Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In a recent social media post, prominent venture capitalist Jason Calacanis has stated that he would never touch Michael Saylor's Strategy even if the stock were to crash.

Calacanis also argues that there should be no Bitcoin bailouts if the company happens to go underwater.

The caustic comments of the early Uber investor come after the Wall Street Journal reported that digital asset treasury companies are "crumbling."

Earlier, Calacanis argued that investors have to avoid Saylor and buy Bitcoin directly. Back then, the angel investor said that he was 95% certain that he would end up being right.

He has also claimed that Strategy's bet was too "convoluted," but he has stopped short of describing it as a Ponzi scheme in his most recent social media post.

"Whenever you see a company using creative new metrics or innovative capital structures, consider that worthy of deeper investigation. Could be nothing, could be brilliant, or could be something bad," Calacanis said back in April.

For now, there is only a 3% chance of Strategy being forced to liquidate its holdings.

Will Strategy bounce back?

As reported by U.Today, Jim Chanos, founder of Kynikos Associates, recently announced that the firm had unwound its anti-MSTR trade after pocketing hefty returns. The stock of the leading Bitcoin treasury firm had crashed by a whopping 45% after Chanos initially announced his bet against Saylor in mid-May.

In late October, Strategy had to boost yield on its preferred shares in order to increase faltering demand.

Some believe that Chanos's latest move might be a sign that cryptocurrency treasury companies will finally see some sort of bullish reversal after facing steep losses.

For now, however, they remain under rather severe pressure, and those companies whose crypto holdings are currently in the red will struggle to sell more shares.

After a disappointing performance during the week, the price of Bitcoin has continued its sluggish action over the weekend. According to data from CoinGecko, the premier cryptocurrency has been hovering around the $102,000 level over the past 24 hours.

While this current choppy price action seems like an improvement from the severe downturn witnessed in recent days, it doesn’t particularly bring calm to the world’s largest cryptocurrency. Interestingly, the latest on-chain data suggests that the Bitcoin price might still be at risk of further correction in the coming days.

Why BTC Price Might Find Bottom Around $95,000

In a November 8 post on the social media platform X, on-chain analyst Burak Kesmeci predicted the local bottom for the price of Bitcoin. According to the crypto pundit, the flagship cryptocurrency could fall to as low as $95,000 before seeing relief and perhaps rebounding to new price highs.

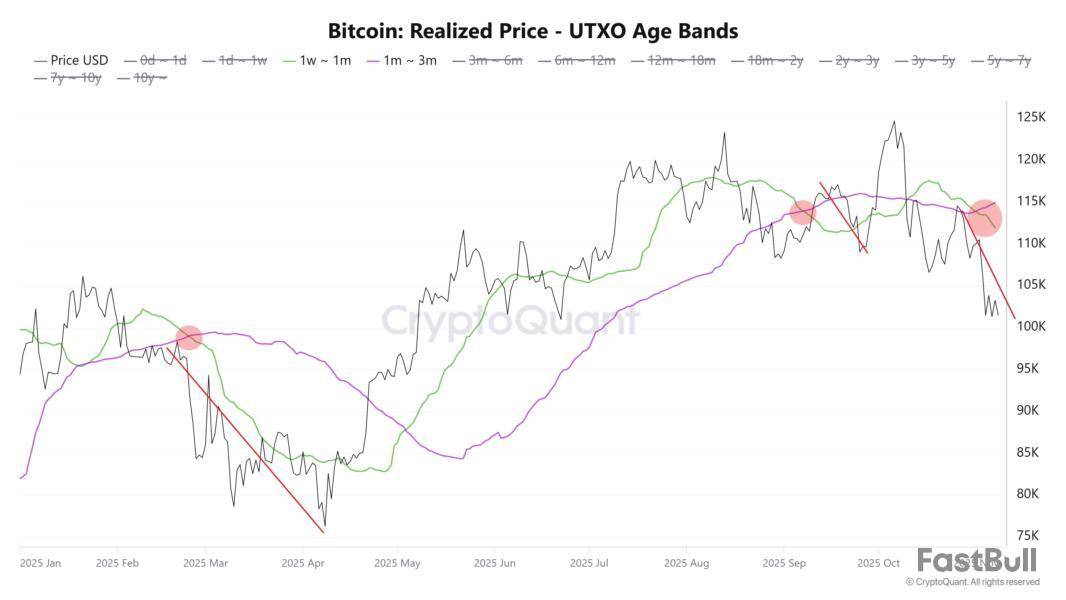

The relevant metric here is the Realized Price of Unspent Transaction Output (UTXO) age bands, which evaluate the holding pattern of different investor classes through their different realized prices. The UTXO age bands metric tracks the average price at which Bitcoin holders purchased their coins compared to how long they’ve held the assets.

