Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Market Update] Spot Gold Continued To Rise In Early Trading, Climbing Above $5,000 Per Ounce, Up 0.69% On The Day

[Market Update] Spot Gold Opened $20 Higher On Monday And Is Currently Trading At $4,986 Per Ounce. Spot Silver Opened More Than 1% Higher And Is Currently Trading At $79 Per Ounce

[South African Reserve Bank Governor Warns Of Risks From Rising Stablecoin Usage] South African Reserve Bank (SARB) Governor Lesetja Kganyago Has Warned Of The Risks Posed By The Increasing Adoption Of Stablecoins, Stating That These Crypto Assets Risk A "break Apart." He Emphasized The Central Bank's Responsibility To Protect The "unity Of The Currency" And Its Affordability For The Public. The Central Bank Needs To "protect The Unity Of The Currency And Its Affordability For The Public… The Truth Is, These Things Can Break Apart."

North Korea Leader Kim Jong UN Visited Ministry Of Defence To Mark Armed Forces Foundation Anniversary

[US House Minority Leader: Democrats Will Not Pass Homeland Security Funding Agreement Without ICE Reform] House Minority Leader Hakeem Jeffries Stated That Democrats Are Insisting On Comprehensive Reform Of Immigration And Customs Enforcement (ICE) By Friday's (February 13) Deadline, Threatening To Withhold Remaining Government Funding For The Department Of Homeland Security (DHS) Otherwise. Key Demands From The Democrats Include: Prohibiting Law Enforcement Officers From Entering Private Property Without Judicial Authorization, Mandating The Use Of Body Cameras And Identification Badges, And Prohibiting Face Coverings (masks) During Law Enforcement. If An Agreement Is Not Reached By The End Of This Week, The DHS Will Face Another Shutdown, Which Will Impact Customs And Border Protection (CBP), Federal Emergency Management Agency (FEMA), Transportation Security Administration (TSA), And The Coast Guard

[Trump's Treasury Secretary Recommends: Justice Department Investigation And Senate Hearings For Kevin Warsh's Nomination Should Proceed Simultaneously] Despite Key Republican Senator Thom Tillis's Vow To Block All Federal Reserve Nominations, Treasury Secretary Scott Bessant Has Recommended That The Senate Begin Hearings On President Trump's Nominee For Federal Reserve Chair, Kevin Warsh. Bessant Stated That Trump Nominated Warsh On January 30 To Succeed Powell, And That Warsh Received Broad Senate Support During His Confirmation As A Fed Governor. He Believes That Despite The Blockade, Hearings On Warsh's Latest Nomination Should Continue

US President Trump: We Are Withdrawing (DHS) Officials From Minneapolis; They Are Doing A Good Job There

The US Will Hold Midterm Elections In November, And Treasury Secretary Bessant Sees The Dow Jones Industrial Average's New High As Evidence That The Country's Economy Is In An Upward Cycle, Benefiting Ordinary People. Speaking About The Federal Reserve's Policy, Bessant Said He Expects The Central Bank To Be Cautious About Any Efforts To Shrink Its Balance Sheet

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

What really is altcoin season?

Altcoin season, often called “altseason,” occurs when a significant portion of altcoins, cryptocurrencies other than Bitcoin, experience rapid price increases that outpace Bitcoin’s performance.

This period is characterized by a shift of investor capital from Bitcoin into assets such as Ether , Solana , Cardano (ADA) and even smaller tokens like Dogecoin or Pudgy Penguins (PENGU).

