Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Russian President Putin Held A Telephone Call With United Arab Emirates President On Saturday - RIA Cites Kremlin

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To North And South America At Minus $1.30/Bbl Versus Asci

SOMO - Iraq March Basrah Medium Crude Official Selling Price To Europe At Minus $3.55/Bbl Versus Dated Brent

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To Asia At Minus $1.70/Bbl To Oman/Dubai Average

Ukraine's Oil And Gas Firm Naftogaz Says Russia Attacked Its Facilities In Eastern Poltava Region Overnight

[Polymarket Prediction: "Bitcoin To Rebound To $75K In February" Probability Rises To 64%] February 8Th, As Bitcoin Surged Back Above $70,000, Currently Trading At $70,132. The Probability Of "Bitcoin Rising To $75,000 In February" On Polymarket Has Increased To 64%. Additionally, The Probability Of Rising To $80,000 Is 30%, And The Probability Of Falling To $60,000 Is 37%

[Ethereum Surges Above $2,100, Up 4.06% In 24 Hours] February 8Th, According To Htx Market Data, Ethereum Rebounded And Broke Through $2100, With A 24-Hour Increase Of 4.06%

[Bitcoin Breaks $70,000, 24-Hour Gain 2.1%] February 8, According To Htx Market Data, Bitcoin Broke Through $70,000, With A 24-Hour Growth Of 2.1%

Ukraine President Zelenskiy: He Has Imposed Sanctions Against Some Foreign Manufacturers Of Components For Russian Drones And Missiles

Apk-Inform Cuts Ukraine's 2026/27 Rapeseed Exports To 2.70 Million Tons From 2.96 Million Tons

Apk-Inform Increases Ukraine's 2025/26 Grain Ending Stocks To 11.5 Million Tons From Previous 6.8 Million Tons Due To Lower Exports

Apk-Inform Cuts Ukraine's 2025/26 Barley Export Forecast To 2.0 Million Tons From 2.5 Million Tons

Apk-Inform Cuts Ukraine's 2025/26 Grain Export Forecast To 40.48 Million Tons From Previous 45.18 Million Tons Due To Slow Pace Of Shipments

Russia's Fsb Says Perpetrator And Accomplice In Assassination Attempt On General Alekseyev Detained In United Arab Emirates

China Foreign Ministry: 'Strongly Condemns' The Attack, Supports Pakistan Government Effort To 'Maintain National Security'

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

Key takeaways A new wave of DEX wars has shifted from token incentives to a focus on speed, leverage and sustainable infrastructure. Hyperliquid continues to lead the market with over $300 billion in monthly volume, strong liquidity and rising institutional adoption. Aster’s growth is powered by airdrops, Binance-backed credibility and leverage that attract professional traders. Lighter is gaining momentum through its Ethereum layer-2 speed, zero-fee trading model and exclusive points-based yield farming system. Platforms like SushiSwap, PancakeSwap and Curve leveraged yield farming and governance token incentives to attract liquidity. This approach catalyzed rapid capital formation, bringing billions of dollars onchain within a short time. Those early battles were about who could attract the most total value locked (TVL) and traders through token incentives — not about speed, leverage or institutional-grade infrastructure. The dust eventually settled with Uniswap taking the lead. The playbook it established, including liquidity mining, airdrops and tokenized participation, became the foundation for the more sophisticated decentralized exchange (DEX) wars now unfolding in perpetuals.

Inside the DEX liquidity wars

Hyperliquid, a DEX built on its own high-performance blockchain infrastructure, saw major growth in 2025. The exchange handled more than $300 billion in trading volume around mid-2025, with daily activity occasionally approaching $17 billion. Its deep liquidity and fast execution have helped it gain strong traction among active and professional traders.

One of the key drivers behind Hyperliquid’s strong growth was its ability to boost liquidity and user activity through a points-based rewards program. The effort eventually led to a large airdrop.

In total, 27.5% of the token supply was distributed to 94,000 addresses, rewarding early and active participants. What started as a way to get more people trading has since become one of the most valuable token distributions in recent crypto history. The airdrop is now valued at around $7 billion-$8 billion.

Rivals are, however, catching up fast.

Aster is a rapidly growing DEX built on BNB Smart Chain that has positioned itself as one of Hyperliquid’s main competitors. On some days, reported trading volumes have at times surged into the tens of billions of dollars, occasionally surpassing Hyperliquid’s figures. The project’s connection to Changpeng “CZ” Zhao, co-founder of Binance, has also drawn significant attention from the market.

