Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Brazil's Central Bank Monetary Policy Director Galipolo: But Despite Setting Interest Rates At 15%, Activity Has Proven More Resilient Than Expected With Rates At That Level

Brazil's Central Bank Monetary Policy Director Galipolo: There Is Indeed A Need To Acknowledge An Improved Environment For Inflation

Brazil's Central Bank Monetary Policy Director Galipolo: Central Bank Was Quite Resilient And Patient In Gradually Building Confidence And Allowing The Interest Rate Effect To Take Hold In The Economy

Brazil's Central Bank Monetary Policy Director Galipolo: We Implemented Interest Rate Hikes In Response To The Deteriorating Environment, Including Inflation Expectations, Forex, Economy Overheating

US Defense Secretary Hegseth: Overnight, USA Military Conducted Right-Of-Visit, Maritime Interdiction And Boarding On The Aquila Ii Without Incident In The Indopacific

Equinor: Two People Hospitalised Due To Incident At Norway's Oseberg Oil And Gas Field, Output Is Unaffected

Bank Of England: Bank Expects To Execute This Transaction In The Near Future, Subject To Market Conditions

India Foreign Ministry: Foremost Priority Is To Safeguard Interest Of Indian Consumers On Energy

UK Prime Minister Starmer's Spokesperson: PM Is Getting On With The Job Delivering Change To Britain, Has No Plans To Stand Aside

Shanghai International Energy Exchange: Adjusts Price Limits, Margin Requirements For Crude Oil Sc2903, Low-Sulfur Fuel Oil Lu2703, No. 20 Rubber Nr2702, And International Copper Bc2702 Contracts

According To A Statement From A Thames Valley Police Spokesperson Cited By The Sun, British Police Are Assessing Allegations That Prince Andrew Leaked Information To Epstein

Agrural - Brazil's Center-South 2026 Second Corn Planting Hits 22% Of Expected Area As Of Last Thursday

Iran's Atomic Chief Eslami Says The Transfer Of Uranium Materials From Iranian Territory Is Not Currently On The Agenda. Even If Such Discussions Arise In The Future, Some Countries Have Expressed Their Willingness To Assist In Negotiations, But This Issue Has Not Been Discussed In The Current Talks

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks

No matching data

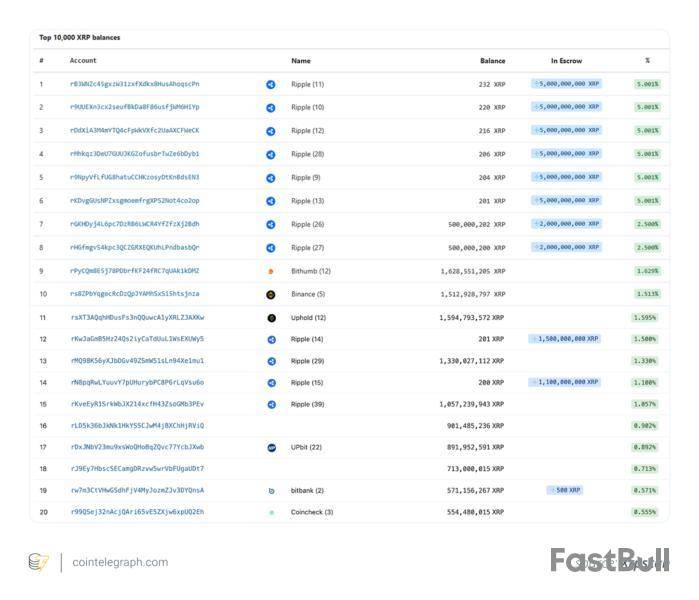

The undisputed XRP rich list

Ripple Labs is by far the largest XRP owner, controlling around 42% of the total 100 billion supply. This is unsurprising, as it is the company that developed the XRP Ledger and created the XRP digital currency.

The San Francisco-based operation has its massive stake broken down into two categories:

Ripple runs an escrow release system where a predictable monthly amount of XRP is unlocked. Typically, 1 billion XRP is released per month using a smart contract mechanism on the XRP Ledger.

This is a method for managing supply and maintaining price stability. These released funds are used to fund Ripple’s operational expenses and provide liquidity for its On-Demand Liquidity Service (ODL).

As a part of careful treasury management, Ripple doesn’t flood the markets with fresh XRP every month. Instead, 60% or more of monthly unlocked funds are relocked, with the company not needing the full complement for operational costs.

In an extreme example, if Ripple were to stop relocking tokens, the whole 35-billion escrow stash would be depleted in just three years.

The relocking pattern currently in place means Ripple will likely continue to top the XRP rich list for years to come. For many crypto users, such large control of the supply is uncomfortable. The 42% controlling stake gives it unprecedented influence on the marketing dynamics.

It is basically a double-edged sword that offers flexibility but raises concerns about decentralization and the ethos it backs.

Did you know? There are over 6.6 million active XRP wallets; however, many of these may actually be very small or inactive wallets. Additionally, a notable share of those wallets likely belongs to repeat users who maintain multiple addresses. So, in reality, there might be fewer than 1 million unique XRP holders worldwide.

Chris Larsen’s billionaire empire

You might not be surprised to learn that Ripple co-founder and executive chairman Chris Larsen is the largest individual XRP owner with over 2.5 billion XRP worth around $7 billion.

