Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The S&P 500 Rose 0.17%, The Dow Jones Industrial Average Rose 336 Points (0.69%), The Nasdaq Composite Rose 0.27%, And The Semiconductor Index Rose 0.88%

BOE Chief Economist Pill: BOE In The Past Has Perhaps Put Too Much Weight On Inflation Being At Target Rather Than Future Risks

Russian Central Bank: Sets Official Rouble Rate For February 25 At 76.6342 Roubles Per USA Dollar (Previous Rate - 76.7519)

The S&P 500 Opened 0.38 Points Lower, Or 0.01%, At 6837.37; The Dow Jones Industrial Average Opened 23.74 Points Higher, Or 0.05%, At 48827.80; And The Nasdaq Composite Opened 14.33 Points Higher, Or 0.06%, At 22641.60

Fed Governor Cook: The Neutral Rate Could Fall Over Time As Productivity Gains Are Realized Or If Changes In Job Market Raise Inequality, With Ai Gains Concentrated Among Those Who Are Better Off

Fed Governor Cook: Transition Could Create Opportunities, But Job Displacement May Come First And The Unemployment Rate Rise

India Trade Minister: India-USA Will Resume Trade Talks As Soon There Is More Clarity On Tariffs

BOE Governor Bailey: Expect To See Scope For Some Further Easing Of Policy, Probably During This Year

White House Official: 'No Change Of Heart' On Trump's Plan For 15% Tariff Rate Under Section 122 Statute, Timing Of Change To 15% Unclear

Canada Is Renewing Its Military Training Mission In Ukraine For Three Years To 2029 - Defense Minister

Canada To Give Ukraine C$300 Million In Additional Military Aid, New Money Is Part Of A C$2 Billion Package For Kyiv - Defense Minister

White House Official Says Trump Administration Is Working To Change New Temporary USA Tariff Rate To 15% From 10% Published By Customs And Border Protection

Federal Reserve Governor Waller: AI May Pose Risks, Including Risks Related To Data Protection

Mexico Economic Activity Index YoY (Dec)

Mexico Economic Activity Index YoY (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Chicago Fed National Activity Index (Jan)

U.S. Chicago Fed National Activity Index (Jan)A:--

F: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks FOMC Member Waller Speaks

FOMC Member Waller Speaks U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Dec)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Dec)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Dec)

U.S. Factory Orders MoM (Excl. Defense) (Dec)A:--

F: --

P: --

U.S. Factory Orders MoM (Dec)

U.S. Factory Orders MoM (Dec)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Dec)

U.S. Factory Orders MoM (Excl. Transport) (Dec)A:--

F: --

U.S. Dallas Fed General Business Activity Index (Feb)

U.S. Dallas Fed General Business Activity Index (Feb)A:--

F: --

P: --

U.S. Dallas Fed New Orders Index (Feb)

U.S. Dallas Fed New Orders Index (Feb)A:--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks South Korea PPI MoM (Jan)

South Korea PPI MoM (Jan)A:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime RateA:--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)A:--

F: --

P: --

The US 15% global tariff takes effect.

The US 15% global tariff takes effect. U.K. CBI Retail Sales Expectations Index (Feb)

U.K. CBI Retail Sales Expectations Index (Feb)A:--

F: --

P: --

U.K. CBI Distributive Trades (Feb)

U.K. CBI Distributive Trades (Feb)A:--

F: --

P: --

Brazil Current Account (Jan)

Brazil Current Account (Jan)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. FHFA House Price Index (Dec)

U.S. FHFA House Price Index (Dec)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Dec)

U.S. S&P/CS 10-City Home Price Index YoY (Dec)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Dec)

U.S. FHFA House Price Index YoY (Dec)A:--

F: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. FHFA House Price Index MoM (Dec)

U.S. FHFA House Price Index MoM (Dec)A:--

F: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Dec)A:--

F: --

P: --

FOMC Member Waller Speaks

FOMC Member Waller Speaks U.S. Richmond Fed Manufacturing Composite Index (Feb)

U.S. Richmond Fed Manufacturing Composite Index (Feb)--

F: --

P: --

U.S. Conference Board Present Situation Index (Feb)

U.S. Conference Board Present Situation Index (Feb)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Feb)

U.S. Conference Board Consumer Expectations Index (Feb)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Feb)

U.S. Conference Board Consumer Confidence Index (Feb)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Dec)

U.S. Wholesale Sales MoM (SA) (Dec)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Feb)

U.S. Richmond Fed Manufacturing Shipments Index (Feb)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Feb)

U.S. Richmond Fed Services Revenue Index (Feb)--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Jan)

Australia RBA Trimmed Mean CPI YoY (Jan)--

F: --

P: --

Australia Construction Work Done YoY (Q4)

Australia Construction Work Done YoY (Q4)--

F: --

P: --

Australia Construction Work Done QoQ (SA) (Q4)

Australia Construction Work Done QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Final QoQ (SA) (Q4)

Germany GDP Final QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Revised YoY (Working-day Adjusted) (Q4)

Germany GDP Revised YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Germany GDP Final YoY (Not SA) (Q4)

Germany GDP Final YoY (Not SA) (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Mar)

