Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Adp: In The Four Weeks Ending January 24, U.S. Private Sector Employment Increased By An Average Of 6,500 People Per Week

Equinor Aims To Boost International Petroleum Output To 900000 Boed By 2030, Says Head Of Foreign Operations

The Times: British Prime Minister Keir Starmer Is Expected To Appoint Antonia Romeo As Cabinet Secretary

Brazil Finance Minister Haddad: Regarding My Political Future, I Am Considering Different Scenarios With Lula

EU's Kallas Says She Will Propose List Of Concessions That Europe Should Demand Of Russia As Part Of Ukraine Peace Deal

Brazil Finance Minister Haddad: I Met With Lula Yesterday And He Asked Me For A Few More Things Before I Leave The Ministry, I Will Fulfill Them

Google Welcomes The Opportunity To Address The UK Competition And Markets Authority (CMA)'s Concerns And Will Continue To Engage In Constructive Dialogue With The CMA

Brazil Finance Minister Haddad: A More Structural Reform For The Fgc Guarantee Fund Is Being Discussed Following Banco Master Case

Brazil Finance Minister Haddad: I Received Indications That Tiago Cavalcanti And Guilherme Mello Were Willing To Collaborate With Brazil In Central Bank Roles

Brazil Finance Minister Haddad: This Means That The External Perspective On Brazil Has Been Better Than The Internal One

Brazil Finance Minister Haddad: I Don't See Much Reason For Real Interest Rates To Continue Rising As They Are

British Prime Minister Starmer's Office Released Cabinet Meeting Minutes, Expressing Gratitude For The Support Of His Cabinet Colleagues

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)A:--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)A:--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)A:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)A:--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)A:--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Jan)

South Korea Unemployment Rate (SA) (Jan)--

F: --

P: --

Australia House Loan Permits MoM (SA) (Q4)

Australia House Loan Permits MoM (SA) (Q4)--

F: --

P: --

China, Mainland PPI YoY (Jan)

China, Mainland PPI YoY (Jan)--

F: --

P: --

No matching data

Ripple’s price has been consolidating over the past few weeks following a strong uptrend against both USDT and BTC.

Given its current position, the market still appears poised for at least one more rally before a potential reversal takes shape.Technical Analysis

By ShayanThe USDT Pair

On the USDT chart, Ripple’s token has been consolidating within a symmetrical triangle, positioned just beneath the upper boundary of the broader ascending channel that has guided the price action in recent months. Since symmetrical triangles can resolve in either direction, the next decisive breakout will determine the market’s trajectory.

Currently, XRP is trading above both the 100-day and 200-day moving averages, which have recently shown a bullish crossover. This setup favors a breakout to the upside, potentially carrying the price beyond both the triangle and the larger channel. However, if XRP falls back below these moving averages, the outlook would turn bearish, opening the door for a decline toward the $2.10 support zone.

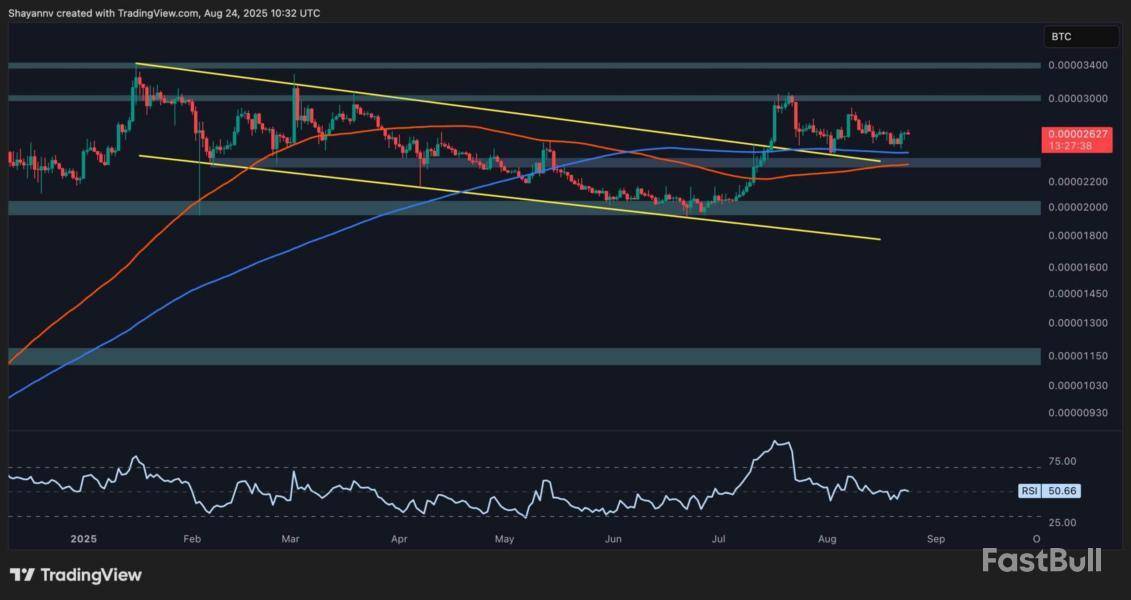

On the XRP/BTC chart, the price has also been consolidating, mirroring the USDT pair’s behavior after breaking out of a descending channel and moving above both the 100-day and 200-day moving averages. The key difference here is that these moving averages have not yet formed a bullish crossover, suggesting the market may not be ready for a decisive breakout just yet.

Still, with the asset holding above both moving averages and the critical 2,400 SAT support area, the outlook remains constructive. If momentum builds, a rally toward the 3,000 SAT level seems likely, with even a potential retest of the 3,400 SAT resistance zone on the table.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up