Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

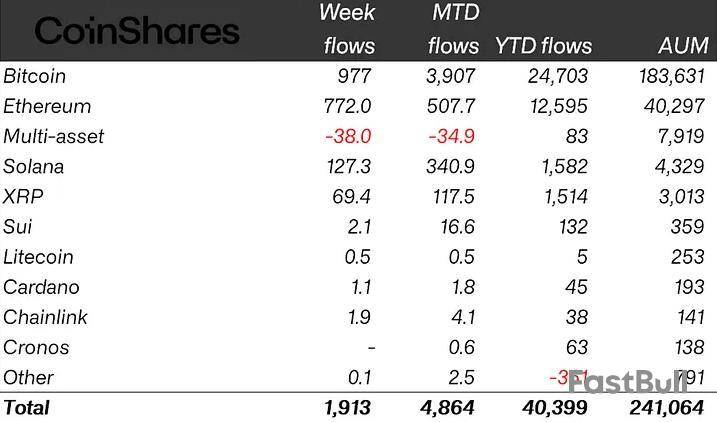

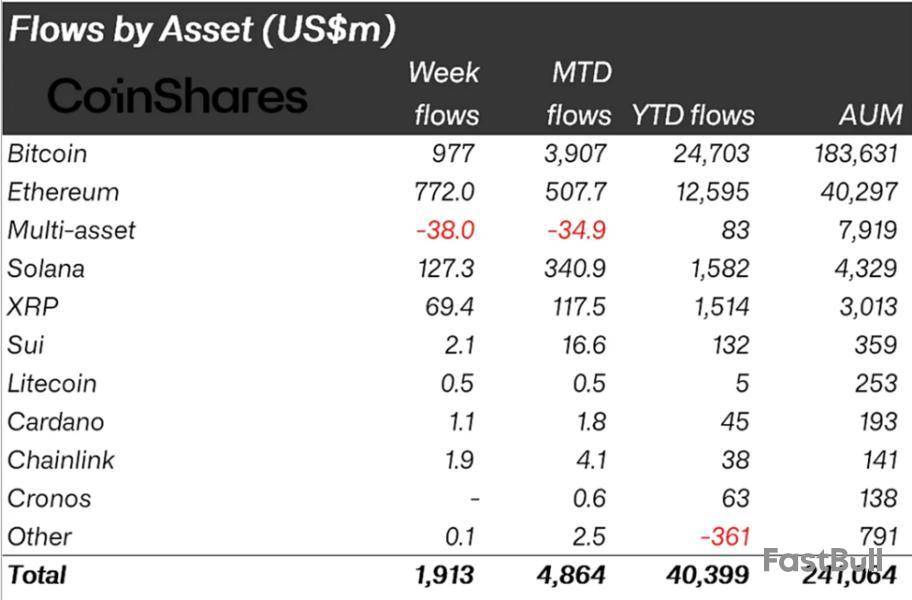

Cryptocurrency funds recorded a second consecutive week of inflows last week, extending the $3.3 billion in gains recorded the week before.

Crypto exchange-traded products (ETPs) logged $1.9 billion in inflows last week, data from CoinShares showed Monday.

Bitcoin and Ether led the way with inflows of $977 million and $772 million respectively, while Solana and XRP also saw strong demand with $127 million and $69 million of inflows.

With the new gains, the total assets under management (AUM) in global crypto ETPs surged to a new high of $40.4 billion year-to-date, CoinShares’ head of research, James Butterfill, noted.

Bitcoin funds extend inflow streak to four weeks

Bitcoin funds maintained momentum last week, attracting the largest share of inflows after topping the gains with $2.4 billion in inflows the previous week.

