Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China's Central Bank: Says Economy Overall Stable, But Faces Challenges In Imbalance Between Supply And Demand

BofA Expects Bank Of Japan To Raise Rates By 25 Bps In September 2026, Followed By 25 Bps Hikes Each In January And July 2027

KYODO News: Japanese Prime Minister Sanae Takaichi Is Considering Retaining All Cabinet Ministers

BofA Global Research Expects Japan's Bank Of Japan To Raise Interest Rates By 25 Bps In April Versus Prior Forecast Of June After April

Russian President Putin Third Suspect Arrested In Connection With Attempted Assassination Of General Alexeyev In Moscow

Vda Lobby: German Auto Company Survey Shows 28% Moving Investments Abroad, 19% Cancelling Them

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)A:--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)A:--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)A:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)A:--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)A:--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Jan)

South Korea Unemployment Rate (SA) (Jan)--

F: --

P: --

No matching data

Bitcoin treasury company Strategy (formerly MicroStrategy) acquired an additional 1,955 BTC for approximately $217.4 million at an average price of $111,196 per bitcoin between Sept. 2 and Sept. 7, according to an 8-K filing with the Securities and Exchange Commission on Monday.

Strategy now holds a total of 638,460 BTC — worth around $71 billion — bought at an average price of $73,880 per bitcoin for a total cost of around $47.2 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor. That's equivalent to more than 3% of Bitcoin's total 21 million supply and implies around $24 billion of paper gains.

The latest acquisitions were made using proceeds from at-the-market sales of its Class A common stock, MSTR, perpetual Strike preferred stock, STRK, and perpetual Strife preferred stock, STRF.

Of Strategy's perpetual preferred stocks, STRD is non‑convertible with a 10% non‑cumulative dividend and the highest risk‑reward profile. STRK is convertible with an 8% non‑cumulative dividend, allowing equity upside. STRF is non‑convertible with a 10% cumulative dividend, making it the most conservative. STRC is a variable‑rate, cumulative preferred stock offering monthly dividends, with adjustable rates designed to keep it near par.

Strategy's STRK, STRC, STRF, and STRD perpetual preferred stock's respective $21 billion, $4.2 billion, $2.1 billion, and $4.2 billion ATM programs are in addition to the firm's "42/42" plan, which targets a total capital raise of $84 billion in equity offerings and convertible notes for bitcoin acquisitions through 2027 — upsized from its initial $42 billion, "21/21" plan after the equity side was depleted.

S&P 500 snub

Saylor gave his usual hint at the likelihood of another bitcoin acquisition filing ahead of time, sharing an update on Strategy's bitcoin acquisition tracker on Sunday, stating, "needs more orange."

Strategy's bitcoin acquisitions. Image: Strategy.

In its Q2 financial results, Strategy committed not to issue common equity if its market cap to net asset value (mNAV) ratio is below 2.5x, except for specific purposes such as paying interest on debt obligations and funding preferred equity dividends. However, much to the confusion and frustration of many market participants, Strategy reneged on that guidance just two weeks later, clarifying that it will still issue MSTR below 2.5x mNAV if it deems the issuance to be "advantageous to the company" to provide greater flexibility in executing its capital markets strategy.

Last week, Strategy reported it had bought 4,048 BTC for $449.3 million, taking its total holdings to 636,505 BTC. The pace of Strategy's bitcoin buys had generally been slowing as it switched focus from its common stock ATM program to its perpetual preferred stocks for funding bitcoin acquisitions, but renewed MSTR issuance has resulted in larger purchases again over the past few weeks.

On Friday, despite strong quarterly results, meeting all the criteria, and being one of the top three largest firms by market cap outside of the S&P 500, Strategy was snubbed for inclusion, with the index adding AppLovin, Robinhood, and EMCOR Group, effective Sept. 22. The next rebalancing is scheduled for December.

S&P 500 inclusion could have been a major bullish catalyst, forcing passive funds to buy shares and exposing the company to millions of investors, with an estimated $22 trillion associated with products tracking or benchmarked against the index, according to Bloomberg analyst James Seyffart.