The age bands under focus in Kesmeci’s analysis are the 1-week to 1-month group (green line) and the 1-month to 3-month cohort (purple line), which offer insight into short-term holders’ behavior and overall market sentiment. According to the on-chain analyst, the green line has crossed below the purple line three times in 2025.

Kesmeci noted that this cross often preceded short-term corrections, including the ones seen on February 24 ($99,000 to $76,000) and September 8 ($117,000 to $109,000). Similarly, this cross occurred on November 1, with the Bitcoin price falling from $110,000 to $99,000.

Furthermore, the average dip suffered by the Bitcoin price on these three occasions stands at around 13.3%, with a 45-day consolidation period. Based on this historical pattern, Kesmeci expects the Bitcoin price bottom to form around the $95,000 and $96,000 region after the most recent crossing of the 1-week to 1-month band below the 1-month to 3-month band.

Kesmeci concluded:

In short, long-term investors are in the red, and this is an undesirable situation for a bull cycle. However, if history repeats itself, Bitcoin may “catch its breath” once more in this region and prepare the ground for a new rise.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands around $102,440, reflecting a nearly 1% decline in the past day.

Spanish crypto influencer Álvaro Romillo, founder of the alleged Ponzi scheme Madeira Invest Club (MIC), has been detained without bail by a Spanish court on charges of perpetrating a $300 million fraud.

Romillo was arrested in Spain on Thursday after being deemed a flight risk when Spanish officials discovered a Singapore bank account, funded with €29 million ($33.5 million) from businesses linked to Romillo, according to local news reports. National Court judge José Luis Calama ordered Romillo imprisoned without bail after Romillo testified before the court, answering questions for two hours.

The Central Operational Unit of Spain's Civil Guard believes Romillo's MIC perpetrated a Ponzi scheme that defrauded 3,000 victims for a total of €260 million (over $300 million). Spanish authorities began probing MIC in late 2024, announcing three complaints in Oct. 2024. Over the past year, Romillo has cooperated with authorities, appearing at court hearings, while law enforcement seized assets including dozens of luxury cars .

Only when prosecutors discovered the foreign bank accounts was Romillo arrested out of fear that he would flee the country, according to reports. The fraud could wind up with Romillo sentenced "to 9 years in prison, and even up to 18 years in prison if it is considered that they constitute a mass offense," a report obtained by Cadena SER stated.

MIC solicited deposits (around €2,000 minimum per investor) to buy digital “artwork” contracts and shares in luxury goods, like yachts, Ferraris, and gold, with guaranteed buyback and fixed profits that were unusually high, at around 20% per year. Romillo told the court during his appearance Friday that he intended to pay investors back and has even returned money to 2,700 parties, though he did so in cash and claimed to have no way to account for the payments.

Romillo had also previously admitted to funding the 2024 election campaign of far-right Spanish MEP Luis "Alvise" Pérez, leader of the SALF party, with a €100,000 under-the-table cash donation. Pérez is under investigation in a separate case from the larger MIC investigation.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