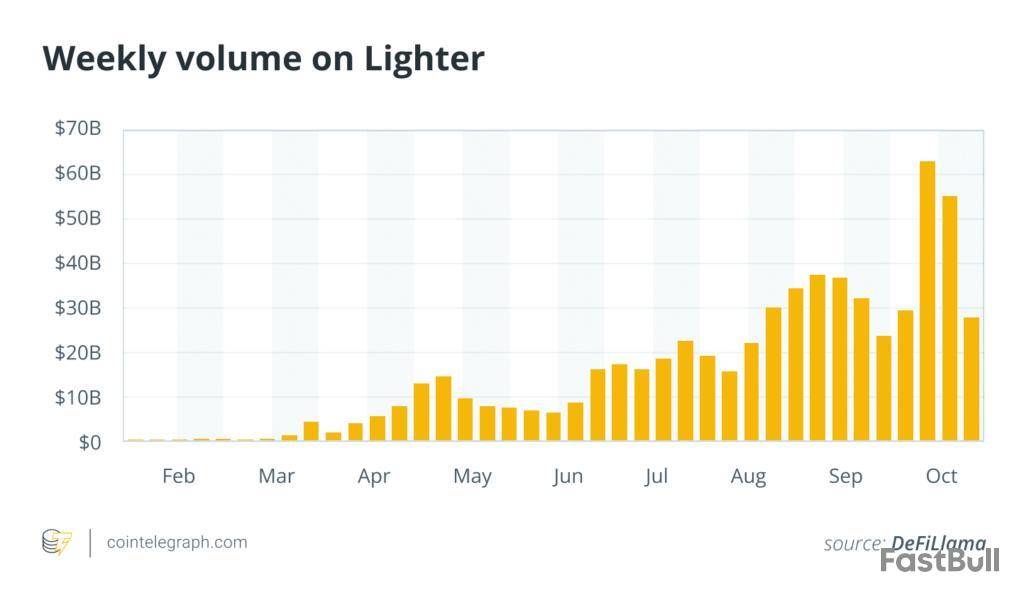

Meanwhile, Lighter, a new exchange built on an Ethereum rollup, has reported daily trading volumes surpassing $8 billion.

Together, these challengers are turning what was once Hyperliquid’s clear lead into a three-way fight for market share.

According to Calder White, chief technology officer of Vigil Labs — a Silicon Valley startup that recently raised $5.7 million to apply AI to understand and trade cryptocurrency markets — the apparent surge has very different underpinnings across platforms.

“Our system shows that Aster’s growth is very narrative-driven, with traders recycling capital to increase volumes, while Hyperliquid continues to carry the most organic flow from serious participants. Both Aster and Lighter are relying on the same points-to-airdrop playbook to bootstrap liquidity and activity to compete with Hyperliquid for market share,” said White.

Aster’s high-stakes play for DEX dominance

Aster’s momentum comes from its close ties to CZ, who now advises the project. His involvement has led many online to refer to Aster as “Binance’s DEX.” The exchange has introduced tokenized stocks, allowing users to trade major assets onchain with up to 1,000x leverage. It also plans to launch its own layer-1 blockchain.

The combination has turned Aster into one of the most daring experiments in DEX design to date.

Fueling that rise is Aster’s massive airdrop program, which rewards users for generating trading activity. Season two distributed 320 million Aster tokens worth about $600 million and concluded on Oct. 5, 2025.

The incentive model has already translated into strong activity. Aster recently generated over $20 million in 24-hour fees, placing it among the top revenue earners in decentralized finance (DeFi). There’s also growing speculation that the team may be using part of those earnings for token buybacks. If true, that move could further boost Aster’s token value and help sustain trader interest beyond the airdrop period.

Some participants stand to earn significant rewards, ranging from thousands of dollars to potential seven-figure payouts for the most active traders. The scale of these incentives has driven strong volume across the platform, although it remains to be seen whether users will continue trading once the rewards taper off.

Airdrops and exclusivity drive Lighter’s rise

Lighter has quickly established itself as one of the more technically ambitious stacks in DeFi. Built on a custom Ethereum layer-2 with zero-knowledge circuits, it supports sub-five-millisecond matching latency. The goal is to approach centralized exchange (CEX) speeds. The platform offers zero trading fees for retail users, while API and institutional flows face premium charges.

Lighter has driven rapid growth through its Lighter Liquidity Pool (LLP) program, which has become one of the most attractive yield opportunities in DeFi. The pool currently offers around 60% annual percentage yield (APY) on more than $400 million in deposits. Access to the LLP is linked to a user’s points balance, giving higher allocation limits to more active traders.

Lighter’s zero-fee model and points system have fueled growing speculation among traders. Since its launch, the exchange has recorded substantial trading volumes, at times rivaling Hyperliquid. Much of the excitement now centers on expectations of an upcoming token launch, widely rumored to take place later this year.

