Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

French President Macron Tells Le Monde And Other European Papers: Now Is Good Time For Europe To Launch A Means Of Joint Borrowing, For Example Via Eurobonds

Bank Of Japan Offers To Sell Y 500 Billion Japanese Government Bonds As Collateral For USA Dollar Funds-Supplying Operations In Repo Pact For 2/12 - 2/20

Kazakhstan's Net Gold And Foreign Currency Reserves $69.526 Billion In Jan (10.1% Change Month-On-Month) - Central Bank

Malaysian Palm Oil Board - Malaysia's January Palm Oil Exports 1.48 Million T, Up 11.44% From December

Malaysian Palm Oil Board - Malaysia's January Palm Oil End-Stocks 2.82 Million T, Down 7.72% From December

Malaysian Palm Oil Board - Malaysia's January Crude Palm Oil Production 1.58 Million T, Down 13.78% From December

Bank Indonesia Senior Deputy Governor: There Is Room To Cut Interest Rate Further, But Will Be Data Dependent

Japan Jan LNG Spot Contract Price At $11.30/Mmbtu-Japan Oil, Gas And Metals National Corporation (State-Owned Jogmec)

[Owl 24H Trading Volume Surpasses $14 Million] February 10Th, According To Coinmarketcap Data, Owl'S 24-Hour Contract Trading Volume Exceeded 14 Million US Dollars, With The Main Trading Platforms Being Gate ($6.27 Million), Mexc ($4.63 Million), Bingx ($1.68 Million), Etc.In Addition, Users Can Also Conduct Owl Contract Trading On Platforms Such As Aster, Weex, Kcex, Lbank, Hotcoin, Etc

Japan Trade Minister Akazawa: Plan To Visit USA Between Feb 11-14 To Discuss Japan's Investment Plan

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)A:--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)A:--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

No matching data

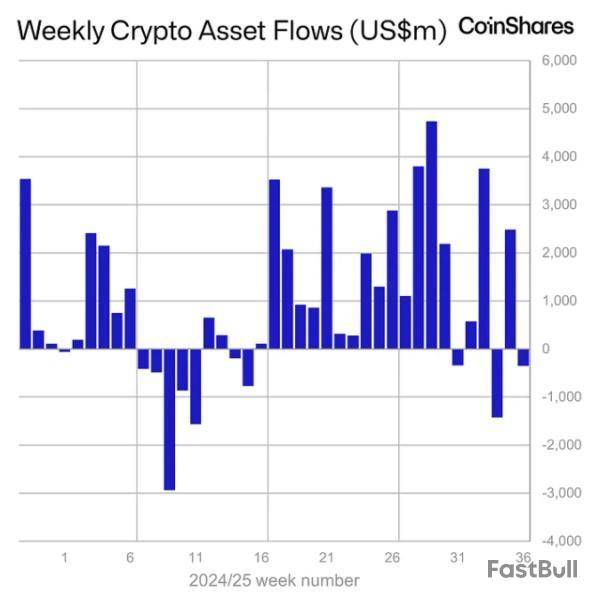

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares generated net outflows of $352 million last week, reversing the trend once again after the prior week's $2.5 billion inflows, according to CoinShares' data.

Weaker payroll figures and improving prospects for a September interest rate cut in the U.S. failed to bolster sentiment, CoinShares Head of Research James Butterfill said in a Monday report.

Trading volume also fell 27% week-over-week, suggesting the appetite for digital assets has cooled, Butterfill added. Nevertheless, with year-to-date inflows of $35.2 billion, 4.2% ahead of last year's total on an annualized basis, broader sentiment remains intact, he said.

Weekly crypto asset flows. Images: CoinShares.

Ethereum investment products lead outflows

Regionally, sentiment was polarized, Butterfill noted, with U.S.-based digital asset investment products witnessing $440 million in net outflows, while crypto funds in Germany and Hong Kong saw inflows of around $85 million and $8 million, respectively.

Despite softer sentiment and modest outflows later in the week, Bitcoin funds still recorded $524 million in net inflows.

In contrast, Ethereum products drove last week's net outflows, with $912 million exiting across a broad set of ETP issuers. Still, year-to-date inflows remain strong at $11.2 billion, Butterfill said.

The U.S. spot Ethereum ETFs accounted for $787.6 million of last week's net outflow figure, according to data compiled by The Block, while the U.S. spot Bitcoin ETFs brought in $250.3 million.

Meanwhile, Solana and XRP-based investment products continued to witness modest but steady inflows of $16.1 million and $14.7 million, respectively. Solana investment products have now logged 21 consecutive weeks of inflows totaling $1.16 billion, while XRP funds have attracted $1.22 billion over the same period, Butterfill noted.

Earlier on Monday, CoinShares announced it is set to go public in the U.S. via a $1.2 billion merger with special purpose acquisition company Vine Hill that will see it listed on the Nasdaq.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up