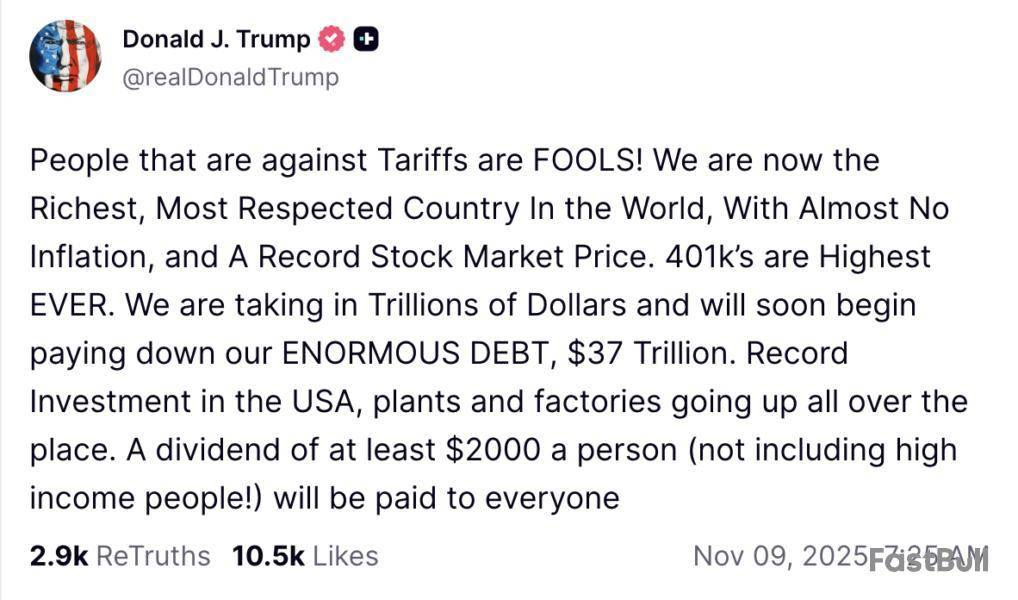

United States President Donald Trump announced on Sunday that most Americans will receive a $2,000 “dividend” from the tariff revenue and criticized the opposition to his sweeping tariff policies.

“A dividend of at least $2000 a person, not including high-income people, will be paid to everyone,” Trump said on Truth Social.

The US Supreme Court is currently hearing arguments about the legality of the tariffs, with the overwhelming majority of prediction market traders betting against a court approval.

Kalshi traders place the odds of the Supreme Court approving the policy at just 23%, while Polymarket traders have the odds at 21%. Trump asked:

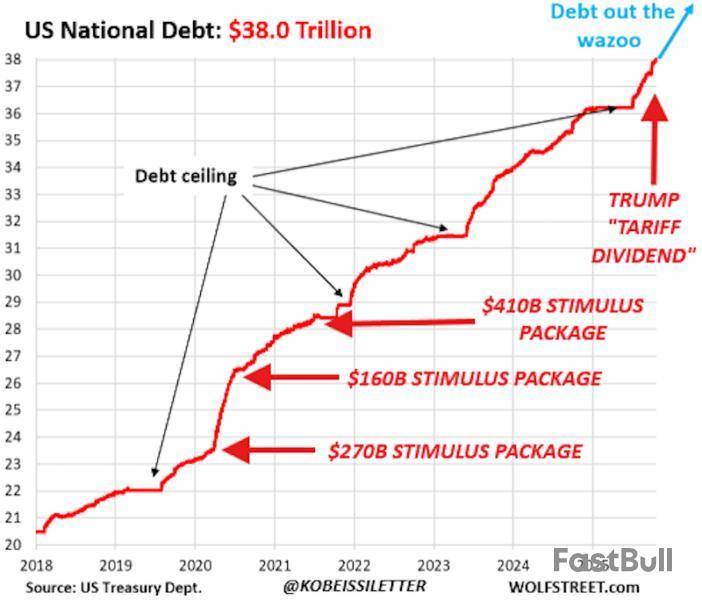

Investors and market analysts celebrated the announcement as economic stimulus that will boost cryptocurrency and other asset prices as portions of the stimulus flow into the markets, but also warned of the long-term negative effects of the proposed dividend.

The proposed economic stimulus will boost asset markets, but at a steep cost

Investment analysts at The Kobeissi Letter forecast that about 85% of US adults should receive the $2,000 stimulus checks, based on distribution data from the economic stimulus checks during the COVID era.

While a portion of the stimulus will flow into markets and raise asset prices, Kobeissi Letter warned that the ultimate long-term effect of any economic stimulus will be fiat currency inflation and the loss of purchasing power.

“If you don’t put the $2,000 in assets, it is going to be inflated away or just service some interest on debt and sent to banks,” Bitcoin analyst, author, and advocate Simon Dixon said.

“Stocks and Bitcoin only know to go higher in response to stimulus,” investor and market analyst Anthony Pompliano said in response to Trump’s announcement.

Bitcoin-focused X account Documenting Bitcoin shared an email from Bitcoin's pseudonymous creator Satoshi Nakamoto with the subject "Bitcoin P2P e cash paper," dated Nov. 8, 2008, contained in the cryptographic mailing list. This email came eight days after the release of the Bitcoin white paper by Satoshi Nakamoto in 2008.

