Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

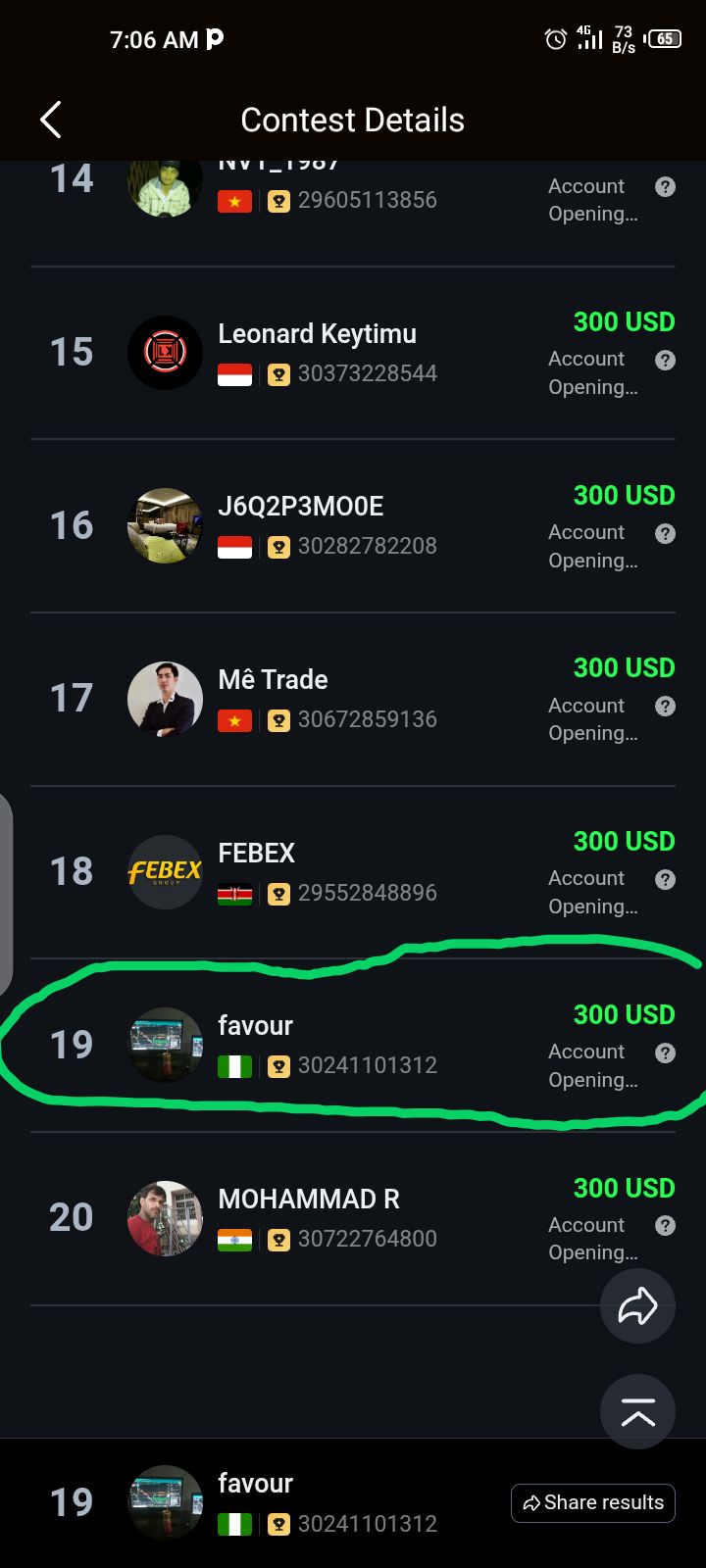

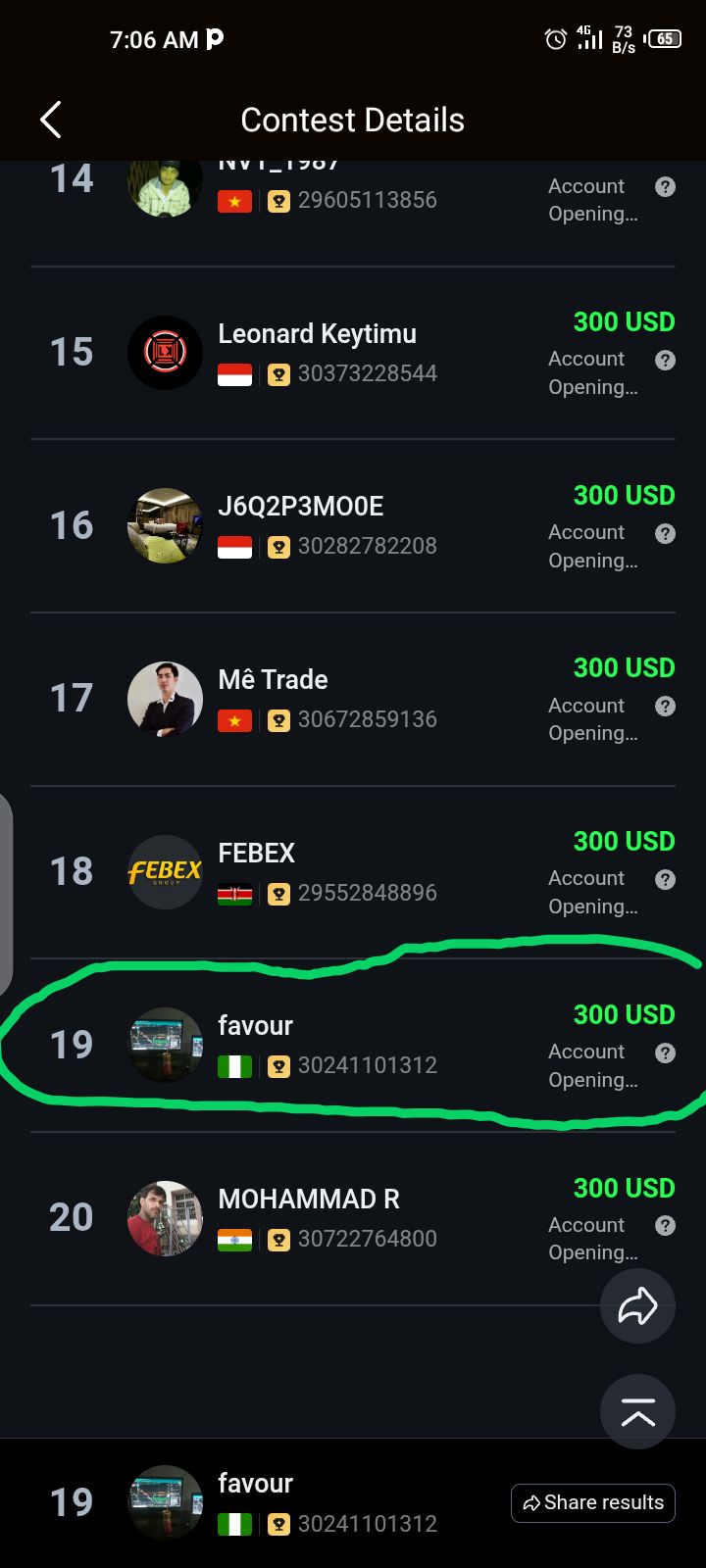

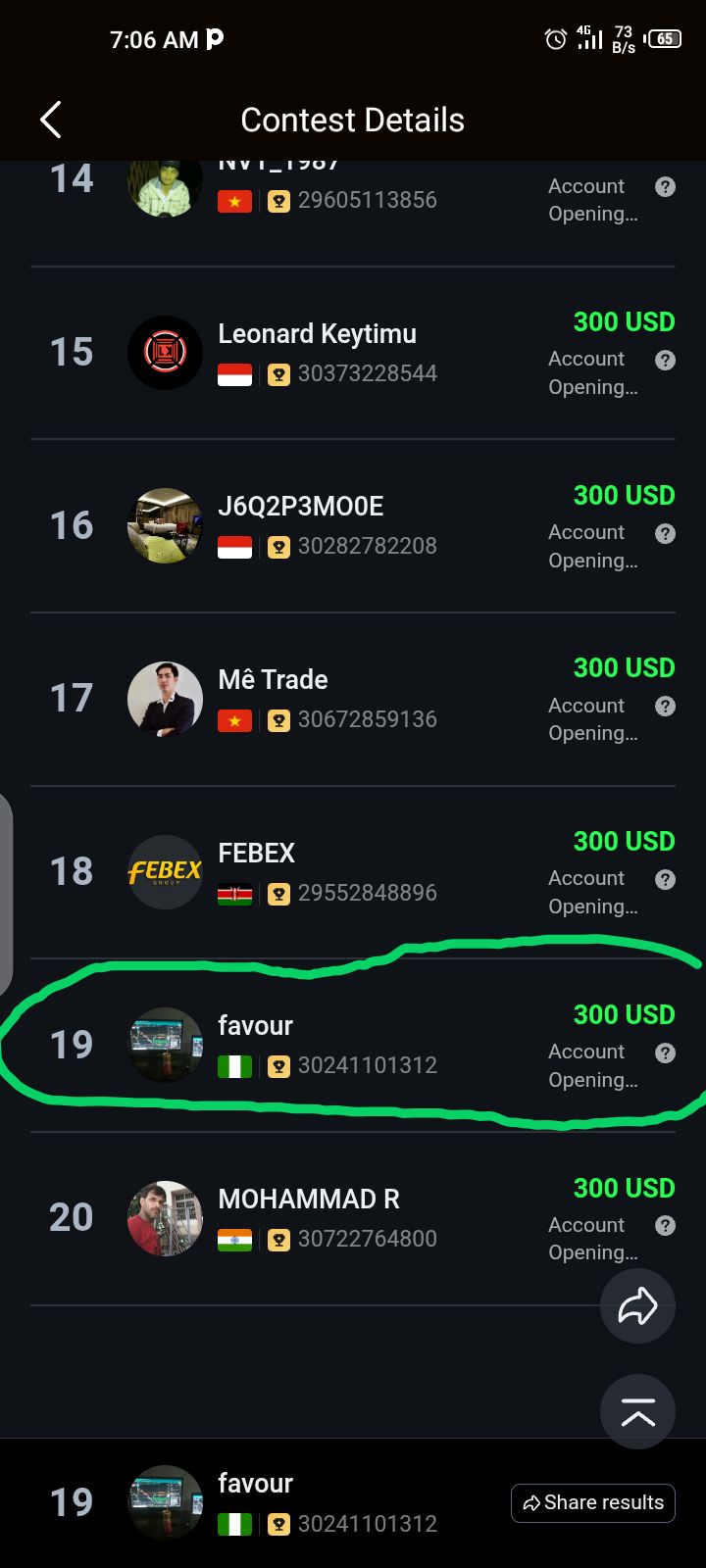

Signal Accounts for Members

All Signal Accounts

All Contests

French President Macron Tells Le Monde And Other European Papers: Now Is Good Time For Europe To Launch A Means Of Joint Borrowing, For Example Via Eurobonds

Bank Of Japan Offers To Sell Y 500 Billion Japanese Government Bonds As Collateral For USA Dollar Funds-Supplying Operations In Repo Pact For 2/12 - 2/20

Kazakhstan's Net Gold And Foreign Currency Reserves $69.526 Billion In Jan (10.1% Change Month-On-Month) - Central Bank

