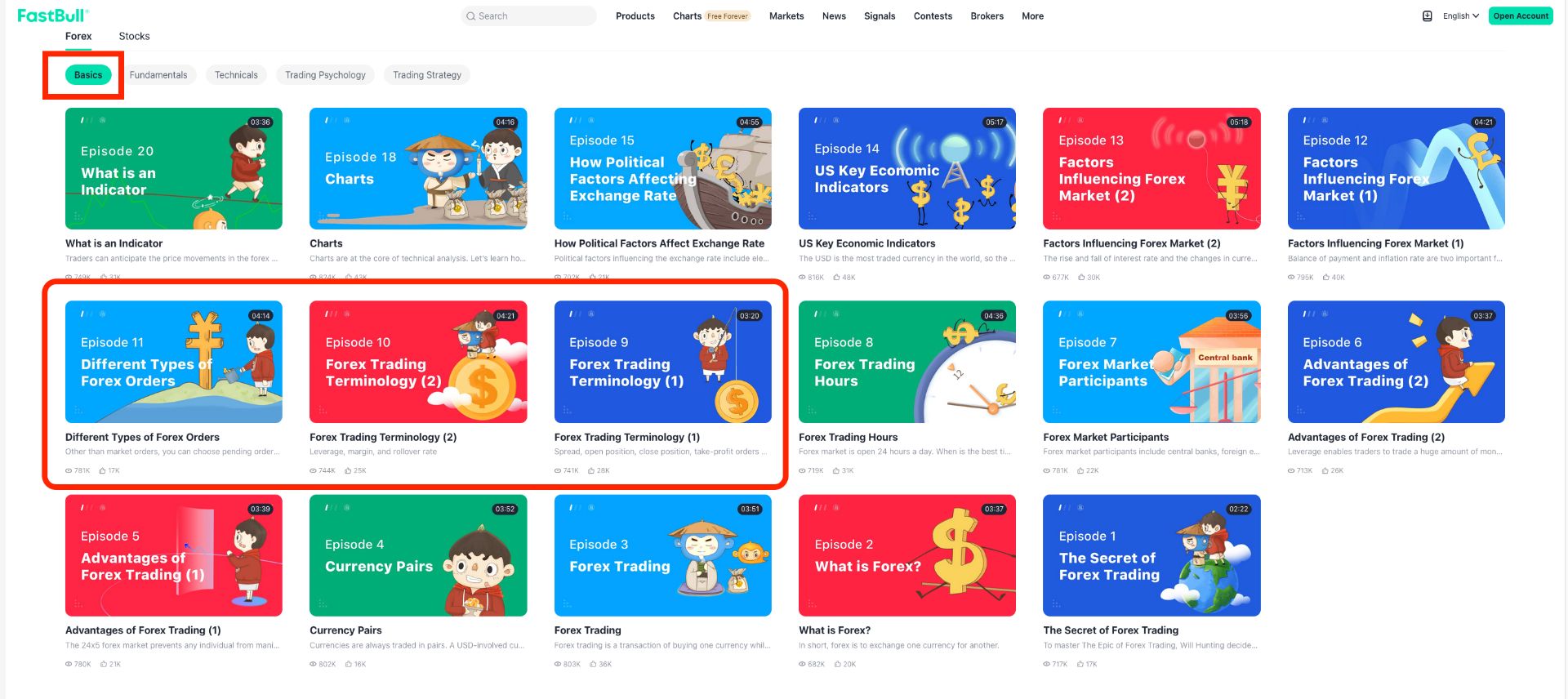

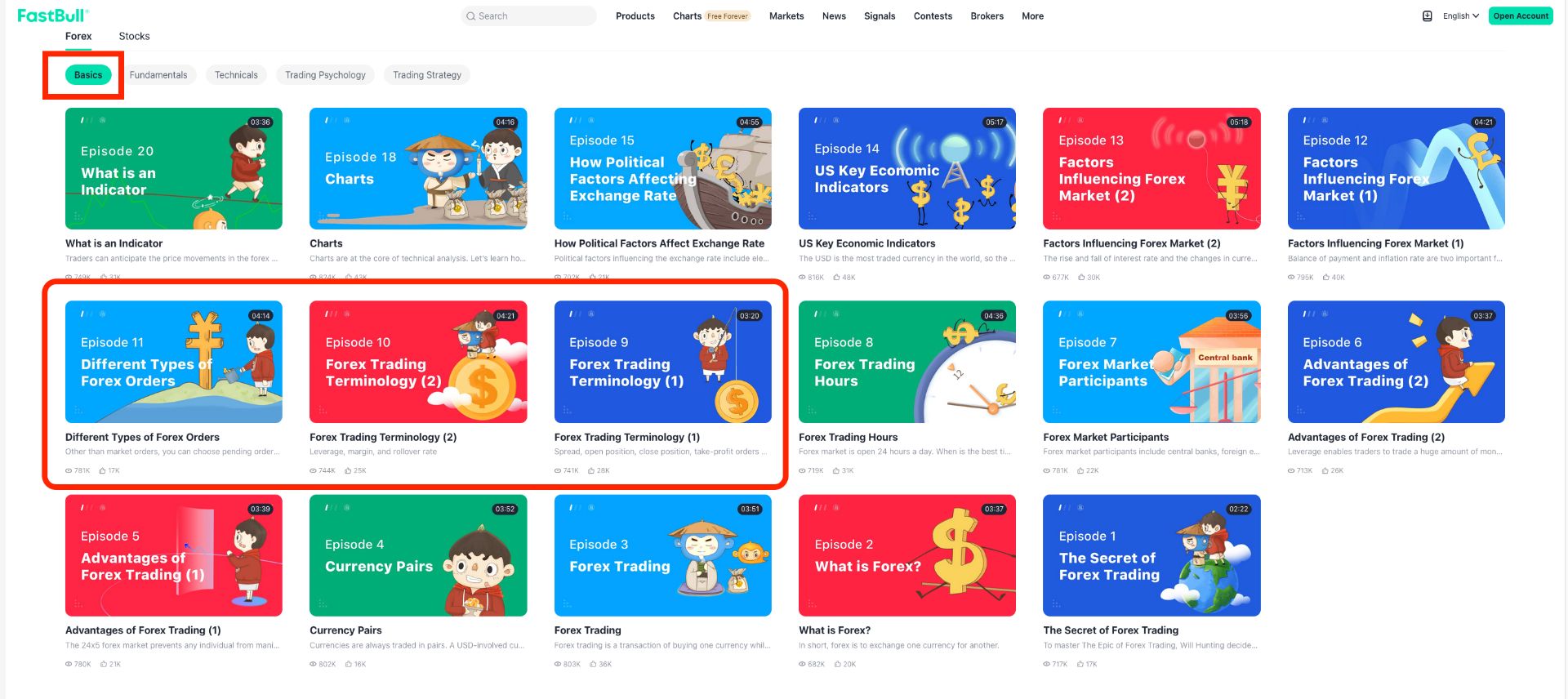

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Industry Minister Akazawa: Decline To Comment On Possibility Of Expanding The Use Of Russian Crude Oil

Europe's STOXX 600 Up 1.9% In Early Trading, If Sustained Would Be Biggest One-Day Gain Since April 2025

Japan Industry Minister Akazawa: G7 Energy Ministers Will Hold A Meeting Tonight To Discuss Possible Release Of Oil Reserves Among Other Issues

Malaysia Transport Minister:Government Working To Assist Malaysian Ships Stranded In Middle East

Iran's Army Says It Targeted Refineries And Fuel Storage In Israel's Haifa With Drones In Retaliation To 'Attacks On Oil Depots In Iran'

Malaysia Transport Minister: Government Will Facilitate Transfer Of Empty Shipping Containers From Port Areas To Avoid Congestion

Shanghai Futures Exchange: Adjusts Price Limits, Margin Ratios For Some Fuel Oil, Petroleum Asphalt And Butadiene Rubber Futures

China, Mainland PPI YoY (Feb)

China, Mainland PPI YoY (Feb)A:--

F: --

P: --

China, Mainland CPI YoY (Feb)

China, Mainland CPI YoY (Feb)A:--

F: --

P: --

Japan Leading Indicators Prelim (Jan)

Japan Leading Indicators Prelim (Jan)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Jan)

Germany Industrial Output MoM (SA) (Jan)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Mar)

Euro Zone Sentix Investor Confidence Index (Mar)A:--

F: --

P: --

Mexico Core CPI YoY (Feb)