He distributes his holdings across eight distinct crypto wallets, which are tagged by blockchain explorers.

Of his eight wallets, No. 1 through 4 still contain just over 500 million XRP and have never made any outbound transfers. He received these funds as a founder’s gift in 2013. Although wallet No. 5 has been in selling action during 2025, reducing holdings from 500 million XRP to 280 million.

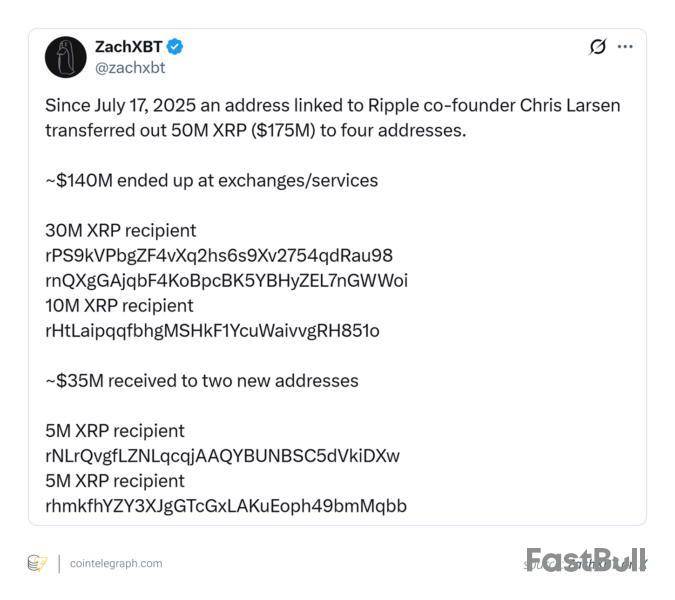

In July 2025, Larsen made significant sell-offs, hitting the headlines when $175 million worth of XRP was transferred onto exchanges after July 17. These sales coincided with XRP reaching seven-year highs above $3.

Still, Larsen’s total holdings represent 4.6% of the entire XRP market cap. This makes him not just one of the wealthiest XRP owners, but one of crypto’s richest individuals.

Even as an individual, he retains enough XRP to significantly influence market dynamics.

“Wallets linked to Chris Larsen only have another 2.81B XRP ($8.4B) left!” noted ZachXBT on X.

Did you know? To enter the top 10% of the XRP rich list, you only require 2,396 XRP, which is about $7,000 as of August 2025.

XRP exchange powerhouses

Billions of dollars in customer funds live on exchange platforms either during daily trading activity or for storage. A selection of the world’s most popular exchanges make the XRP rich list.

Upbit, the Korean giant, is the XRP exchange leader with around 6 billion XRP in custody. It shows that Korean retail demand is incredibly strong, along with the institutional trading volume.

Elsewhere, Binance is in second place on the exchange list with over 2.7 billion XRP across its multiple custody wallets. Similarly, Uphold has been growing its position recently with nearly 2 billion XRP, followed by Coinbase at 780 million XRP.

Interestingly, this number for Coinbase has dropped substantially since Q2 2025. It’s likely to be strategic repositioning rather than potential regulatory caution, especially since the US Securities and Exchange Commission’s case against Ripple Labs was dropped earlier in August 2025. This gave XRP unprecedented judicial standing in the United States.

Still, Coinbase slashed holdings by 57% in a single month, while competitors continue to expand their reserves.

It is worth mentioning, though, that the exchange holdings are primarily customer assets rather than institutional trading positions. So, understanding what exchanges hold large XRP amounts can give insight into retail ownership and demand as opposed to institutional control.

Did you know? Only 100 addresses control around 68% of the total circulating supply of XRP in 2025. This gives it one of the highest concentration rates among the top market cap cryptocurrencies.

Whales accumulate record-breaking XRP

2025 has been a watershed year for XRP. It’s gone from a crypto pariah embroiled in a fight with the SEC to an asset with clear legal standing.

Momentum has been building as whales collect XRP. In June 2025, it hit another milestone where wallets holding more than 1 million XRP reached 2,708 addresses. This is the highest level in XRP’s 12-year history.

Each of these whale wallets contains over $2 million worth of XRP at 2025 prices. It reflects institutional confidence in the asset, with the XRP Ledger daily active addresses climbing to 295,000 in June 2025.

This is an activity spike, which indicates interest from both retail and institutions. It’s a jump of nearly seven times the trailing three-month average of 35,000-40,000 active addresses.

XRPScan can give you a peek into the rich list, with the top wallets held by Ripple holding 5 billion XRP in escrow. Outside of these, you can see notable rich list wallets are linked to known global exchanges, with only two anonymous trader wallets making their place in the top 20.

What’s clear from the XRP rich list 2025 is the revelation of highly concentrated ownership.

Ripple Labs dominates at every metric, including Larsen, whose stake totals over $8 billion of XRP holdings.

It raises valid decentralization concerns, especially when combined with record-breaking whale accumulation and growth in institutional wallets. That said, the legal clarity that has emerged following a five-year lawsuit is fueling increased confidence in the asset among institutional investors.

Exchanges, too, are accumulating funds at historic levels, with customer custody deposits swelling these numbers on the rich list. It’s a metric that suggests token ownership is still of interest to retail investors despite concerns.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up