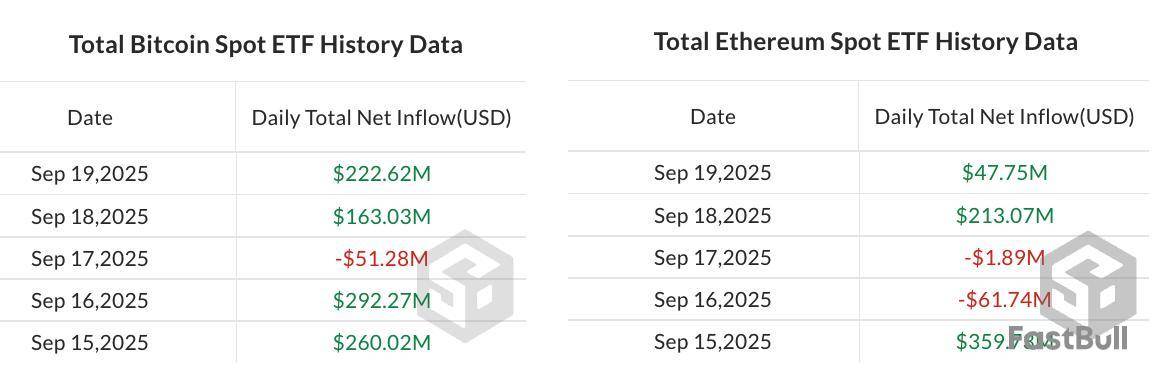

The latest inflows marked the fourth straight week of gains for Bitcoin exchange-traded funds (ETFs), bringing the four-week total to $3.9 billion, according to SoSoValue.

In contrast, short-Bitcoin ETPs continued to struggle, with $3.5 billion in outflows and total AUM dropping to a multiyear low of $83 million.

Ether ETPs also saw strong investor demand last week, with fresh inflows pushing year-to-date totals to a record $12.6 billion, according to CoinShares data.

Positive response to the Fed’s rate cut

The fresh inflows in crypto funds came amid the US Federal Reserve slashing the key US interest rate by 0.25 points last Wednesday, marking its first cut of the year.

According to CoinShares’ Butterfill, the inflows marked a positive response to the interest cut despite initial caution from investors.

“After months of speculation, the US Federal Reserve cut interest rates last week. Although investors initially reacted cautiously to the so-called ‘hawkish cut’, inflows resumed later in the week,” Butterfill said.

Following the Fed’s rate cut, spot crypto prices saw slight volatility, with Bitcoin price edging up to multi-week highs above $117,000 last Thursday, according to CoinGecko data.

Ether also briefly surged above $4,600 last Thursday after starting the week at around $4,500.

Despite strong inflows and rising prices, the investor sentiment remained cautious last week, according to the Crypto Fear & Greed Index, which measures the overall sentiment of the cryptocurrency market.

According to data from Alternative.me, the Crypto Fear & Greed Index was neutral last week with a score of 53. The index dropped to “Fear” on Monday, with a score of 45.

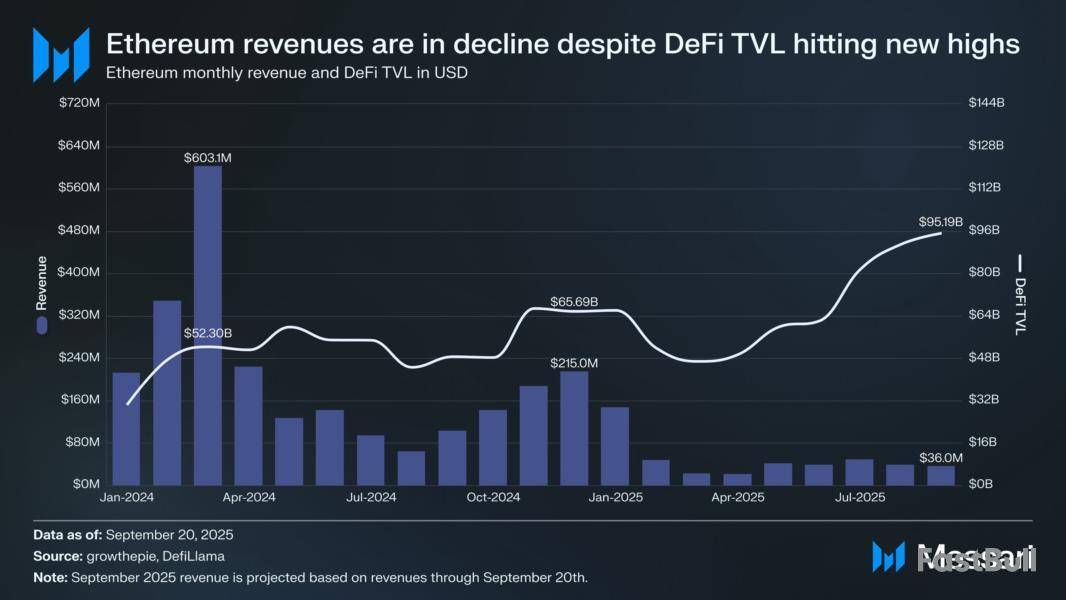

Low-risk DeFi has become the focal point of debate within the Ethereum community. Many argue it could serve as the network’s core driver, much like Google Search drives Google.