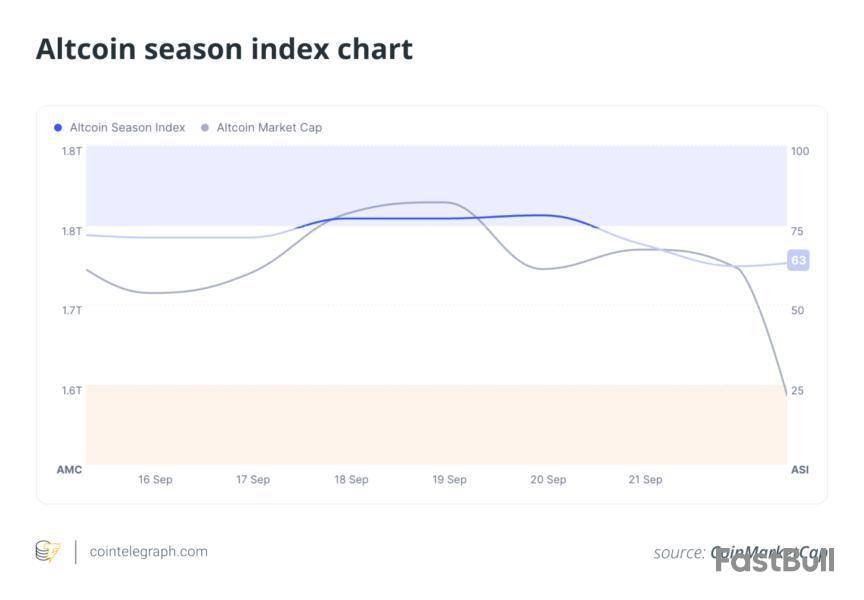

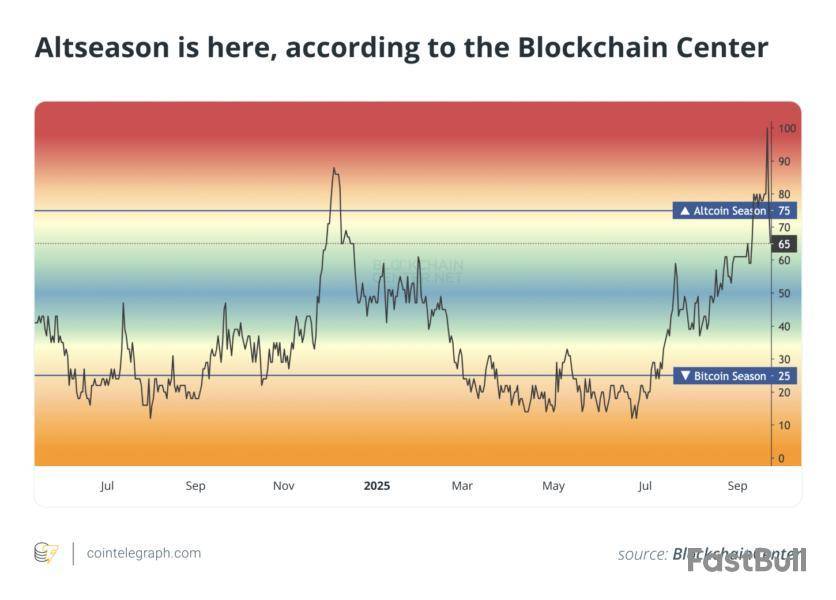

The Altcoin Season Index is frequently used as a benchmark. Per Blockchain Center’s definition, altseason is considered underway when at least 75% of the top 100 altcoins outperform Bitcoin over a 90-day period.

Historically, altcoin seasons have delivered outsized returns. For instance, during the 2021 cycle, large-cap altcoins gained approximately 174%, while Bitcoin advanced only about 2% over the same span.

These episodes raise a central question: What factors consistently drive altcoin season, and why do they matter?

Bitcoin’s price cycle: The catalyst for altcoin rallies

Bitcoin is the crypto market’s bellwether. Its price movements often set the stage for altcoin season. Typically, altseason follows a Bitcoin bull run.

When Bitcoin surges, say, crossing milestones such as $100,000, as it did in late 2024, investors pour capital into the market. Once Bitcoin’s price stabilizes or consolidates, traders often rotate their profits into altcoins, seeking higher returns from more volatile assets.

This pattern is rooted in market psychology. Bitcoin’s rally attracts new capital, boosting overall market confidence. As Bitcoin’s growth slows, investors look for the next big opportunity, and altcoins, with their potential for outsized gains, become the go-to choice. For instance, after Bitcoin’s 124% gain in 2024, 20 of the top 50 altcoins outperformed it, signaling the early stages of an altseason.

A key metric to watch is Bitcoin dominance (BTC.D), which measures Bitcoin’s share of the total crypto market capitalization. When BTC.D drops below 50%-60%, it often signals capital flowing into altcoins. In August 2025, Bitcoin dominance fell to 59% from 65%, hinting at an impending altseason.

Market sentiment and FOMO: The psychological fuel

Altcoin season thrives on human emotion, specifically, the fear of missing out (FOMO). As altcoins like Ether or memecoins like Pepe (PEPE) start posting double- or triple-digit gains, social media platforms like X, Reddit and Telegram light up with hype.

This buzz creates a feedback loop: Rising prices attract more investors, which drives prices higher still. In 2024, memecoins like Dogwifhat (WIF) surged over 1,100%, fueled by community-driven excitement.

Social media trends are a leading indicator of altcoin season. Heightened discussions on platforms like X often precede price rallies, as retail investors jump in to capitalize on the momentum.

