Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Election: PM Takaichi Says Japan's Lethal Arms Export Restrictions Will Be Eased From Current Levels

Japan Finance Minister Katayama: Need To Take Professional Approach As Tapping This Not Easy, When Asked Whether Japan Could Tap Forex Reserves To Fund Tax Cuts, Spending

Russian President Putin Held A Telephone Call With United Arab Emirates President On Saturday - RIA Cites Kremlin

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To North And South America At Minus $1.30/Bbl Versus Asci

SOMO - Iraq March Basrah Medium Crude Official Selling Price To Europe At Minus $3.55/Bbl Versus Dated Brent

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To Asia At Minus $1.70/Bbl To Oman/Dubai Average

Ukraine's Oil And Gas Firm Naftogaz Says Russia Attacked Its Facilities In Eastern Poltava Region Overnight

[Polymarket Prediction: "Bitcoin To Rebound To $75K In February" Probability Rises To 64%] February 8Th, As Bitcoin Surged Back Above $70,000, Currently Trading At $70,132. The Probability Of "Bitcoin Rising To $75,000 In February" On Polymarket Has Increased To 64%. Additionally, The Probability Of Rising To $80,000 Is 30%, And The Probability Of Falling To $60,000 Is 37%

[Ethereum Surges Above $2,100, Up 4.06% In 24 Hours] February 8Th, According To Htx Market Data, Ethereum Rebounded And Broke Through $2100, With A 24-Hour Increase Of 4.06%

[Bitcoin Breaks $70,000, 24-Hour Gain 2.1%] February 8, According To Htx Market Data, Bitcoin Broke Through $70,000, With A 24-Hour Growth Of 2.1%

Ukraine President Zelenskiy: He Has Imposed Sanctions Against Some Foreign Manufacturers Of Components For Russian Drones And Missiles

Apk-Inform Cuts Ukraine's 2026/27 Rapeseed Exports To 2.70 Million Tons From 2.96 Million Tons

Apk-Inform Increases Ukraine's 2025/26 Grain Ending Stocks To 11.5 Million Tons From Previous 6.8 Million Tons Due To Lower Exports

Apk-Inform Cuts Ukraine's 2025/26 Barley Export Forecast To 2.0 Million Tons From 2.5 Million Tons

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

Key takeaways:

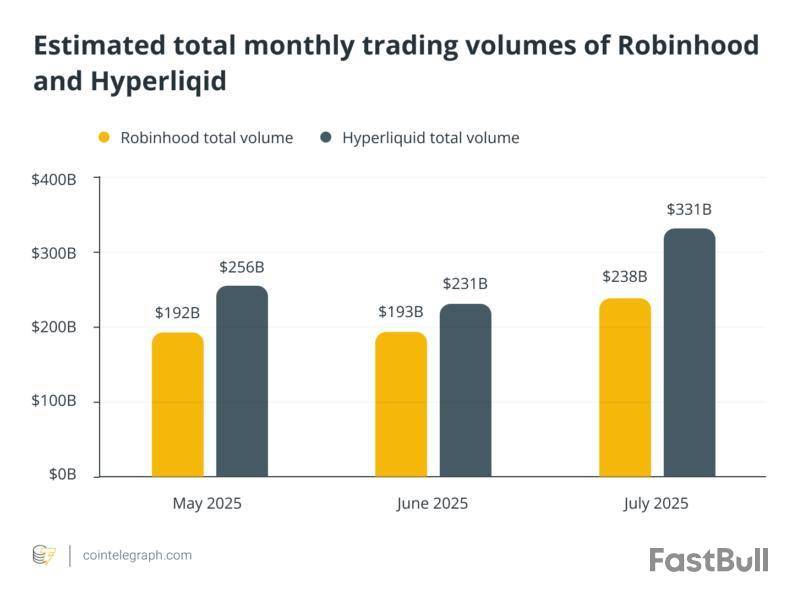

Hyperliquid processed around $330 billion in trading volume in July 2025, briefly surpassing Robinhood.

A split-chain design enabled CEX-like speed while keeping custody and execution onchain.

The HLP vault and Assistance Fund buybacks aligned traders, market makers and token holders in a reinforcing loop.

A large airdrop, Phantom Wallet integration and self-funded operations helped attract users and sustain adoption.

A year after launching its own layer 1 (L1), Hyperliquid has become one of decentralized finance’s (DeFi) top perpetuals venues, logging about $319 billion in trading volume in July 2025. Remarkably, the core team behind it is believed to consist of only 11 people.

This guide looks at the technical design and operational choices that enabled such scale.

What is Hyperliquid?

Hyperliquid is a decentralized perpetuals exchange built on a custom layer 1.

Its chain is divided into two tightly connected components: HyperCore, which manages the onchain order book, margining, liquidations and clearing; and HyperEVM, a general-purpose smart contract layer that interacts directly with exchange state.

Both are secured by HyperBFT, a HotStuff-style proof-of-stake (PoS) consensus that enforces a single transaction order without relying on offchain systems. HyperEVM launched on mainnet on Feb. 18, 2025, adding programmability around the exchange core.