However, a number of experts caution that this view may be overly optimistic given Ethereum’s fierce competition with stablecoins and RWAs.

Low-risk DeFi – A New Growth Engine for Ethereum?

As BeInCrypto reported, Vitalik Buterin suggested that low-risk DeFi protocols like Aave or MakerDAO could become a primary revenue source for Ethereum . He likened this model to how Google derives much of its revenue from Google Search.

“Importantly, low-risk defi is often very synergistic with a lot of the more experimental applications that we in ethereum are excited about.” Vitalik observed.

Applied to Ethereum’s case, Vitalik emphasizes that the network needs safe financial activities that support savings and payments—especially for underserved communities—to preserve the ecosystem’s cultural identity.

This view from Vitalik has sparked lively debate. David Hoffman states that low-risk DeFi does not generate much blockspace demand for Ethereum. Nevertheless, locking large amounts of ETH in lending protocols like MakerDAO, Aave, or Uniswap elevates ETH into a form of “commodity money” within the Ethereum ecosystem.

Some developers argue that low-risk DeFi is universal, simple, and scalable to billions of users. Stani Kulechov has envisioned a day when Aave could distribute yield to billions globally, turning DeFi into a foundational financial tool for humanity.

“Low-risk DeFi is Ethereum’s workhorse: simple, powerful, and universally useful. One day, Aave could be distributing yield to billions across the globe.” Stani commented.

Low Revenue, Hard to Justify the Valuation

Not everyone agrees with Vitalik. Another X user argues that low-risk DeFi alone cannot justify Ethereum’s enormous market cap, currently about $0.5 trillion. Trading volume from these protocols reached only around $36 million in September—a figure far too small to create sustained cash flow for the network. Moreover, despite DeFi’s TVL of roughly $95.2 billion and a stablecoin supply of $161.3 billion, these metrics still do not generate enough blockspace demand to keep network fees attractive for validators.

“Low-risk DeFi as Ethereum’s ‘Google Search’ can only work if it prioritizes ETH as the primary monetary asset. However, with stablecoins dominant and many pushing Ethereum as the ‘RWA chain,’ ETH must compete with an ever-increasing field of monetary assets for this position,” a user on X shared.

Another commentator warns that Vitalik’s framing of serving the unbanked via low-risk DeFi misstates the practical objective. They caution that moving lending/borrowing markets entirely on-chain at Layer-1 degrades user experience and reduces composability. Ethereum also struggles to compete with dedicated payment systems like Stripe or Circle, or fee-optimized chains like Solana, where high MEV subsidizes low costs.

Competition with Stablecoins and RWAs

Another strand of thought holds that Ethereum is in fierce competition with stablecoins and RWAs to retain the role of the ecosystem’s native monetary asset. While RWAs may attract users with yield, they are unlikely to match ETH’s reliability and liquidity; thus, ETH retains an edge as an unmatched monetary asset.

Notably, some analysts stress the appeal of neutral chains like Ethereum as a custody layer for centralized assets such as USDC or RWAs. Holding USDC on Aave via Ethereum may be less susceptible to intervention by Circle than storing it on centralized enterprise chains, increasing Ethereum’s attractiveness as a censorship-resistant infrastructure.

Although some see the idea of “nationalizing” core DeFi protocols on Ethereum as the right direction, many experts believe Ethereum is not yet ready to provide low-risk, low-cost, highly scalable DeFi services. This remains an endgame target that goes beyond merely on-chain lending/borrowing.

“Enshrined services is the real endgame (one step beyond what Vitalik is saying here), but it should not be limited to lending.” an expert shared on X.

