Yes, bro, just look for simple language.

Yes, bro, just look for simple language.Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

At Least 20 Pakistani Protesters Have Died In Anti-American Demonstrations Following The Assassination Of Iranian Supreme Leader Ayatollah Khamenei, According To Pakistani Police Sources On March 1. The Sources Indicated That Three Protesters Died In Clashes With Police During The Demonstrations In Islamabad, The Pakistani Capital. Around 2 P.m., Approximately 4,000 Protesters Marched Towards The Diplomatic Quarter, Where The U.S. Embassy Is Located, And Police Opened Fire To Disperse The Crowd. The Injured Were Taken To Hospitals For Treatment. Several Protesters Were Detained By Police. Security Forces Have Increased Security At The Entrances To The Embassy District

EU Reiterates Solidarity With Iranian People, Supports Aspirations For A Future Where Their Rights And Freedoms Are Fully Respected

EU Statement: Nuclear Safety Is Critical Priority, Preservation Of Maritime Security And Respect Of Freedom Of Navigation Also Of Utmost Importance

In Pre-market Trading In Sydney On Monday, The US Dollar Was Down 0.01% Against The Japanese Yen, At 156.03 Yen. The Australian Dollar Was Down More Than 0.4% Against The US Dollar, At 0.7052. The New Zealand Dollar Was Down 0.66% Against The US Dollar, At 0.5958

EU Statement: We Call For Maximum Restraint, Protection Of Civilians And Full Respect Of International Law, Including Principles Of UN Charter

EU Statement: We Will Continue To Protect EU Security And Interests, Including Through Additional Sanctions

[Iran's Judicial Chief Announces The Establishment Of A Provisional Leadership Council] On March 1, Local Time, Iranian Judicial Chief Ejei Officially Announced That A Provisional Leadership Council Had Been Legally Established And Was Fulfilling Its Duties In The Most Efficient Manner. In His Speech, He Sternly Warned External Forces, Stating That The Vacancies Left By The Fallen Generals Would Be Immediately Filled By New "standard-bearers." He Emphasized That The Iranian Government And People Would Never Be Defeated By These "cunning And Brutal" Acts Of Enemy Terrorism Or Psychological Warfare

White House Press Secretary Leavitt: President Trump Was Briefed On The Austin, Texas Shooting

Israeli Official Says That Beyond Military Actions, Israel 'Acting In Its Own Ways' To Get The Iranian People To Come Out Against The Regime

Airstrikes Hit Iraqi Hashd Shaabi Headquarters Near The Western Qaim District On The Syrian Border, Killing At Least Two Fighters - Security Sources

[Hospital In Tehran, Iran, Attacked By US And Israel] It Was Learned On The Evening Of March 1 Local Time That Gandhi Hospital In Tehran, The Capital Of Iran, Was Attacked By The United States And Israel

United Arab Emirates Announces Closure Of Its Embassy In Tehran And Withdrawal Of Its Ambassador From Iran - Foreign Ministry Statement

