Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Treasury Yields Rose Sharply In The Short Term, With The 10-year Treasury Yield Rising More Than 2 Basis Points To 4.242% And The 30-year Treasury Yield Rising More Than 3 Basis Points To 4.885%

Russia's Fsb Says Attempted Assassination Of General Alexeyev Was Ordered By Ukraine With Poland's Participation

South Korea President Lee Congratulates Japan Prime Minister Takaichi For Party's Election Victory, Wishes Japan's Continued Success Under Her Leadership - X Message

Jp Morgan Raises 2026 Year End Target For Japan's Nikkei Index To 61000 Versus Prior Target Of 60,000

[Market Update] Spot Silver Surged 5.00% Intraday, Currently Trading At $81.72 Per Ounce. New York Silver Futures Jumped 6.00% Intraday, Currently Trading At $81.52 Per Ounce

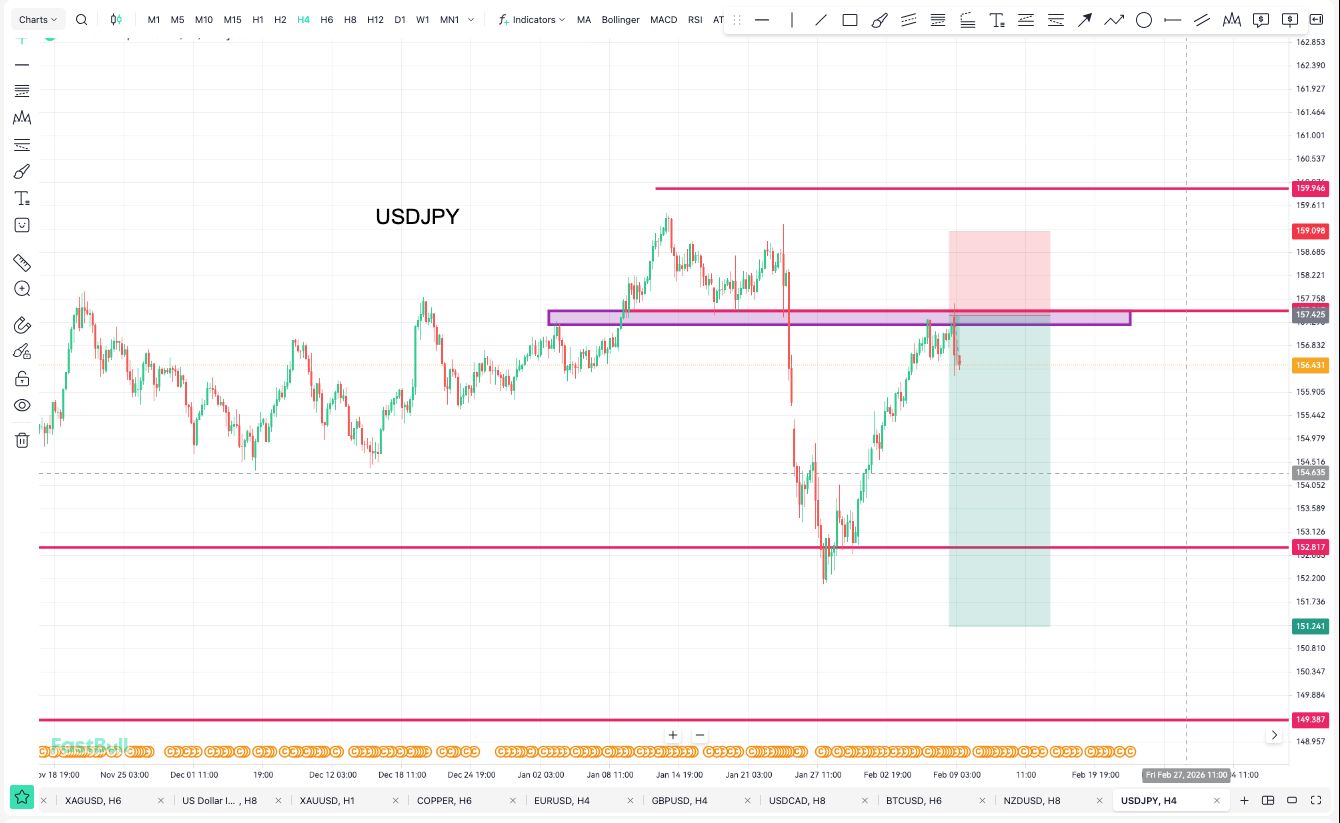

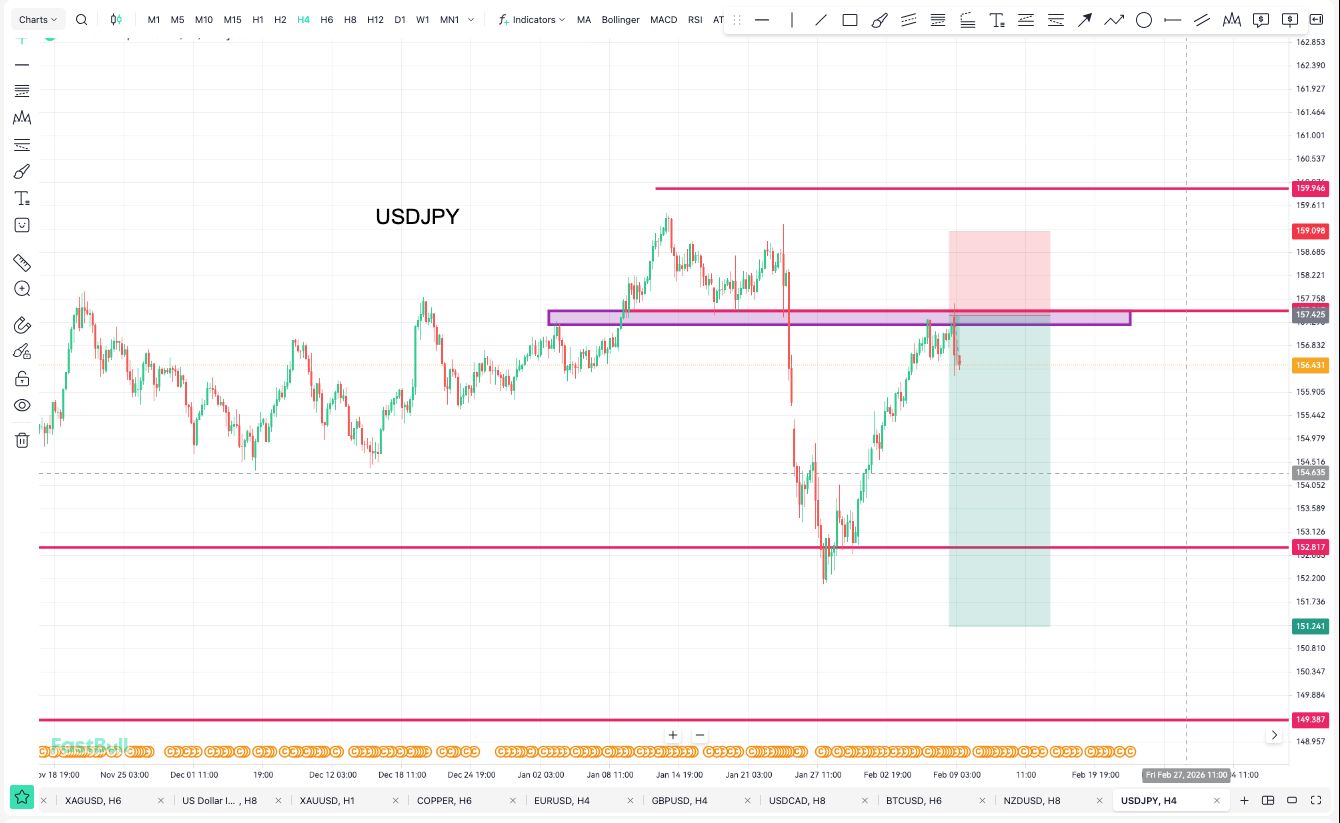

Jpm, Barclays Expect Yen To Stay Soft Following Sanae Takaichi's Landslide Victory In Election

Former Bank Of Korea Board Member Lee Ju Yeol: Dollar-Won Rate Between 1400 And 1470 Looks Appropriate

[US Companies File Section 337 Investigation Request Against Certain Automotive Parts, Components, And Downstream Vehicles] According To The Trade Remedy And Investigation Bureau Of The Ministry Of Commerce Of China, On February 5, 2026, General Motors Filed An Application With The US International Trade Commission Under Section 337 Of The Tariff Act Of 1930, Alleging That Certain Vehicle Parts, Components, And Downstream Vehicles Exported To, Imported Into, Or Sold In The US Infringe Its Patent Rights. General Motors Requested A Section 337 Investigation And The Issuance Of A General Exclusion Order, A Limited Exclusion Order, And A Cease And Desist Order. Twenty Companies From The US And China Are Involved In The Case

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Solana , the seventh-ranked cryptocurrency asset, has traded below $150 in the last 30 days as the coin struggles to break out. However, the coin has not been able to breach the resistance level and posted its worst quarter of 2025.

Solana’s quarterly outlook for 2025

Cryptorank data reveals that Solana dipped by 39.1% in the fourth quarter (Q4) of 2025.

