Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Ivory Coast 2025/26 Cocoa Arrivals Reached 1.263 Million T By February 8 Versus 1.322 Million T A Year Earlier - Exporters' Estimate

Federal Reserve: U.S. One-year Inflation Expectations Fell To 3.09% In January, Down From 3.42% Previously

EU Proposes To Include Kulevi Port In Georgia And Karimun Port In Indonesia For Handling Russian Oil Exports, Document Shows

UBS CEO Ermotti: Seeing Good Momentum In The Capital Market Pipeline, But We Should Not Underestimate Geopolitics And Volatility

UBS CEO Ermotti: Key Priority For 2026 Is To Complete Integration, After Complex Migration Done Over The Weekend

EU Proposes To Remove Two Chinese Banks From Sanctions And To Add Banks From Laos, Tajikistan And Two Banks From Kyrgyzstan For Providing Crypto Asset Services To Russia

EU Proposes To Sanction 42 New Vessels, Mainly Oil Tankers, In Russia's Shadow Fleet, Document Shows

EU Proposes, For The First Time, To Include Third Country Ports In 20Th Package Of Sanctions Against Russia, Document Shows

Spot Gold Broke Through $5,050 Per Ounce, Up 1.72% On The Day; Spot Silver Is Currently Up 5.65%

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

No matching data

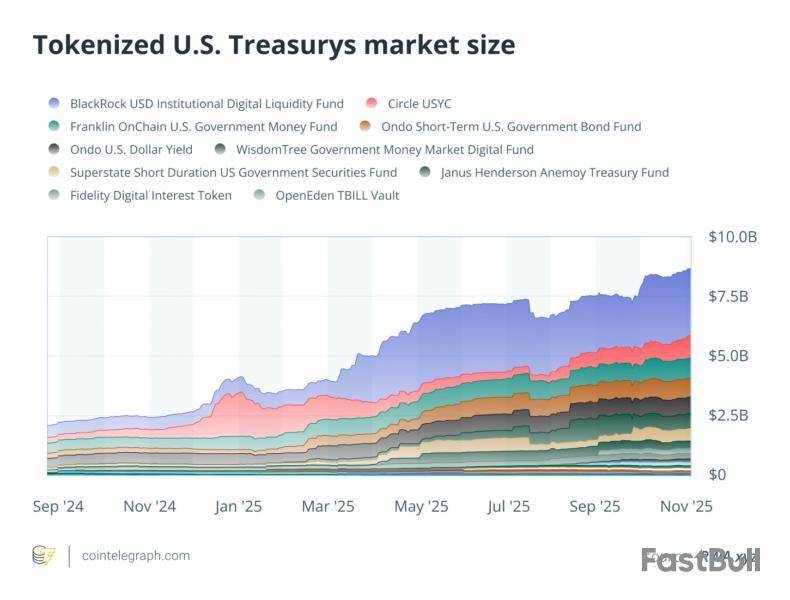

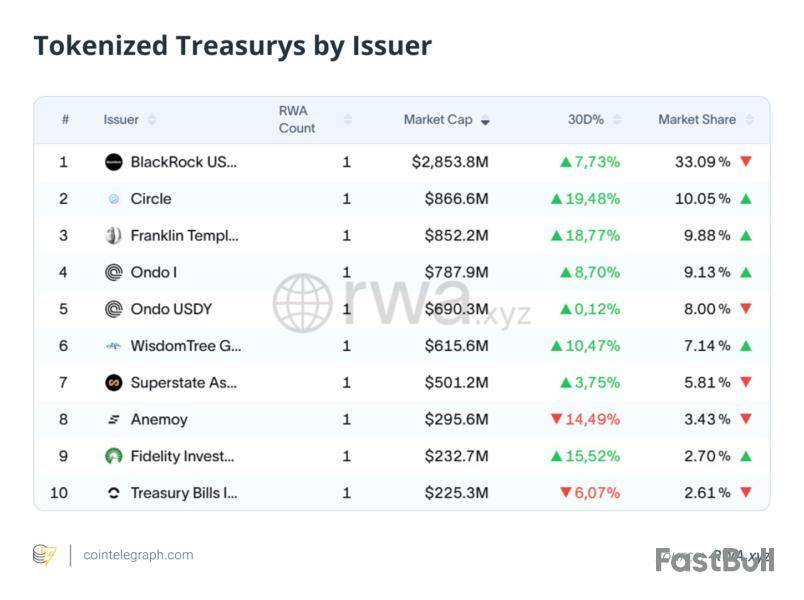

From yield to collateral: The $8.6 billion turning point Tokenized U.S. Treasuries, the largest class of real-world assets (RWA) after stablecoins, have entered a new phase. Tokenized money-market funds (MMFs), which pool cash into short-term U.S. government securities, are shifting from passive yield to collateral for trading, credit and repo transactions. As of late October, the total market cap of tokenized Treasuries reached $8.6 billion, up from $7.4 billion in mid-September. The increase was led by BlackRock’s BUIDL, which reached about $2.85 billion, followed by Circle’s USYC at $866 million and Franklin Templeton’s BENJI at $865 million. Fidelity’s newly launched tokenized MMF also showed impressive growth and rose to $232 million.