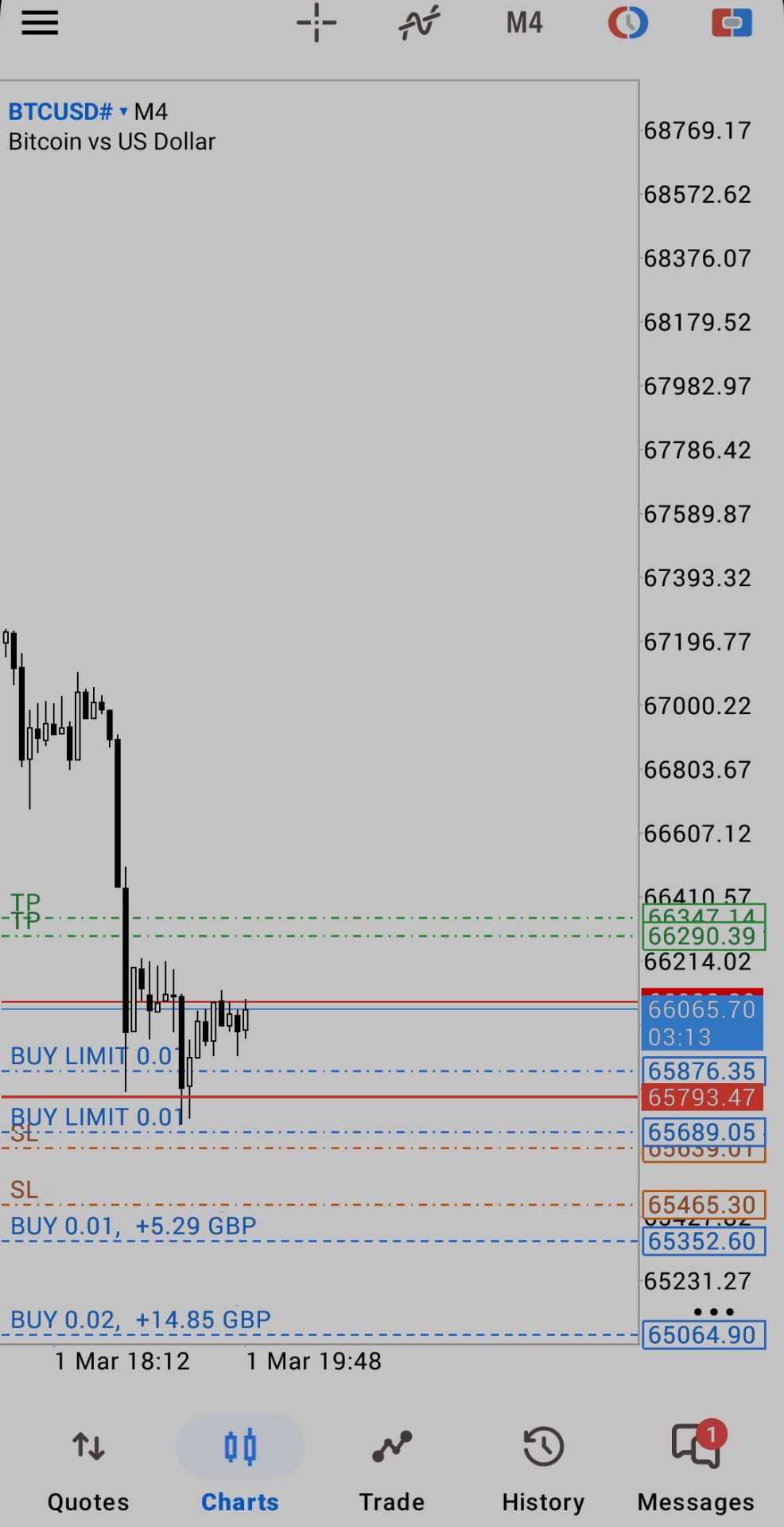

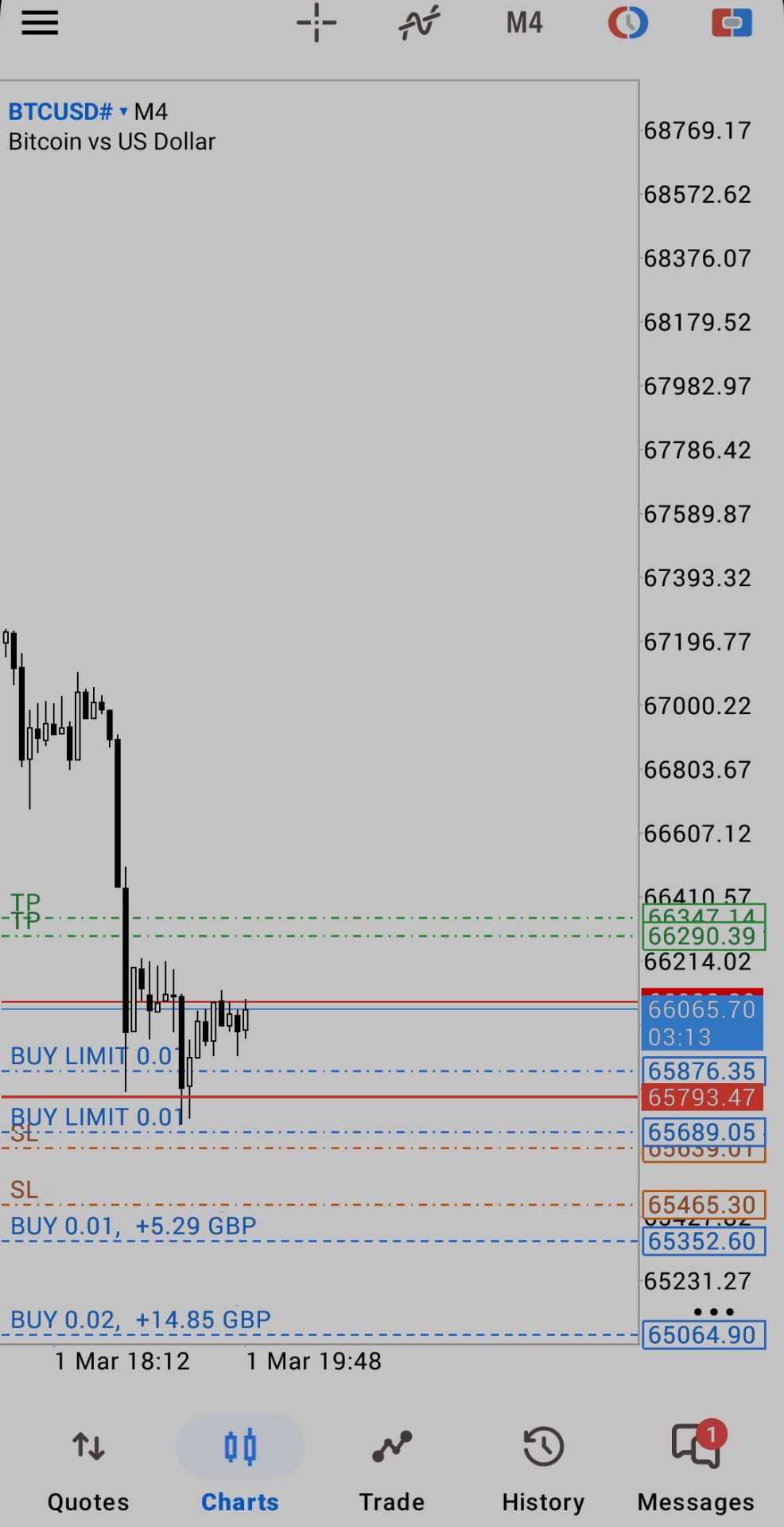

[Cryptocurrency Market Rises And Falls On Sunday] Currently, The Marketvector™ Digital Asset 100 Small Cap Index Is Up 3.35%, Temporarily At 2678.70 Points. It Reached 2799.63 Points At 10:07 Beijing Time, Before Gradually Giving Back Its Gains. The Marketvector™ Digital Asset 100 Mid Cap Index Is Up 2.00%, At 2717.02 Points, Having Reached 2830.33 Points At 10:07. The Marketvector™ Digital Asset 100 Index Is Up 2.67%, At 13431.13 Points, Having Risen To 13784.24 Points At 10:46. Currently, Solana Is Up 0.38%, Dogecoin Is Down 1.11%, And XRP Is Down 0.39%. Bitcoin Is Down 0.68%, Temporarily At $66395; Ethereum Is Up 1.06%, Temporarily At $1982

The Australian Dollar Weakened In Early Trading On Monday As Investors Focused On Escalating Tensions With Iran

France PPI MoM (Jan)