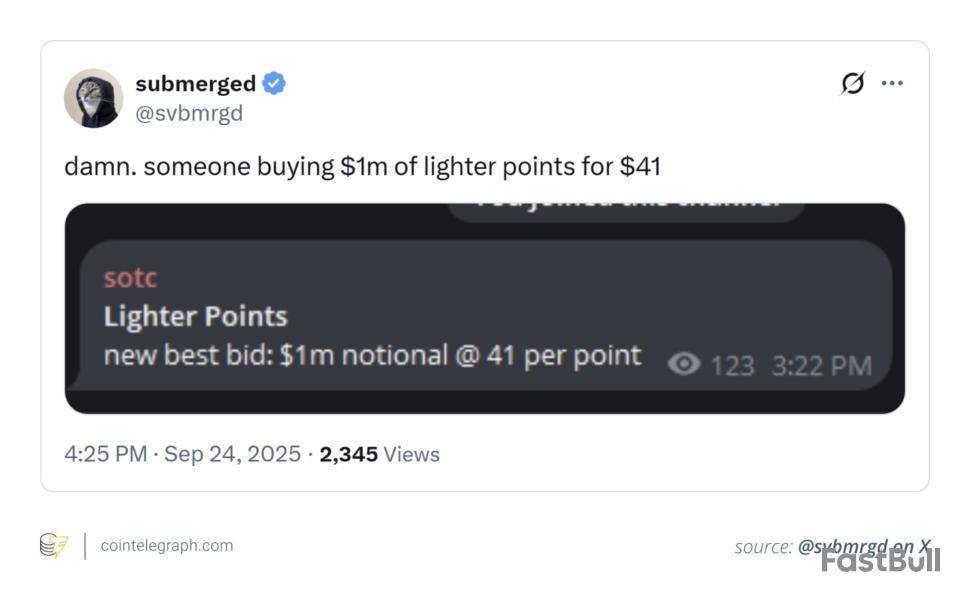

While there is no token just yet, there’s already a bustling over-the-counter market for Lighter points, with points being sold for tens of dollars each. Prices have climbed from $39 to over $60, with one trader reportedly spending $1 million at $41 each.

One of the easiest ways to value a perpetual DEX is by examining open interest (OI), which represents the total value of all trades still open on the platform. The higher the OI, the more real money is sitting in positions. On Hyperliquid, for example, $13.2 billion in OI supports a circulating market capitalization of about $15.2 billion.

Lighter currently holds about $2.1 billion in OI. Assuming roughly 15%-20% of tokens are unlocked at the time of its token launch, this would imply a circulating market cap of around $1 billion-$1.1 billion and a fully diluted valuation (FDV) near $5 billion-$5.5 billion. With about 12 million points tied to that initial float, each point would be valued at roughly $83 to $100.

Should 15%-20% of the supply be allocated to the community, that would translate into an airdrop worth $750 million-$1.1 billion for users — potentially one of the most significant token distributions in DeFi since Hyperliquid’s drop.

Institutional liquidity enters the chat

A growing subplot in this battle is the gradual but notable entry of institutional liquidity. Funds that once avoided onchain derivatives, citing slippage, latency or compliance concerns, are now allocating test capital to these platforms.

Hyperliquid’s speed-focused, transparent design has attracted growing interest from professional traders, while Aster’s Binance-linked narrative is drawing significant attention across Asian trading communities.

Lighter, with its sub-five-millisecond execution speed and onchain settlement model, is drawing interest from prop-trading firms looking for yield without counterparty risk. The next phase of the DEX wars may depend less on airdrops and more on which platforms can offer the most reliable rails for serious capital.

Infrastructure vs. narrative: Who wins in the long run?

While competition between Lighter, Aster and Hyperliquid keeps heating up, Hyperliquid still sets the benchmark in onchain derivatives, supported by unmatched open interest, strong execution quality and growing institutional traction.

Instead of slowing down, the exchange has stepped up its efforts, introducing HIP-3, which allows anyone to launch a perp DEX on Hyperliquid’s rails, launching its USDH stablecoin and moving quickly to list perpetuals for rival tokens like ASTER to capture narrative-driven flows.

Hyperliquid has also kept its community engaged through new reward mechanics. The Hypurr non-fungible token (NFT) collection, launched on Sep. 28, 2025, quickly became a hit, with floor prices hovering around 1,200 HYPE (roughly $55,000 each). The collection’s strong demand has fueled speculation about future reward rounds and potential updates to the points program.

According to White, this split among emerging DEXs shows how far incentives can move markets compared to how much infrastructure can stabilize them.

“Hyperliquid is betting on execution and liquidity, while Aster and Lighter are showing just how far incentives can stretch the market,” he said.

“The real test will be whether traders stay once the airdrop music fades.”

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up