For example, in 2025, Google Trends data for “altcoins” shattered records, reaching an all-time high in August, surpassing the May 2021 altseason peak, with search interest entering “price discovery” during Bitcoin’s consolidation above $110,000. This surge reflects exploding retail FOMO, especially for ETH, SOL and memecoins like DOGE, as institutional exchange-traded fund (ETF) inflows (e.g., $4 billion into ETH) rotate capital into altcoins.

Macroeconomic factors: Liquidity and risk appetite

The broader economic landscape plays a massive role in the altcoin season. Macroeconomic conditions like interest rates, inflation and global liquidity significantly influence crypto markets.

When central banks, such as the US Federal Reserve, cut interest rates or increase liquidity through measures like quantitative easing, riskier assets like altcoins tend to thrive. Lower interest rates push investors away from traditional safe havens like bonds and into high-risk, high-reward assets like altcoins.

For instance, analysts are hoping that Fed rate cuts in 2025 could inject liquidity into markets, fueling altcoin momentum. Conversely, tighter monetary policies can suppress altcoin growth by reducing market liquidity. In 2020-2021, aggressive money printing and low interest rates created a perfect storm for altcoins, with the altcoin market cap hitting record highs.

Geopolitical events and regulatory developments also matter. Pro-crypto policies in major markets, such as the US or EU, boost investor confidence and drive capital into altcoins. For example, the 2024 approval of Ether spot ETFs, with inflows reaching nearly $4 billion in August 2025, shows how regulatory clarity sparks altcoin rallies.Technological innovation and new narratives

Altcoin season isn’t just about hype; it’s often driven by technological advancements and emerging narratives. Each altseason tends to have a defining theme.

In 2017, it was the initial coin offering (ICO) boom. In 2021, decentralized finance (DeFi) and non-fungible tokens (NFTs) took center stage. In 2025, analysts point to AI-integrated blockchain projects, tokenization of real-world assets (RWAs) and layer-2 solutions as key drivers.

Platforms like Ethereum, Solana and Avalanche are gaining traction for their scalability and ability to support tokenized securities, from stocks to real estate. These innovations attract institutional capital, which often flows into altcoins before retail investors pile in.

Ethereum, in particular, plays a pivotal role. As the backbone of DeFi, NFTs and layer-2 solutions, Ether’s price surges often signal the start of broader altcoin rallies.

Institutional and retail capital: The money flow

The crypto market has matured, and institutional adoption is now a major driver of altcoin season. Unlike past retail-led booms, in 2025, institutional capital drives altcoin season, with Bitcoin dominance dropping below 59%, echoing 2017 and 2021 pre-altseason trends.

Ether ETFs amassed nearly $4 billion in inflows in August 2025 alone, while Solana and XRP (XRP) ETF reviews signal broader adoption. The US Securities and Exchange Commission’s streamlined ETF listing rules in September boosted over 90 applications, with XRP ETF approval odds at 95%, potentially unlocking $4.3 billion-$8.4 billion.

Solana exchange-traded products saw $1.16 billion year-to-date inflows, and CME’s SOL/XRP futures options launch in October 2025 will draw hedge funds. Retail investors amplify this via FOMO, with memecoins like DOGE ( 10% to $0.28) and presale tokens surging.

CryptoQuant shows altcoin trading volume on Binance Futures hitting $100.7 billion daily in July 2025 (the highest since February), driven by altcoin-to-stablecoin trades, not BTC rotation.

DeFi total value locked (TVL) reached over $140 billion, and the Altcoin Season Index hit 76, with 75% of altcoins outperforming BTC. This $4-trillion market cap growth reflects fresh capital. October’s ETF decisions could trigger over $5 billion of inflows, blending institutional stability with retail hype for sustained altcoin rallies in Q4.

Key metrics to watch: How to spot altcoin season

In the past, analysts have suggested that altcoin season was signaled when Bitcoin dominance fell below 55%, along with an Altcoin Season Index above 75, rising altcoin-to-stablecoin volumes and technical indicators.

To navigate altcoin season, investors rely on several indicators:

Risks and strategies to navigate altcoin season

While altcoin season offers massive opportunities, it’s not without risks. Altcoins are highly volatile, often losing 50%-90% of their value post-peak. Speculative hype, scams and regulatory uncertainty can also derail gains.

To maximize returns, you could consider these strategies:

However, caution is key. The crypto market is unpredictable, and altseason is often only clear in hindsight. By understanding the drivers, such as Bitcoin’s cycle, market sentiment, macro conditions and technological trends, investors can position themselves to ride the wave while managing risks.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up