Institutional adoption: Exchanges, banks and custodians step in

Digital representations of Treasury bills are starting to move through the same settlement and margin systems that support traditional collateral markets. The first practical test of fund-as-collateral came in June, when BUIDL was approved on Crypto.com and Deribit. By late September, Bybit extended the concept, announcing it would accept QCDT, a DFSA-approved tokenized money-market fund backed by U.S. Treasuries, as collateral. The token can be posted by professional clients on the exchange’s trading platform in place of cash or stablecoins. This allows them to earn the underlying yield from the Treasury fund and maintain trading exposure.

In traditional banking, DBS became the first to move toward actively testing tokenized funds. The Singapore lender confirmed that it will make Franklin Templeton’s sgBENJI, which is the onchain version of its U.S. Government Money Fund, available for trading and lending on the DBS Digital Exchange, together with Ripple’s RLUSD stablecoin. The bank is also running pilot transactions to use sgBENJI as repo and credit collateral. The project turns tokenized money-market funds from a passive investment into a working part of the bank’s financing infrastructure.

Infrastructure and messaging: The hidden engine of tokenized finance

The infrastructure that links banks and blockchain systems has also advanced. Chainlink and Swift, working with UBS Tokenize, completed a pilot that processed subscriptions and redemptions for a tokenized fund using standard ISO 20022 messages. In simple terms, the test showed that the same message format banks already use to settle securities and payments can now trigger smart-contract actions on a blockchain.

The pilot marks a clear step toward interoperability. Tokenized funds have so far existed in separate digital systems that required custom links to connect with banks. Using ISO 20022 as the message format gives both sides a shared language. It allows custodians and fund administrators to move tokenized assets through the same settlement and reporting processes already used for traditional securities.

For investors and institutions, this means tokenized Treasuries are starting to fit into the normal financial workflow rather than sitting apart as a crypto experiment.

Market composition and frictions

The market is still led by a handful of large funds, but it is slowly diversifying. BlackRock’s BUIDL still holds the largest share of the market at about 33% of total tokenized Treasuries. Franklin Templeton’s BENJI, Ondo’s OUSG and Circle’s USYC each account for about 9% to 10%.

A quick look at the table below shows how this balance is starting to shift. The space once dominated almost entirely by one instrument now has several regulated managers sharing meaningful portions of the market. This distribution spreads liquidity and makes collateral acceptance more practical for venues and banks that prefer diversified exposure.

Where tokenized Treasuries still meet friction is not on the demand side, but through regulatory hurdles. Most of the funds are open only to Qualified Purchasers under U.S. securities law, typically institutions or high net worth individuals (HNWI).

The cut-off times are another subtle but important limit. Like traditional money-market funds, tokenized versions only allow redemptions and new subscriptions at specific times of the day. During periods of heavy redemptions or liquidity stress, this schedule can delay withdrawals or injections of liquidity. This makes them behave less like 24/7 crypto assets and more like traditional funds.

Tokenized funds still trade on less liquid markets and depend on blockchain settlement cycles. Therefore, exchanges tend to discount their posted value more heavily than they would conventional Treasury bills. For example, venues such as Deribit apply margin reductions of about 10%. Treasuries in traditional repo markets, on the other hand, only carry haircuts of about 2%.

The difference reflects operational rather than credit risk, such as delays in redemption, onchain transfer finality and lower secondary-market liquidity. As tokenized Treasuries mature and reporting standards tighten, these discounts are expected to narrow toward conventional money-market norms.

Outlook: From pilots to production

The coming quarter will be about connecting the pilots mentioned in this article. The repo tests by the DBS, experiments by exchanges and the Swift x Chainlink ISO 20022 integration all point toward routine intraday collateral use.

On the regulatory front, the U.S. CFTC commenced its Tokenized Collateral and Stablecoins Initiative on Sept. 23. If these consultations and repo programs progress, tokenized Treasuries should shift from pilot projects to production-level tools. They will function as an active layer of the global collateral stack, bridging bank balance sheets, stablecoin liquidity and onchain finance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up