Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mozambique Energy Minister Says "Government Is Doing Everything Required" To Make Sure Mozal Smelter Does Not Close

Brazil's Central Bank Monetary Policy Director Galipolo: And I Thank God For Having Gone Through The Banco Master Process Under Lula's Presidency

Brazil's Central Bank Monetary Policy Director Galipolo: I Thank Finance Minister Haddad For His Support In The Banco Master Case

Brazil's Central Bank Monetary Policy Director Galipolo: We Analyze How We Can Create More Enforcement For Matching The Liabilities And Assets Of Banks Following Banco Master Case

ECB President Christine Lagarde: I Have Great Respect For ECB Governing Council Member Villeroy De Roy's Personal Decision

White House National Economic Council Director Hassett: Lower Employment Data Should Not Cause Panic

White House National Economic Council Director Hassett: Employment Data Should Be Expected To Decline Slightly

Brazil's Central Bank Monetary Policy Director Galipolo: Inflation Expectations Above The Target Are Quite Concerning To US

Brazil's Central Bank Monetary Policy Director Galipolo: We Will Continue To Monitor The Data, We Are Not Pursuing Any Specific Real Interest Rate

Brazil's Central Bank Monetary Policy Director Galipolo: There Is Indeed A Need To Acknowledge An Improved Environment For Inflation

Brazil's Central Bank Monetary Policy Director Galipolo: Central Bank Was Quite Resilient And Patient In Gradually Building Confidence And Allowing The Interest Rate Effect To Take Hold In The Economy

US Defense Secretary Hegseth: Overnight, USA Military Conducted Right-Of-Visit, Maritime Interdiction And Boarding On The Aquila Ii Without Incident In The Indopacific

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks

No matching data

Bitcoin's historic playbook is no longer relevant, according to research and brokerage firm K33's October outlook, which argues that the familiar four-year halving cycle — once the market's metronome — has been rendered obsolete by the rise of institutional adoption, sovereign participation, and macro policy alignment.

Bitcoin hit new all-time highs this week in both U.S. dollars and euros — its first euro-denominated record since January 2025.

"The 4-year cycle is dead, long live the king," K33 Head of Research Vetle Lunde wrote in the report, suggesting that this time is indeed different and bitcoin has entered a fundamentally new regime where structural forces, not retail mania, dictate its trajectory.

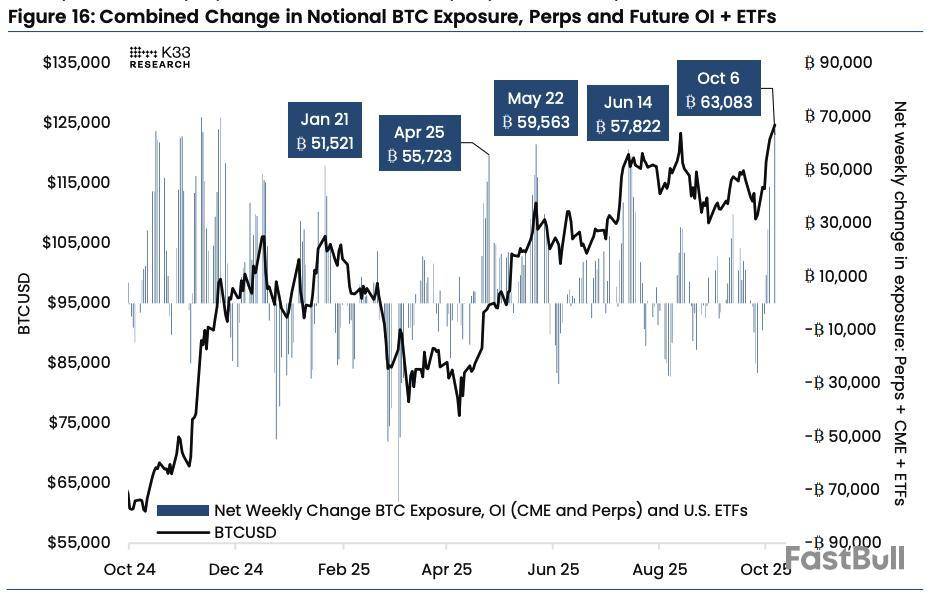

However, Lunde conceded the market looks overheated in the near term, noting that bitcoin ETF and derivatives exposure surged by over 63,000 BTC ($7.75 billion) in a single week — the strongest accumulation of 2025. Open interest on CME futures jumped by nearly 15,000 BTC, while U.S. ETFs absorbed over 31,600 BTC in seven days. Historically, similar spikes have marked local tops and mean reversion plays. Still, the analyst expects only short-term consolidation, not a structural reversal.