Did you know? Hyperliquid achieves a median trade latency of just 0.2 seconds (with even 99th‑percentile delays under 0.9 seconds) and can handle up to 200,000 transactions per second, rivaling centralized exchanges on speed.

The $330-billion month: What the data shows

July was Hyperliquid’s strongest month yet. Data from DefiLlama shows the platform processed about $319 billion in perpetuals trading volume. That pushed DeFi-wide perpetuals to a record $487 billion — a 34% jump from June.

At the same time, industry trackers highlighted a combined $330.8 billion figure, which included spot trading as well. Headlines noted this meant Hyperliquid briefly surpassed Robinhood.

Robinhood’s July metrics provide the basis for comparison: $209.1 billion in equities notional plus $16.8 billion in crypto trading, along with $11.9 billion at Bitstamp (a Robinhood subsidiary), totaling around $237.8 billion.

Several outlets noted that July marked the third straight month Hyperliquid’s volumes topped Robinhood’s, which is a striking outcome for a team of only 11. And these are monthly figures, not cumulative totals. That means the platform is showing sustained high-frequency activity rather than a one-off spike.

Engineering for throughput

Hyperliquid’s scale comes from a carefully split state machine operating under one consensus.

HyperCore acts as the exchange engine, with central-limit order books, margin accounting, matching and liquidations all kept fully onchain. The documentation stresses that it avoids offchain order books. Each asset’s book exists onchain as part of the chain state, with price-time priority matching.

HyperEVM is an Ethereum Virtual Machine (EVM)-compatible environment on the same blockchain. Because it shares consensus and data availability with HyperCore, applications can build around the exchange without leaving the L1.

Both components rely on HyperBFT, a HotStuff-inspired PoS consensus that delivers a consistent transaction order across the entire system. The design aims for low-latency finality while keeping custody and execution onchain.

This structure differs from typical decentralized exchange (DEX) models: automated market makers (AMMs) that rely on liquidity pools or hybrid order-book DEXs that keep orders onchain but match them offchain.

Hyperliquid instead runs its core exchange logic (order books, matching, margin and liquidations) entirely onchain while still enabling EVM-based apps to integrate natively.

The operating model: How 11 people attained CEX speed

Hyperliquid’s organizational design is deliberately lean.

Founder Jeff Yan has said the core team consists of about 11 people, with hiring intentionally selective to maintain speed and cultural cohesion. The emphasis is on a small, coordinated group rather than rapid headcount expansion.

The project is entirely self-funded and has declined venture capital. Yan frames this as aligning ownership with users and keeping priorities independent of investor timelines. This approach also explains the absence of major centralized-exchange listings — the focus remains on technology and community adoption.

Execution follows a tight feedback loop. When an API outage on July 29 disrupted order execution for 37 minutes, the team reimbursed affected traders $1.99 million the next business day. For a DeFi venue, that speed of response stood out as an example of its “ship, fix, own it” mindset.

“Hiring the wrong person is worse than not hiring at all,” said Yan on staying lean.

Together, selective hiring, independence from venture capital and rapid incident management help explain how a small team can operate at a centralized-exchange cadence while keeping custody and execution fully onchain.

The HLP + Assistance Fund flywheel

Protocol mechanisms align trader activity with liquidity provisioning.

Hyperliquidity Provider (HLP) vault

HLP is a protocol-managed vault that handles market-making and liquidations on HyperCore. Anyone can deposit capital, with contributors sharing in the vault’s profit and loss (PnL) and a portion of trading fees. By making market-making infrastructure open and rules-based, HLP reduces reliance on the bilateral market-maker deals common elsewhere.

Assistance Fund (fee buybacks)

According to DefiLlama dashboards, 93% of protocol fees flow to the Assistance Fund, which buys back and burns HYPE tokens, while 7% go to HLP. This creates a feedback loop: Higher organic volume funds larger buybacks, reducing token supply, while still allocating a portion to support the vault.

Funding mechanics

Perpetual funding on Hyperliquid is purely peer-to-peer, with no protocol take, paid hourly and capped at 4% per hour.

Rates combine a fixed interest (0.01% per eight hours, prorated hourly) with a variable premium derived from an oracle that aggregates centralized exchange spot prices.

This structure helps keep perpetual prices aligned with spot. Payments are made by both sides of the book, reinforcing risk sharing without embedding yield promises.