The Bitcoin white paper, "A Peer-to-Peer Electronic Cash System," was released Oct. 31, 2008, amid the global financial crisis. The nine-page document laid the foundation for what would become the world’s first cryptocurrency.

The white paper outlined a vision for a decentralized, peer-to-peer financial system built on cryptographic proof rather than trust in third-party intermediaries.

Satoshi Nakamoto explains "difficulty adjustment"

The email from Satoshi Nakamoto shared by Documenting Bitcoin, which dated November 2008, explains Bitcoin's difficulty adjustment.

Documenting ₿itcoin 📄@DocumentingBTCNov 08, 2025Satoshi Nakamoto Explains ‘Difficulty Adjustment’

“As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new bitcoin,” pic.twitter.com/HTYXf7Y1CP

A part of the email reads: "Increasing hardware speed is handled: to compensate for increasing hardware speed and varying interest in running node over time, the proof of work difficulty is determined by a moving average targeting an average number of blocks per hour. if they're generated too fast, the difficulty increases."

It continued: "As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new bitcoin."

Bitcoin market reset?

Coinbase Institutional's report highlights significant leverage clearing from the crypto market after the Oct. 10 liquidation, suggesting a short-term bottom may have formed: "October’s sell-off wasn’t the end of the cycle—it may have been the reset it needed."

Based on options implied distribution, BTC price expectations for the next three to six months are between $90,000 and $160,000, with a bullish tilt. The report also cites Fed rate cuts, liquidity easing and new regulations as medium-term tailwinds, potentially extending the current cycle to 2026.

At the time of writing, BTC was up 1.02% in the last 24 hours to $103,228.

American Bitcoin, the Nasdaq-listed mining and treasury firm backed by Eric Trump and Donald Trump Jr., has raised its Bitcoin stash to 4,000 BTC, worth about $415 million, according to a company announcement released Friday.

The firm purchased nearly 170 BTC between October 24 and November 5, a haul valued at more than $14 million at current market rates.

American Bitcoin Boosts Holdings

Eric Trump, listed as co-founder and Chief Strategy Officer, said the company is growing its stock of Bitcoin through a mix of scaled mining operations and market purchases.

Reports have disclosed that this size of accumulation puts American Bitcoin at about the 25th spot among corporate Bitcoin holders, based on data from Bitcointreasuries.net.

The Michael Saylor-led Strategy (formerly MicroStrategy) remains far ahead as the largest corporate holder with more than 641,000 BTC on its books, worth around $66 billion.

Trump-Linked Ventures Report Large Crypto Gains

Based on reports, members of the Trump family have collected roughly $1 billion in pre-tax gains over the last year from a range of crypto projects.

Those projects include memecoins such as TRUMP and MELANIA, which together reportedly brought in about $427 million, plus the WLFI token with about $550 million in gains.

Reports also point to big outside backers. Chinese entrepreneur Justin Sun is reported to have invested $75 million in WLFI, while Abu Dhabi’s MGX fund is said to have provided $2 billion to Binance using the USD1 stablecoin. The family’s various ventures have pushed their combined crypto exposure into the multi-billion dollar range. Mining Margins Squeeze Firms After Halving

Miners across the sector are feeling pressure after the 2024 Bitcoin halving cut block rewards from 6.25 BTC to 3.125 BTC.

That change tightened profit margins, forcing some operators to seek new revenue streams, including AI-focused computing services.

American Bitcoin’s model ties mining and treasury accumulation together, but the economics for smaller miners are getting tougher.

Arkham@arkhamNov 08, 2025TRUMP MEDIA AND TECHNOLOGY GROUP HOLDS OVER $1 BILLION OF BITCOIN

Trump Media and Technology Group ($DJT) has disclosed holdings of over $1.3 Billion of BTC as of September 30th 2025.$DJT holds $BTC. pic.twitter.com/WzAIOnN29y

Trump Media’s Holdings And The Broader Picture

Regulatory filings show that Trump Media and Technology Group now holds more than 11,500 BTC, worth over $1.3 billion, even as the company records heavy operating losses.

The concentration of Bitcoin across several Trump-linked businesses points to a deliberate strategy: treat Bitcoin as a reserve asset and a core part of several commercial efforts.

Bitcoin was trading at $102,175 at press time, up a meager 0.3% over 24 hours. That price sits about 15% below the all-time high of $126,000 reached in early October.

Featured image from Unsplash, chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up