Combined change in notional BTC exposure, perps, and futures OI + ETFs. Image: K33.

K33 positions 2025's rally as the antithesis of prior euphoric bitcoin peaks. In 2017, optimism over CME's futures launch fueled a blow-off top, and in 2021, the dream of ETFs ended in Securities and Exchange Commission rejection. However, in 2025, those dreams are a reality, Lunde said, and bitcoin is now a material part of the global institutional market.

BlackRock now manages roughly $100 billion in bitcoin ETF assets, Morgan Stanley is guiding clients toward up to 4% crypto allocations, and Washington D.C. has embraced a crypto-friendly agenda — including President Trump's Strategic Bitcoin Reserve and plans to open 401(k) plans to digital assets, the analyst noted.

"During the 2021 climax, tighter monetary policy and expected post-COVID sobriety coincided with the peak. In 2026, Trump is expected to replace Jerome Powell with a rate-cutting marionette, putting out the fire from the expansionary Big Beautiful Bill with gasoline," Lunde said. "Abundance, rather than restrictive austerity, is on the books, a setup clearly favoring scarce assets like bitcoin."

No October peak?

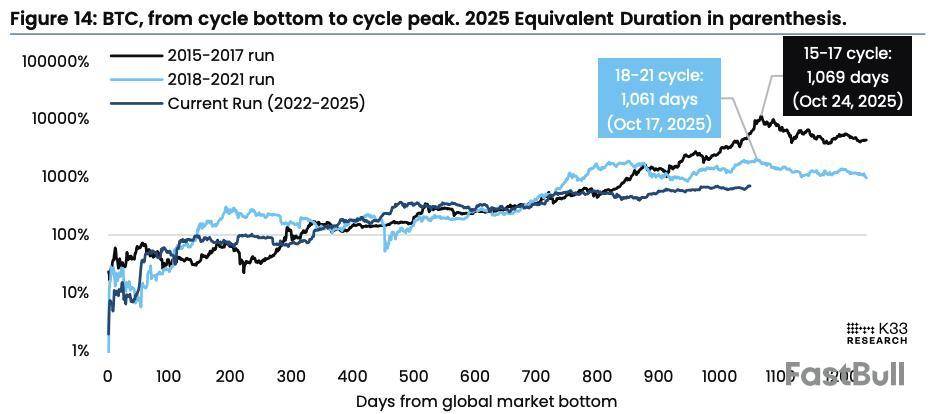

While historical fractal analysis suggests bitcoin could be nearing a cyclical high — 1,051 days from the November 2022 bottom, roughly matching the approximate 1,060-day expansions of prior bull runs — Lunde dismissed such symmetry as a coincidence.

BTC from cycle bottom to cycle peak. Image: K33.

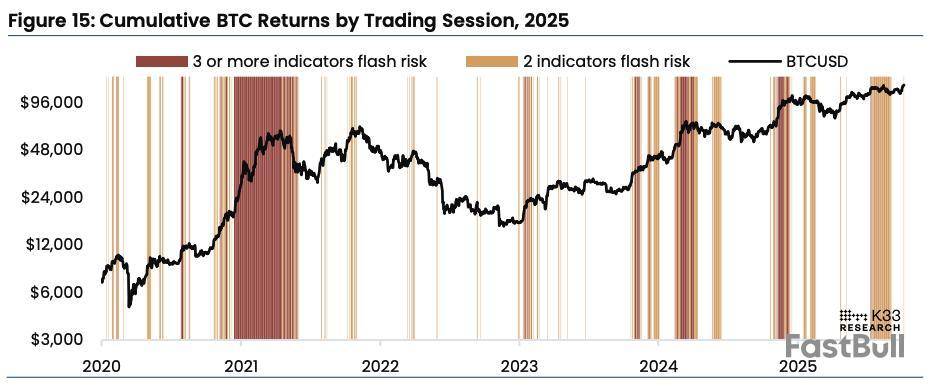

"Fractals are lazy," he said. Instead, K33 applies a six-part framework of market risk factors, including assessment of funding rates, RSI, bitcoin dominance decline, perps vs. spot volumes, social trends, and supply dynamics.

Only two indicators — perp/spot divergence and an overbought RSI metric — currently flash red. By K33's measure, that keeps the market outside the "danger zone" typical of prior peaks, and means bitcoin's price action remains healthy. "Nothing points toward another repeat of the dreaded 4-year cycle," Lunde concluded.

Cumulative BTC returns by trading session, 2025. Image: K33.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up