This marks lower performance compared to Q1, 2025, when SOL registered a 34.1% decline. Solana’s Q4 outlook stunned many bulls as market participants anticipated the upsurge recorded in Q2 and Q3 to continue.

Notably, in Q2, SOL rose from its bearish decline of 34.1% to close the quarter green by 24.2%. The asset continued on its bullish trajectory to close Q3 at 34.9%, thus marking its highest quarterly performance for 2025.

The poor outlook has been building since October as Solana finished each month in the red. In October, despite a monthly average growth of 12.5%, SOL underperformed and closed with a 10.3% drawdown.

November was worse in the quarter as it plunged by 28.3%, even though bulls were expecting a monthly 6.84% increase.

Although Solana does not have a historical bullish precedent in December, the asset has crashed below its monthly average of -4.29%. Currently, it has lost a total of 4.82%.

As of this writing, Solana is changing hands at $127.02, representing a 2.21% increase in the last 24 hours. The coin climbed from a low of $124.02 to a peak of $127.81. Investors in the broader crypto market rotated capital from Ethereum to Solana.

This is reflected in the spike in trading volume, which soared by 40.52% to $2.87 billion in the last 24 hours. Solana has also reclaimed its seven-day Simple Moving Average (SMA) with bullish potential if its Relative Strength Index (RSI) remains neutral at 41.42.

Solana flips Ethereum in yearly revenue

Meanwhile, the Solana exchange-traded fund (ETF) around mid-December saw steady inflow over seven days. Solana recorded almost $700 million in cumulative flows to register a milestone as a result of institutional interest.

Interestingly, despite posting its worst quarter in 2025, Solana is still on the verge of flipping Ethereum in terms of yearly revenue. According to Solana Founder Anatoly Yakovenko, SOL’s revenue could reach $1.4 billion, as against $522 million accruing to Ethereum.

The development indicates that the market volatility did not impact only Solana, as Ethereum also struggled in terms of revenue.

As it stands, market participants can only hope for a better price outlook for Solana in 2026 and that it does not repeat its poor showing of Q1, 2025.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up