France PPI MoM (Jan)A:--

F: --

Germany Unemployment Rate (SA) (Feb)

Germany Unemployment Rate (SA) (Feb)A:--

F: --

P: --

India GDP YoY

India GDP YoYA:--

F: --

P: --

India Quarterly GDP YoY (Q3)

India Quarterly GDP YoY (Q3)A:--

F: --

P: --

France Unemployment Class-A (Jan)

France Unemployment Class-A (Jan)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Mexico Trade Balance (Jan)

Mexico Trade Balance (Jan)A:--

F: --

P: --

South Africa Trade Balance (Jan)

South Africa Trade Balance (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Feb)

Germany CPI Prelim MoM (Feb)A:--

F: --

P: --

Germany HICP Prelim MoM (Feb)

Germany HICP Prelim MoM (Feb)A:--

F: --

P: --

Germany CPI Prelim YoY (Feb)

Germany CPI Prelim YoY (Feb)A:--

F: --

P: --

Germany HICP Prelim YoY (Feb)

Germany HICP Prelim YoY (Feb)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Jan)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Jan)A:--

F: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Jan)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Jan)A:--

F: --

P: --

Canada GDP QoQ (SA) (Q4)

Canada GDP QoQ (SA) (Q4)A:--

F: --

P: --

Canada GDP Annualized QoQ (SA) (Q4)

Canada GDP Annualized QoQ (SA) (Q4)A:--

F: --

P: --

Canada GDP YoY (SA) (Q4)

Canada GDP YoY (SA) (Q4)A:--

F: --

P: --

U.S. Core PPI MoM (SA) (Jan)

U.S. Core PPI MoM (SA) (Jan)A:--

F: --

Canada GDP MoM (SA) (Dec)

Canada GDP MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Jan)

U.S. PPI MoM (SA) (Jan)A:--

F: --

U.S. Core PPI YoY (Jan)

U.S. Core PPI YoY (Jan)A:--

F: --

P: --

Canada GDP YoY (Dec)

Canada GDP YoY (Dec)A:--

F: --

P: --

U.S. PPI YoY (Jan)

U.S. PPI YoY (Jan)A:--

F: --

P: --

Canada GDP Deflator QoQ (Q4)

Canada GDP Deflator QoQ (Q4)A:--

F: --

P: --

U.S. Chicago PMI (Feb)

U.S. Chicago PMI (Feb)A:--

F: --

P: --

U.S. Construction Spending MoM (Dec)

U.S. Construction Spending MoM (Dec)A:--

F: --

Canada Federal Government Budget Balance (Dec)

Canada Federal Government Budget Balance (Dec)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

South Korea Trade Balance Prelim (Feb)

South Korea Trade Balance Prelim (Feb)A:--

F: --

Japan Manufacturing PMI Final (Feb)

Japan Manufacturing PMI Final (Feb)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Feb)

Indonesia IHS Markit Manufacturing PMI (Feb)--

F: --

P: --

Indonesia Trade Balance (Jan)

Indonesia Trade Balance (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Feb)

Indonesia Core Inflation YoY (Feb)--

F: --

P: --

Indonesia Inflation Rate YoY (Feb)

Indonesia Inflation Rate YoY (Feb)--

F: --

P: --

India HSBC Manufacturing PMI Final (Feb)

India HSBC Manufacturing PMI Final (Feb)--

F: --

P: --

Australia Commodity Price YoY (Feb)

Australia Commodity Price YoY (Feb)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Feb)

Russia IHS Markit Manufacturing PMI (Feb)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Feb)

U.K. Nationwide House Price Index MoM (Feb)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Feb)

U.K. Nationwide House Price Index YoY (Feb)--

F: --

P: --

Turkey GDP YoY (Q4)

Turkey GDP YoY (Q4)--

F: --

P: --

Germany Actual Retail Sales MoM (Jan)

Germany Actual Retail Sales MoM (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Feb)