Key takeaways:

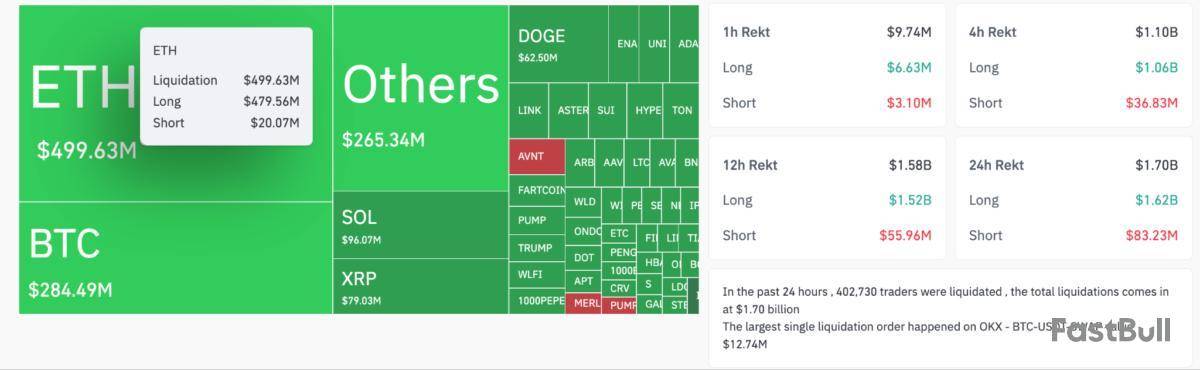

Bitcoin dropped 4% to $112,000 in a marketwide correction, liquidating $1.6 billion in longs.

Analysts say the BTC bull market may have run its course, based on several bearish onchain signals.

Bitcoin bears extended the sell-side activity into the weekly open on Monday as the drop to $112,000 resulted in a large liquidation of leveraged positions across the crypto market.

Meanwhile, according to analysts, Bitcoin shows signs of “cycle exhaustion,” pointing to further downside.

Bitcoin wipes out liquidity in drop to $112,000

Bitcoin price fell as low as $111,980 on Monday, down 4% in the past 24 hours, amid a broader market tumble, per Cointelegraph Markets Pro and TradingView.

This extended the deviation from the Aug. 14 all-time high of $124,500 to 10% and was accompanied by massive liquidations across the derivatives market.

Over $1.62 billion in long positions were liquidated, with Ether accounting for $479.6 million. Bitcoin followed with $277.5 million in long liquidations.

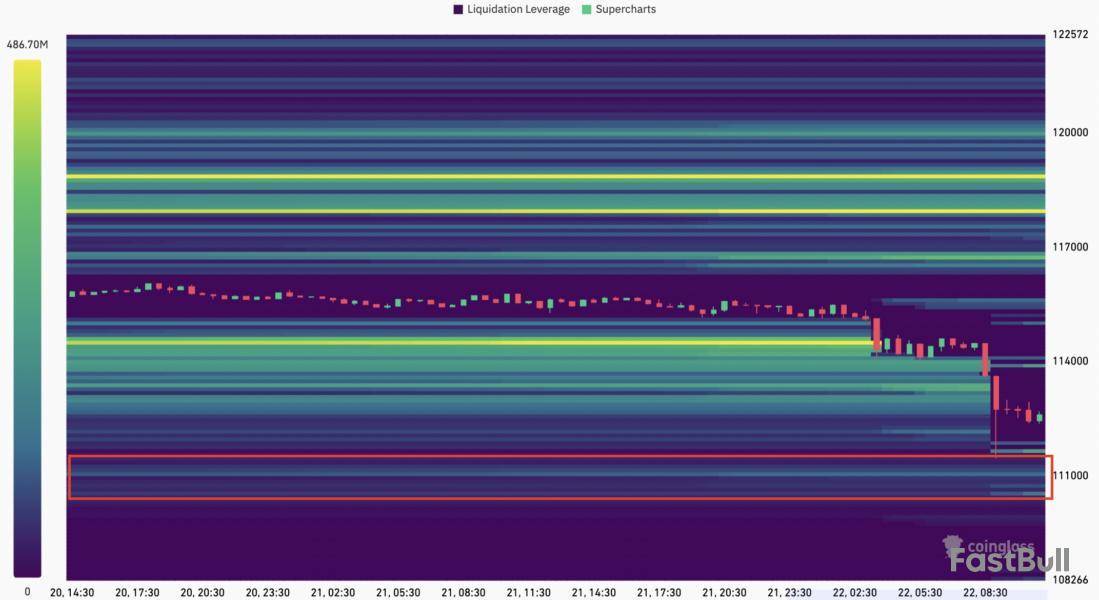

Across the board, a total of $1.7 billion was wiped out of the market in short and long positions, as shown in the figure below.

The sudden market drop led to the liquidation of 402,730 traders over the period, catching many off guard as investor sentiment flipped bearish.