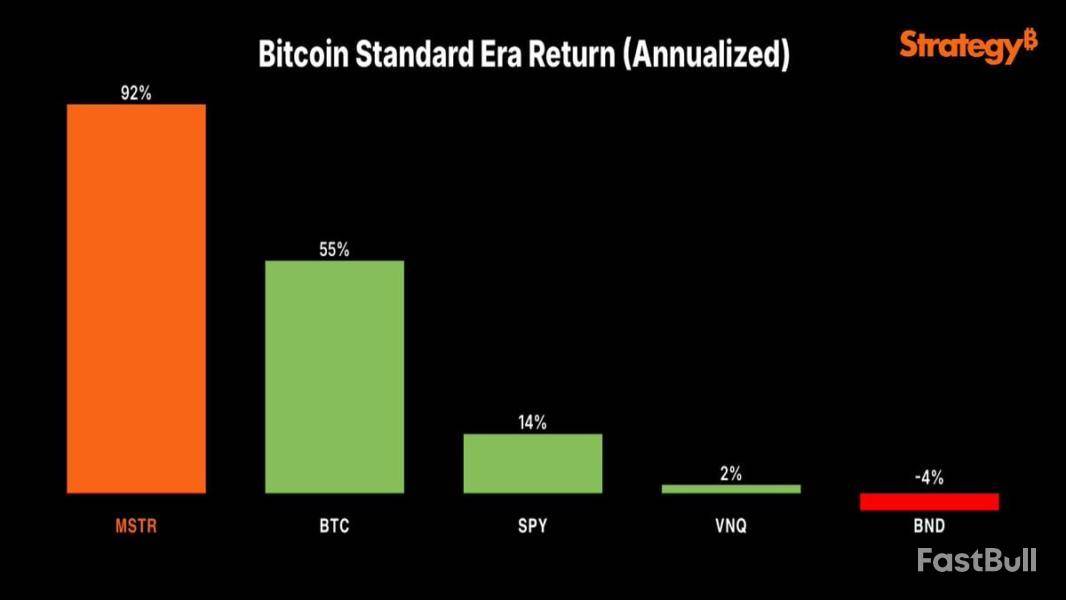

Responding after the news, Saylor posted simply, "Thinking about the S&P right now…," alongside a chart of Strategy's outperformance against the S&P 500 and BTC since adopting its bitcoin treasury strategy.

MSTR vs. SPY. Image: Strategy.

Has the corporate bitcoin treasury bubble popped?

According to Bitcoin Treasuries data, there are now 171 public companies that have adopted some form of bitcoin acquisition model. MARA, Tether-backed Twenty One, Adam Back and Cantor Fitzgerald-backed Bitcoin Standard Treasury Company, Bullish, Metaplanet, Riot Platforms, Trump Media & Technology Group, CleanSpark, and Coinbase make up the remainder of the top 10, with 52,477 BTC, 43,514 BTC, 30,021 BTC, 24,000 BTC, 20.000 BTC, 19,239 BTC, 15,000 BTC, 12,703 BTC, and 11,776 BTC, respectively.

While the number of bitcoin treasury companies continues to increase, the value of many of the cohort's shares is down significantly from their summer peaks, with David Bailey's Kindly MD (NAKA) plunging 84%, Metaplanet dropping 64%, and Strategy itself down 26%, for example.

This was exacerbated last week after Nasdaq announced it would be tightening oversight of companies raising funds to buy crypto, requiring shareholder votes for some deals and pushing for expanded disclosures. In response, Saylor said Nasdaq's new position doesn't affect Strategy, its ATM programs, or its other capital markets activities.

MSTR closed up 2.5% on Friday at $335.87, according to The Block's Strategy price page, in a week that saw bitcoin gain 1.9%. MSTR is currently down 2% in pre-market trading on Monday, per TradingView, and 11.9% year-to-date compared to bitcoin's 18.7%.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up