Malaysian Palm Oil Board - Malaysia's January Palm Oil Exports 1.48 Million T, Up 11.44% From December

Malaysian Palm Oil Board - Malaysia's January Palm Oil End-Stocks 2.82 Million T, Down 7.72% From December

Malaysian Palm Oil Board - Malaysia's January Crude Palm Oil Production 1.58 Million T, Down 13.78% From December

Bank Indonesia Senior Deputy Governor: There Is Room To Cut Interest Rate Further, But Will Be Data Dependent

Japan Jan LNG Spot Contract Price At $11.30/Mmbtu-Japan Oil, Gas And Metals National Corporation (State-Owned Jogmec)

[Owl 24H Trading Volume Surpasses $14 Million] February 10Th, According To Coinmarketcap Data, Owl'S 24-Hour Contract Trading Volume Exceeded 14 Million US Dollars, With The Main Trading Platforms Being Gate ($6.27 Million), Mexc ($4.63 Million), Bingx ($1.68 Million), Etc.In Addition, Users Can Also Conduct Owl Contract Trading On Platforms Such As Aster, Weex, Kcex, Lbank, Hotcoin, Etc

Japan Trade Minister Akazawa: Plan To Visit USA Between Feb 11-14 To Discuss Japan's Investment Plan

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)A:--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)A:--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