The Bitcoin liquidation heatmap showed the price eating away liquidity around $112,000, with more than $400 million bid orders between $111,500 and $110,000.

This suggests that Bitcoin’s price might drop further to sweep this liquidity before any potential recovery.

Is the Bitcoin bull cycle out of steam?

The Fed’s interest rate cut last week, which was once viewed as a vital bullish catalyst for BTC, failed to push markets higher, implying that the Bitcoin bull cycle may have run its course.

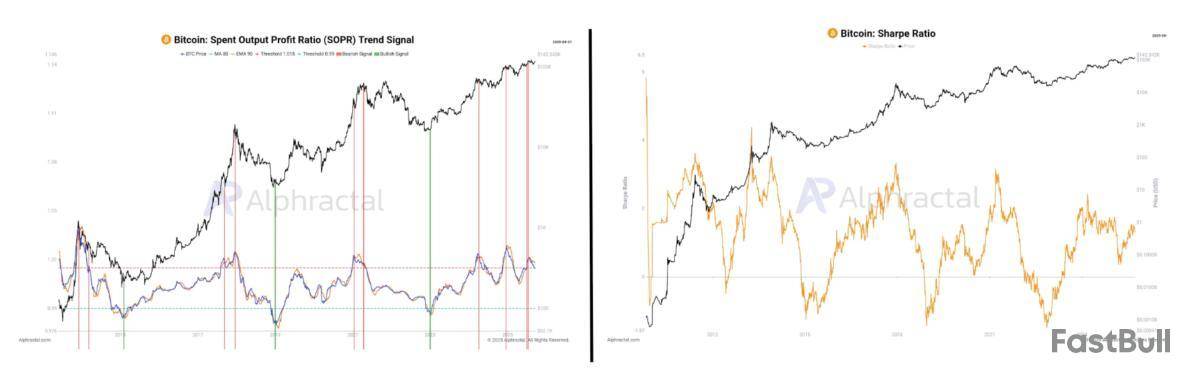

“Bitcoin is already showing signs of cycle exhaustion and very few are seeing it,” said Alphractal founder Joao Wedson in an X post on Monday.

Several onchain signals now warn that Bitcoin’s rally may have run out of steam.

Bitcoin’s Spent Output Profit Ratio (SOPR), a metric that measures the overall profitability of all spent Bitcoin transactions on the blockchain, shows fading profitability, raising chances of a deeper correction.

The Sharpe ratio is weaker than in 2024, meaning risk vs. return and profit potential are lower.

“This won’t attract as many institutions as most people believe,” said Wedson, adding:

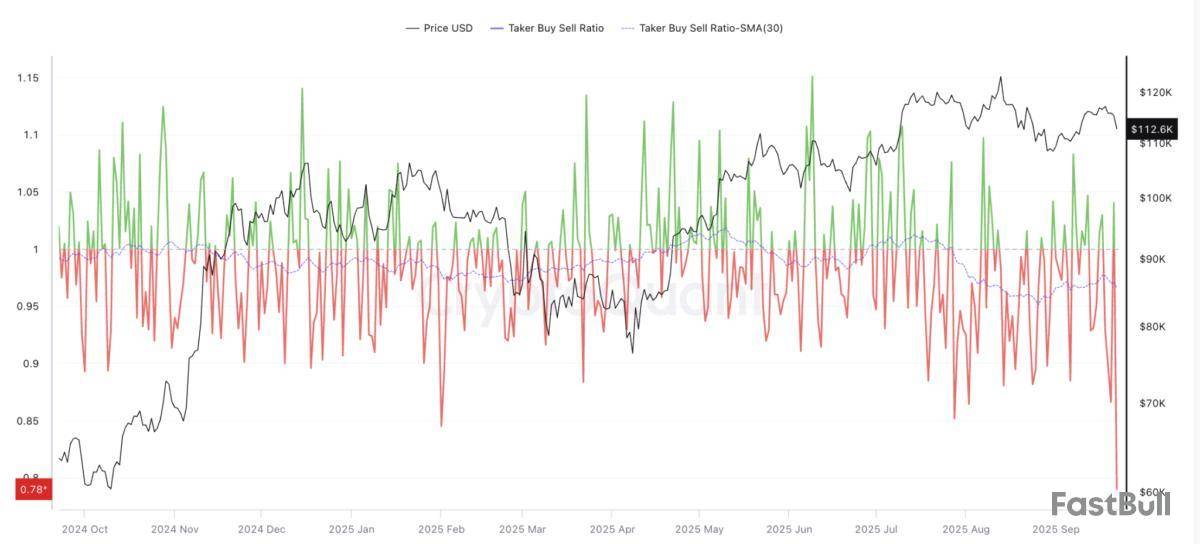

Meanwhile, Bitcoin’s taker buy/sell ratio across all exchanges, a metric gauging market sentiment, was at -0.79, according to data from CryptoQuant.