Germany GfK Consumer Confidence Index (SA) (Mar)--

F: --

P: --

RBA Gov Bullock Speaks

RBA Gov Bullock Speaks Euro Zone Core HICP Final MoM (Jan)

Euro Zone Core HICP Final MoM (Jan)--

F: --

P: --

Euro Zone Core CPI Final YoY (Jan)

Euro Zone Core CPI Final YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Final YoY (Jan)

Euro Zone Core HICP Final YoY (Jan)--

F: --

P: --

Euro Zone HICP Final MoM (Jan)

Euro Zone HICP Final MoM (Jan)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Jan)

Euro Zone HICP MoM (Excl. Food & Energy) (Jan)--

F: --

P: --

Euro Zone HICP Final YoY (Jan)

Euro Zone HICP Final YoY (Jan)--

F: --

Euro Zone Core CPI Final MoM (Jan)

Euro Zone Core CPI Final MoM (Jan)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Jan)

Euro Zone CPI YoY (Excl. Tobacco) (Jan)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

No matching data

Nubank, Latin America’s largest digital bank, is reportedly planning to integrate dollar-pegged stablecoins and credit cards for payments.

The move was disclosed by the bank’s vice-chairman and former governor of Brazil’s central bank, Roberto Campos Neto. Speaking at the Meridian 2025 event on Wednesday, he highlighted the importance of blockchain technology in connecting digital assets with the traditional banking system.

According to local media reports, Campos Neto said Nubank intends to begin testing stablecoin payments with its credit cards as part of a broader effort to link digital assets with banking services.

"What the data shows is that people aren't buying to transact, they're buying as a store of value, he reportedly said. “And we need to understand why this is happening. I think it's changing a bit, but we need to understand it."

He also noted that the challenge for banks is finding a way to accept deposits in tokenized forms and use these assets to issue credit for clients.

Founded in São Paulo in 2013, Nubank is a Brazilian digital bank serving more than 100 million customers across Brazil, Mexico and Colombia. The bank first entered the digital asset space in 2022 by allocating 1% of its net assets to Bitcoin and rolling out crypto trading for its customers.

In March 2025, Nubank broadened its crypto lineup with the addition of four altcoins, giving customers access to Cardano (ADA), Cosmos (ATOM), Near Protocol (NEAR), and Algorand (ALGO).

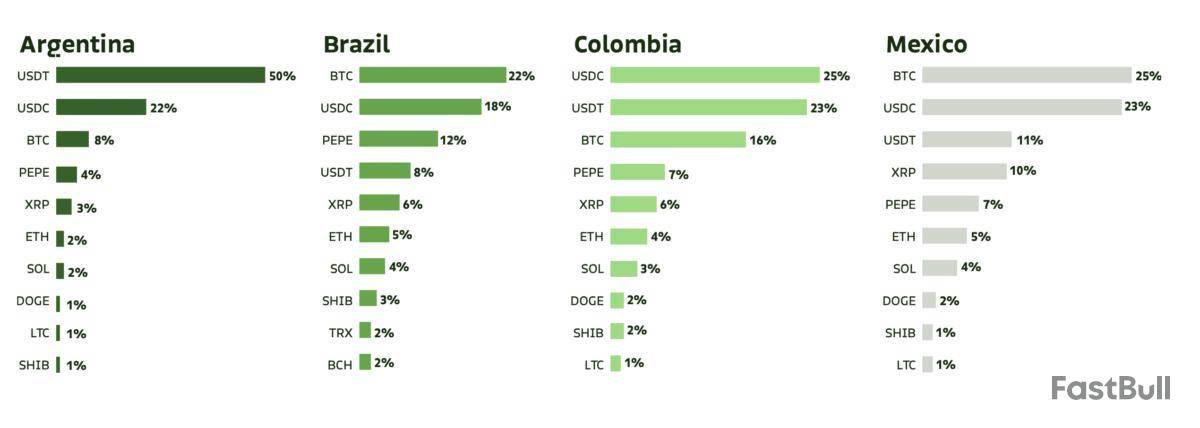

Stablecoin adoption surges in Latin America

Stablecoin adoption has been surging in Brazil. In February, the president of the Central Bank of Brazil told attendees at a Bank for International Settlements event that 90% of crypto activity in the country was linked to stablecoins.

Dollar-pegged digital assets have also gained traction in Argentina, where inflation has exceeded 100% in recent years.

According to a March 2025 report from Bitso, USDt (USDT) and USDC (USDC) accounted for 50% and 22% of all cryptocurrency purchases in the country in 2024, respectively. The same report found that stablecoins made up 39% of all purchases on its platform across the region in 2024.

Stablecoin adoption has also been growing in other Latin American countries.

In July 2025, the Central Bank of Bolivia signed an agreement with El Salvador to promote crypto as a “viable and reliable alternative” to fiat. Since lifting its crypto ban in June 2024, Bolivia has allowed banks to process Bitcoin and stablecoin transactions.

In Venezuela, where inflation hit 229% in May, stablecoins like USDt have started to replace the bolívar in daily commerce, from groceries to salaries. Chainalysis data shows they made up 47% of all crypto transactions under $10,000 in 2024.

Magazine: Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up