Distribution and community

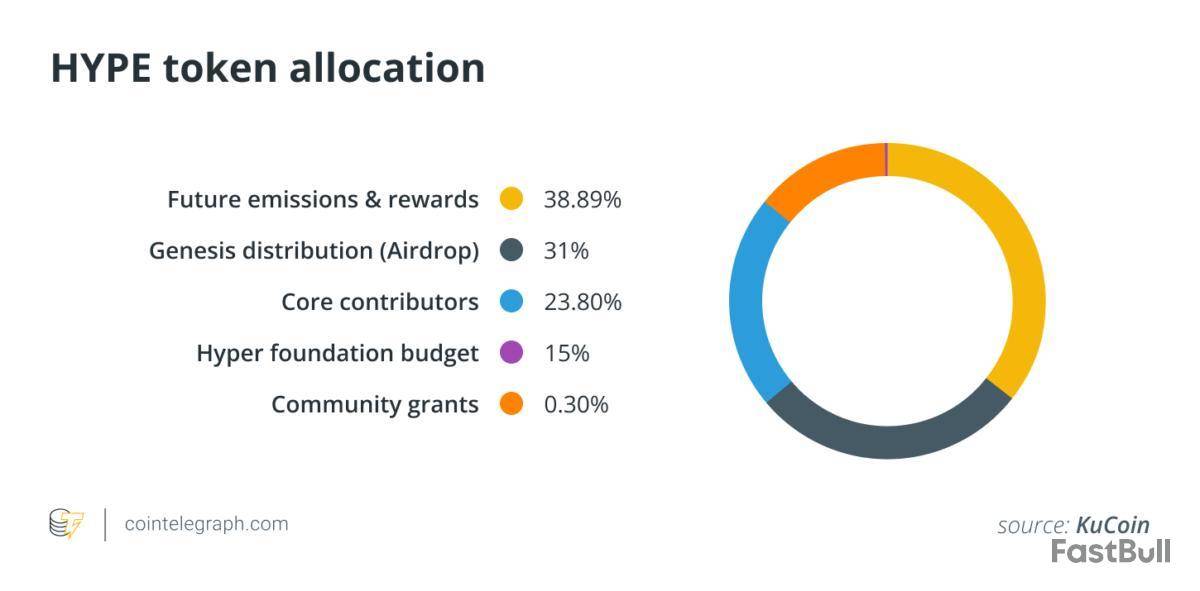

Hyperliquid’s token distribution leaned heavily toward users.

On Nov. 29, 2024, the project launched the HYPE genesis airdrop, distributing about 310 million tokens to early participants. The event coincided with the token’s trading debut, reinforcing a community-first approach. Hyperliquid (HYPE) is used for staking in HyperBFT and for gas payments onchain.

Momentum accelerated in mid-2025 when Phantom Wallet integrated Hyperliquid perpetuals directly in-app. Analysts and media noted a clear boost in flow and adoption.

VanEck’s July report attributed $2.66 billion in trading volume, $1.3 million in fees and roughly 20,900 new users to the Phantom rollout. Separate reporting tracked $1.8 billion in routed volume within the first 16 days.

On the product side, HyperEVM went live on Feb. 18, 2025, enabling general-purpose smart contracts and creating pathways for wallets, vaults and listing processes to integrate around the exchange. That flexibility encouraged outside developers to plug into the ecosystem and supported a steady pipeline of new markets.

Did you know? Hyperliquid’s genesis airdrop distributed around $1.6 billion worth of HYPE across 90,000 users, equal to 31% of the total supply. At peak prices, the average airdrop value exceeded $100,000 per user.

Critiques and risk factors

Decentralization and validator set

In early 2025, researchers and validators raised concerns over validator transparency and centralization. The team acknowledged the issue and said it would make the code open-source after strengthening its security. The team also outlined plans to expand validator participation.

Concentration risk

Hyperliquid’s market share (often estimated at 75%-80% of decentralized perpetuals trading) poses concentration challenges. Commentators highlighted the benefits of network effects but also noted the systemic risks if liquidity shifts or shocks occur at a single venue.

Operational incidents

A 37-minute API outage on July 29 temporarily halted trading. Hyperliquid reimbursed roughly $2 million to users the next day. While the swift refund reinforced its reputation for responsiveness, the event also highlighted the exposure leveraged traders face during outages.

Governance and treasury execution

Observers sometimes scrutinize how protocol-managed vaults allocate capital offchain or across chains, as well as the design of buyback mechanisms. These remain areas of operational risk to watch as Hyperliquid scales.

Did you know? Hyperliquid depends on validator-maintained price oracles. If these oracles are manipulated, it may trigger premature or inaccurate liquidations. To counter this, Hyperliquid limits open interest levels and blocks orders more than 1% away from the oracle price, though the HLP vault is exempt from those restrictions.

Final thoughts: Why Hyperliquid scaled when others stalled

Four factors help explain Hyperliquid’s outsized growth.

First, its execution-first chain design: HyperCore handles onchain matching and margin, while HyperEVM provides composability, both ordered under HyperBFT. Together, this setup delivers near CEX-level latency while keeping custody and state fully onchain.

Second, incentive alignment through fee-funded buybacks (via the Assistance Fund) and the open HLP vault created a reflexive liquidity loop as trading volumes expanded.

Third, maintaining a lean core team of about 11 contributors minimized managerial overhead and kept product cycles fast.

Fourth, distribution advantages (most notably Phantom Wallet’s integration) reduced onboarding friction and expanded reach during a favorable cycle for onchain derivatives.

For those evaluating long-term durability, several watchpoints stand out:

Whether validator decentralization and code open-sourcing progress as promised

How quickly spot markets, central limit order book activity and third-party apps build around HyperEVM

Whether revenue and volume remain resilient as competitors begin adopting similar models.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up