Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Prime Minister Carney Suspends Planned Trip To Munich Security Conference After School Shooting In British Columbia -PM's Office

Indonesia So Far Has Approved Nickel Mining Quota Of Around 260 Million To 270 Million Metric Tons For 2026

[Kite Market Cap Surpasses $340 Million, Now Ranked In The Top 100 Cryptocurrencies] February 11Th, According To Cmc Data, Kite'S Market Cap Has Exceeded 3.4 Billion US Dollars, With A Growth Of Over 24% In The Past 7 Days, Now Ranking In The Top 100 Of The Cryptocurrency Market Cap List, With A Tvl Of 19 Billion US Dollars

Hsi Closes Midday At 27299, Up 116 Pts, Hsti Closes Midday At 5510, Up 59 Pts, Xiaomi Up Over 4%, Techtronic Ind, Zto Express-W, China Res Mixc, Wh Group, Hang Lung Ppt Hit New Highs

Malaysia Prime Minister Anwar: Malaysia Expects To Save Myr2.5 Billion This Year Via Ron95 Subsidy Rationalization

Reserve Bank Of Australia's Hauser: Even Relatively Small Demand Shocks Can Push The Economy's Speed Limit

Reserve Bank Of Australia's Hauser: Australian Economy Clearly Closer To Balance Than Many Peers

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)A:--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)A:--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)A:--

F: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)A:--

F: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)A:--

F: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction YieldA:--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)A:--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)A:--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Jan)

South Korea Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Australia House Loan Permits MoM (SA) (Q4)

Australia House Loan Permits MoM (SA) (Q4)A:--

F: --

P: --

China, Mainland PPI YoY (Jan)

China, Mainland PPI YoY (Jan)A:--

F: --

P: --

China, Mainland CPI MoM (Jan)

China, Mainland CPI MoM (Jan)A:--

F: --

P: --

China, Mainland CPI YoY (Jan)

China, Mainland CPI YoY (Jan)A:--

F: --

P: --

Turkey Retail Sales YoY (Dec)

Turkey Retail Sales YoY (Dec)--

F: --

P: --

Italy Industrial Output YoY (SA) (Dec)

Italy Industrial Output YoY (SA) (Dec)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

Mexico Industrial Output YoY (Dec)

Mexico Industrial Output YoY (Dec)--

F: --

P: --

Brazil PPI MoM (Dec)

Brazil PPI MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Russia Trade Balance (Dec)

Russia Trade Balance (Dec)--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Jan)

U.S. Average Weekly Working Hours (SA) (Jan)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Jan)

U.S. Private Nonfarm Payrolls (SA) (Jan)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Jan)

U.S. Manufacturing Employment (SA) (Jan)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Jan)

U.S. Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Jan)

U.S. Average Hourly Wage MoM (SA) (Jan)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Jan)

U.S. U6 Unemployment Rate (SA) (Jan)--

F: --

P: --

U.S. Average Hourly Wage YoY (Jan)

U.S. Average Hourly Wage YoY (Jan)--

F: --

P: --

U.S. Unemployment Rate (SA) (Jan)

U.S. Unemployment Rate (SA) (Jan)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Jan)

U.S. Nonfarm Payrolls (SA) (Jan)--

F: --

P: --

Canada Building Permits MoM (SA) (Dec)

Canada Building Permits MoM (SA) (Dec)--

F: --

P: --

U.S. Employment Benchmark (Not SA)

U.S. Employment Benchmark (Not SA)--

F: --

P: --

U.S. Employment Benchmark (SA)

U.S. Employment Benchmark (SA)--

F: --

P: --

U.S. Government Employment (Jan)

U.S. Government Employment (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. Budget Balance (Jan)

U.S. Budget Balance (Jan)--

F: --

P: --

FOMC Member Hammack Speaks

FOMC Member Hammack Speaks Japan Domestic Enterprise Commodity Price Index YoY (Jan)

Japan Domestic Enterprise Commodity Price Index YoY (Jan)--

F: --

P: --

No matching data

Cryptocurrencies are becoming a core part of the economy in Venezuela as citizens turn to digital assets to shield themselves from a collapsing currency and tighter government controls.

From small family stores to large retail chains, shops across the country now accept crypto through platforms such as Binance and Airtm. Some businesses even use stablecoins to pay employees, while universities have begun offering courses dedicated to digital assets.

“There’s lots of places accepting it now,” shopper Victor Sousa, who paid for phone accessories with USDt (USDT), told the Financial Times. “The plan is to one day have my savings in crypto.”

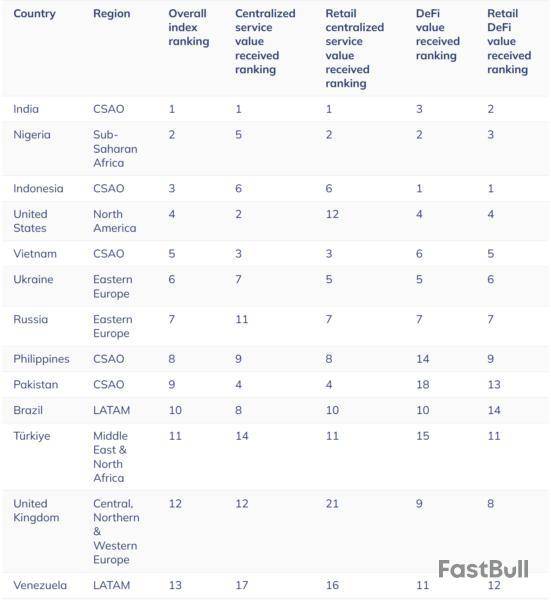

Venezuela ranked 13th globally for crypto adoption, according to the Chainalysis 2024 Crypto Adoption Index report, which noted a 110% increase in usage in the year.

Bolívar’s crash pushes Venezuelans into crypto

The continued slide of the bolívar currency has intensified demand for crypto. Since the government stopped defending the currency in October, it has lost more than 70% of its value. Inflation reached 229% in May, according to the Venezuelan Finance Observatory (OVF).

“Venezuelans started using cryptocurrencies out of necessity,” said economist Aarón Olmos. He noted that they face inflation, low wages, foreign currency shortages and difficulty opening bank accounts.

However, access is not always smooth. With US sanctions on Venezuela’s financial sector, Binance restricts services linked to sanctioned banks and individuals. Connectivity issues also hinder widespread use. Still, experts say the ecosystem is resilient, per the FT report.

The government’s stance on crypto remains inconsistent. Venezuela launched its own digital currency, the petro, in 2018, but the project collapsed last year. The main exchange regulator was shut down in 2023 following corruption allegations tied to oil-linked transactions.

Cointelegraph reached out to Binance for comment, but had not received a response by publication.

Crypto remittances surge in Venezuela

As Cointelegraph reported, crypto remittances have become a crucial lifeline for Venezuelans as the country’s economy sinks deeper into crisis. In 2023, digital assets made up 9% of the $5.4 billion in remittances sent home, about $461 million.

Families are increasingly relying on cryptocurrencies over traditional services like Western Union, which are weighed down by high fees, delays and currency shortages.

Meanwhile, military tensions are rising between the US and Venezuela. On Tuesday, Venezuela’s defense minister announced the deployment of naval vessels and drones to patrol the country’s Caribbean coast following Washington’s decision to send an amphibious squadron of three warships, joined later by a missile cruiser and a nuclear-powered submarine, to the region.

The buildup comes after the Trump administration accused President Nicolás Maduro of working with cartels and expanded its pursuit of Venezuelan leaders, doubling the reward for Maduro’s capture to $50 million and offering $25 million for Interior Minister Diosdado Cabello.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up