When the metric dips below 1, it indicates that bears are in control of the market, and when the metric is above 1, it shows that bulls are in control.

The ratio at -0.79 indicates that active selling volume (taker sell) now outpaces buying, reflecting negative trader sentiment.

The last time similar levels were observed was at the Jan. 20 peak, when Bitcoin reached the $109,000 range before entering a three-month correction period that saw BTC price drop by 32% to $74,000 in April.

The taker buy/sell ratio reinforces that the market is in a critical zone, as growing selling pressure exposes weaknesses in Bitcoin’s price structure.

As Cointelegraph reported, analysts are now mixed on the possibility of a rally in October after markets turned bearish on Monday.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Crypto inflows climbed toward the $2 billion mark last week, with positive sentiment drawing from the Federal Reserve’s (Fed) decision to cut interest rates.

Amid strong crypto inflows, the total AuM hit a YTD high of $40.4 billion, putting the market on track to match or slightly exceed last year’s $48.6 billion positive flows.

Fed Rate Cut Pushed Crypto Inflows Past $1.9 Billion Last Week

BeInCrypto reported the Fed’s move to cut interest rates last week, with chair Jerome Powell framing the rate cut as a risk management decision

Against this backdrop, the Dollar weakened while equities and Bitcoin rallied on liquidity-driven optimism.

This translated to a notable surge in crypto inflows, reaching $1.913 billion last week.

“Digital asset investment products saw $1.9 billion of inflows last week, marking a positive response to the ‘hawkish cut’ by the FED last week,” James Butterfill wrote in the latest CoinShares report.

The data show that Bitcoin and Ethereum led with inflows of $977 million and $772 million, respectively. Meanwhile, Solana and XRP registered similar sentiment, attracting positive flows of $127.3 million and $69.4 million, respectively.

Meanwhile, this marked the second consecutive week of positive flows, after the $3.3 billion recorded in the week ending September 13.

However, comparing the two successive weeks shows that while investment into Bitcoin products reduced from $2.4 billion to $977 million, Ethereum registered a notable surge, moving from $645 million to $772 million last week.

With the surge in crypto inflows ascribed to the Fed’s interest rate cut decision, Butterfill acknowledged initial caution among investors.

“Although investors initially reacted cautiously to the so-called hawkish cut, inflows resumed later in the week, with $746 million entering on Thursday and Friday as markets began to digest the implications for digital assets,” Butterfill added.

On regional metrics, sentiment was broadly positive, save for Hong Kong, which recorded minor outflows. Meanwhile, the US, Switzerland, and Brazil all recorded notable crypto inflows.

If anything, last week’s positive flows suggest that US economic data continue to elevate Bitcoin and crypto as an alternative asset class.

They point to an abounding role of crypto and digital assets as portfolio diversifiers and hedges against economic uncertainty.

With multiple Fed officials, including Powell and Stephen Miran, set to speak this week, any indications of continued traditional finance (TradFi) market uncertainty could also bode well for crypto inflows this week.

B HODL Plc, a new British firm founded to accumulate and generate revenue from bitcoin in its treasury, listed on the Aquis Stock Exchange in London on Monday after raising approximately £15.3 million ($20.7 million) to embark on its strategy.

The company's shares began trading on the AQSE Growth Market at 8 a.m. local time under the ticker "HODL." Aquis is a UK exchange for small and mid-sized growth firms, with fewer than 100 listings and a total market capitalization below £5 billion ($6.8 billion) — a low-cost alternative to the London Stock Exchange, but far smaller and less liquid.

Ahead of the listing, B HODL raised a total of £15.3 million ($20.7 million) before expenses through the issue of 109,537,520 new ordinary shares at £0.14 ($0.19) each. This includes a previously announced £13.3 million ($18 million) from a direct subscription for 95,251,802 shares and an additional £2 million ($2.7 million) from an oversubscribed WRAP Retail Offer conducted by Winterflood Securities, which added 14,285,718 shares. The new shares rank equally with existing ordinary shares in all respects, including dividend and distribution rights following exchange admission.