No matching data

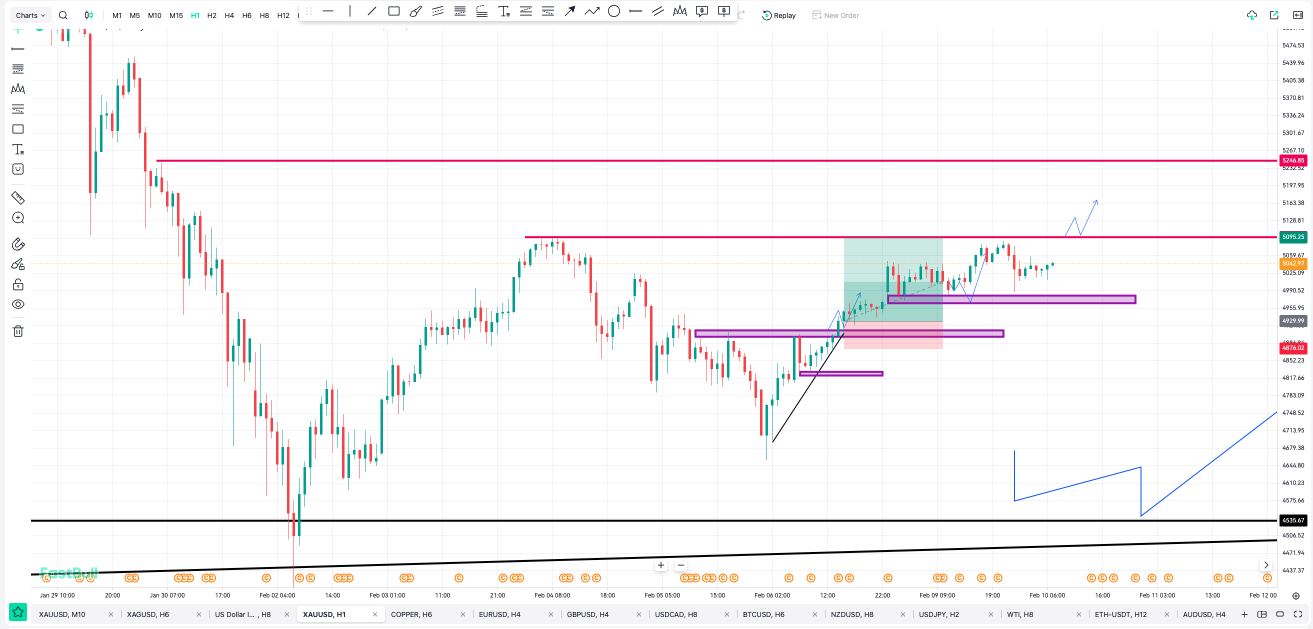

Since early October, XRP's trend has been defined by a wide descending channel that is still stuck inside. Every attempt to break above the upper boundary has been thwarted by diminishing volume, lower highs and ongoing pressure from the major moving averages — particularly the 50-day and 100-day EMAs, which are still sloping downward.

XRP staying down

Although this keeps XRP in a controlled downtrend, structurally, the asset is finally nearing a turning point given that the price is currently testing the channel's midrange once more. The market's response around $2.05-$2.10, a support area that has consistently absorbed selling without permitting acceleration to the downside, provides the first significant signal. Higher local lows have been produced by each retest, which is frequently the first indication that a downtrend is losing steam. Chart by TradingView">

A breakout would become the central scenario if XRP were to maintain that base and move toward the upper boundary of the channel, which is located between $2.22 and $2.27. But cost is not the whole picture. The payments data from XRP Ledger provides the deeper signal. The most recent spike above 1,000,000 daily payments indicates that the network is maintaining high usage despite price suppression, which is a psychological and functional threshold.

XRP's upcoming volatility boost

In the past, when XRP payments crossed this threshold and remained there, the asset typically saw an increase in volatility within a few days or weeks. Although utility creates a floor under the market and undermines bearish narratives, it does not ensure bullish price action.

This is further supported by the payment volume chart, which shows that over the last three months, transfers between accounts have been steadily rising, with multiple spikes hitting or surpassing the multibillion-dollar equivalent. This suggests that even though speculative liquidity has decreased, bigger players — payment processors, liquidity providers and whales — remain engaged.

What comes next? The point at which XRP's downward trend either ends or resets sharply is getting closer. The most obvious indication of a trend reversal would be a breakout above the channel, along with consistent payments above the one million mark. If that does not happen, the asset may drift back toward $2.00, but the on-chain activity will prevent the structural weakness that was previously observed.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up