Mexico Core CPI YoY (Feb)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Feb)

Mexico 12-Month Inflation (CPI) (Feb)A:--

F: --

P: --

Mexico PPI YoY (Feb)

Mexico PPI YoY (Feb)A:--

F: --

P: --

Mexico CPI YoY (Feb)

Mexico CPI YoY (Feb)A:--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Feb)

U.S. Conference Board Employment Trends Index (SA) (Feb)A:--

F: --

China, Mainland M2 Money Supply YoY (Feb)

China, Mainland M2 Money Supply YoY (Feb)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Feb)

China, Mainland M1 Money Supply YoY (Feb)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Feb)

China, Mainland M0 Money Supply YoY (Feb)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q4)

Japan Nominal GDP Revised QoQ (Q4)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q4)

Japan GDP Annualized QoQ Revised (Q4)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Feb)

U.K. BRC Overall Retail Sales YoY (Feb)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Feb)

U.K. BRC Like-For-Like Retail Sales YoY (Feb)A:--

F: --

P: --

China, Mainland Exports YoY (CNH) (Feb)

China, Mainland Exports YoY (CNH) (Feb)A:--

F: --

P: --

China, Mainland Imports (CNH) (Feb)

China, Mainland Imports (CNH) (Feb)A:--

F: --

P: --

China, Mainland Exports (Feb)

China, Mainland Exports (Feb)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Feb)

China, Mainland Imports YoY (CNH) (Feb)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Feb)

China, Mainland Imports YoY (USD) (Feb)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Feb)

China, Mainland Exports YoY (USD) (Feb)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Feb)

China, Mainland Trade Balance (CNH) (Feb)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Feb)

China, Mainland Trade Balance (USD) (Feb)A:--

F: --

P: --

Indonesia Retail Sales YoY (Jan)

Indonesia Retail Sales YoY (Jan)A:--

F: --

P: --

Germany Exports MoM (SA) (Jan)

Germany Exports MoM (SA) (Jan)A:--

F: --

P: --

France Trade Balance (SA) (Jan)

France Trade Balance (SA) (Jan)A:--

F: --

France Current Account (Not SA) (Jan)

France Current Account (Not SA) (Jan)--

F: --

P: --

Italy PPI YoY (Jan)

Italy PPI YoY (Jan)--

F: --

P: --

South Africa GDP YoY (Q4)

South Africa GDP YoY (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Feb)

U.S. NFIB Small Business Optimism Index (SA) (Feb)--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. Yield--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Feb)

U.S. Existing Home Sales Annualized Total (Feb)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Feb)

U.S. Existing Home Sales Annualized MoM (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Mar)

U.S. EIA Natural Gas Production Forecast For The Next Year (Mar)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Mar)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Mar)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Mar)

U.S. EIA Short-Term Crude Production Forecast For The Year (Mar)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Feb)

Japan Domestic Enterprise Commodity Price Index YoY (Feb)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Feb)

Japan Domestic Enterprise Commodity Price Index MoM (Feb)--

F: --

P: --

Japan PPI MoM (Feb)

Japan PPI MoM (Feb)--

F: --

P: --

Germany CPI Final YoY (Feb)

Germany CPI Final YoY (Feb)--

F: --

P: --

Germany CPI Final MoM (Feb)

Germany CPI Final MoM (Feb)--

F: --

P: --

Germany HICP Final YoY (Feb)

Germany HICP Final YoY (Feb)--

F: --

P: --

Germany HICP Final MoM (Feb)

Germany HICP Final MoM (Feb)--

F: --

P: --

Turkey Retail Sales YoY (Jan)

Turkey Retail Sales YoY (Jan)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil Retail Sales MoM (Jan)

Brazil Retail Sales MoM (Jan)--

F: --

P: --

U.S. CPI MoM (Not SA) (Feb)

U.S. CPI MoM (Not SA) (Feb)--

F: --

P: --

No matching data

Gold prices have continued to climb from the post-FOMC low of $4,182. Market participants are reassessing the monetary-policy outlook after the Fed’s latest rate cut.

4335.20

Entry Price

4286.00

TP

4389.00

SL

492.0

Pips

Profit

4286.00

TP

4285.97

Exit Price

4335.20

Entry Price

4389.00

SL

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up