Backed by CoinCorner and Adam Back

The company is headed up by former solicitor and co-founder of the advocacy group Bitcoin Policy UK, Freddie New, as CEO, and is backed by UK bitcoin exchange CoinCorner, which holds 14.3% of issued share capital. CoinCorner CEO Danny Scott serves as Chief Bitcoin Officer and as a director of B HODL.

"We are delighted to welcome a broad base of new shareholders alongside our strategic investors and look forward to this journey together," Scott said in the statement. "Our team has been building in Bitcoin for over a decade, and we are determined to make B HODL the leading UK-listed Bitcoin Company. The hard work of building the future of finance begins now."

Additionally, Blockstream CEO Adam Back is listed as a major shareholder, having acquired over 25.5% of the issued share capital. Back is also set to lead the U.S.-based Bitcoin Standard Treasury Company as CEO once it goes public on the Nasdaq via a merger with Cantor Fitzgerald–backed SPAC Cantor Equity Partners I. BSTR will launch with 30,021 BTC on its balance sheet, placing it in the top-four public bitcoin treasury companies globally, and aims to raise up to $1.5 billion through a mix of equity, convertible notes, and preferred stock.

B HODL's directors aim to build the company into a global player in Bitcoin services, with a focus on Lightning liquidity and infrastructure to support mainstream adoption, according to a statement shared with The Block. The strategy centers on building a substantial bitcoin treasury, with an initial focus on utilizing it to operate highly ranked Lightning nodes, including existing nodes run by CoinCorner. This approach aims to provide scalable liquidity, generating routing fees from Lightning payments. Over time, the company plans to expand and diversify its revenue streams as new opportunities emerge, while continuing to accumulate bitcoin quickly through further issuance of ordinary shares, according to the firm.

“Today's admission is a landmark moment for B HODL," New said in the statement. "We are proud to be the first listed British company dedicated from day one to bitcoin accumulation and revenue generation. The strong support we have received from our new investors, with the WRAP offer upsized and closed early due to demand, underlines the scale of interest in Bitcoin's long-term potential — both as an asset and as a means of payment. With our admission complete, we can now focus on building our bitcoin treasury and deploying it productively through Lightning infrastructure. We believe this strategy positions us at the heart of Bitcoin's next phase of growth, and we are excited to be commencing this journey with all our stakeholders."

UK bitcoin treasury companies on the rise

While U.S. firms, led by Michael Saylor's Strategy, continue to dominate corporate bitcoin acquisitions, the number of BTC treasury companies in the UK is also on the rise.

The Smarter Web Company is the largest of more than a dozen UK firms that have adopted or plan to adopt a bitcoin treasury strategy, with 2,470 BTC ($278 million). The second-largest is Satsuma Technology with 1,149 BTC ($129 million), and Phoenix Digital Assets is third with 247 BTC ($28 million), according to Bitcoin Treasuries data.

B HODL shares are currently trading for £17.88 ($21) per TradingView.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Japanese Bitcoin treasury firm Metaplanet has deepened its crypto bet with its biggest purchase yet after adding 5,419 BTC for roughly $632.5 million at an average price of $116,724.

The move has boosted the company’s total holdings to 25,555 BTC, which were accumulated for about $2.71 billion at an average cost of $106,065 per BTC, according to CEO Simon Gerovich.Metaplanet’s Bitcoin Hoard Expands

Metaplanet’s aggressive accumulation strategy has delivered a whopping 395.1% year-to-date BTC yield in 2025. With this purchase, the Tokyo-listed firm now ranks as the fifth-largest public corporate BTC holder, overtaking Bullish and trailing only Michael Saylor’s Strategy, Marathon Digital, XXI, and Bitcoin Standard Treasury Company, according to the data compiled by Bitcoin Treasuries.

Metaplanet hasintensifiedits Bitcoin acquisition strategy after boosting its year-end target from 10,000 to 30,000 BTC. To support this goal, the company raised $837 million via international share offerings, of which the bulk of the funds were allocated for purchases scheduled in September and October.

Building on this momentum, the firm disclosed plans to generate $1.4 billion through the issuance of 385 million new shares, earmarked entirely for additional BTC acquisitions.