Turkey Manufacturing PMI (Feb)--

F: --

P: --

Italy Manufacturing PMI (SA) (Feb)

Italy Manufacturing PMI (SA) (Feb)--

F: --

P: --

South Africa Manufacturing PMI (Feb)

South Africa Manufacturing PMI (Feb)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Feb)

Euro Zone Manufacturing PMI Final (Feb)--

F: --

P: --

U.K. M4 Money Supply MoM (Jan)

U.K. M4 Money Supply MoM (Jan)--

F: --

P: --

U.K. M4 Money Supply YoY (Jan)

U.K. M4 Money Supply YoY (Jan)--

F: --

P: --

U.K. Mortgage Lending (Jan)

U.K. Mortgage Lending (Jan)--

F: --

P: --

U.K. Mortgage Approvals (Jan)

U.K. Mortgage Approvals (Jan)--

F: --

P: --

U.K. M4 Money Supply (SA) (Jan)

U.K. M4 Money Supply (SA) (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Feb)

U.K. Manufacturing PMI Final (Feb)--

F: --

P: --

India Manufacturing Output MoM (Jan)

India Manufacturing Output MoM (Jan)--

F: --

P: --

India Industrial Production Index YoY (Jan)

India Industrial Production Index YoY (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Feb)

Brazil IHS Markit Manufacturing PMI (Feb)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks Canada Manufacturing PMI (SA) (Feb)

Canada Manufacturing PMI (SA) (Feb)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Feb)

U.S. IHS Markit Manufacturing PMI Final (Feb)--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. U.S. ISM Inventories Index (Feb)

U.S. ISM Inventories Index (Feb)--

F: --

P: --

Yes, bro, just look for simple language.

Yes, bro, just look for simple language.

No matching data

Crypto hack in August shook the digital asset industry as hackers stole $163 million across 16 incidents, according to blockchain security firm PeckShield. This marked a sharp jump from July’s $142 million, proving how cyberattacks are becoming more frequent and sophisticated. The largest hit was a $91.4 million theft from multiple anonymous Bitcoin addresses, highlighting that even individual investors remain highly vulnerable.

BtcTurk Hack and Exchange Security Risks

One of the biggest cases was the hack of Turkey’s leading exchange BtcTurk, which lost $54 million. Shockingly, this was not the first time—the exchange had already lost the same amount in June 2024, pushing its total losses above $100 million in just one year.

CEO Özgür Güneri confirmed unauthorized access was detected, affected wallets were frozen, and investigations with local authorities are ongoing.

Other victims included:

These repeated cases prove how centralized crypto exchanges are a constant target for hackers.

Why Crypto Hacks Are Increasing

Analysts say the rapid growth of the crypto sector is a key reason for these rising hacks. New platforms and protocols are often launched quickly, skipping proper security audits, which creates easy entry points for attackers.

Human error also plays a big role. Many users still fall victim to phishing scams, weak passwords, and not enabling two-factor authentication, making both exchanges and personal wallets easy targets.

Market Impact and Bitcoin Price Drop

The hacks weighed on investor confidence. Bitcoin dropped 1.23% in the past 24 hours, trading at $107,725.91 with a market cap of $2.15 trillion, according to CoinMarketCap. Over the past week, BTC slipped 4.62%, though it still shows a 2.21% gain in the last 90 days.

Analysts warn that repeated security breaches could slow adoption, even if long-term interest in Bitcoin remains strong.

A Wake-Up Call for the Crypto Industry

The $163 million stolen in August is a serious warning sign. Each hack erodes trust, delays adoption, and pressures regulators to enforce stricter rules. Experts call for:

Unless crypto security becomes a top priority alongside innovation, the industry risks letting vulnerabilities overshadow its potential.

FAQs

How much was stolen in crypto hacks in August 2025?A total of $163 million was stolen across 16 separate hacks, according to PeckShield data

What was the biggest single crypto hack in August?The largest was a $91.4 million theft from multiple anonymous Bitcoin wallets.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up