Last week, the company also announced the launch of Metaplanet Income Corp., a Miami-based US subsidiary with an initial capital of $15 million. The subsidiary is designed to focus on Bitcoin income generation and derivatives trading, thereby creating a clear separation from Metaplanet’s core BTC holdings. Leadership responsibilities will be shared between CEO Gerovich, Dylan LeClair, and Darren Winia.

According to the firm, this organizational structure will allow revenue-generating activities to operate efficiently while having minimal impact on consolidated financial statements for the fiscal year ending December 31.Weathering Bitcoin Turbulence

The latest announcement comes as Bitcoin rattled markets heading into the final week of September and retreated to $112,000. The sharp pullback triggered more than $1 billion in liquidations of crypto long positions, as it marked the largest single liquidation event of 2025 to date.

Meanwhile, Metaplanet’s stock fell 3.12% to $3.98 during Monday’s session in Japan, according to the Yahoo Finance data. The stock showed significant intraday volatility. Despite this, it remains up almost 70% year-to-date.

The cryptocurrency market faced a brutal shake-up as Bitcoin slipped below the $115,000 mark and Ethereum dropped under $4,500, erasing weeks of bullish momentum. What started as a period of cautious optimism quickly turned into a wave of panic selling, leaving bulls struggling to regain control. The sharp correction has pushed the market into a new, uncertain phase where confidence is being tested, and short-term volatility is dominating sentiment.

Top analyst Maartunn highlighted one of the key drivers behind the downturn: an overleveraged derivatives market. In the last 24 hours alone, the crypto market witnessed $597 million in BTC and ETH long liquidations, marking one of the heaviest waves of forced selling in recent months. This liquidation wipeout serves as a harsh reminder to tradersof the risks of excessive leverage in a market that can turn abruptly.

The selloff also underscores the fragile balance between bullish enthusiasm and macroeconomic uncertainty. With central banks recalibrating policy and liquidity conditions tightening, crypto faces a complex environment. As prices test lower support levels, the coming days will reveal whether this correction is a temporary shakeout or the beginning of a deeper phase of market revaluation.

Liquidations Trigger Speculation on Crypto’s Next Phase

According to Maartunn, the past 24 hours delivered one of the harshest blows to overleveraged traders this year. Data shows that $189 million in Bitcoin longs were liquidated, alongside an even larger $408 million in Ethereum longs, bringing the total wiped out positions close to $600 million. This wave of liquidations happened within hours, highlighting just how fragile sentiment can be when leverage builds up across major assets.

The sudden sell-off sent shockwaves through the market, forcing bulls to retreat as Bitcoin slipped under the $115K level and Ethereum dropped below $4,500. Traders who had built aggressive long positions in anticipation of continued upside quickly found themselves on the losing side, as cascading liquidations amplified the decline. Such events are not uncommon in crypto, but the size and speed of this move have left investors reassessing the short-term landscape.

Now, speculation is heating up about what comes next. Some analysts argue this was nothing more than a leverage reset, a necessary purge to clear excessive speculation and allow the market to build a healthier foundation for the next leg upward. Others are less optimistic, viewing the event as a potential trigger for a corrective stage, where broader selling pressure could drag prices lower before any recovery.

What’s clear is that the market has entered a new phase of uncertainty. Investors are watching closely for whether fresh demand steps in to stabilize prices, or if further selling pressure forces a deeper pullback. Until clarity emerges, volatility is likely to dominate.

Total Crypto Market Cap Analysis

The total cryptocurrency market cap has experienced a sharp pullback, currently sitting around $3.83 trillion after a 3.3% daily decline. The chart highlights the rejection near the $4 trillion mark, a key psychological resistance level that has repeatedly capped upward moves in recent weeks. Despite this setback, the market remains well above its medium-term supports, suggesting the broader uptrend is still intact.

Looking at the moving averages, the 50-day SMA (~$3.87T) is being tested, and a decisive close below could open the door to further downside toward the 100-day SMA (~$3.68T). However, as long as the market holds above this zone, the bullish structure remains valid. The 200-day SMA (~$3.31T) continues to provide a strong foundation for the longer-term trend, showing that the bull market context remains strong.

This recent drop reflects the heavy liquidations across BTC and ETH longs, which have rippled through altcoins, increasing volatility across the board. If the market stabilizes above $3.8T, it could set the stage for another attempt at breaking $4T. Conversely, a deeper breakdown below $3.7T may shift momentum, signaling a potential corrective phase in the short term.

Featured image from Dall-E, chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up